Sergey Pakulin

Thesis

RGC Resources’ (NASDAQ:RGCO) Q3 earnings report unveils substantial growth in extensions and new customers, influenced by favorable conditions and recent legislative decisions. However, the financial landscape has its ups and downs, with Q3 revenue of $13.66M missing expectations by $4.34M and a GAAP EPS of $0.07. The following analysis argues that while certain metrics and strategies point towards optimism, lingering concerns related to profitability, cash flow, and external factors such as interest rates and regulatory decisions warrant a “hold” rating.

Company Profile

RGC Resources, Inc., established in 1883 in Roanoke, Virginia, has maintained its position in the energy services sector, primarily focusing on the distribution and sale of natural gas through its significant infrastructure, which includes about 1,168 miles of pipelines and a liquefied natural gas storage facility. Beyond its foundational operations, RGC has also delved into unregulated services, illustrating its adaptability and alignment with current market dynamics. This progression showcases RGC’s capability to both honor its legacy and address contemporary energy challenges.

RGC Resources’ Q3 Earnings Highlights

According to the most recent Q3, RGC Resources has embarked on a positive trajectory, revealing substantial growth across multiple domains. Within the first nine months, there was a successful completion of extensions equalling 3.1 miles and the procurement of 464 new customers. This upward movement can be attributed to the fortuitous construction weather in the Roanoke area, combined with a consistent uptrend in customer acquisition since 2020. However, it must be noted that the years 2021 and 2022 faced disruptions due to state-imposed service disconnection moratoriums.

In a more focused view of the situation, CEO Paul Nester has indicated a marginal increase in inbounds, either from real estate developers or potential new industrial and commercial clientele. Analyzing this trend, it becomes evident that RGC Resources had favorable inbounds for a period ranging from six to 18 months prior. A prominent constraint in this context was the uncertainty surrounding the completion of Mountain Valley. The recent decisions, including bipartisan support in Congress, the signature by President Biden, approval from the FRA, and a swift, decisive resolution by the Supreme Court, have added a layer of certainty to the situation.

Such certainty has bolstered their economic strategy, allowing them to delineate the expected timing for the arrival of gas in Mountain Valley. Nester’s confidence suggests a rise in future inbounds, especially given the assurance of supply, alongside competitive pricing that is considered to be among the lowest globally. The flow, expected to deliver two billion cubic feet per day through a 42-inch pipe, supports this prediction.

Financial indicators further support the optimistic outlook. The company’s collections have reached levels akin to pre-pandemic results, with a bad debt expense reduction of approximately $223,000 over the previous nine months. The third quarter operating income saw an escalation of 9.6% to $1,798,000, a growth attributed mainly to the interim base rates initiated earlier in the year, and investments in the RNG project and Mountain Valley Pipeline AFUDC.

Moreover, the net income for the quarter stood at $687,000, an increase of roughly $94,000 from the same period in 2022. The trailing 12-month results exhibited a 10% increment of $955,000, a result of effective execution on Roanoke Gas’ organic growth strategy and non-cash equity earnings from Mountain Valley investment. Capital expenditure sustained its momentum, with $19.4 million invested in utility property, reflecting a $1.9 million increase from 2022.

Lastly, the fiscal overview also outlines an anticipated spending of about $4.5 million more on utility plant, culminating in nearly $23.9 million for the fiscal year.

Performance

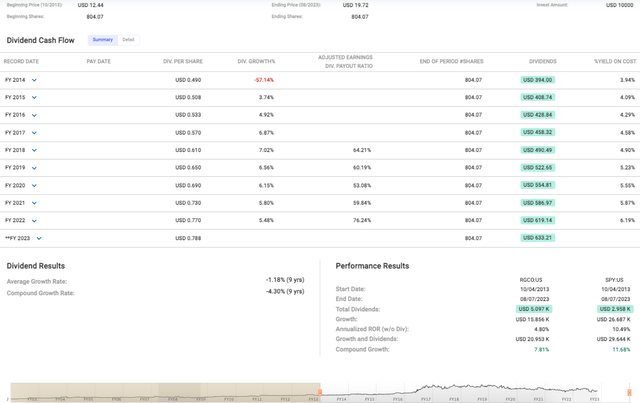

With optics on the medium-term (see data below), you’ll notice that the price increase from USD 12.44 in October 2013 to USD 19.72 in August 2023 showcases a respectable growth of over 58%. However, this translates to an annualized rate of return without dividends of only 4.80%. While this rate isn’t abysmal, it falls notably short of the broader market, as represented by the S&P 500 Index, with an 11.68% compound growth rate over the same period.

Fast Graphs

The dividend history paints a mixed picture. While dividends have increased steadily over the last nine years, the compound growth rate is negative at -4.30% implying that while the company has been able to maintain a steady payout, it hasn’t successfully grown those payouts in line with a long-term, sustainable growth strategy.

Valuation

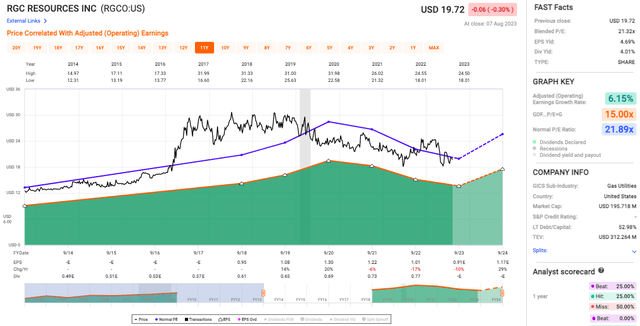

The blended P/E ratio of 21.32x (see chart below), hovering just below the normal P/E ratio of 21.89x suggests that the stock is slightly undervalued compared to its historical norms. And the adjusted (operating) earnings growth rate at 6.15% signifies steady, albeit not groundbreaking, growth. But considering the current P/E ratios, an investor could argue that the market has mostly priced in this growth rate.

Fast Graphs

Risks & Headwinds

Seeking Alpha

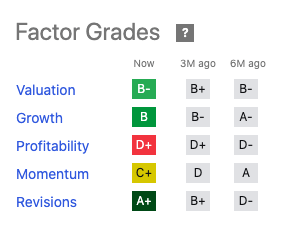

Seeking Alpha investors exploring the possibility of an entry point may have observed the Factor Grades, including the notable “Profitability” grade of D+ for RGCO. You’ll notice that even as half of the other metrics have shown improvements over the last quarter, the profitability score has been a noticeable laggard that worth’s examining.

Seeking Alpha

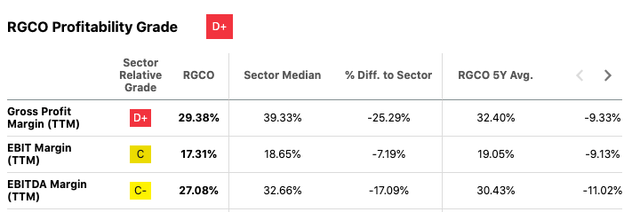

Starting with the Gross Profit Margin at 29.38%, trailing the sector median by over 25%, signals an inherent inefficiency in generating profit from core operations. This trend follows suit in EBIT and EBITDA Margins, both of which are lagging behind the sector median by 7.19% and 17.09% respectively.

Seeking Alpha

The Net Income Margin, graded at D-, at a negative -1.14%, compared to the sector’s positive 9.68% also rings alarm bells while the Levered Free Cash Flow Margin (FCF) is similarly concerning, standing at -12.45%. Although this is marginally better than the five-year average, it’s still a negative figure, indicating possible constraints in maintaining and expanding operations.

Seeking Alpha

However, even though we’re on the subject of risk, it’s not all doom and gloom. The Return on Total Capital at B+, 4.51%, surpassing the sector median.

Seeking Alpha

And the Asset Turnover Ratio, showing a 38.40% improvement over the sector, reflects some operational efficiency and capital utilization.

Seeking Alpha

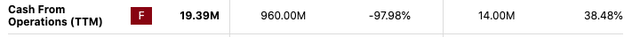

But the dark clouds reemerge when we look at Cash from Operations with a grade of F, with only 19.39M compared to the sector’s staggering 960.00M, is another red flag and indicates that RGCO’s ability to generate sufficient cash flow from its main business activities is severely hampered.

Next, circling back to the Q3 report, while many elements of RGC Resources’ performance have been impressive, there are a few issues within the report that merit a closer look, such as the delivered gas volumes. These were notably lower than in the previous year, a development largely attributable to warmer weather. The 6% decline in heating degree days (a meteorological measurement used to quantify the demand for energy needed to heat a building) translates into a 3% drop in total volumes delivered in comparison to the third quarter of the preceding year.

This weather impact extends into the first nine months of the fiscal year, where gas volumes were also reported to be lower. The commercial and industrial sectors were affected in particular, with volumes down by 2% year-to-date.

Moving into the financial sphere, the interest expense has been a subject of concern. The rise in the general interest rate environment has put this expense under pressure, particularly as it relates to floating rate debt that supports the Mountain Valley investment.

Lastly, this complexity extends to RGC Resources’ earnings guidance, where a wider-than-usual range has been noted. Investors might interpret this as a reflection of uncertainty, potentially linked to the outcome of the ongoing rate case filed in December of 2022. At the time of this analysis, it’s still progressing through the audit phase with RGC anticipating their testimony on August 23.

Final Takeaway

Based on RGC Resources’ data, I would rate the stock as a “hold.” While the company has shown positive growth and some favorable financial indicators, there are significant risks and constraints such as low profitability scores, negative net income margin, and concerning cash flow, coupled with the uncertainty surrounding some external factors like interest rates and regulatory decisions. The stock’s past performance and valuation also suggest a stable but not exceptional growth prospect, making it suitable for a more cautious approach rather than a “buy” call right now.