A lot has been in the news about the Energy Transition, including more solar on home rooftops, and battery electric vehicles (BEV) replacing internal combustion engine (ICE) vehicles. But who has been leading in this transition, and how much financial incentive have they enjoyed to participate? Are all income classes engaged in the transition? Who has profited from tax incentives for rooftop solar and BEVs?

Xcel Energy’s Solar*Rewards Program:

In 2004, Colorado voters passed Amendment 37 which created a 2% electricity bill surcharge for all Xcel customers to fund solar panel installation on homes, businesses, and utility-scale, beginning in 2006. At that time, solar panel installation costs were $9 per watt DC, and Xcel offered a 50% rebate for residential solar installations up to 10 kilowatts.

Which customers could afford to place $90,000 on their roof with solar panels, even if Xcel was to rebate half of the cost? Predominately, only the more well-to-do customers who could afford this expense. Once the solar systems were installed, the homeowners generated more of their own household energy, and did not buy as much electricity from Xcel. By lowering their monthly Xcel Energy electricity consumption and bill, these same homeowners also paid a much lower 2% surcharge on electricity sales to provide subsidy money for other solar installations.

This incentive program, albeit passed by the citizenry of Colorado and approved by the Colorado Public Utility Commission (CPUC), by virtue of the early program rich customers who received the 50% rebate was a “Reverse Robin Hood” situation where the lower/middle class in Colorado subsidized the wealthy and their new solar systems.

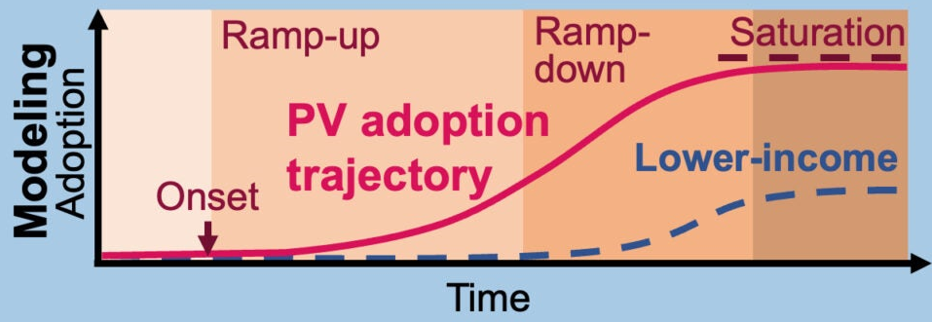

Tax rebates for installing residential solar power has done little to spur adoption in low-income communities in the United States. Even though solar power has increased dramatically over the past decade, and the cost of photovoltaic panels has fallen significantly, lower-income communities have been much slower than high-income users to ramp up.

Rooftop solar has disproportionately benefited high-income and White residents.

While low-and moderate-income (LMI) residents make up 43% of the U.S. population, only 21% of residential solar installations benefited these communities in 2019. On top of that, nearly half of communities with a majority of Black residents did not have a single solar system installed.

This disparity is exacerbated by the inequitable design of existing tax credits that incentivize residential solar. The solar investment tax credit (ITC) provides minimal advantage for those with little to no federal income tax, and thus have little use for a tax break.

Around 7 in 10 American tax filers would not have enough annual tax liability to receive the full ITC 25D benefit, according to 2018 data from the IRS. And the more than 4 in 10 Americans that do not have any federal income tax liability at all would see zero benefit.

Further excluding potential LMI solar customers, California utilities consider residential rooftop solar their only source of competition, and are pressuring the CPUC to adopt their plan to eliminate incentives and replace them with a steep solar tax of around $50 per month on residents who install rooftop solar. The plan would drastically reduce the credits households could receive toward their monthly bills for selling excess electricity and put solar out of their reach for the LMI customers.

Figure 1 demonstrates the photovoltaic (PV) adoption trajectory which shows the disproportionate share of solar installations by lower income families.

Figure 1 – PV Adoption Trajectory

Tax Incentives for BEVs:

The average BEV sold in the U.S. in July 2022 was $66,000, up 13.7% year over year. The average new ICE car in America sold for $48,043, up 12.7% from a year earlier. Thus the BEVs are commanding a 37.4% price premium. Who in American can afford the 37% premium, pay the electric bills which are climbing (14% increase in 2022)? Are the lower and middle classes clamoring to buy these high-priced BEVs, albeit with the $7,500 federal tax credit, and state and local incentives?

One of the biggest complaints about electric vehicles remains their prices. They are unattainable for most consumers, even with large subsidies.

From a standpoint of equity, BEV tax incentives impact only upper-income people since lower-income families have much lower tax rates, and thus benefit less from tax breaks.

Barriers to low and moderate income citizens using BEV tax breaks include: 1) lack of access to disposable income/capital, and 2) insufficient tax burden or lower applied tax rates.

The recent University of California at Berkeley study found that since 2006, US households have received more than $18 billion in federal income tax credits which have gone predominantly to higher-income Americans. The bottom three income quintiles have received about 10% of all credits, while the top quintile has received about 60%. The most extreme is the program aimed at battery electric vehicles, where we find that the top income quintile has received about 90% of all credits.

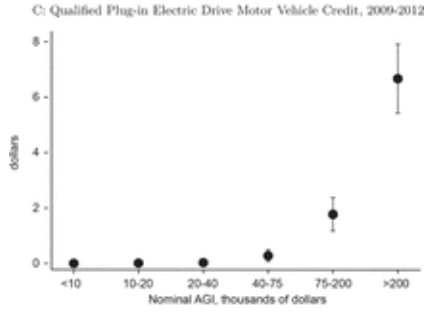

Figure 2 plots the average Qualified Plug-in Electric Drive Motor Vehicle Credit (PEDMVC) amount per return by AGI category. Among all filers with more than $200,000 in AGI, the average amount claimed in residential energy credits was about $80, more than 3 times the average amount received by filers in any other income category.

Figure 2 – Qualified Plug-in Electric Drive Motor Vehicle Credit (PEDMVC) vs. Thousands of Dollars of AGI, 2009-2012

Source: https://www.journals.uchicago.edu/doi/full/10.1086/685597

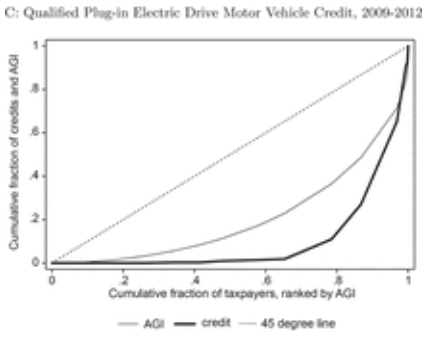

Figure 3 plots the cumulative fraction of PEDMVC received by taxpayers ranked by AGI. The figures show that the first 50% of taxpayers based on AGI receive about 15% of all PEDMVC, and the first 80% of taxpayers receive about 40% of all PEDMVC. If income were equally distributed across taxpayers, then the AGI curve would exactly follow the 45-degree line with, for example, the richest 50% of filers receiving 50% of the PEDMVC. The farther below the 45-degree line, the more concentrated the tax credits are to high-income filers.

With a large majority of federal voters and taxpayers being left out of the clean energy subsidies, how long will it be before they realize they are subsidizing their well-heeled neighbors with the new solar systems and BEVs?

Figure 3 – Cumulative Fraction of PEDMVC vs. Cumulative Fraction Of Taxpayers Ranked By AGI, 2009-2012

Source: https://www.journals.uchicago.edu/doi/full/10.1086/685597

Summary:

- Early rooftop solar customers were predominately in the higher income bracket of America, and enjoyed significant financial incentives to install solar and also to avoid utility surcharges that support future solar installations.

- Financial tax breaks/incentives for BEVs have gone to the upper echelon of American taxpayers who can use the tax break and have the sufficient income to afford BEVs.

- In effect, lower to middle income federal taxpayers are subsidizing the higher income brackets to install solar and purchase BEVs.

- How long will the lower and moderate income Americans continue to pay the federal tax subsidies to richer neighbors for solar panels and BEVs?

Copyright © August 2023 Ronald L. Miller All Rights Reserved