PM Images

Energy Transfer (NYSE:ET) is having a strong 2023 as units appreciated from $11.62 to a 52-week high of $13.67. Units of ET are retracing a bit after earnings, finishing the week down -4.06%. ET has now missed analyst estimates on the top and bottom line for the past 4 quarters. Despite a history of missing on earnings, ET’s importance to society, its valuation, and the distribution make this one of the most interesting investments I have allocated capital toward. In a world where technology is front and center, I still like companies that make things and have hard physical assets that provide services. I still believe that the energy infrastructure industry is undervalued because life as we know it would be drastically different without this sector. The future energy demand is expected to increase by 50% over the next 3 decades. Oil and gas will play a critical role in meeting the future energy demand, and ET will remain a top choice to transport natural gas, crude, and refined products throughout the country. ET has a distribution yield of 9.66%, which still looks cheap, and if units keep selling off, the opportunity will grow even larger.

Seeking Alpha

Energy Infrastructure companies are still undervalued and the market is discounting their importance to society

I am pro-renewable energy, and I am invested in several renewable energy companies because they are projected to increase their percentage in the global energy mix over the next several decades. Why I see the opportunity in renewables, I am a realist and understand that eradicating oil and gas isn’t probable over the next 20-30 years. I continue to read many different energy industry publications to understand current trends and future predictions. I continue to allocate capital toward energy infrastructure companies due to the information I will share from these publications:

- 72nd Edition of the Statistical Review of World Energy (can be read here)

- International Energy Agency Oil 2023 Analysis and Forecast to 2028 (can be read here)

- U.S. Energy Information Administration Annual Energy Outlook 2023 (can be read here)

- U.S. Energy Information Administration Short-Term Energy Outlook July 2023 (can be read here)

- BP Energy Outlook 2023 (can be read here)

Over the past decade, there hasn’t been a year where global oil production exceeded the amount consumed. In 2022 the global economy consumed 97,309,000 Bpd of crude while the production level was 93,848,000 Bpd. Natural gas has been produced at a slight surplus over the period compared to the deficit of oil produced. The U.S. is the largest oil and gas producer, producing 18.93% of global oil production and 24.2% of global natural gas production. When Canada is accounted for, an additional 5.94% of oil production and 4.57% of natural gas production comes online. This is the main reason why I am consistently allocating capital to energy infrastructure companies. There is 24.87% of the global oil production and 28.77% of the global natural gas production occurring in North America, and it all needs to be treated and transported.

Steven Fiorillo, Energy Institute

The 2023 Annual Energy Outlook from the EIA indicates that production levels in their reference cases for petroleum and other liquids and natural gas will increase through 2050 in the U.S. The U.S. will also remain a net exporter of petroleum and liquified natural gas (LNG) products. If the U.S., which is the largest oil and gas producing nation globally, is projected to increase production and be a net exporter through 2050, the logical conclusion is that more takeaway capacity will be needed, and energy infrastructure companies will generate larger levels of distributable cash flow (DCF) as more fuel passes through their systems.

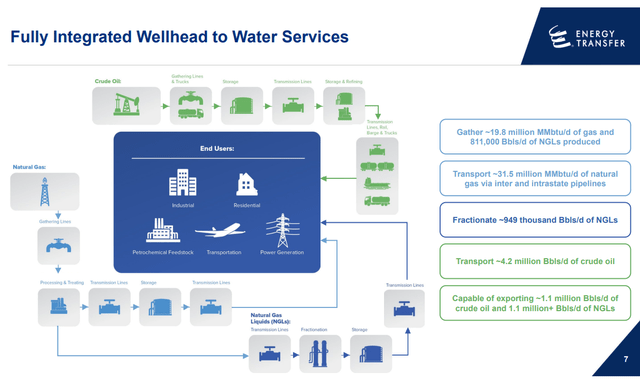

Energy Transfer continues to dominate the MLP sector and exporting should be a huge future catalyst

In Q2 ET completed its acquisition of Lotus Midstream for a combination of $930 million in cash and 44.5 million of newly issued units. ET added 3,000 miles of active gathering lines and 2 million barrels of crude storage. ET is projecting that the integration of Lotus will generate significant synergies between the companies and immediately enhance their ability to generate free cash flow and distributable cash flow. I like the deal because it provides ET with a bi-directional connection from the Permian Basin to Cushing OK, and adds capacity to other major hubs, including Midland.

ET finished Q2 generating $3.12 billion in Adjusted EBITDA and $2.04 billion of DCF on a consolidated basis. $1.54 billion of the total DCF is attributable to the partners of ET. ET saw its NGL fractionation volumes increase 5%, midstream gathering volumes increase 8%, NGL transportation volumes increase 13%, intrastate natural gas transportation volumes increase 3%, crude transportation increase by 23%. ET guided that in 2023 we will see between $13.1 billion and $13.4 billion in Adjusted EBITDA, which is the largest amount from all the MLPs.

For the past several years, I have discussed ET’s strength in the exporting sector and why it was a strategic move for the company. ET has export facilities on the East and Gulf coasts with a large pipeline system that spans over 120,000 miles. ET recently signed 3 long-term agreements to sell LNG from the proposed Lake Charles export facility in Louisiana. The first deal that was announced was with an unnamed Japanese consortium for the purchase of 1.6M tons/year for a 20-year term. The 2nd agreement acts as a middleman where Swiss commodities trader Gunvor would buy LNG from Chesapeake Energy (CHK) at a price indexed to the Japan-Korea Marker for 15 years. CHK would supply the Lake Charles facility with enough volumes of gas to produce 1M tons/year for 15 years; after liquefaction. The 3rd deal is with an unnamed U.S. customer and involves a tolling arrangement for 1M tons/year for 15 years.

The Lake Charles facility has come under question, and on the conference call, ET discussed this project at length. In May of 2022, ET received an extension from FERC on the deadline for the completion of the construction of Lake Charles LNG facility to December of 2028. The DOE denied ET’s request for an extension for the commencement of exports and in April, denied ET’s appeal placing this project in Limbo. We have now been informed that ET has been in discussions with the DOE and is filing a new application for export authorization. ET expects to file in August and, during the DOE’s review, work with existing customers, prospective equity investors, and other stakeholders to progress the development of the Lake Charles export facility. Ultimately I believe that ET will be granted the authorization because commodities are too important to the U.S. in global trade, and there will be a continuous need for U.S. energy on the global stage.

Energy Transfer

The Nederland and Marcus Hook export terminals continue to benefit from increased demand both in the U.S. and international markets. ET has made a final investment decision on an expansion to its NGL export capacity at the Nederland facility to address increased demand. They expect the expansion to cost $1.25 billion and add roughly 250,000 bpd of export capacity. ET also is pursuing a project at the Marcus Hook facility that would add incremental ethane refrigeration and storage capacity.

I am bullish on ET’s future because as the demand for energy increases, so will the need for ET’s services throughout the value chain. ET generates incremental profits throughout every segment in transporting crude, natural gas, and natural gas liquids. Exporting could be a critical differentiator between ET and the rest of the sector in the future and allow ET to grow even quicker. If ET gains the approvals from the DOE it will expand their exporting capability and should drive higher volumes through their infrastructure due to contracted exports.

Energy Transfer

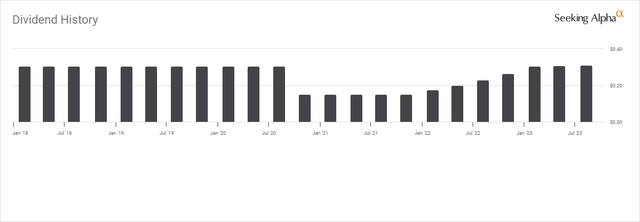

The distribution is back and ET is looking to reward unitholders in the future

ET goes ex-dividend on 8/11, and the current distribution is larger than before the cut. In the November 2020 distribution, ET made a -50% reduction from $.305 to $0.1525. Since the February 2022 distribution, ET has provided unitholders with 7 consecutive quarterly distribution increases, bringing the annualized distribution to $1.24. On the conference call, management indicated that they will continue to target a 3% to 5% annual distribution growth rate.

If ET grows the distribution at a 4% rate which is the midpoint of their guidance, the annualized distribution could grow by 17% by the 2027 distribution. Management reduced its leverage, acquired 2 companies, and provided 7 distribution increases, bringing the distribution above its prior levels before the cuts in less than 3 years. ET is getting back to its roots and could become a distribution growth machine. I think between the new acquisitions and the potential export expansion, ET has the ability to provide larger increases to the distribution in the future and this is becoming an enticing yield story all over again.

Seeking Alpha

Energy Transfer still looks undervalued compared to its peers

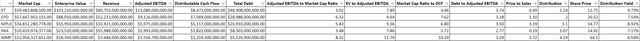

I updated all of the numbers for the MLPs I compare ET against, and they still look undervalued. I used the following MLPs in my peer group:

- Plains All American Pipeline (Plains All American Pipeline, L.P. (PAA) Stock Price Today, Quote & News)

- Magellan Midstream Partners (Magellan Midstream Partners, L.P. (MMP) Stock Price Today, Quote & News)

- MPLX LP (MPLX LP (MPLX) Stock Price Today, Quote & News)

- Enterprise Products Partners (Enterprise Products Partners L.P. (EPD) Stock Price Today, Quote & News)

Steven Fiorillo, Seeking Alpha

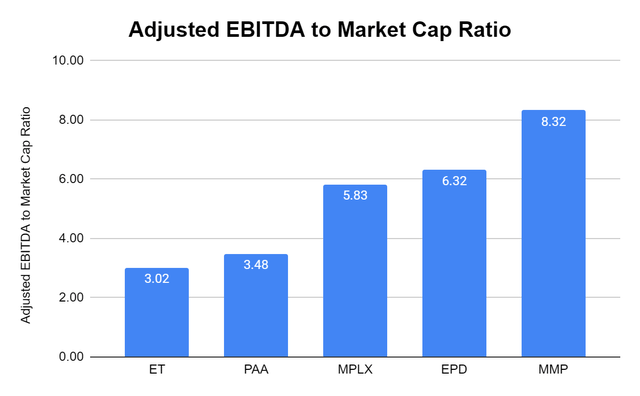

ET trades at the lowest Adjusted EBITDA to market cap ratio in its peer group at 3.02x. The peer group average is 5.39, and units of ET still look to be on sale compared to this metric.

Steven Fiorillo, Seeking Alpha

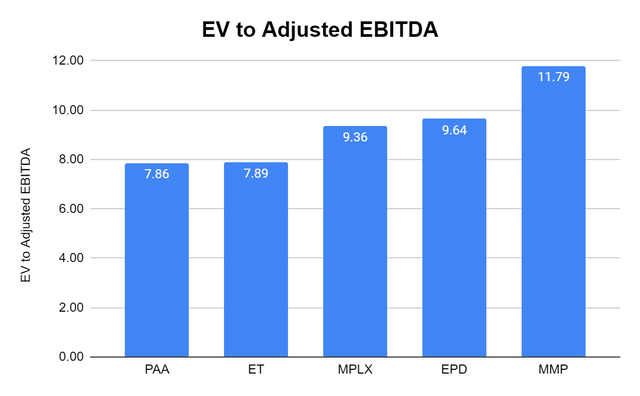

ET’s EV to Adjusted EBITDA is 7.89 compared to a 9.31 peer group average. PAA trades at a similar valuation then the rest of the group trade between 9.36x and 11.79x.

Steven Fiorillo, Seeking Alpha

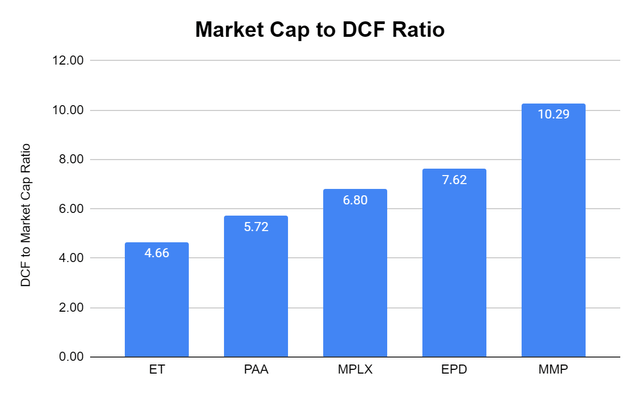

When looking at the DCF that these companies generate compared to their market caps, ET trades at 4.66x compared to a 7.02x average.

Steven Fiorillo, Seeking Alpha

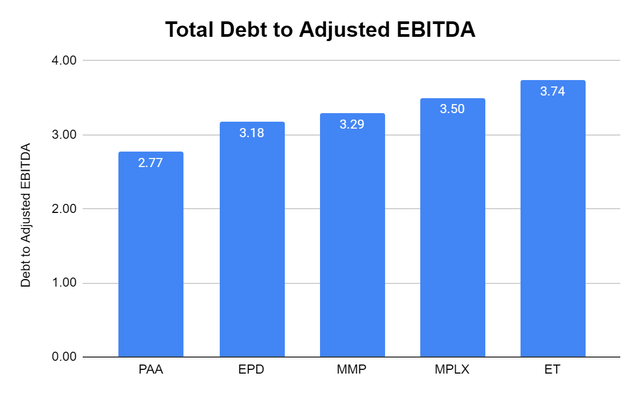

ET has the largest amount of debt, but they also produce the largest amount of Adjusted EBITDA and DCF. ET has a 3.74x total debt to Adjusted EBITDA ratio, which isn’t that high even though it’s the largest in the peer group.

Steven Fiorillo, Seeking Alpha

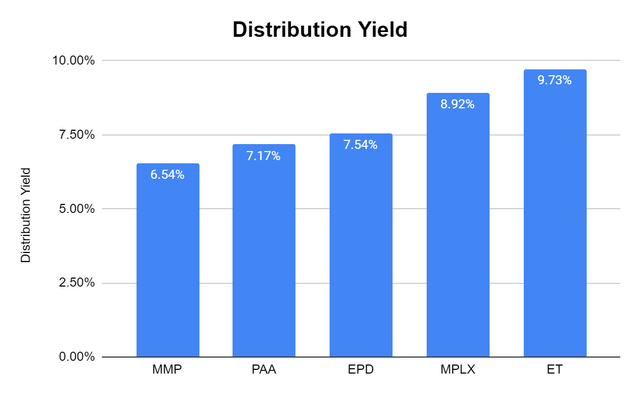

ET is also the largest-yielding MLP in the peer group, with a 9.73% yield compared to the peer group average of 7.98%.

Steven Fiorillo, Seeking Alpha

Conclusion

I still feel that ET is undervalued, considering you are paying 3.02x its market cap for ET’s Adjusted EBITDA and 4.66x for its DCF. Today you would be getting the largest yielder out of the growth with a commitment to 3-5% in annual distribution growth at the lowest valuation. Oil and gas aren’t going away, and with the global demand set to increase along with production in the U.S., ET’s services will continue to see increased demand. If units continue to retrace in the coming weeks, I think the opportunity will just get stronger. I think ET deserves a stronger valuation, and eventually, the market will come around.