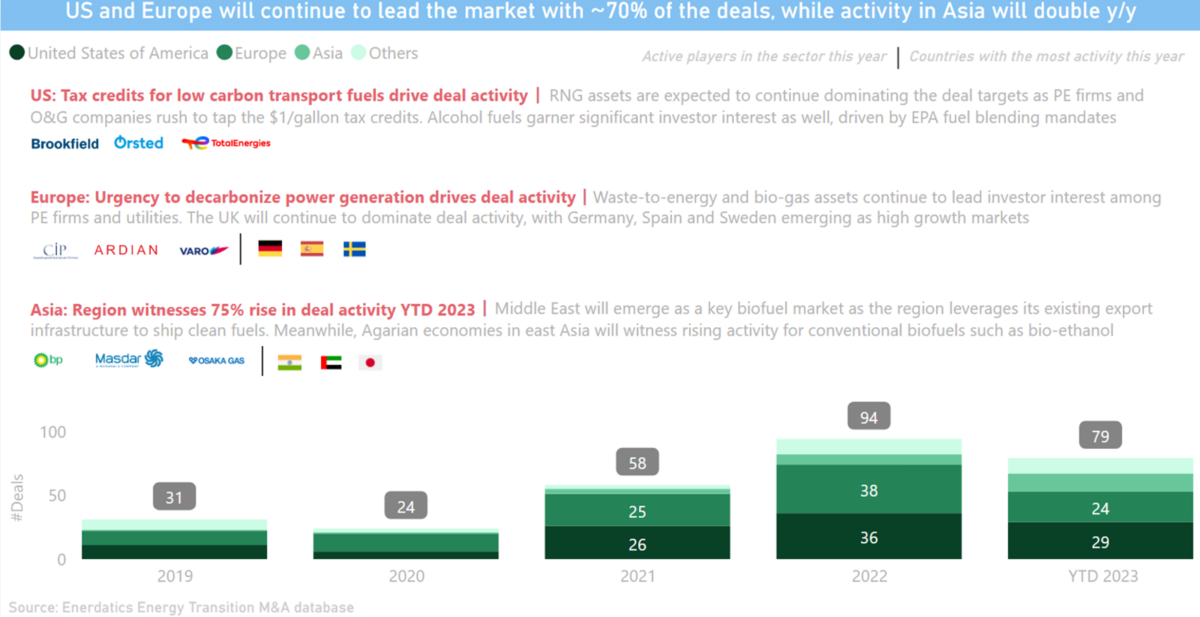

US and Europe will continue to lead the market with ~70% of the deals, while Asia will witness its activity double y/y.

US: Tax credits for low carbon transport fuels drive deal activity – RNG assets are expected to continue dominating the deal targets as PE firms and O&G companies rush to tap the $1/gallon tax credits. Alcohol fuels garner significant investor interest as well, driven by EPA fuel blending mandates.

Europe: Urgency to decarbonize power generation drives deal activity – Waste-to-energy and bio-gas assets continue to lead investor interest among PE firms and utilities. The UK will continue to dominate deal activity, with Germany, Spain and Sweden emerging as high growth markets.

Asia: Region witnesses 75% rise in deal activity YTD 2023 – Middle East will emerge as a key biofuel market as the region leverages its existing export infrastructure to ship clean fuels. Meanwhile, Agarian economies in east Asia will witness rising activity for conventional biofuels such as bio-ethanol.