tadamichi

Written by Nick Ackerman, co-produced by Stanford Chemist.

Miller/Howard High Income Equity Fund (HIE) is a term structured fund that is anticipated to be liquidated near the end of 2024. As we wind down closer to the liquidation date over the next year and a half or so, this discount should naturally start to contract. Investors are exposed to a fairly volatile portfolio in this fund. While the portfolio is rather diversified, it leans toward the energy sector and employs leverage in its strategy as well.

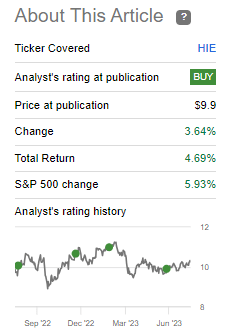

In our last update, we also looked at another term fund set to liquidate in 2024. That was the Invesco High Income 2024 Target Term Fund (IHTA). Since that update, HIE has delivered some attractive returns as the broader market participation has picked up, including the energy sector, which remains the laggard in 2023.

HIE Performance Since Prior Update (Seeking Alpha)

Today, we are revisiting HIE as they’ve posted their latest semi-annual report for the six months that ended April 30th, 2023. There wasn’t anything too unexpected in the latest report, but it did show that the fund took down borrowings substantially.

The Basics

- 1-Year Z-score: 0.06

- Discount: 7.28%

- Distribution Yield: 5.93%

- Expense Ratio: 1.57%

- Leverage: 6.8%

- Managed Assets: $201.191 million

- Structure: Term (expected November 24th, 2024)

HIE is classified as a “diversified, closed-end management investment company whose primary objective is to seek a high level of current income with capital appreciation as a secondary objective.”

They intend to invest “at least 80% of its total assets in dividend or distribution paying equity securities of US companies and non-US companies traded on US exchanges. The Fund will seek to invest in securities that the Investment Advisor considers to be financially strong with reliable earnings, high dividend or distribution yields, and rising dividend growth. The Fund may invest up to 25% in Master Limited Partnerships (“MLPs”), generally in the energy sector. The Fund intends to engage in an options writing strategy consisting of writing put options on securities already held in its portfolio or securities that are candidates for inclusion in its portfolio. It may also engage in covered call writing strategies, and it may buy put and call options. The Fund may write covered put and call options up to a notional amount of 20% of the Fund’s total assets.”

It’s important to note that funds can switch to perpetual funds or push back the liquidation date; that’s why it’s only an “expected” or “anticipated” liquidation date. We discussed that more in-depth in our previous articles, but for HIE, the Board can extend the term by one year without a need for shareholder approval. They may also put it up for a vote to shareholders to switch to a perpetual structure.

Performance – Attractive Discount And Deleveraging

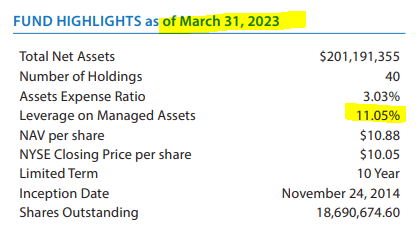

The fund had previously shown in its last fact sheet that leverage was reduced to a rather modest level.

HIE Fund Highlights (Miller/Howard (highlights from author))

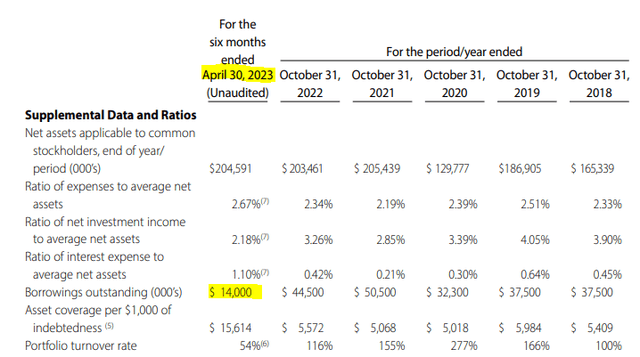

However, the latest report shows that they reduced it even further a month later.

HIE Fund Ratios (Miller/Howard (highlights from author))

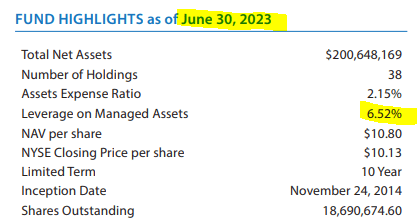

This lower amount of leverage was reflected in the most recent fact sheet as well, with data as of June 30th, 2023.

HIE Fund Highlights (Miller/Howard (highlights from author))

It’s unclear what exactly is driving this deleveraging. It may be in the anticipated liquidation for next year, which would be a bit strange as there is still a fair amount of time left. Otherwise, the manager could be just taking leverage down after a strong run in the energy market for the last couple of years.

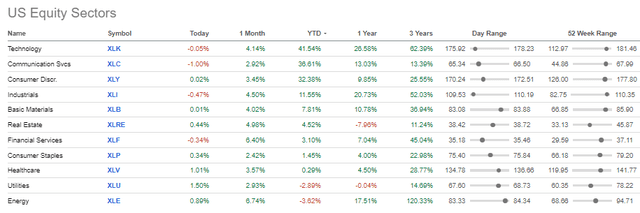

This could have been luck or fairly smart, considering they deleveraged heading into a year where energy is still not positive. Energy and utilities are the only sectors still negative on a YTD basis now that market participation has broadened considerably.

Sector Performance (Seeking Alpha)

Either would be fairly strange because the incentive for management is to leverage to the hilt and generate a higher advisory fee. So a manager doing the right thing for shareholders can sometimes be perplexing. Nevertheless, I feel this is a positive development, and the leverage levels will be something I watch closely going forward.

In the supplemental data and ratios used to highlight the borrowing’s outstanding decline, one might also notice that the average expenses to average net assets have increased. This was driven largely by the significant increase in interest expenses to average net assets going from 0.42% to 1.10%. Which would mean that the actual operating expenses increased less than expected. That was driven in part by the advisory fee itself dropping from 1% to 0.90% this year.

The fund’s expense ratio is still rather high, but this is another move that doesn’t happen frequently: seeing advisory fees drop. They often add in limited-time waivers of fees that are temporary. Combining that with a reduction in leverage and the fund is helping, at least a bit, to offset the higher leverage costs on the remaining leverage.

Overall, the fund’s long-term history hasn’t been that strong due to being exposed to energy in an overweight manner. That worked out well from 2020 through 2022, but before that and in 2023, it was an albatross dragging down results. In particular, the fund launched at the end of 2014 and immediately participated in the rapid move lower following the oil price. Still, for those who picked it up post-Covid, we are sitting on strong gains.

I also believe that the portfolio is structured so that – barring another black swan event – it can still deliver acceptable returns until the anticipated liquidation. With a reduction in leverage, a black swan event would not likely have the same impact as the Covid pandemic did in wreaking havoc on the fund.

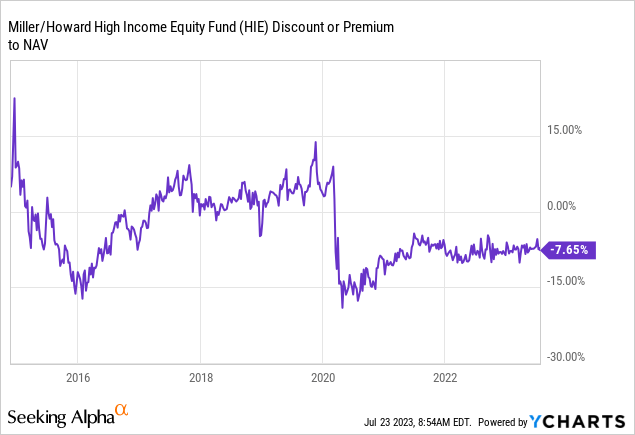

The fund’s discount is still at a level where some alpha can be generated going into its termination, making it a decent choice to consider today.

Ycharts

Distribution – NII Takes A Hit As Expected

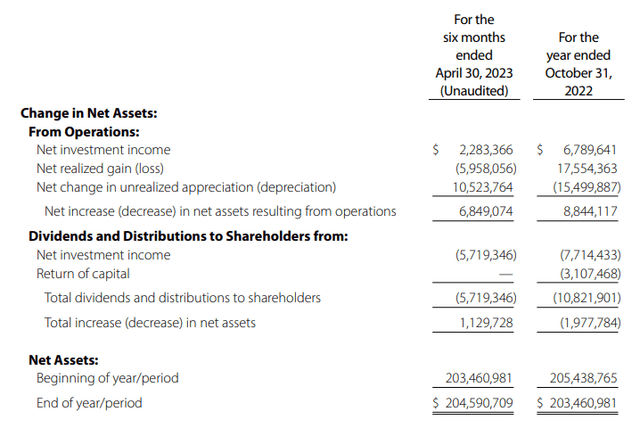

With rising interest rate costs for their borrowings, the fund’s leverage expenses climbed despite the other moves to reduce leverage and reduce the advisory fee. That saw a drop in net investment income from the prior annual report if annualized and from the year-ago period.

HIE Semi-Annual Report (Miller/Howard)

A year ago, the fund reported NII for the six-month period at $2.687 million. The interest expense declined on an absolute basis due to reduced leverage. Going forward, this could come down further even as borrowings were once again slashed. The borrowing rate finished this period at 5.68%.

The fund will write options against its underlying portfolio to generate additional capital gains potential. The latest report showed a total options gain of $1.061 million. Including that with the NII calculation (because options premiums are something that can occur quite regularly,) we’d get distribution coverage of nearly 60%. While underlying positions in their portfolio in the energy sector have yields that should be covering this, several portfolio positions have much lower yields. This coverage is also quite strong compared to equity peers as well.

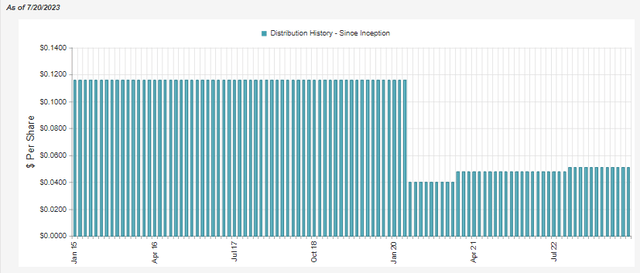

After the Covid crash, the fund has been more conservative in its payout after having to slash it during Covid.

HIE Distribution History (CEFConnect)

Currently, the fund’s distribution rate on a NAV basis comes out to 5.50%. In the prior two years, this resulted in helping the NAV recover back to pre-Covid levels. However, for investors in CEFs, it’s likely too low to generate interest from most investors. This is one of the reasons that the discount could remain so sticky.

Another benefit for investors that invested post-Covid crash is that the fund is sitting on a sizeable amount of capital loss carryforwards. These carryforwards can be used to offset any potential realized gains regarding the taxable character of the fund’s distribution. The fund also carries MLPs and other energy infrastructure companies that pay out return of capital distributions as well. That can result in return of capital distributions that would be non-destructive (i.e., ROC payments showing up while the NAV is still rising.)

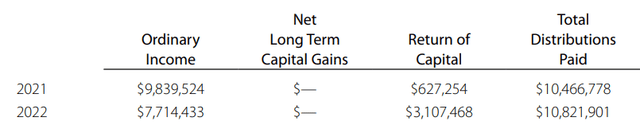

HIE Distribution Tax Classification (Miller/Howard)

HIE’s Portfolio

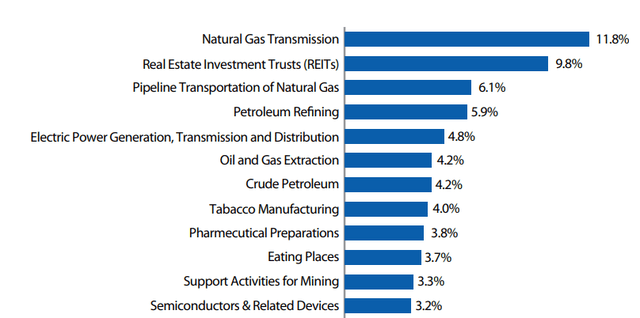

This fund is extremely active. Turnover in the latest report came to 54%. If annualized out, that would be some of the lowest in the last several years. The 2022 fiscal year saw a turnover of 116%, but those figures were dwarfed by 2020’s 277% portfolio turnover rate. At the same time, energy exposure has continued to dominate the fund’s exposure, even with the incredibly active portfolio. The breakdown gets into the industry breakdown from their last semi-annual report.

HIE Industry Breakdown (Miller/Howard)

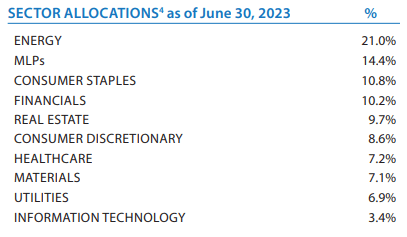

In looking at the latest fact sheet, we can see a more updated breakdown of the sector allocation. Note that they split up the “energy” sector from the “MLP” sector. Combining that would give us over 35% in energy exposure.

HIE Sector Allocations (Miller/Howard)

We also know that they deleveraged during that month, leading to potential changes. However, we can see that some of the largest industry exposure will still tilt the fund into the energy space.

The portfolio isn’t very large, with generally 40 or fewer positions. The largest position in the fund is Mount Vernon Liquid Assets Portfolio generating a 4.96% yield for the fund. This is a truly large position as it represented nearly 23.5% of the fund in its last report. They mention this is similar to a money market fund, but it is private and not registered with the SEC. This cash-like position is because they participate in securities lending, and this is where they put the cash collateral to work.

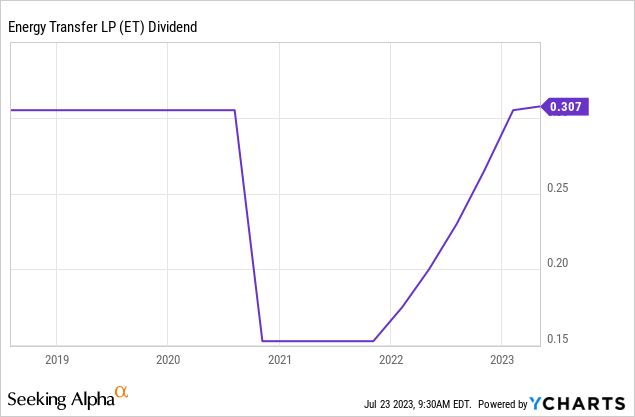

This position is then followed up by the second largest weighting, Energy Transfer (ET), which represented around 4.7% of the portfolio in its last report. Canadian Natural Resources (CNQ) and TC Energy Corp. (TRP) are also quite large positions with similar weightings of 4.47% and 4.46%, respectively. All three of these positions represent exposure to the energy space.

ET, in particular, seems to be a popular MLP with income investors. They had cut their dividend but, as they intended, ramped it back up. The payout is now just above where it was when they cut with the latest raise.

Ycharts

This represents a yield of 9.35%, and for HIE, it is one of the higher-yielding names in their portfolio. CNQ carries a more modest yield of 4.33%, and TRP does as well, with a yield of 6.86%.

Overall, it’s a value-oriented portfolio approach that invests with an emphasis on dividend payers, exactly consistent with the fund’s strategy.

Conclusion

HIE is a value-oriented portfolio with an overweight allocation to the energy sector. This can lead it to be more volatile, but with the anticipation of liquidation next year, the fund has the opportunity to generate alpha relative to non-termed peers. The fund has reduced its leverage materially with the latest report, but this will be something to monitor closely to see if they ramp it back up. A reduction in leverage, in my opinion, is a positive at this time. The reduction in the advisory fee is also a positive move.