AlexLMX/iStock via Getty Images

All financial numbers in this article are in Canadian dollars unless noted otherwise.

Introduction

I finally pulled the trigger on a stock I’ve had on my watchlist since the day I first researched it. Last month, I deployed a big portion of my cash to add Calgary-based oil major Canadian Natural Resources (NYSE:CNQ). It’s now my 7th-largest position and my second-largest oil investment with an average entry price of $58.02 (NY-listed shares).

When I say that the company behind the CNQ ticker is one of the best oil companies on Earth, I’m serious.

CNQ has everything I’m looking for in an energy stock. This includes deep reserves, low breakeven prices, a healthy balance sheet, a great dividend track record, and the aim to distribute almost every penny of excess free cash flow to shareholders through special dividends and buybacks.

Canadian Natural Resources

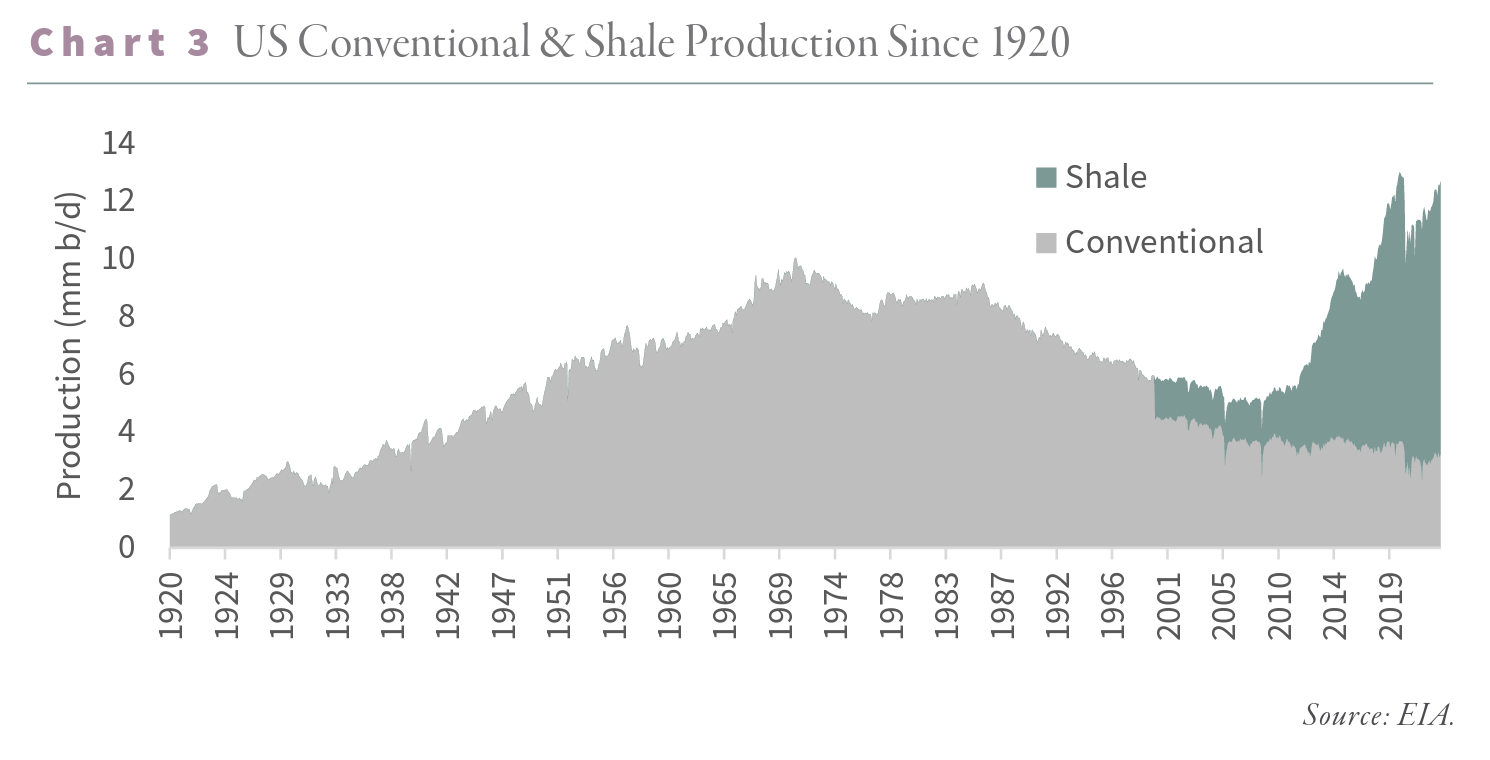

Especially at a time when US shale production, which was the global supply engine between the Great Financial Crisis and 2021, is running out of momentum, I think investors need to be prepared for a prolonged period of elevated energy prices and invest in companies with deep reserves in a time when most are running out of tier 1 drilling inventory.

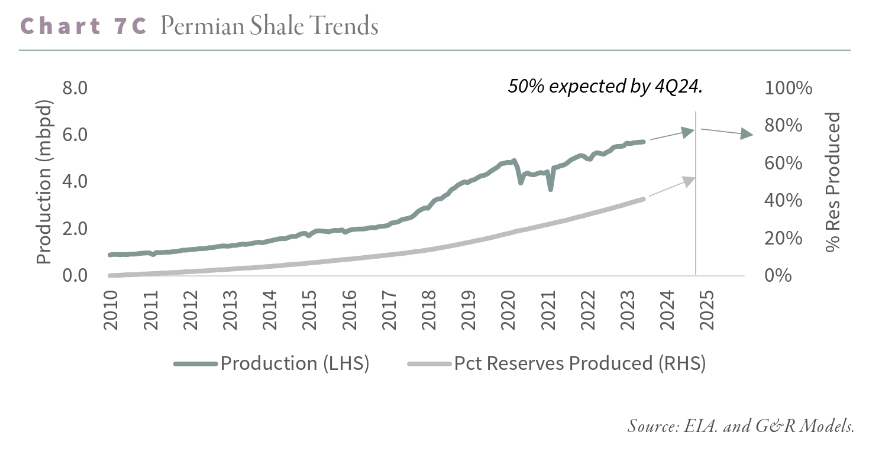

Currently, the Permian is the only basin in the US capable of strong growth. All other major basins have gone sideways since the pandemic.

Goehring & Rozencwajg

Now, even the Permian is expected to reach peak production at the end of next year, as I discussed in a recent article.

Goehring & Rozencwajg

On top of these (bullish) secular long-term developments, Saudi Arabia is determined to defend $80 Brent by all means necessary, which is currently adding to the oil price rally.

Changes in both supply and demand are fueling the upswing. On the supply side, declining inventories reflect recent production cuts from Saudi Arabia and Russia—in contrast to earlier this year, when traders and analysts suspected Moscow had failed to follow through on an earlier pledge to pump less oil.

“The market is really starting to respond to the production cuts by Saudi Arabia,” said Saad Rahim, chief economist at Trafigura, a Geneva-based commodity trading house.

At the same time, a range of economic indicators is signaling that fears about recession in the U.S. and the eurozone may have been overblown, boosting expectations for energy consumption. – Wall Street Journal

That’s where CNQ comes in. Not only do I need investments to protect my portfolio against inflation, but it’s also a terrific income vehicle with the potential to outperform its peers and the market by a wide margin.

So, let’s get to the details!

What Makes Canadian Natural So Special

As its $65 billion market cap may suggest, Canadian Natural Resources is a giant.

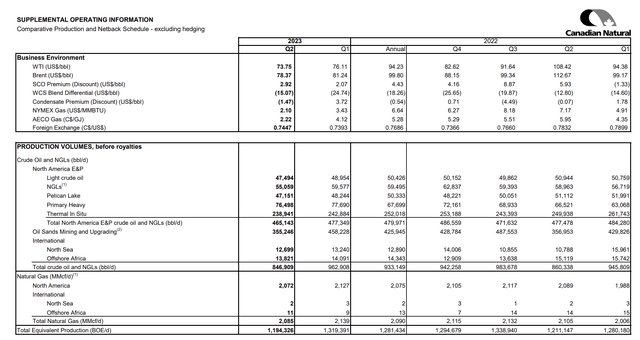

In the second quarter, the company achieved a quarterly production of around 1.19 million BOEs (barrels of oil equivalent) per day, including natural gas production of about 2.1 bcf per day and production of liquids of roughly 847,000 barrels per day.

These numbers were influenced by operational impacts from wildfires in Western Canada, third-party pipeline outages, and planned turnaround activities.

The wildfires led to temporary shutdowns of some assets between May and July, with no significant damage reported. Most of the production affected by the wildfires has been restored, which is the biggest takeaway when it comes to these fires.

Energy Portal

Statistics Canada reported that oil and gas extraction fell by 3.6% during the month, marking the largest decline since April 2020. The wildfires primarily affected installations in western parts of the province, including areas from Edmonton to the Rocky Mountains’ Foothills in the Clearwater, Montney, and Duvernay formations. – Energy Portal

Furthermore, oil production from international assets remained steady. Heavy oil production in 2Q23 increased by 15% compared to the prior-year quarter, supported by strong drilling results counteracting natural field declines.

Operating costs for heavy oil decreased primarily due to lower natural gas fuel costs.

Canadian Natural Resources

With that in mind, the company has more than 30 years of proven reserves, which beats its average peer by more than ten years. Last year, the company’s new reserves exceeded production, which shows that the company has way more than 30 years’ worth of high-quality production, which protects it against forced M&A deals down the road – the same cannot be said about a wide range of peers.

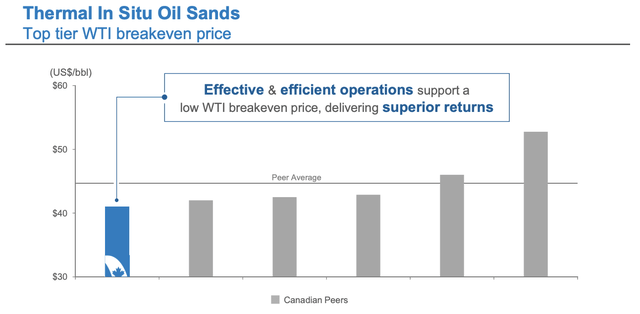

Adding to that, the company is breakeven at roughly $40 WTI, which makes it one of the most efficient oil producers in the world.

Canadian Natural Resources

It also helps that the company has a very healthy balance sheet.

The company ended the second quarter with a net leverage ratio of 0.7x EBITDA and remains well-prepared in terms of liquidity, boasting substantial resources such as revolving bank facilities, cash reserves, and short-term investments. As of the end of 2Q, the company’s liquidity stood at an impressive $5.6 billion.

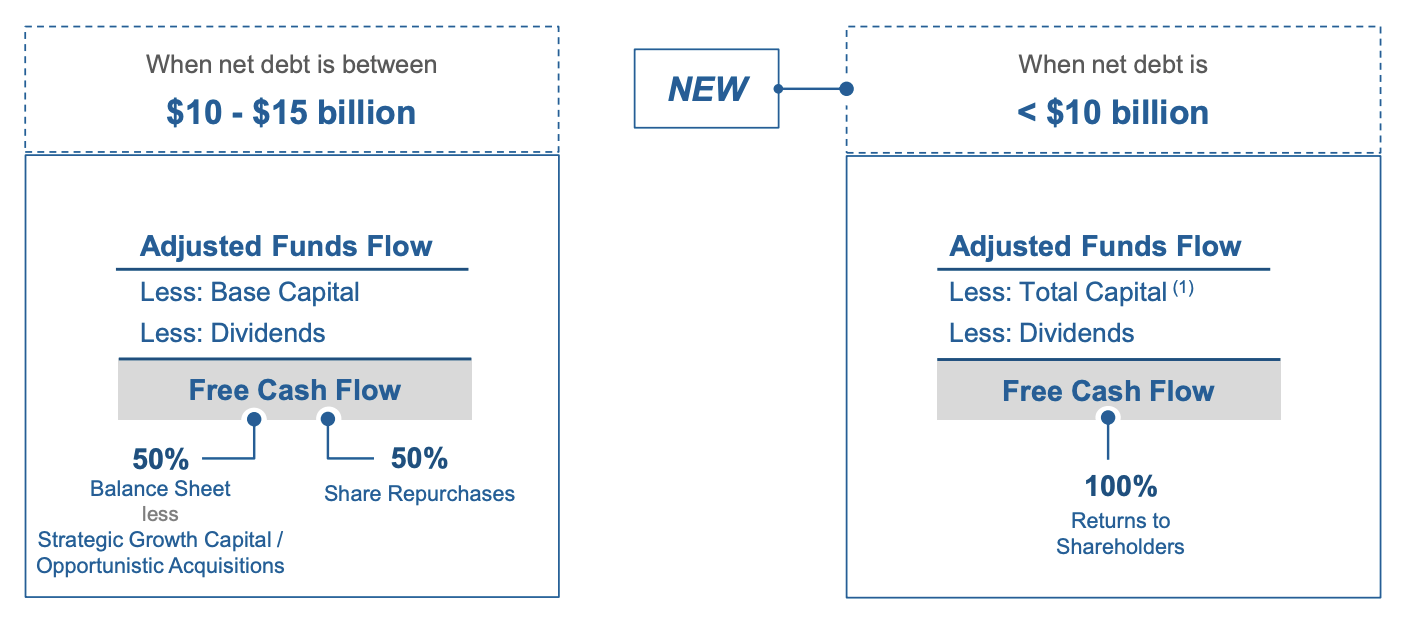

According to my calculations, the company ended the second quarter with $12.1 billion in net debt. Going into 2024, it could reach its target of $10 billion.

Once the net debt level has reached $10 billion, the company sees no need to lower it further, as it has pledged to distribute all of its free cash flow to shareholders. In this case, the company beats most of its peers that have pledged to distribute between 70% and 80% of free cash flow.

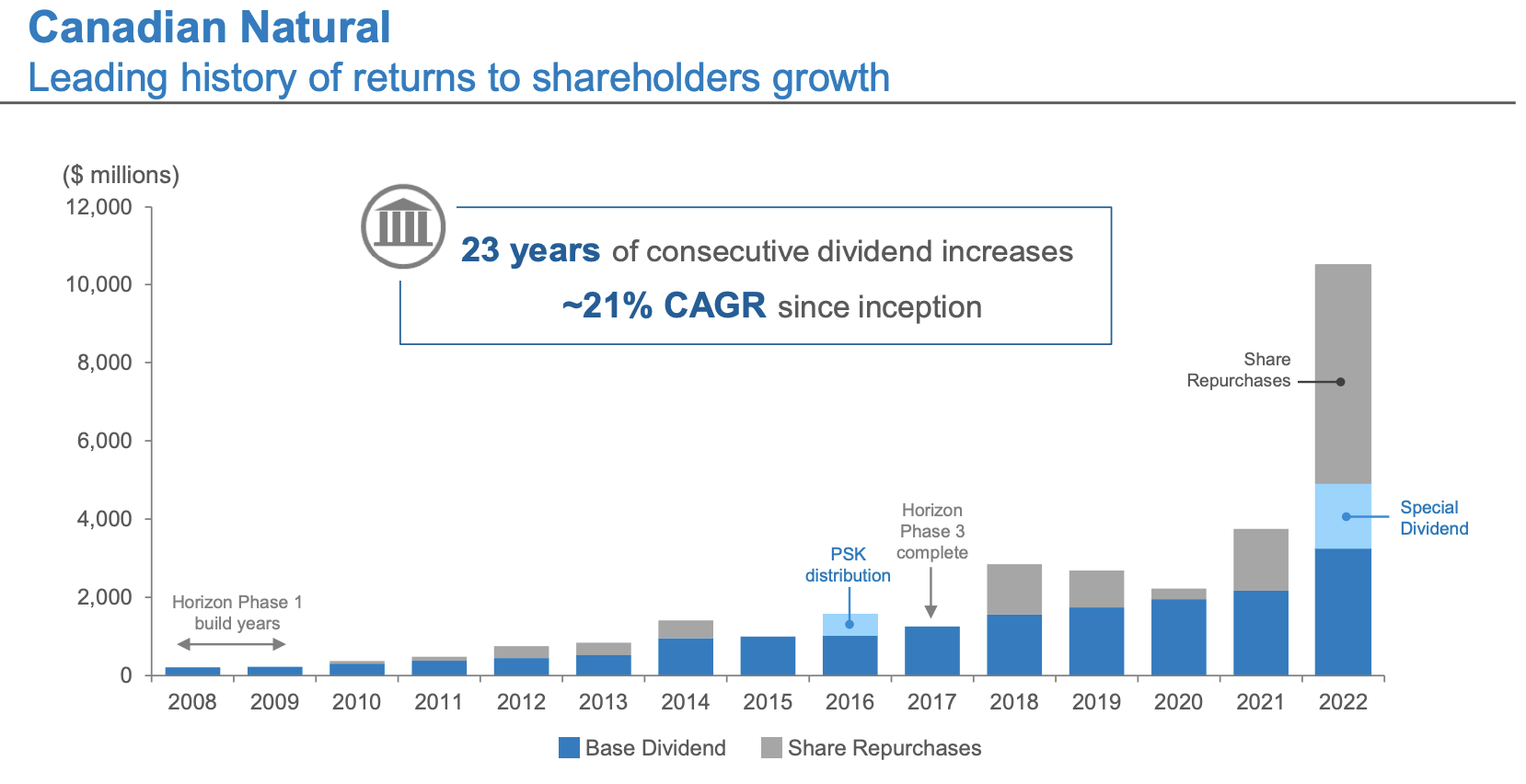

A big part of its distribution consists of dividends.

The company has a history of 23 consecutive dividend increases, which include the Great Financial Crisis, the 2015/2016 oil price slump, and the pandemic.

Canadian Natural Resources

After a 5.9% hike in March, the current dividend is $0.90 per share per quarter, which translates to a yield of 4.5%.

This excludes special dividends. Last year, the company paid a special dividend of $1.50, which brought last year’s total dividend to $4.60. This would indicate a yield of 5.7% using the current stock price.

When adding buybacks, the total distribution yield was roughly 12%.

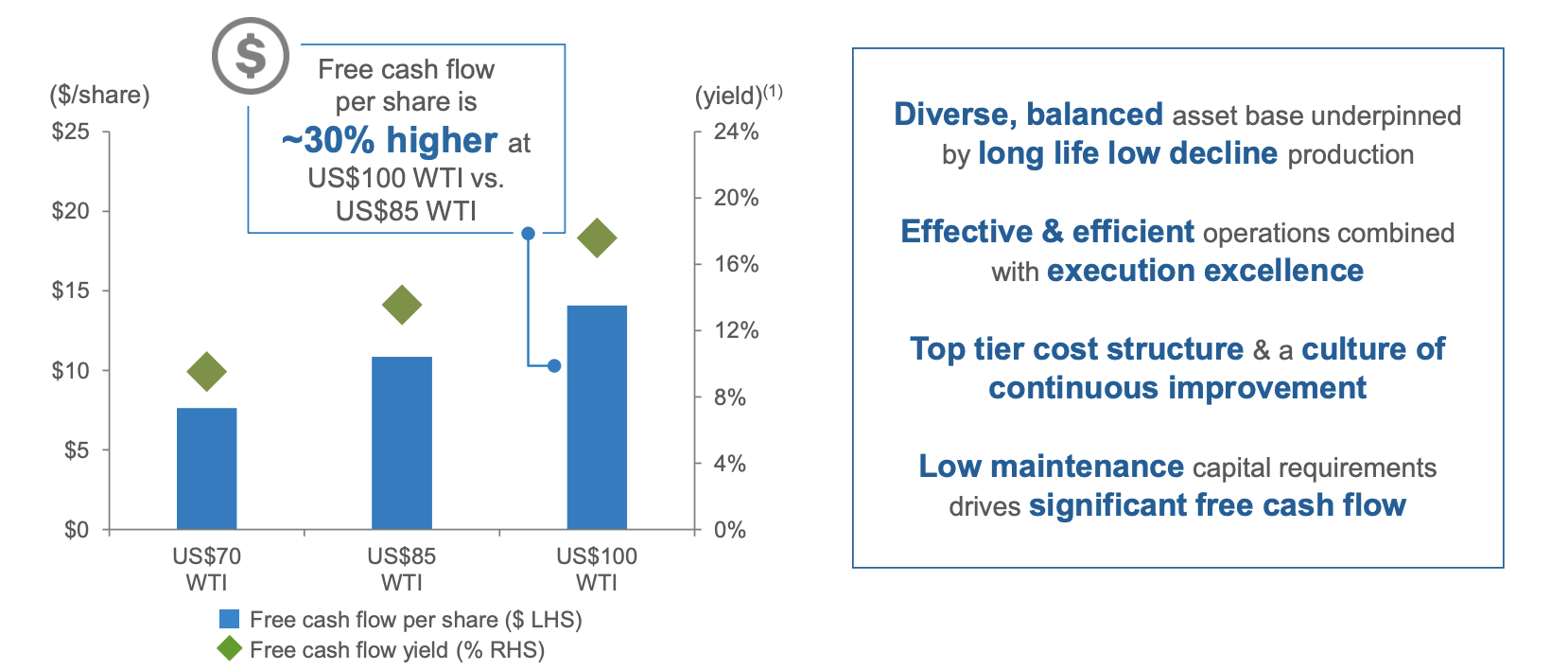

I expect this rate to remain high based on my bullish oil price thesis and the fact that the company’s implied free cash flow yield is high.

At $85 WTI, the company has a free cash flow yield of more than 12%.

Meaning next year, the company can distribute 12% of its current market cap if its net debt load falls to $10 billion. At $100 WTI, that number rises to almost 20%.

Canadian Natural Resources

I almost feel like a snake oil salesman, but it’s all based on reasonable assumptions and the company’s ability to distribute cash.

The year-to-date returns to shareholders, including dividends totaling $2.9 billion and share repurchases of $1.4 billion, reached a significant milestone of $4.3 billion this year. That’s 6.6% of its market cap in the first half of 2023.

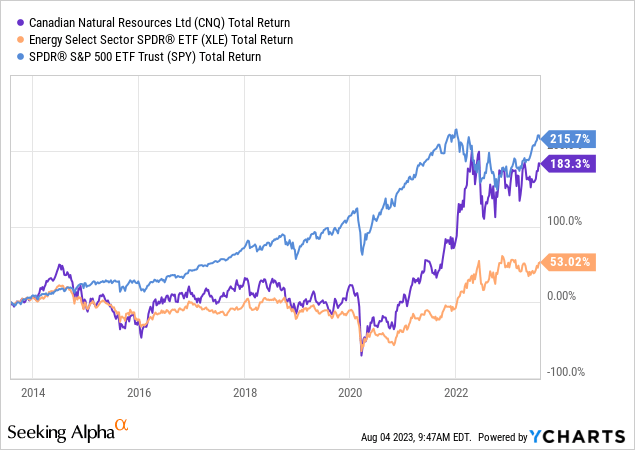

This also contributes to the company’s consistent outperformance.

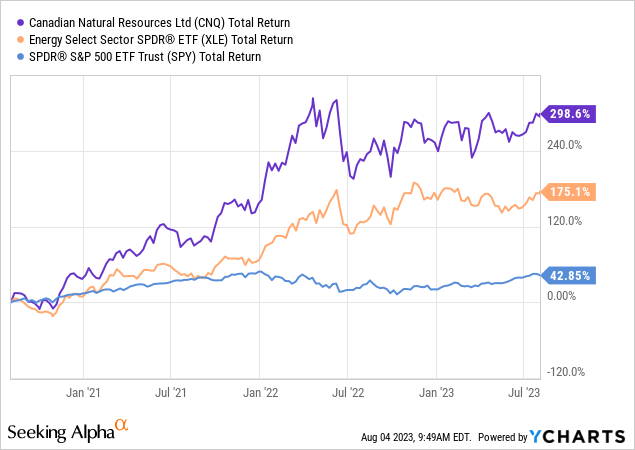

Over the past ten years, NY-listed CNQ shares have outperformed the energy ETF (XLE) by a wide margin. The performance even comes close to the S&P 500’s total return.

Since 2020, CNQ and XLE have outperformed the market by a wide margin. I expect outperformance to continue, as I’m bullish on oil and believe that we will soon get a rotation from growth to value stocks, benefitting undervalued stocks like CNQ.

It also needs to be said that the pending Trans Mountain Pipeline (“TMX”) is expected to be opened in the next few months, which will increasingly allow Canadian producers to capture better prices for their oil and reach more customers.

Google News (Oilprice.com)

The TMX is one of the reasons why I like Canadian oil players, in addition to their deep reserves and low breakevens. According to Oilprice.com:

Canadian oil sands producers are in a rush to boost production as the Trans Mountain expansion comes online, providing an additional 590,000 bpd in capacity.

Bloomberg reports that Canadian Natural Resources and Cenovus are among the producers planning on output boosts in the coming months.

This brings me to the valuation.

Valuation

Valuing commodity-driven stocks is tricky, as the outlook depends on the price of commodities.

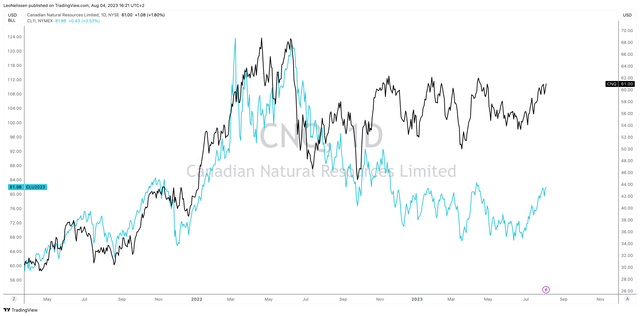

Looking at the relationship between CNQ and WTI crude oil, we see that CNQ has gone sideways while oil has declined.

TradingView (NYMEX WTI Crude Oil, CNQ)

There are two reasons for this divergence:

- Oil equities were massively undervalued when oil was trading at $120.

- Unlike crude oil futures, CNQ is a value-adding company that is aggressively buying back stock. Hence, in the long term, a healthy divergence (to the upside) makes sense.

Based on the company’s free cash flow potential, I believe that it is about 50% undervalued if oil prices work their way up to $100 in the next 12 to 24 months. On a longer-term basis, I expect much higher gains, accompanied by aggressive buybacks and juicy special dividends.

I think we’ve only scratched the surface when it comes to the company’s ability to reward investors.

If my oil price thesis bears fruit, we could be looking at a tremendous total return for many years to come.

However, for now, we also need to incorporate recession fears. I do not rule out regular corrections, which I will be using to boost my position.

Pros & Cons

Pros

- Resilient Reserves and Low Breakeven: CNQ’s extensive reserves and $40 WTI breakeven price enhance stability and protect against supply limitations.

- Strong Financial Position: With a healthy balance sheet, low leverage, and substantial liquidity of $5.6 billion, CNQ offers financial security.

- Consistent Dividend Growth: CNQ’s 23 consecutive dividend increases and 4.5% yield (excluding specials) showcase its reliable income potential.

- Capital Appreciation: CNQ’s history of outperforming energy ETFs and market indices suggests potential for long-term capital gains.

- Strategic Pipeline Advantage: Anticipation of the Trans Mountain Pipeline opening enhances CNQ’s market access and pricing opportunities.

Cons

- Commodity Price Sensitivity: CNQ’s valuation is closely tied to oil prices, exposing it to volatility in the commodity market.

- Market Uncertainties: Recession fears and market corrections could impact CNQ’s short-term performance.

- Regulatory and Environmental Risks: CNQ faces potential challenges from changing regulations and growing environmental concerns.

- Energy Transition Impact: Long-term shifts towards renewable energy could affect CNQ’s future demand.

Takeaway

I couldn’t be more thrilled about my recent investment in Canadian Natural Resources. With deep reserves, low breakeven prices, and a healthy balance sheet, CNQ has all the qualities I look for in an energy stock. As US shale production loses momentum and energy prices remain elevated, CNQ stands out as one of the best oil companies on Earth.

Their impressive dividend track record and commitment to distributing excess free cash flow to shareholders through special dividends and buybacks make CNQ a great income vehicle that has the potential to outperform its peers and the market.

Considering the projected growth in oil prices and CNQ’s undervaluation, I see tremendous potential for future gains. While there might be some bumps along the way, I’m confident that CNQ’s ability to reward investors makes it a solid addition to my portfolio for years to come.