Art Wager/E+ via Getty Images

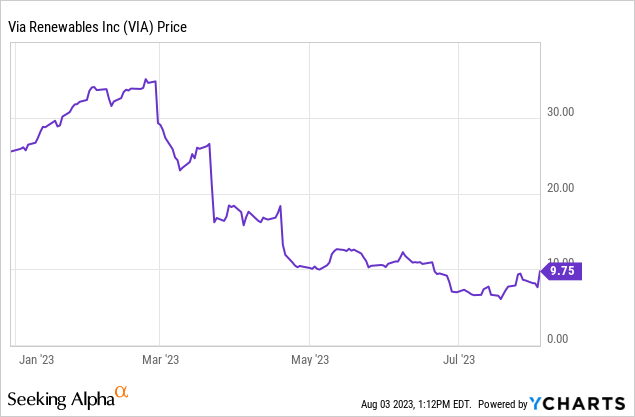

Via Renewables (NASDAQ:VIA) last declared a quarterly cash dividend of $0.7592 per share on its Series A fixed-to-floating rate preferred shares (NASDAQ:VIASP). This was a 2.6% increase from the prior quarterly and meant an 18.4% annualized forward yield. The company, previously known as Spark Energy, has had a rough 2023 with the common shares down around 62%, the common dividend of $0.91 per quarter suspended, and yet another extreme weather event in a core Sun Belt market sparking a further trimming of shareholder sentiment which had been dimmed by the 2022 energy crisis and the 2021 Winter Storm Uri. Via Renewables is an independent retail energy services company that makes money by sourcing power and gas to sell into the 100 utility service territories across the 19 states it operates.

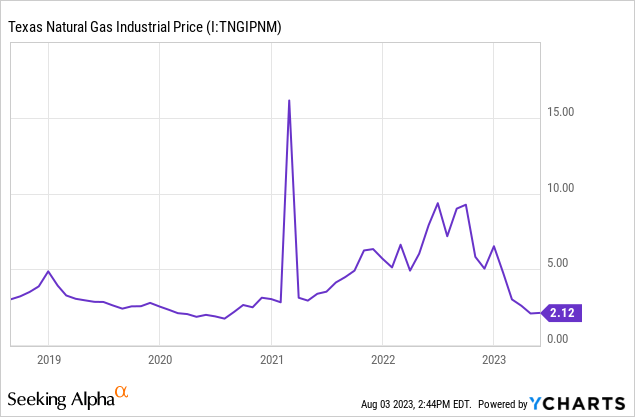

If income is the prize, the commons felt the full brunt of extreme weather events that saw the ticker dip from highs north of $30 per share to just under $10 following a post-fiscal 2023 second-quarter earnings surge. What’s the play here? The preferreds. Firstly, a double-digit yield on a security that’s fallen by 30% since the start of the year is not for no reason. The market is a voting machine and the consensus prior to the second quarter was that the financial stability, balance sheet, and future viability of Via Renewables had been radically eroded by back-to-back generational disruptive events that saw the company lose money. Via Renewables realized a $60 million hit from Storm Uri when natural gas prices in the Lone Star State spiked north of $15 per thou cf.

The Floating Rate Series A Preferred Shares

The 2022 energy crisis sparked by Russia’s invasion of Ukraine and the subsequent disruption to European energy supply also caused incredible volatility with US natural gas prices moving to intense highs. Stability is the key to stable earnings and two periods of huge volatility have contributed greatly to the pullback of the common shares. This type of broad macro-level risk is an intrinsic part of the company’s investment story.

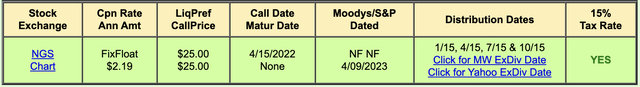

Via Renewables Series A Fixed-to-Floating Rate Preferred Shares initially paid out a fixed $2.19 annual coupon up until they floated on the 15th of April last year. The floating rate is equal to a 3-month LIBOR plus 6.578%. However, LIBOR has been replaced with SOFR for all relevant US securities. 3-month SOFR currently stands at 5.31% with the preferreds also applying a tenor spread adjustment of 0.26161%. Hence, the current aggregate floating headline coupon rate stands at 12.15%. The preferreds are also trading hands for $16.49 per share, a roughly $8.51 difference or 34% discount from their $25 par value.

QuantumOnline

Hence, the yield on cost stands at 18.4% with the preferred holders essentially able to snag the security for 66 cents on the dollar. Further, these are perpetual and cumulative which means there will trade indefinitely until Via Renewables chooses to redeem them. The company could of course also buy the preferreds on the open market ahead of this as it would save them paying the full par value at a later stage. The discount is not without risk with the first layer of security stripped away when the common dividend was suspended. Further, the discount on what’s essentially a half bond and half equity security is cognizant of market fears around the specter of further rate rises.

Risks And A Strengthening Balance Sheet

The Fed hiked rates ten consecutive times, paused, then hiked by 25 basis points at its last July FOMC meeting to bring rates to a 22-year high. The market is currently pricing in a 17.5% chance of rates being hiked at the upcoming 20th September FOMC meeting, a move generally regarded as negative for preferreds whose value tends to fall in response to any interest rate increases. However, the floating rate mechanism should help insulate the security from future volatility with the underlying business relatively recession-proof. To be clear here, the market does not hand out 18.4% yields for no reason, Via Renewables is one extreme weather event from a worsening of its financials and these events have become more frequent in the post-pandemic zeitgeist. 2023 has already seen Texas subject to record heat, driving record demand for electricity to stay cool and sparking volatility for electricity prices in the state.

The company saw revenue for its second quarter come in at $91.4 million, a decline of 5.9% over its year-ago comp. The heatwave raised doubts about profitability which eventually came in strong during the quarter with Via Renewables recording a net income of $19.1 million, up from $12.5 million in the year-ago comp with its hedges working to stabilize earnings during the quarter. Critical for the holders of the preferreds, cash and equivalents as of the end of the second quarter was $47 million, up $13.4 million from its year-ago comp. For some context, Via Renewables has spent $4.92 million since the start of 2023 on paying its preferred holders. Its annual 2023 preferred dividend bill is likely to be just north of $10 million, a level of cash that is easily covered by its current cash pile and against a business that generated $34.7 million in cash from its operating activities during the second quarter. I’m rating the preferreds as a buy against this.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.