DR/iStock via Getty Images

Southern Company (NYSE:SO) is one of the largest electric and gas utilities. Southern Company share price has slightly outperformed the sector for several years as the company struggled with completion of the only new nuclear power generating plant in the US. Vogtle Unit 3 recently entered commercial operation with Vogtle Unit 4 wrapping up construction – both of which are billions over construction budgets. The removal of this overhang should add positive investor interest over time. With the trend towards disruptive Performance-Based-Regulation in the utility sector, Southern Company will become one of the preferred utilities due to its regulatory environment.

Southern Company serves 4.4 million electric and 4.4 million natural gas customers. SO operates integrated utilities Alabama Power, Georgia Power, and Mississippi Power. Southern Company Gas operates in Illinois, Georgia, Virginia, and Tennessee. Regulated electric utilities generated 72% of 2022 revenues with regulated gas utilities chipping in 20% and merchant power producer Southern Power contributing 8%. In addition, SO operated 43,000Kw of power generating from “all of the above” sources.

As a regulated utility, profitability is controlled by state regulators. As part of due diligence, investors should analyze the regulatory environment of each of the utilities they own. State utility regulations vary greatly from state to state, however, making that task quite complicated for the average retail investor. Decades ago, I discovered Standard & Poor’s (SPGI) consulting arm Regulatory Research Associates RRA offers a proprietary ranking of state utility regulatory environments as a component of S&P’s credit review process. RRA’s ranking allows investors to identify states with above average financial support for the utilities under their jurisdiction. Known as the RRA State Regulatory Rankings, the latest proprietary listing is dated Dec 2022 and can be found in the filings of the Kansas utility regulators, the Kansas Corporation Commission, on page 4. The ratings are divided into three major and three minor subgroups with the highest rating of 1-1, an average rating of 2-2 and the lowest of 3-3.

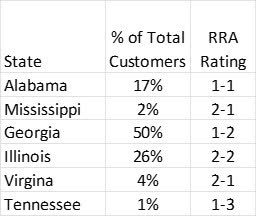

Investors should prefer utilities servicing states which rate higher than “average” for regulatory oversight. The table below lists the states served by Southern Company, the percentage of customers in each state and the RRA rating for each gatekeeper of SO profitability.

RRA State Ratings for Southern Company (Kansas Corporation Commission, Guiding Mast Investments)

Southern Company services a geography dominated by utility regulators considered as some of the most credit supportive in the US. 75% of SO customers reside in states which are rated better than Average (2-2) and 68% of customers are in the top category for credit support, rated 1-1 to 1-3.

There is a growing trend in the US of replacing traditional methods of rate setting with a new scheme, which investors should monitor closely. The age-old formula of a fixed rate of return on investment from an approved asset base and traditional cost of service ratemaking is changing to a “performance-based” structure whereby regulators set specific policy and utility performance goals and the utility is financially rewarded or penalized based on achieving these benchmarks. Known as Performance Based Regulations PBR, the UK moved to PBR in the 1980s and PBRs are utilized in Canada.

At the heart of Performance Based Regulations are usually two features: Award Penalty Mechanisms and Multiyear Rate Plans. Award Penalty Mechanisms, or targeted performance incentives, are implemented whereby regulators set a specific target and the utility is financially rewarded or penalized based on achieving that target. Overall target categories include electricity reliability, customer service management, success in demand-side management, and operating cost containment. Usually, the goal of demand-side management is to “encourage” consumers to use less energy during peak hours, or to move the time of energy use to off-peak times such as nighttime and weekends. Multiyear Rate Plans usually feature a moratorium on rate cases which typically lasts 3 to 5 years. Between rate cases, ratepayer prices can be adjusted based on a predetermined “attrition relief mechanism” or ARM. Some ARMs are industry-index based, with the most common being a stairstep ARM with revenue increasing by a certain percentage each year and these annual increases are determined in advance.

Hawaii and Connecticut state utility regulators are leading the way with new PBR programs, and PBR popularity is expected to grow. Colorado, Illinois, Nevada, North Carolina, New York, Maine, and Washington have begun implementing PBR, mostly through the adoption of Multiyear Rate Plans with stair-step annual utility rate increases. However, Connecticut regulators have become more aggressive and have implemented more than a dozen policy goals for their Award Penalty Mechanisms, including targets for reliability, emissions reductions, and cost control. In April, CT regulators announced their new policies and ratemaking formulas, and it was not advantageous to investors of CT utilities. Full implementation is expected by May 2024.

The largest electric utilities in the state are Connecticut Power and Light CPL, a subsidiary of Eversource (ES) and United Illuminating, a subsidiary of Avangrid (AGR). CPL and UI are in the midst of rate negotiations with state regulators, known as the Public Utility Regulatory Agency PURA. In a recent Aquarion (ES) water utility case decided under the new regulatory structure, allowed ROE was reduced from 9.25% to 8.73%. On Friday July 21, PURA issued a negative proposed final decision for United Illuminating which also included a ROE reduction of a similar -0.52%. The order used interesting descriptive reasoning for UI reduction in profitability:

The reduction in the ROE was justified by a variety of factors including (1) rate design cost of service study being incomplete – 2bp; (2) imprudent and inefficient management of transmission accounting – 5bp; (3) Tropical Storm Isaias -5bp [down from 15bp originally discussed]; (4) English Station remediation delays – 20bp; (5) “troubling” customer service – 20bp. Total: -52bp of ROE.

Of interest, these justifications appear to be somewhat partisan and subjective, utilizing terms such as “imprudent and ineffective management”. Aquarion has sued to overturn the PURA’s mandated rate reduction, and a Superior Court judge has issued a 30-day stay of the Aquarion rate cut. The Superior Court agreed with the argument that PURA was determined to make an example of Aquarion in order to help set the stage for the rollout of performance-based regulation for all PURA-regulated utilities.

By comparison to Southern’s state regulatory environments, Connecticut RRA rating is 3-1, Below Average, and is one of only nine states with a Below Average rating.

The gaining popularity of performance-based regulations, which have the potential to be exploited to further partisan policies, is a substantial reason investors need to be cognizant of each state’s regulatory environment, and hence the importance of RRA’s tool. Southern Company operates in one of the most supportive regulatory environments and this singular fact should not be overlooked nor underappreciated.

Southern reported weak 2nd qtr. 2023 revenues, and slightly higher than expected earnings per share. Warmer weather slowed both electricity and natural gas demand and, combined with lower fuel prices, reduced quarterly revenues by 20%. Quarterly GAAP diluted earnings were $0.76 per share, down from $1.03 last year, and in line with an expected $0.75 per share. Investors should expect flat 2023 earnings from 2022 at $3.61 per share. Higher utility rates in 2024 will generate improved margins, added to the positive impact of Vogtle moving into commercial operation, should expand earnings to the $4.05 range in 2024. Long-term utility investors should add Southern to their portfolio, especially during upcoming market weakness.

Personally, I have owned SO since the early 1980s when I lived in Atlanta and have been in and out of the stock a few times since. My current holdings date to Aug 2015 and SO is considered a core holding in the utility sector. According to dividendchannel.com calculator, since 2015, SO has generated a 10.7% annual total return with dividend reinvested vs 8.7% for the S&P Utility ETF (XLU). Over the next few years, as Southern’s Vogtle investments are rewarded with higher allowed ROE based on the project’s completion, I except the outperformance to continue, and even to expand.