Cimmerian

Do you know what’s wonderful in a recession? A very conservative 8% yield that tends to grow every year no matter what the economy is doing.

Do you know what would be better than a relatively safe 8% yield? A very conservative 8% yield from a future dividend aristocrat (2026).

And do you know the only thing that could be better than all this? An 8% yielding future aristocrat who just announced a deal to boost its growth rate by 15% and potentially could deliver 15% long-term returns. Possibly, for decades to come!

Let me show you why TC Energy Corporation (NYSE:TRP)’s spinoff makes one of the best 8% yielding stocks on earth even better!

And you know what’s most exciting of all?

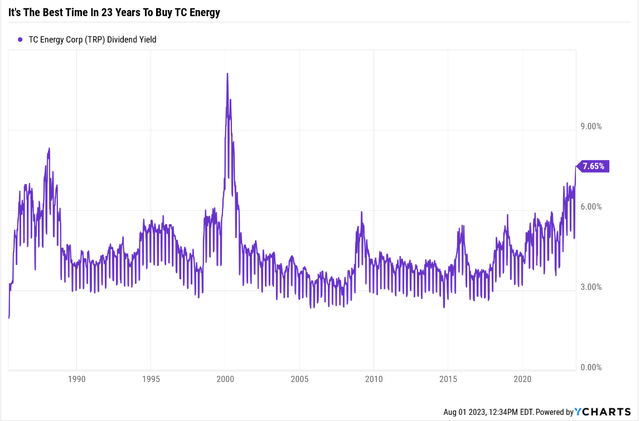

Ycharts

TRP’s dividend hasn’t been this high since the tech bubble caused value stocks to crash 50%!

And then this happened.

March 2000: The Last Time TRP Yielded More That Today

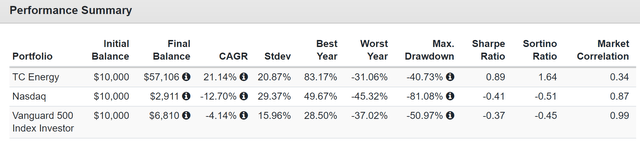

Portfolio Visualizer Premium

From March 2000 to March 2009, the Nasdaq (COMP.IND) fell 81% while TRP soared 470%.

How To Do Spinoffs Right

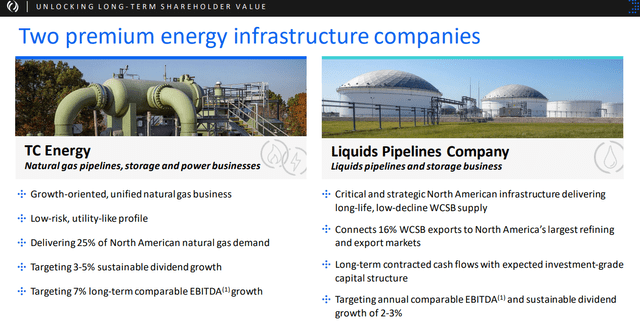

investor presentation

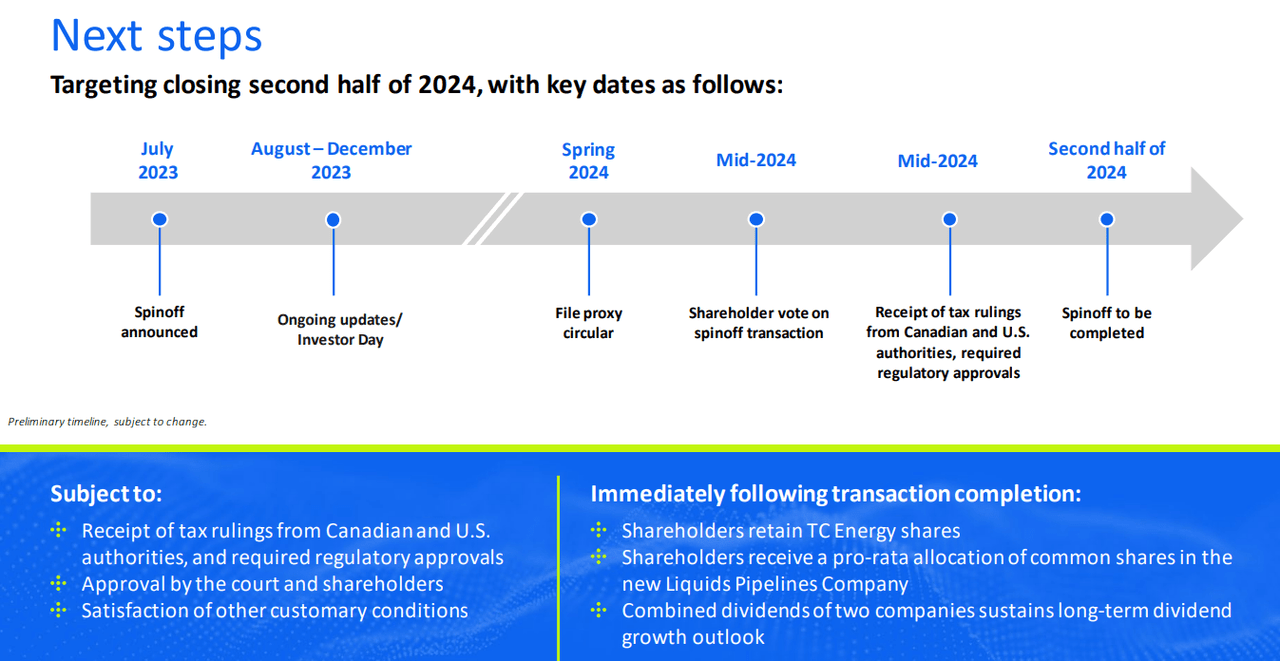

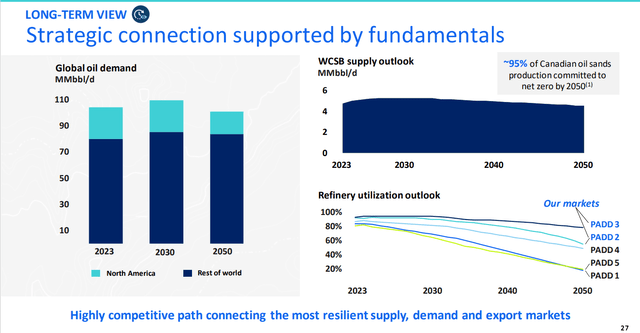

TC Energy has announced it plans to spin off its liquids business (about CAD 1.5 billion in 2022 EBITDA) in a tax-free spinoff likely sometime in 2024. The liquids business is made up of just over 3,000 miles of crude oil pipeline infrastructure transporting Western Canadian Sedimentary Basin crude to U.S. refining markets.” – Morningstar.

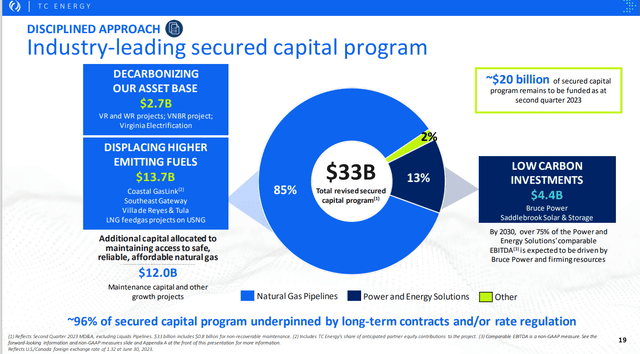

This is a very shareholder friendly move for several reasons. First, the new TC energy will be focused on natural gas and renewables, the fastest parts of its business.

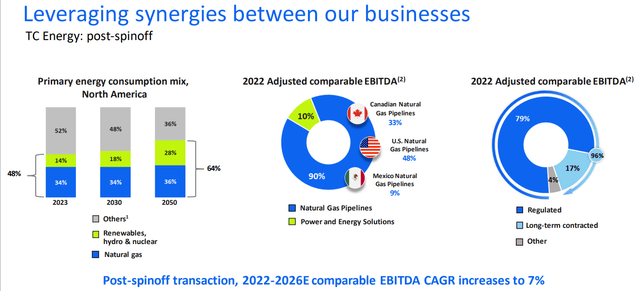

investor presentation

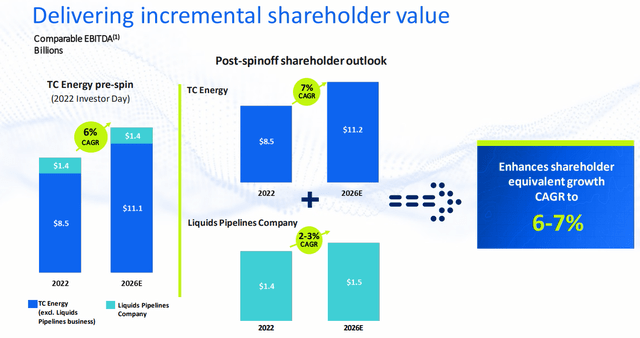

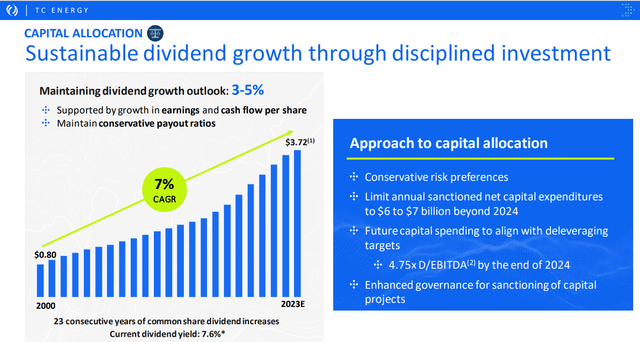

First, the new TC Energy is going to be focused on the fastest-growing part of the business, which management says can generate 7% long-term growth.

In contrast, the oil pipeline business has 2% to 3% growth created by inflation. It’s a regulated business where regulators permit annual inflation adjustments.

In real-terms, this is a no growth business, and now it won’t be weighing on the potential valuation of TC energy.

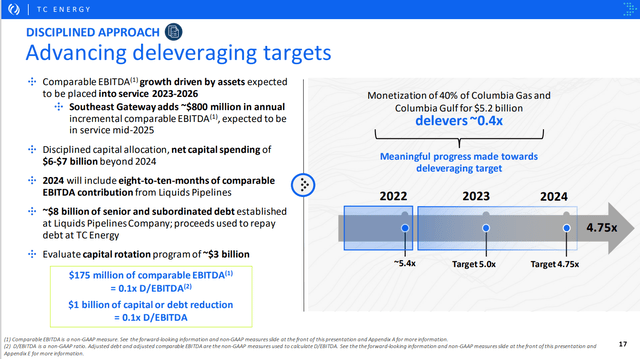

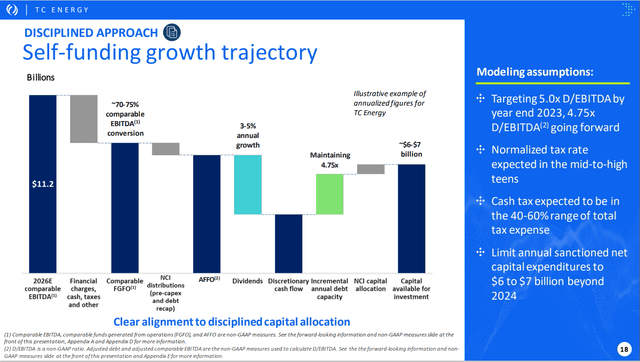

The spinoff is expected to be capitalized at 5 times debt/EBITDA, essentially offloading debt off TC Energy’s balance sheet to help achieve its targeted 4.75 times debt/EBITDA ratio by 2024.” – Morningstar.

TRP’s debt/EBITDA ratio hit 5.5 in 2022, causing Moody’s to downgrade it to BBB equivalent and S&P to put it on a negative outlook.

After this spinoff was announced, Fitch affirmed its BBB+ stable rating.

- S&P BBB+ negative outlook: 5% 30-year bankruptcy risk

- Moody’s BBB (equivalent) stable outlook: 7.5% 30-year bankruptcy risk

- Fitch BBB+ stable outlook: 5% 30-year bankruptcy risk

- DBRS: A- stable outlook: 2.5% 30-year bankruptcy risk.

investor presentation

TRP is tapping into the new Spinco to pay down its own debt without putting the entire combined company at risk.

Management isn’t hurting anyone with this deal, and by 2024 TRP says it can be back to target long-term leverage of 4.75X.

investor presentation

By splitting the company, TRP says that it will be able to make the new TRP grow 7% over time, which is 1% faster than current guidance. Which analysts agree with.

Investor Presentation

8% yield and now 7% growth? That’s 15% long-term total returns. How impressive is that?

Greatest Investors In History

| Name | Returns | Time Horizon | Most Famous For |

| Jim Simons (Co-Founder Renaissance Technologies) | 62% CAGR | 1988 to 2021 (best investing record ever recorded) | Pure Quant Based Investing |

| Joel Greenblatt | 40% CAGR | 21 years at Gotham Capital | “Above-Average Quality Companies At Below-Average Prices” |

| George Soros | 32% CAGR | 31 years |

Valuation mean reversion, “Reflexivity” = Opportunities can be found by carefully studying the value and the market prices of assets |

| Peter Lynch | 29.2% CAGR at Fidelity’s Magellan Fund | 1977 to 1990 (13 years) | “Growth At A Reasonable Price” |

| Bill Miller (Legg Mason Value Trust 1990 to 2006) | 22.8% CAGR and beat the S&P 500 for 15 consecutive years | 16 years | |

| Warren Buffett | 20.8% CAGR at Berkshire | 55 Years | Greedy when others are fearful |

| Benjamin Graham | 20% CAGR vs 12% S&P 500 | 1934 to 1956 (22 years) | Margin of Safety |

| Edward Thorp | 20+% CAGR | over 30 years | invented card counting, pure statistically-based investing |

| Charlie Munger | 19.80% | 1962 to 1975 | Wonderful companies at fair prices |

| Howard Marks | 19% CAGR | Since 1995 | Valuation Mean Reversion |

| Anne Scheiber | 18.3% CAGR | 50 years |

Turned $5K into $22 million with no formal training, purely with tax-efficient buy and hold blue-chip investing. |

| John Templeton | 300% from 1939 to 1943, 15.8% CAGR from 1954 to 1992 | 38 years | Market Cycles |

| Wilmot Kidd | 14.7% CAGR vs 11.8% S&P 500 | 1974 to 2021 (47 years) | Concentrated, Fundamentals Driven CEF |

| Carl Icahn | 14.6% CAGR vs 5.6% S&P 500 |

2001 to 2016 (15 Years) |

|

| David Swenson | 13.9% CAGR at Yale’s Endowment (includes bonds and alternative assets) vs 10.7% S&P 500 | 30 years | Alternative Asset Allocation |

| Larry Puglia | 12.1% CAGR vs 10.2% CAGR S&P 500 | 28 years running TROW’s flagship blue-chip fund | Pure blue-chip/wide moat focus. |

| Geraldine Weiss | 11.2% vs 9.8% S&P 500 | 37 years |

Best risk-adjusted track record of any newsletter over 30 years according to Hubbert Financial Digest, popularized dividend yield theory (the only strategy she employed) |

15% long-term returns are on par with the greatest investors in history, such as David Swenson and John Templeton.

It’s also better than the Nasdaq’s 38 year 13.5% annual return, the best performing index in history.

Total Returns Since 1988

Portfolio Visualizer Premium

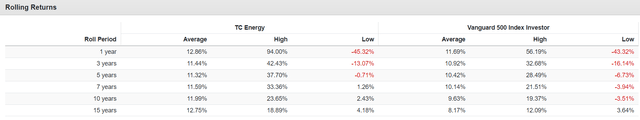

TRP’s historical average annual return and average 15 year rolling return is about 13%. Management currently believes that thanks to an astonishingly wonderful and very safe 8% yield, TRP can deliver even better returns in the future.

How can we tell the dividend is very safe?

- DK safety score: 87% (1.65% severe recession dividend cut risk)

- 22-year dividend growth streak

- BBB to A- credit ratings

- 50% AFFO payout ratio

- safe leverage that’s getting safer over time.

investor presentation

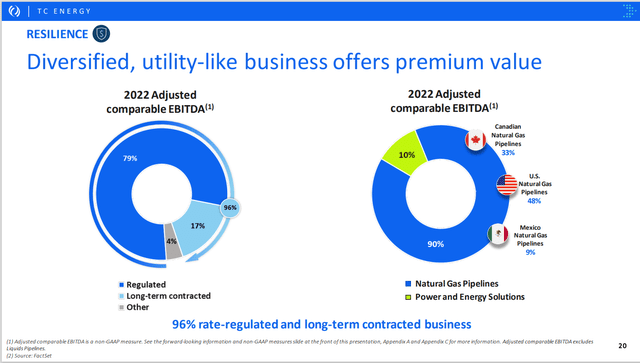

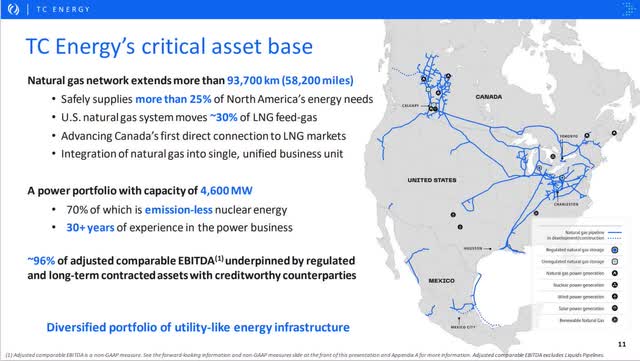

96% of cash flow is regulated or long-term contracted. Just 4% exposure to commodity prices, that’s the 2nd lowest in the industry behind ENB’s 2%. And its sourced from three different countries.

- like Canadian Banks, Canadian pipeline giants are legendary for their utility like safety.

investor presentation

This is what dividend dependability looks like. As the payout ratio falls over time, this dividend will become steadily safer.

Why TC Energy Is A Buy And Hold Forever Ultra-Yield Future Aristocrat

investor presentation

The deal isn’t going to close anytime soon, so just keep buying TRP if you like the company.

Investor Presentation

TRP owns the largest midstream asset collection in North America.

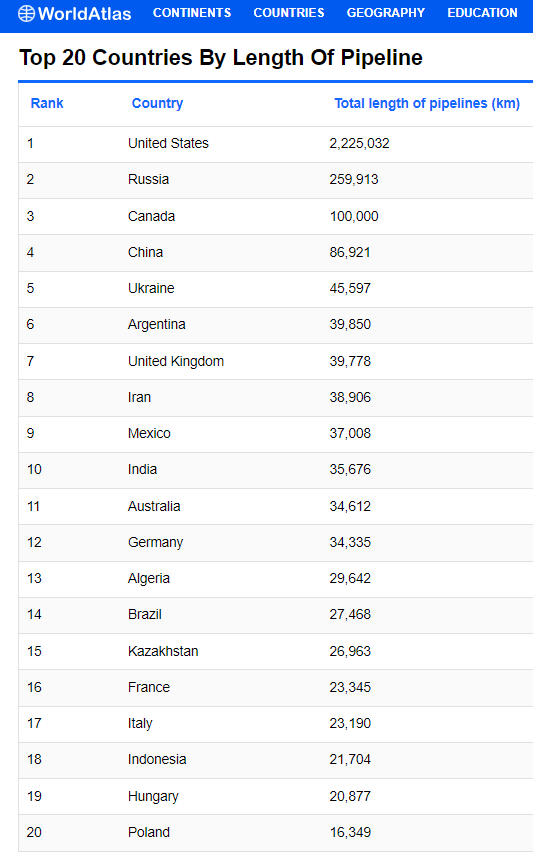

World Atlas

Its almost 60,000 km of pipelines is more than exist in all of Ukraine, or Iran, or the UK.

In fact, if TRP were its own country, its have the 5th most pipelines of any country in the world.

Investor Presentation

TRP’s long-term plans are 100% sustainable with no equity issuances. It’s the gold standard of safe midstream.

- free cash flow self-funding is the platinum standard

- it allows for perpetually falling leverage and steadily rising credit ratings.

Investor Presentation

With very stable cash flow for the next 30 years, TRP will be able to use buybacks to keep growing cash flow/share at 2% to 3% as management is guiding for.

Investor Presentation

TRP has the biggest backlog in the industry and believes that long-term it could find $5.25 billion per year worth of high profitability projects to invest in.

Brookfield

Clean energy alone is a potential $5 trillion annual investment opportunity. Do you see why the bond market is so confident in TRP’s ability to keep generating steady cash flow for decades to come?

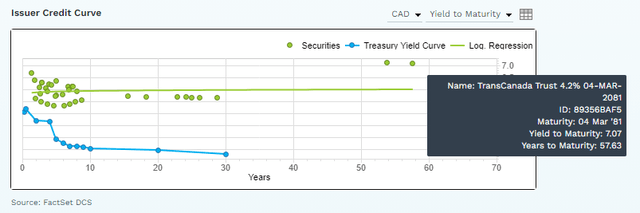

Bond Investors Willing To Bet Millions That TC Energy Will Be Around And Paying It Bills In 2081

FactSet Research Terminal

The smart money on Wall Street agrees with the rating agencies, management and analysts, that TRP right now is a very attractive buy.

Valuation: A Wonderful Company At A Wonderful Price

- DK quality score: 81% very low risk 13/13 Ultra SWAN future aristocrat

- DK dividend safety score: 87% very safe 1.65% severe recession cut risk

- current price: $35.40

- historical fair value: $50.25

- Discount: 30%

- DK rating: potential very strong buy

- yield: 7.9%

- growth: 6% to 7%

- total return potential: 13.9% to 14.9%.

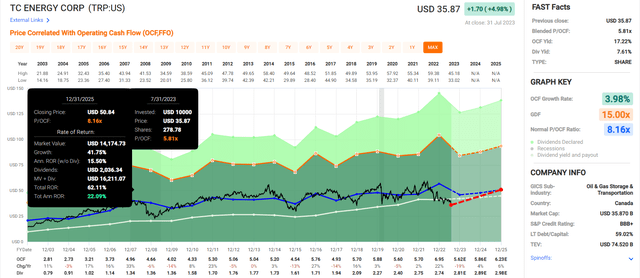

TC Energy 2025 Consensus Total Return Potential

FAST Graphs, FactSet

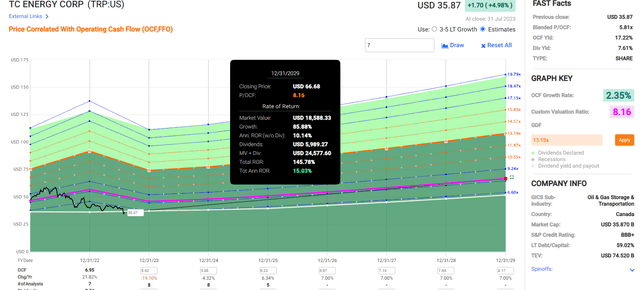

TC Energy 2029 Consensus Total Return Potential

FAST Graphs, FactSet

8% very safe yield, 15% long-term return potential and Buffett-like 22% annual returns possible through 2025.

- S&P consensus through 2025: 6% annually

- S&P consensus through 2029: 38% vs 146% TRP.

Risk Profile: Why TC Energy Isn’t Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

S&P Environmental Risk Summary

Environmental factors are a moderately negative consideration in our credit rating analysis of TC. The diversified energy company is one of the largest providers of transportation and storage of crude oil and natural gas and power generation in North America and will face longer-term volume risks related to reduced drilling activity and demand due to the transition to renewable energy sources. We expect the company to increase spending on low-carbon and renewable energy assets such as recent solar power conversion for pumps and compressors along its various pipeline routes and investments in renewable energy as it seeks to leverage its expertise in the power generation business. Given the opposition to large-scale pipeline projects, including Keystone XL and Coastal Gas Link, we view social factors as having a moderately negative influence. While TC’s approach to these infrastructure projects significantly mitigated the company’s financial risk, we expect ongoing community opposition to new organic industry projects will continue.” – S&P (emphasis added).

TC Energy’s Risk Profile Includes

- political/regulator risk (Keystone cost it $15 billion, which its suing the U.S. government to recoup)

- litigation risk (endless lawsuits from environmentalists)

- project execution risk

- industrial accident risk (up to $1 billion to clean up a spill)

- counter-party risk (it has a lot of customers, and not all are investment grade)

- disruption risk (renewable energy transition)

- M&A execution risk (industry consolidation is expected at some point)

- talent retention risk (tightest job market in over 50 years)

- currency risk (modest, but almost 60% of revenue is not in CAD)

- dividend currency risk (mean-reverting over time but does cause some dividend fluctuations in the short term)

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

DK uses S&P Global’s global long-term risk-management ratings for our risk rating.

- S&P has spent over 20 years perfecting their risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry specific

- this risk rating has been included in every credit rating for decades.

The DK risk rating is based on the global percentile of a company’s risk management compared to 8,000 S&P-rated companies covering 90% of the world’s market cap.

TRP Scores 84th Percentile On Global Long-Term Risk Management

S&P’s risk management scores factor in things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- occupational health & safety

- customer relationship management

- business ethics

- climate strategy adaptation

- sustainable agricultural practices

- corporate governance

- brand management.

TRP’s Long-Term Risk Management Is The 114th Best Risk Manager In The Master List (77th Percentile In The Master List)

| Classification | S&P LT Risk-Management Global Percentile |

Risk-Management Interpretation |

Risk-Management Rating |

| BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

| Strong ESG Stocks | 86 |

Very Good |

Very Low Risk |

| TC Energy | 85 |

Very Good |

Very Low Risk |

| Foreign Dividend Stocks | 77 |

Good, Bordering On Very Good |

Low Risk |

| Ultra SWANs | 74 | Good | Low Risk |

| Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

| Low Volatility Stocks | 65 | Above-Average | Low Risk |

| Master List average | 61 | Above-Average | Low Risk |

| Dividend Kings | 60 | Above-Average | Low Risk |

| Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

| Dividend Champions | 55 | Average | Medium Risk |

| Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal.)

TRP’s risk-management consensus is in the top 23% of the world’s best blue-chips, on par with the likes of:

- Lowe’s (LOW): Ultra SWAN dividend king

- 3M (MMM): Super SWAN dividend king

- Blackrock (BLK): Ultra SWAN

- Royal Bank of Canada (RY): Ultra SWAN

- Northrup Grumman (NOC): Ultra SWAN.

The bottom line is that all companies have risks, and TRP is very good at managing theirs, according to S&P.

How We Monitor TRP’s Risk Profile

- 22 analysts

- four credit rating agencies

- 26 experts who collectively know this business better than anyone other than management

- and the bond market for real-time fundamental risk-assessment

When the facts change, I change my mind. What do you do, sir?” – John Maynard Keynes.

There are no sacred cows at iREIT or Dividend Kings. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: It’s The Best Time In 23 Years To Buy 8% Yielding TC Energy!

The market might be near record highs, but so is TRP!

The market might be 16% overvalued, but TRP is 30% undervalued!

According to Oxford, the market might be headed for potentially a lost decade, but have you seen TRP’s fundamentals!?

8% very safe yield, 7% growth, and a $150 trillion megatrend to power decades of growth!

96% of cash flow regulated or under long-term contract.

23-year dividend growth streak and a balance sheet so strong TRP is tied for the 2nd best credit rating in the industry!

And as for its complex risk profile? 85th percentile long-term risk management according to S&P. Not top 15% among midstreams, but top 15% among all companies of any kind, anywhere in the world!

Are you looking for a buy and hold forever ultra-yield future aristocrat you should be able to trust no matter what happens with the economy next year? Then look no further than TC Energy.

And right now its the best time in 23 years to buy this 8% yielding future aristocrat TC Energy Corporation!