abadonian

Investment Thesis

Vermilion Energy (NYSE:VET) did yesterday after the close report its Q2-23 result. These are my initial takeaways on the result and the company in general. I have covered Vermilion a few times over the last year and those articles can be found here.

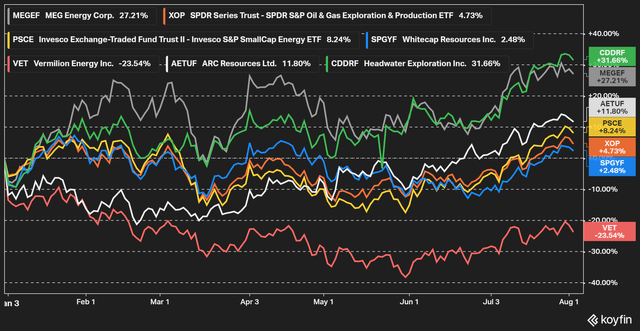

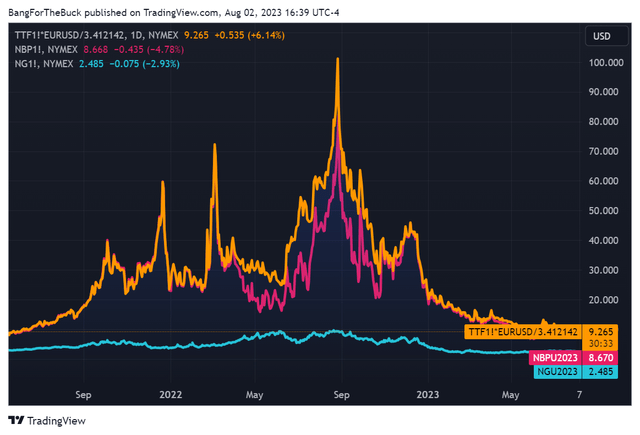

Vermilion has in 2023 had one of the worst performances among the Canadian oil & natural gas producers. Where part of the underperformance makes sense due to a higher exposure to natural gas and the premium priced European natural gas market specifically, which has retraced substantially from the highs seen during 2022.

Figure 1 – Source: Koyfin

Figure 2 – Source: TradingView- Dutch, UK, & U.S. Natural Gas Prices

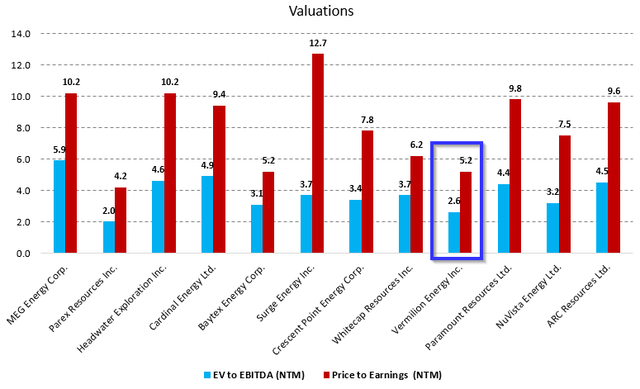

However, that doesn’t quite tell the whole story as Vermilion has seen multiple-compression to a larger degree than for many peers and is consequently trading with one of the more attractive valuations in the industry.

Also, the stock is today pricing in an extremely low probability of higher European energy prices in the near future, where at least I think the probability is substantially higher for such a scenario. So, Vermilion continues to look like a good risk reward even if shareholder distributions will be lower in the near-term when the company is focused on deleveraging.

Q2-23 Result

Vermilion has like many other Canadian oil & natural gas producers been impacted by the wildfires during Q2, but did in the quarter still produce 83,152 boe/d. That is a good production number when we consider the challenges in Canada during the quarter and the fact that the Australian assets were offline. The Australian assets are now expected to come back to production in the end of Q3.

The Q2 production volume was up slightly compared to Q1 (82,455 boe/d) and was within the annual guidance range of 82,000 to 86,000 boe/d, which is unchanged despite the recent disruptions. The mid-point of the Q4 guidance is now as high as 87,500 boe/d.

The company did, despite lower commodity prices, report C$247M in fund flows from operations and C$80M in free cash flow in the quarter. These figures are only marginally lower compared to Q1. Net earnings in the quarter were C$128M or C$0.78/share, which was above expectations.

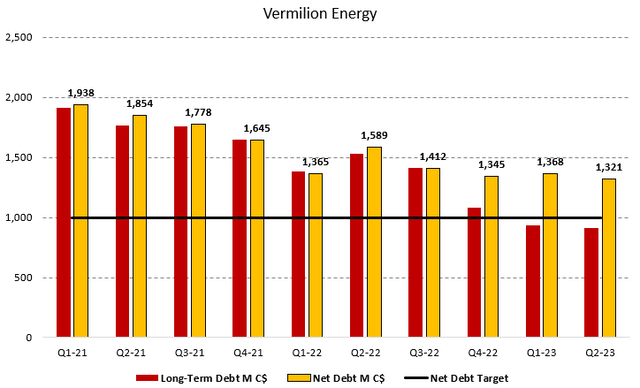

The key focus in 2023 with regards to capital allocation, is to deleverage, where the net debt target is C$1B. The current shareholder distributions are low compared to many peers, but percentage is expected to increase once the net debt target is achieved, which is likely sometime in early 2024, of course somewhat dependent on commodity prices.

Figure 3 – Source: Vermilion Quarterly Reports

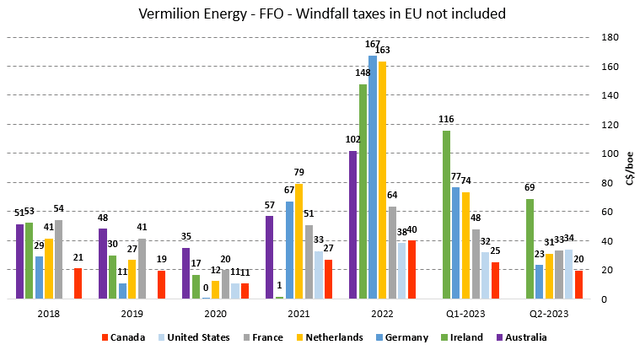

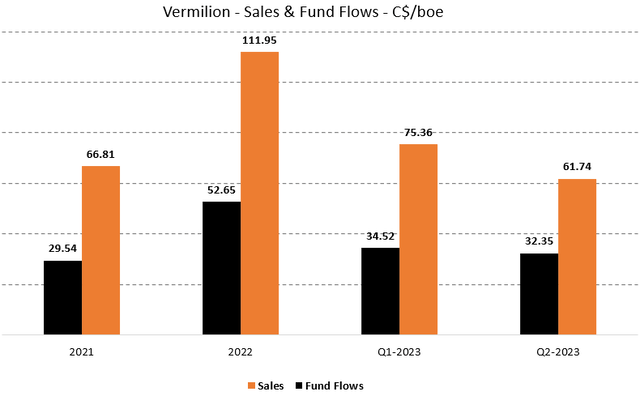

Vermilion is a diversified oil & natural gas producer, where much of production comes from Canada, while the European markets continue to have an outsized impact on fund flows and free cash flow due to the attractive margins, even after the substantial decline in European natural gas prices lately. Please note that the windfall profit tax is not included in the graph below, as it is booked in the corporate segment.

Figure 4 – Source: Vermilion Quarterly Reports

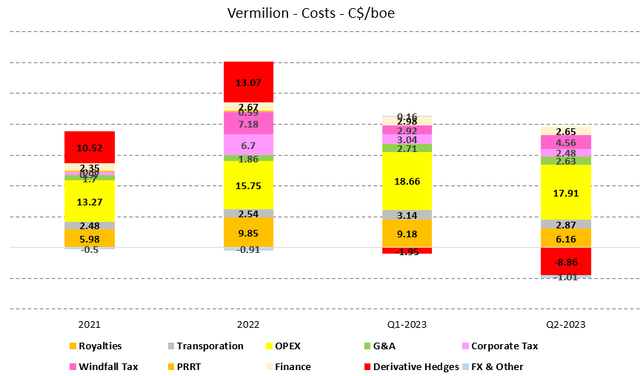

The chart below illustrates a cost breakdown for Vermilion in Q2 compared to a few recent quarters and years, where just about all the line items have declined compared to Q1, except for the windfall profit tax, that increased slightly.

Figure 5 – Source: Vermilion Quarterly Reports

The lower costs in the quarter are part of the reason why the fund flows per barrel of oil equivalent is very respectable at C$32.35, even though the sales price declined substantially compared to Q1. The large realized hedging gain naturally had a substantial impact as well.

Figure 6 – Source: Vermilion Quarterly Reports

Valuation & Conclusion

Q2 was a relatively strong quarter by Vermilion, it had good production despite operational challenges. We saw costs decrease and a larger realized hedging gain, which contributed to solid cash flows, despite lower commodity prices.

As I touched on earlier in this article, part of the recent stock price decline for Vermilion makes sense due to the lower energy prices in Europe. However, the decline has been excessive, even if Vermilion has recovered some from the recent low seen at the end of May. The stock continues to trade with a lower valuation compared to many other peers as illustrated in the chart below.

Figure 7 – Source: Data from Koyfin

Maybe Vermilion deserves a lower valuation due to the political risk of the European exposure, even if I would argue it is disproportionally cheap even after the impact of the windfall profit tax is considered. The lower shareholder distribution might play a part, but that factor is likely to only have a short-term impact.

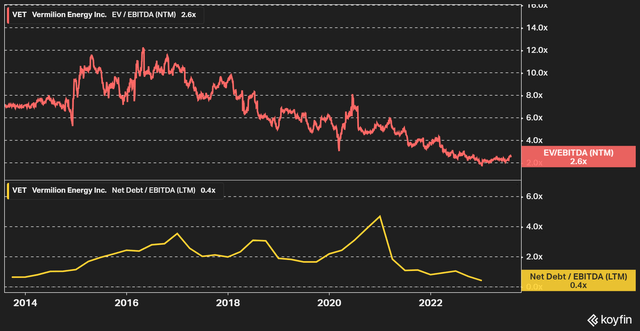

Also, the company is not just cheap compared to its peers. The valuation is also very low compared to how the stock has traded over the last decade, despite the fact that the financial leverage is at the lows of that period.

Figure 8 – Source: Koyfin

So, I continue to like Vermilion at this level even if the shareholder distributions are relatively low until the C$1B net debt target is achieved. I also like the optionality the stock offers if we get another period of higher energy prices in Europe, which I think is more likely than what the market seems to think.