JohnnyGreig

Summary

Following my coverage of Xerox Holdings (NASDAQ:XRX), which I recommended a sell rating due to my expectation that the company would have a hard time countering the secular headwinds, especially after the donation of PARC. This post is to provide an update on my thoughts on the business and stock. I reiterate my sell rating for XRX as I see no sustainable solution that can reposition the business to grow it in the long term.

Investment thesis

With revenues at $1.75 billion, XRX saw growth of 0.4% year over year. The improvement in gross margin was a surprise and is largely attributable to a better product mix as the backlog gets worked down. Gross margins were 34%, operating margins were 6.1%, and EPS was $0.44.

While I am pessimistic about the company’s long-term prospects, I can understand why the stock is still trading at its current levels. I believe the stock is being propped up by short-term optimism due to a number of factors that will fade away in due time. In the Print business, for example, XRX is benefiting from improving demand due to the end of the WFH trend, which is causing a temporary uptick in usage and the workdown of the backlog of equipment orders, both of which are contributing to near-term growth. Cost savings and an improving supply chain environment also contributed greatly to the 1H’s stellar margin performance.

As these tailwinds weaken in 2H23, XRX will likely be forced to face the music at the top. The same holds true for margin; the boost from reducing the size of the company’s rich backlog (helped increase gross margins) is less likely to persist through the second half of FY23 and all of FY24, as the backlog is already relatively close to its normalized levels.

“As expected, backlog has now returned to normalized level. We will no longer provide detailed backlog information as it is being managed in the normal course of business and we do not expect change in backlog to materially affect results going forward.” 2Q2023 earnings

Once all these tailwinds are over, I believe investors will start to view XRX as a business that is facing long-term secular headwinds, particularly in Print which have been evident since pre-Covid periods. Also, XRX is going to face a tough FY23 comparable as the Equipment sales tailwind (from driving down backlog) is gone. Together, these two should drive a huge revenue slowdown, which should hurt margins. To counter this, management is likely to go deep into cost-cutting initiatives. While this will help support profitability in the near term, I don’t see this as a long-term solution.

Lastly, the XRX balance sheet is not in the best condition either. The business is sitting on $3 billion of debt and $480 million in cash, netting a net debt of $2.5 billion, or 4x FY23E EBITDA. This further limits the levers that management can pull to support the stock (ie levering the balance sheet to conduct a share buyback or pay special dividends). While the 7% dividend yield is nice to have, I don’t think it is strong enough to support long-term earnings decline and valuation re-rating.

Valuation

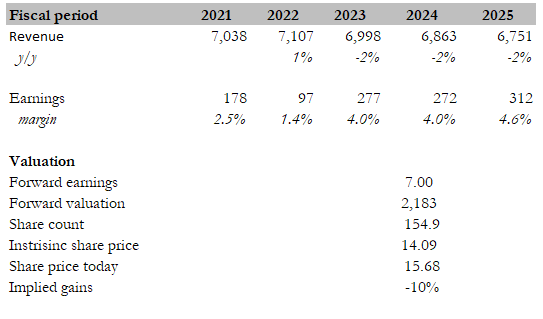

I continue to believe the business is not worth 9x forward earnings due to the strong secular headwind and reduced backlog tailwind. Historically, XRX traded at about 7x earnings (pre-covid), which is a fairer multiple in my opinion. While I believe management is going to expense all efforts to improve margins to drive earnings by cutting costs, I don’t see it as a long-term solution to withstand the secular headwinds. My model indicates a 1-year downside of 10% based on FY25 consensus estimates. Note that I am giving management the benefit of the doubt that they can expand net margin.

Own calculation

Conclusion

I reiterate my sell rating on the stock. Despite a temporary uptick in demand, driven by short-term tailwinds like the end of the work-from-home trend and improved supply chain conditions, I believe the company will face significant challenges in the long term. The secular headwinds in the Print business, along with the depletion of backlog tailwinds, are likely to result in a revenue slowdown and reduced margins. While management may attempt cost-cutting measures to support profitability, it is not a sustainable solution. Moreover, the company’s balance sheet, with significant debt, limits its ability to take decisive actions to support the stock.