imaginima

By Amanda Townsley

At A Glance

- The daily price change in WTI crude oil futures has averaged $1.33 per barrel since 2020, up 87% from the prior three years

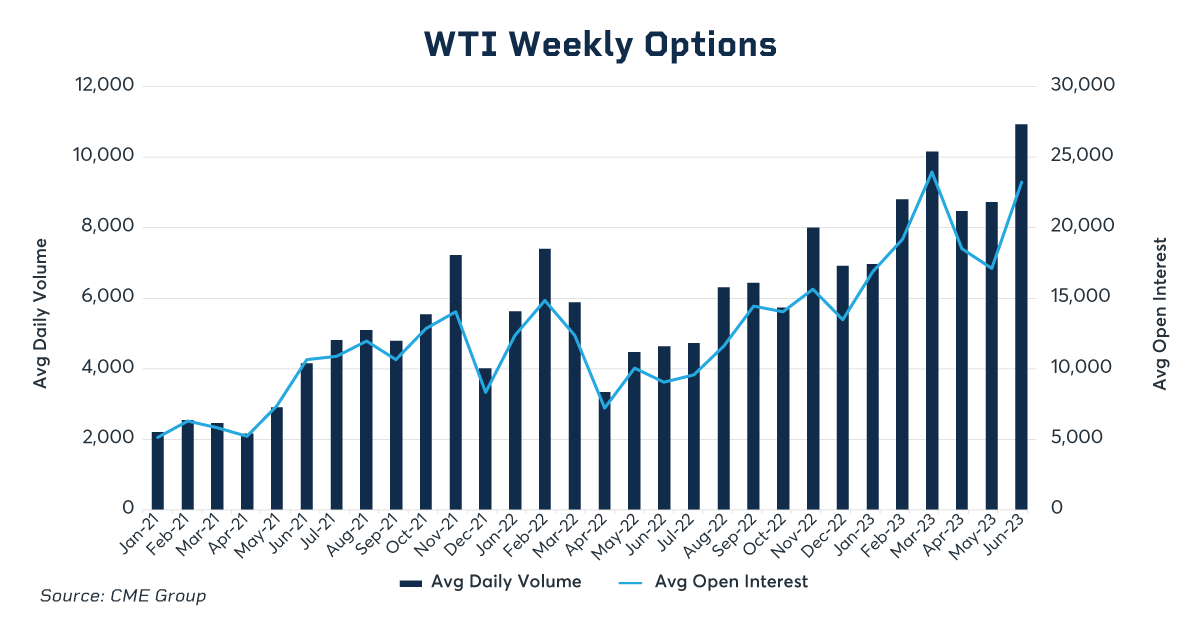

- WTI weekly options volumes traded in June were up 136% year on year

Change in the oil market is a constant. Since 2020, traders have seen unprecedented shifts in supply and demand, increased uncertainty, and a proliferation of market-moving events, all challenges more recently compounded by higher interest rates. As markets evolve, so have the tools of choice for oil traders: WTI crude oil weekly options trading volume is surging. Volumes traded in June 2023 were up 136% year on year, making the weekly options one of the fastest-growing energy products at CME Group.

CME Group

As the name implies, WTI crude oil weekly options expire on a weekly basis. The volumes shown in the chart above cover options that expire each Friday and are listed for four consecutive weeks. They allow traders to hedge a position or express a point of view on price and volatility shifts over a specific window. Like the heavily traded monthly options, weekly puts and calls are also exercisable into the underlying WTI futures contract any time prior to expiry. CME Group has recently launched weekly options with Monday and Wednesday expiries, allowing traders, even more, granularity for trading around specific dates or events.

Why now? The crude oil market is evolving in a few ways that make weekly options uniquely useful tools for risk management and active trading.

High Volatility

The daily price change in WTI has averaged $1.33 per barrel since 2020, up 87% from the prior three years. The change during non-U.S. hours (from close to 8 a.m. central time) has grown even more, 110% higher than in 2017-2019. WTI CVOL, a measure of implied volatility from the options market, has averaged 52% since 2020 as compared to 30% in the same 2017-2019 window.

The higher level of volatility is an expression of the uncertainty in the distribution of outcomes for crude oil prices, and drives increased demand for price risk mitigation for which weekly options are suited. When the market shifts sharply, bids and offers can change so quickly that a trader may not be able to exit a futures trade at the level expected, even if a stop-loss order has been used. The cost of buying a weekly put or put spread to hedge a long futures position during times of concern can be much less than this “gap risk,” providing better-defined downside risk to a portfolio.

Increased Need for Precision

While large price changes in crude oil can come at any time the market is open, potential price moves associated with known events and planned news releases have grown, yielding increased demand for risk management around specific calendar days.

When OPEC+ announced a surprise cut, crude oil prices jumped $4.75 per barrel, making April 3 the largest daily price change in the second quarter of 2023. Prior to 2020, OPEC’s ministerial chiefs met only twice a year, limiting the potential impact of an OPEC action to these few key moments. But 2020 kicked off an era of active supply management: in the last few years, OPEC has been meeting as frequently as 10 times annually. These frequent, scheduled meetings can drive over 1 million barrels per day in production shifts, increasing the likelihood of large price moves, and adding more short-term event risk for traders to manage.

While OPEC is king for oil supply events, so is the economy for demand. Economic expectations have been more in question than usual for the last few years with an escalation in central bank tightening and markets emerging in varying degrees from COVID-19. Since 2022, the oil price change on days when the Federal Reserve announces interest rate decisions has been 40% higher than the daily average. Fed decisions are typically issued every six weeks on Wednesdays, coinciding with the release schedule for the Energy Information Administration (EIA) weekly petroleum data. Scheduled U.S. and Chinese government economic statistics spanning from inflation to jobs to manufacturing activity also contribute to event risk as the market implies their impact on demand or potential response by the Fed.

Lower Capital Cost

WTI weekly options typically have a lower premium than their monthly equivalent. As interest rates have risen – and with it the cost of capital – capital efficiency is of growing importance. A lower premium on a weekly option makes it less costly for traders to use options to take a directional view of the market, hedge a position, or express a point of view on volatility shifts. Using call or put spreads on weekly options is another strategy traders use to reduce premiums and increase return on capital. Since a spread trade involves two puts or two calls, the growth in the use of spreads also contributes to growth in weekly options volume.

Oil Market Insight

The oil market’s higher levels of volatility, increased event risk, and the rising cost of capital are all contributing to growth in WTI crude oil weekly options trading.

But crude oil weekly options aren’t only useful for traders. Analysts, strategists, and market commentators benefit from the increased price transparency created by more granular volatility measures. By evaluating the differences in implied volatility across Monday, Wednesday, and Friday expiries, watchers can determine more precisely what kind of price move the market is expecting around certain events or within short time periods.

As high volatility, high-interest rates, and sensitivity to key events persist, WTI crude oil weekly options could continue to grow in popularity.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.