David McNew

Note: I have covered FuelCell Energy (NASDAQ:FCEL)(OTCPK:FCELB) previously, so investors should view this as an update to my earlier articles on the company.

More than eighteen months after its settlement agreement with POSCO Holdings (PKX), FuelCell Energy finally reported some initial progress in South Korea last week:

FuelCell Energy (…) has taken significant strides in its Korean market re-entry by forging relationships with domestic clean energy electric utilities that have installed FuelCell Energy power platforms.

The company signed a long-term service agreement (“LTSA”) with Noeul Green Energy on July 27 and has also established a memorandum of understanding (“MOU”) with Gyeonggi Green Energy, both aimed at the continuation of stable fuel cell operations and advancing eco-friendly power generation in Korea.

Noeul Green Energy and Gyeonggi Green Energy will enjoy the same superior service FuelCell Energy has provided Korean Southern Power Company since installing a 20-megawatt (MW) FuelCell Energy power platform in 2018.

FuelCell Energy President and Chief Executive Officer Jason Few said, “Through this LTSA and MOU, we are delighted to continue building our relationships with leading generation companies in the Seoul metropolitan area and support their clean energy power delivery commitments in Korea.”

Long-Term Service Agreement with Noeul Green Energy

The 20 MW Noeul Green Energy fuel cell park contains eight SureSource 3000 carbonate fuel cell platforms with a total of 16 fuel cell modules. The plant has been in operation since late 2016.

With the original fuel cell modules approaching the end of their useful life, a full replacement could have provided more than $50 million in profitable near-term service revenue but a closer look at the company’s respective 8-K filing with the SEC puts an end to this hopeful assumption (emphasis added by author):

(…) The Company’s obligations under the LTSA will commence after POSCO International Co., Ltd. or one of its affiliates replaces the 16 fuel cell modules currently being utilized at the Noeul Green Plant using 16 of the 20 fuel cell modules previously purchased by Korea Fuel Cell Co., Ltd. (“KFC”), a subsidiary of POSCO Energy Co., Ltd. (“POSCO Energy”), from the Company under the December 20, 2021 Settlement Agreement among the Company, POSCO Energy, and KFC. The Company expects that this initial module replacement by POSCO International Co., Ltd. or one of its affiliates will occur in the fall of 2023. Once this initial module replacement occurs, the Company’s obligations under the LTSA will begin and the term of the LTSA will continue for 14 years from such time.

In layman’s terms:

With the next (and final) fuel cell module replacement not due until 2030, there won’t be any material revenues derived from this new service agreement for many years to come.

Memorandum of Understanding with Gyeonggi Green Energy

Gyeonggi Green Energy operates the world’s largest fuel cell park containing no less than 21 SureSource 3000 2.8 MW fuel cell platforms with a total of 42 fuel cell modules. The plant has been in operation since early 2014.

According to the 8-K, the company is expected to initially provide a number of replacement modules and enter into a long-term service agreement with Gyeonggi Green Energy.

On July 21, 2023, FuelCell Energy, Inc. (the “Company”) and Gyeonggi Green Energy Co., Ltd. (“Gyeonggi Green”) entered into a non-binding memorandum of understanding (the “MOU”), pursuant to which the Company and Gyeonggi Green have outlined certain anticipated terms of their proposed business relationship with respect to Gyeonggi Green’s 58.8 megawatt (“MW”) fuel cell park, which include that the Company initially would be expected to provide several replacement fuel cell modules to Gyeonggi Green and that the Company and Gyeonggi Green will enter into a long-term service agreement with respect to the long term operations and maintenance services for new replacement fuel cell modules at the fuel cell park.

Given the size of the revenue opportunity, reaching definitive agreements would be a major positive for FuelCell Energy.

Please note that four years ago, POSCO Energy reportedly signed a 15-year long-term service agreement with Gyeonggi Green Energy with a reported value of W157.5 billion (approximately $123.7 million).

As the settlement agreement effectively precludes FuelCell Energy from pursuing long-term service agreements with legacy customers of POSCO Energy (with the exception of Noeul Green Energy and Godeok Green Energy), POSCO Energy’s cooperation will be required.

According to the terms of the late 2021 settlement agreement, FuelCell Energy would first have to repurchase available replacement modules from POSCO Energy before being able to deploy new units (emphasis added by author).

If PE Group cannot enter into an agreement with its Existing Customers to extend or renew the Existing LTSAs by 31 December 2022, PE Group shall cooperate with FCE so that FCE may discuss and (at FCE’s discretion) enter into an extension of the Existing LTSA, a new LTSA to replace an Existing LTSA, or a Module sales agreement with an Existing Customer; provided that (i) should FCE enter into such an arrangement with the Existing Customer, (ii) FCE is required to provide replacement modules to the Existing Customer under such arrangement, and (iii) PE Group has not already deployed all or some the Modules that PE Group ordered under Sections 2.1 and 2.2, FCE shall purchase the number of required replacement modules from PE Group at the price of USD 3,000,000 per Module (to the extent such Modules are available and have not yet been deployed).

With a maximum of four modules left at POSCO Energy following the upcoming replacement of 16 fuel cell modules at the Noeul Green Energy fuel cell park, negative impact from the repurchase requirement is likely to be limited but the company’s overall service margin might experience some temporary pressure.

That said, POSCO Energy might very well decide to deploy the remaining four replacement modules at other customer sites thus eliminating the repurchase requirement for FuelCell Energy.

In sum, investors should be encouraged by the company’s initial progress in South Korea despite near-term financial impact likely being very limited.

Proposed Doubling of Authorized Shares

Unfortunately, the progress in Korea is somewhat offset by the company’s ongoing intent to seek shareholder approval for doubling the number of authorized shares in a special stockholder meeting scheduled for October 10, 2023 (emphasis added by author):

DANBURY, CT, July 18, 2023 – FuelCell Energy, Inc. (…) today announced that it plans to hold a special meeting of its stockholders (“Special Meeting”) on October 10, 2023 to consider and vote on a proposal to amend the Company’s Certificate of Incorporation, as amended, to increase the number of authorized shares of common stock of the Company from 500,000,000 shares to 1,000,000,000 shares.

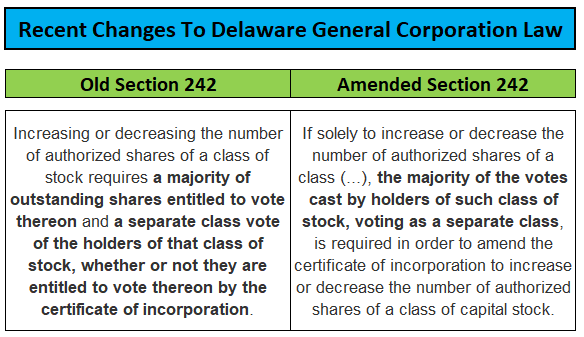

After two failed attempts earlier this year, the company apparently decided to wait until recent amendments to Delaware’s General Corporation Law have made approval much easier:

Manatt.com

While the company had unrestricted cash of $323.2 million at the end of April, estimated cash usage of up to $350 million in the current fiscal year and ongoing losses will require the company to raise more capital going forward.

After the company increased outstanding shares by almost 3,000% over the past four years by relentlessly selling newly issued common stock into the open market, I would expect dilution to continue for the time being.

Bottom Line

While signs of initial progress in South Korea are encouraging, near-term financial impact from these new long-term service agreements is likely to be limited.

After recent amendments to Delaware General Corporation Law will likely result in near-term approval of the company’s proposal to double authorized shares, investors will have to prepare for relentless dilution to continue for the time being.

That said, additional dilution for common shareholders actually strengthens the investment case for the company’s Series B Preferred Shares (OTCPK:FCELB) which trade around 43% of face value despite ranking senior to common stock and being shielded from dilution while paying a rather safe and juicy 11.7% cash dividend on an annualized basis.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.