Brett Holmes Photography

Note to readers: Dollar values in this article are made in reference to Canadian dollars. Also, we refer to the Canadian listing of TC Energy stock (TRP.TO) or (TSX:TRP:CA) and not to the U.S. listing (NYSE:TRP).

The energy investment world knows TC Energy Corporation’s (TRP) operational problems well. From leaks at its Keystone Pipeline to disastrous cost overruns at its Coastal GasLink project, the company has had too many serious blunders to make a shareholder comfortable.

Even the company’s most recent big news release – its sales of a 40% stake in its Columbia Gas pipeline system to Global Infrastructure Partners for $5.2 billion – wasn’t free of problems. The day after the deal was announced, TC Energy declared force majeure and isolated a section of the Columbia Gas Transmission Pipeline after detecting a pressure drop.

As bad as the company’s issues are, when it comes to stocks, it’s all a matter of price versus prospects. In TC Energy’s case, we have to ask at what price does its stock discount the company’s operating snafus, risks of future problems, and a seemingly lax management culture when it comes to safety.

TC Energy Should Be Valued for Its Growth

TC Energy has the benefit of owning and operating an extremely valuable asset base that generates huge cash flow. The fact of the matter is that the company’s $6.5 billion of recurring cash flow can cover many of its operational and financial sins. As we’ve seen with cash-flowing businesses in years past – such as money center banks during the financial crisis – large recurring cash flows can solve even the most severe financial setbacks, as long as they’re temporary in nature.

Today, with the investment community fixated on TC Energy’s current problems, its stock is discounting a lackluster future. In fact, its stock fails to price in any significant free cash flow and EBITDA growth that is likely to occur over at least the next five years.

Moreover, while we view the company’s operational and financial issues as significant, we believe they are temporary. Among the most important are the following:

First, TC Energy has encountered a spate of unacceptable pipeline leaks and problems with its assets on the most basic operational level. If these continue, we suspect they will result in a change of management. Either the current management fixes the situation, or a new management team will make operations and safety its top priority.

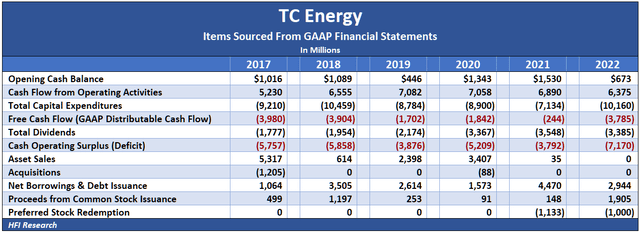

Second, the company has perennially outspent its organic cash flow. The table below shows the cash flow dynamics for the past six years. Note the bloated capex in 2022.

HFI Research

In 2022, the extent of outspending was in large part due to excessively high costs in the Coastal GasLink project. TC Energy plugged its cash flow deficit by issuing shares and taking on additional debt. When new debt issuance soared into the billions of dollars above expectations due to cost overruns without commensurate EBITDA growth, the company grew overleveraged.

Lastly, the company was forced to sell a crown jewel asset – namely, its Columbia Gas pipeline system – to reduce leverage. The sale was made at a disappointing multiple of 10.5 times EBITDA. TC Energy’s stock sold off 5% in the days after the deal was announced.

The Company’s Problems are Solvable

Once TC Energy gets past its ongoing series of setbacks, the irreplaceable role it occupies in North America’s energy infrastructure, the attractive return on capital generated by its asset base, and the company’s significant growth prospects will once again be reflected in a higher stock price.

Regarding the company’s operational issues, we believe that if current management wants to remain in place, it will have to perform an exhaustive review of its infrastructure to ensure it remains in optimal condition. The Keystone pipeline leak has already spurred enhancements in the company’s pipeline integrity program and safety performance process. The process could be costly to the company and shareholders in the near term, but if successful, it would set the company on a track to restoring its reputation.

Turning to the company’s outspending of its organic cash flow, management has pledged to rein in capex below $7 million beginning in 2024. Lower capex will reduce the company’s need for external financing. In concert with new projects entering service, lower capex will allow the company to grow operating cash flow and eliminate its cash flow deficit by 2025 or 2026. At that point, it can then focus on deleveraging using free cash flow.

Lastly, leverage should come under control. EBITDA growth will be one part of the equation, but costs are likely to come down, as well. In our experience, when a company is put at financial risk as a result of bad management decisions, the experience tends to be chastening for management. Management is therefore unlikely to put the company at risk in the future, which tends to be a positive result for long-term shareholders. The overleverage caused by management has already cost TC Energy shareholders in the form of selling a high-returning asset. But now that management’s $5 billion asset sale target has been hit, we don’t expect future adverse asset sales.

Growth Will Drive the Stock Higher

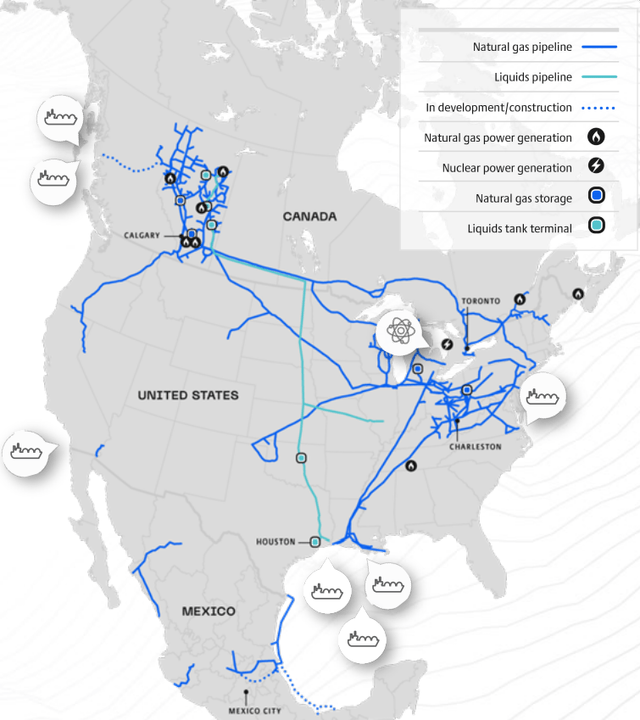

The fact of the matter is that TC Energy is one of Canada’s national champions. From a national perspective, it is important for the company to be well-managed, due to both its size and the vital functions it serves in transporting and producing energy and power throughout North America, as shown in the map below.

TC Energy

Source: TC Energy Sustainable Energy Forum Investor Presentation, June 20, 2023.

TC Energy’s asset base is world-class. The company routinely runs at high utilization across its entire system, which makes its financial results more stable than most of its large North American midstream peers. TC Energy’s assets feature economic characteristics of stability and safety akin to public utilities in the U.S., while its growth potential is far greater.

The market is failing to discount TC Energy’s very real growth prospects as new projects enter service over the coming years. From 2017 through 2022, TC Energy has spent a whopping $55 billion on capex. If we assume that $15 billion of the total was spent on maintenance, the remaining $40 billion should add anywhere from $3 to $4 billion to the company’s Adjusted EBITDA and free cash flow over the next three-to-five years. A full $1.4 billion of new projects entered service in the first quarter, while an additional $4.4 billion are expected to do so over the balance of the year.

These projects were funded through $16 billion of attractively-priced debt and $1.9 billion of common stock sales. Overall, we believe the low cost of financing should result in attractive returns on the new assets for TC Energy shareholders.

The growth projects will cause cash flow to grow in 2023 and well beyond. Management has guided for 5% to 7% year-over-year EBITDA growth in 2023, and we expect 5% growth for several years thereafter.

TC Energy also offers shareholders a safe dividend. Even though its capex obligations in 2023 will cause it to operate at a cash flow deficit, its assets’ high quality and cash flow growth prospects will allow it to easily meet its dividend.

The company’s current $3.72 annual dividend generates a 7.7% yield on its current stock price. Growth over future years will grow the yield significantly. The 5% dividend boost we expect in 2024 would translate to a yield of 8.1% on today’s share price. Such a yield would be significantly higher than the midstream average, and growth will likely continue from there.

Valuation

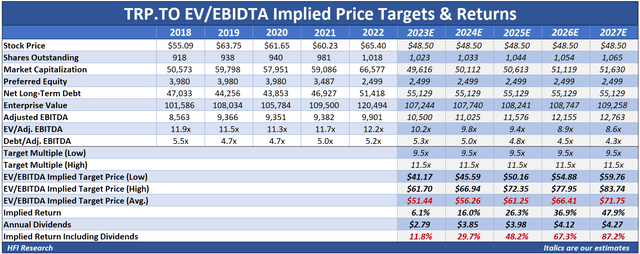

We value TC Energy shares in the range of $52 to $56, above their current price of $48.50. Our price target is the midpoint of the range, or $54. The shares currently offer 11.3% upside to our price target. This upside creates a comfortable margin of safety for buyers at the current price due to TC Energy’s generally stable asset and financial performance.

Our valuations demonstrate that TC Energy’s shares reflect today’s Adjusted EBITDA but do not reflect growth. Using a 10.5-times EV/EBITDA multiple, our valuation estimates that the shares are worth $51.44 today, 11.8% above their current price. Our valuation increases to $71.75 by 2027, for an 87.2% total return. It assumes that Adjusted EBITDA increases by 6% in 2023, by 5% from 2024 to 2027, and that dividends increase by 3.5% each year. Note also that increasing EBITDA reduces TC Energy’s leverage ratio even without any debt reduction.

HFI Research

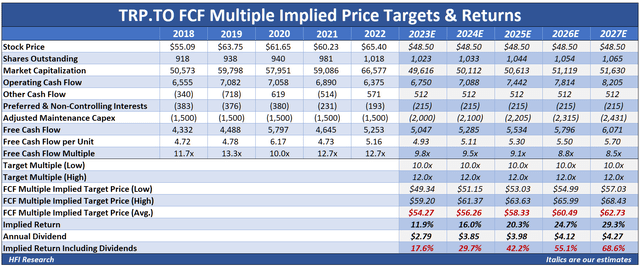

Our free cash flow multiple valuation implies the shares are currently worth $54.27 at an 11-times multiple, 17.6% above their current price. But if operating cash flow increases by 6% in 2023 and by 5% from 2024 through 2027, and if dividends increase by 3.5% annually, our valuation implies that TC Energy offer a total return of 68.6% by 2027.

HFI Research

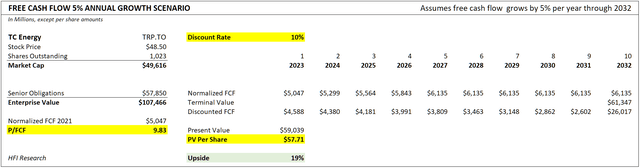

Lastly, our discounted cash flow valuation assumes free cash flow increases by 5% through 2027 and remains flat thereafter, which we believe is conservative. It implies 19% upside from the current share price of $48.50.

HFI Research

Conclusion

TC Energy shares have fallen to the point where they don’t reflect the company’s high-quality assets and significant growth prospects. At their current price, they discount continued operational blunders and stunted growth. While we certainly acknowledge the company’s recent struggles – and until now have recommended that investors avoid the name – we believe the shares have fallen too far, assuming that TC Energy’s operational issues will be remedied. If they are, today’s share price is unusually attractive for a Canadian midstream major, and we’re upgrading our TC Energy rating from Hold to Buy.