Gary Kavanagh

This is a basket containing some of the energy stocks I’ve detailed here over the past several months.

In each of these cases I have personally bought the security, and I purchased them in client accounts. I manage several private equity funds, and all of these stocks have been purchased in some of them. These stocks were all purchased for their dividend/distribution income first, capital appreciation second.

These stocks are presented in the order they were purchased, oldest first. I’ll first present the stocks, and then their combined returns. Now of course I’ve recommended more stocks than these recently, but these have been running for several months since the article was originally written so they’re good ones to look at.

Note: Some of these companies pay a distribution rather than a dividend, however for the sake of simplicity I’ll refer to all payments to shareholders as dividends. Additionally, some of these companies are Limited Partnerships and issue K-1s, which are not suitable for retirement accounts. Do your research before purchasing.

1. Global Partners LP (NYSE:GLP)

8.13% Forward Yield

Originally recommended on Apr 11, 2023 at $30.32/share, this downstream and well-integrated company is a dividend powerhouse.

What I liked about this company for use in an income basket was how spread out and integral it is to the supply chain. They mostly own gas stations, and supply fuel to other gas station owner/operators. Furthermore they own numerous bulk terminals, and supply fuel via truck and railway.

They recently raised their dividend yet again, and are now forward yielding a whopping 8.13%. Given how well integrated they are, and how crucial they are as a company to their customers, I don’t see that dividend going anywhere anytime soon.

2. Hess Midstream (NYSE:HESM)

7.7% Forward Yield

Originally recommended on Apr 26, 2023 at $28.27/share, this midstream focused company is actually owned by its parent company: Hess Corporation.

It’s parent company has large amounts of upstream assets producing crude, especially in the Bakken shale play. HESM is their dedicated midstream service, which operates not just for them but many other clients.

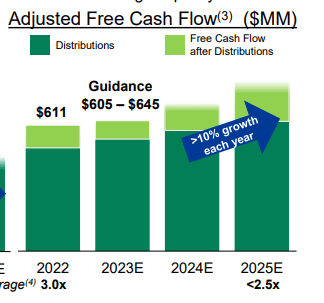

Over the years their distributable cash flow has grown steadily, and their dividend along with it. Check out the graph of adjusted DCF from their latest investor presentation:

HESM Adjusted Distributable Cashflow (HESM May 2023 Investor Presentation)

Given Hess Midstream’s vertical integration they should have no problem continuing that dividend in the future. Currently boasting a forward yield of 7.7%, they’re a solid addition to a dividend portfolio.

3. HF Sinclair (NYSE:DINO)

3.54% Forward Yield

Originally recommended on May 6th at $39.24/share, this stock is now up a whopping +28.67% from its deep value territory.

HF Sinclair is a deeply vertically integrated company with assets throughout midstream and downstream. You probably know them best for the Sinclair gas stations with the large brachiosaurus in the front.

My thesis at the time of the article was that a lot of their value hadn’t shown up in the pricing and they were sitting on a point of strong support technically. Clearly investors have started to get the picture since then that the $30s was an absolutely insanely low price for this great company.

Is it still in buyable territory? Absolutely.

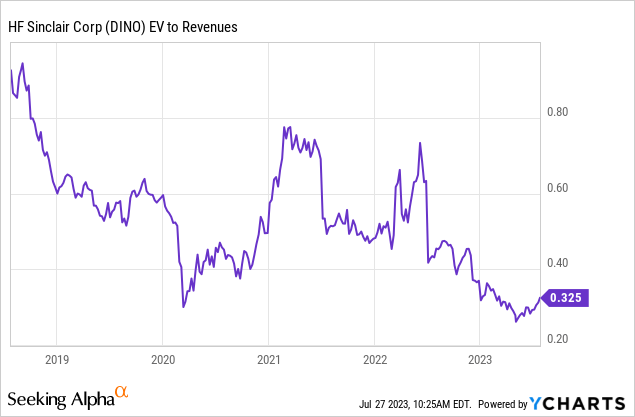

When I recommended it, it was at the lowest point in 2023 in EV to Revenue. Since then it has rebounded, but it’s still incredibly low compared to its historical numbers. HF Sinclair is now a stronger company than it was historically with the integration of Holly Energy Partners and Sinclair together, and should be worth much more than it was.

This company is an absolute powerhouse that will continue to build value for investors. At a 3.54% forward yield, it isn’t the biggest payer on the list, but with an 11% payout ratio it has more runway than most companies to continue raising it and that’s why I recommend it. This company is going to keep growing and raising that dividend over time.

4. Dorchester Minerals, L.P. (NASDAQ:DMLP)

8.59% Forward Yield

Originally recommended on May 11, 2023 at $28.37, this company focuses on upstream production in several basins in the US. They are the owner of producing and non-producing crude oil and natural gas mineral, royalty, overriding royalty, net profits, and leaseholder interests as detailed in the original article.

Their diversity of ownership in production in various basins around the country helps assure that even as commodity prices change they can continue to receive income as a result. This is one of those stocks that will just sit back and make money in one of the most boring ways possible.

DMLP does not pay a base dividend, but is entirely variable based off of total receipts. This isn’t a problem though as I expect crude pricing to have a floor around $65-$70/bbl even in the event of an increasingly unlikely recession.

Currently forward yielding 8.59%, DMLP will have no problem continuing these payments to shareholders.

Returns

Assuming a $10,000 initial investment in each ticker, here are the returns you would have seen so far if they were bought when I recommended them:

| TICKER | PURCHASE PRICE | CURRENT PRICE | CHANGE |

| GLP | $30.32 | $33.24 | +$963 |

| HESM | $28.27 | $31.41 | +$1110 |

| DINO | $39.24 | $50.73 | +$2928 |

| DMLP | $28.37 | $31.43 | +$1078 |

| TOTAL | – | – | +$6080 OR +15.2% |

Now of course we’re more interested in income, but capital appreciation is never a bad thing. I always try to choose stocks that will provide capital appreciation in addition to their dividends, and that’s why I’ve focused very heavily in energy recently – a topic I detailed in an article over here.

Combined, these stocks are currently yielding 6.55% based on today’s pricing and an equal purchase into each one of them.

Now that’s a very respectable yield, but what’s even more impressive is how integrated these four companies are in various sections of the oil supply chain and how they represent upstream, midstream, and downstream together.

These are four companies that are doing very well for themselves, have plenty of runway to either continue their current dividend (like DMLP) or continue to grow it and their share price (like the others).

Hopefully this article gave you some ideas of where to invest for energy income, and if you own any of these companies drop me a comment and let me know!