zhengzaishuru

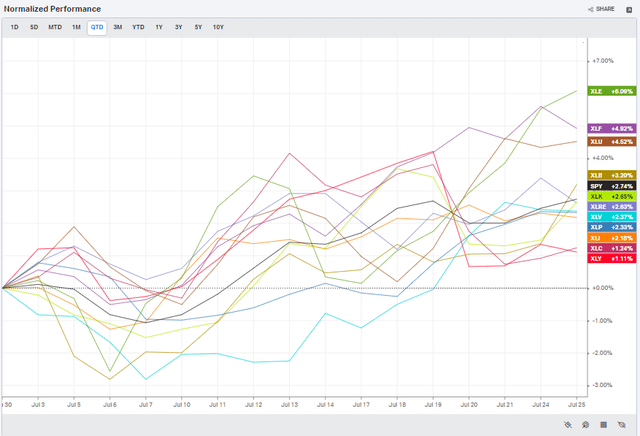

The oil price rebound has caught some investors off guard. So far in July, the Energy sector is the best performer in the S&P 500. What’s more, there has been added relative strength among small caps. Combine those two positive factors, and eyeing small-sized oil & gas firms is not a bad top-down method.

I have a buy rating on shares of VAALCO Energy (NYSE:EGY) for its low valuation, high yield, and positive technicals.

Energy Sector Leading in July

Koyfin Charts

According to Seeking Alpha, EGY, an independent energy company, acquires, explores for, develops, and produces crude oil, natural gas, and natural gas liquids. The company holds Etame production-sharing contracts related to the Etame Marin block located offshore in the Republic of Gabon in West Africa. It also owns interests in an undeveloped block offshore Equatorial Guinea, West Africa.

The Houston-based $470 million market cap Oil and Gas Exploration and Production industry company within the Energy sector trades at a low 8.4 trailing 12-month GAAP price-to-earnings ratio and pays a high 4.4% dividend yield. Ahead of earnings in August, the stock carries a high 48% implied volatility percentage along with a material 5.2% short interest.

Back in May, EGY reported an operating earnings miss. While the consensus called for $0.17 of EPS, Q1 results verified at $0.07 while its sales of crude oil, natural gas, and natural gas liquids summed to just $80.4 million, another miss, though revenue was higher by 17% on a year-on-year basis. I dug deeper and found that high capex has resulted in lower free cash flow, and the firm plans more capital investments that are hoped to create strong ROI opportunities.

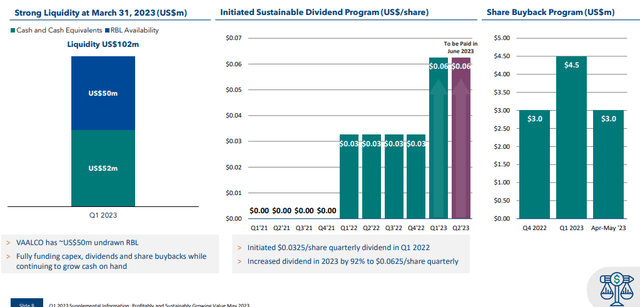

VAALCO boasts a strong, bank debt-free balance sheet with an unrestricted cash balance of $52.1 million and Adjusted Working Capital of $40.2 million, according to the most recent data at the end of its Q1. Also, along with a strong dividend, the management team returned $10.5 million to shareholders through share buybacks from the initiation of the program in November 2022 through May 9, 2023.

Key risks include adverse energy commodity price changes, geopolitical risks with the firm’s non-US assets and operations, unfavorable forex changes, and risks related to its high capex.

Debt-Free Balance Sheet, Strong Financial Foundation

VAALCO

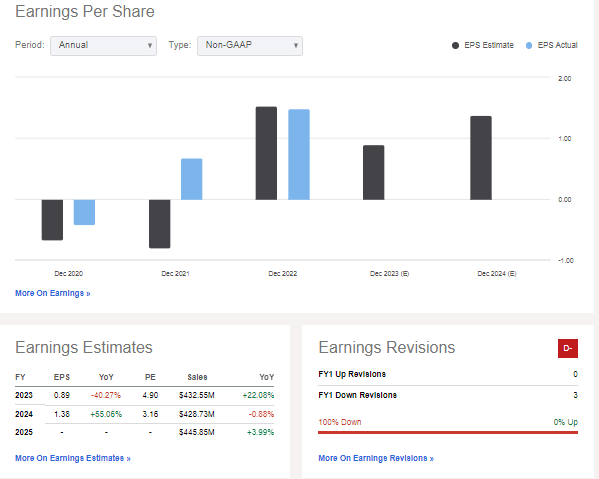

On valuation, the consensus expectation calls for lower per-share profits this year following 2022’s strong energy market and commodity price situation. With more stable oil and gas prices this year, expectations are much more tame, but the latest jump in energy commodities is a boon for an E&P name like VAALCO. What’s more, EPS is seen recovering toward last year’s levels in the out year.

So, we have a normalized earnings figure to consider in the valuation. I also like that the company’s top line is forecast to be higher in the current fiscal year compared with that of 2022. A dark blot, though, is that free cash flow per share is just $0.09 over the last 4 quarters (though Q1 capex was high at $27.7 million from cash capital) – I would like to see that figure improve.

VAALCO Energy: Annual Earnings Trajectory

Seeking Alpha

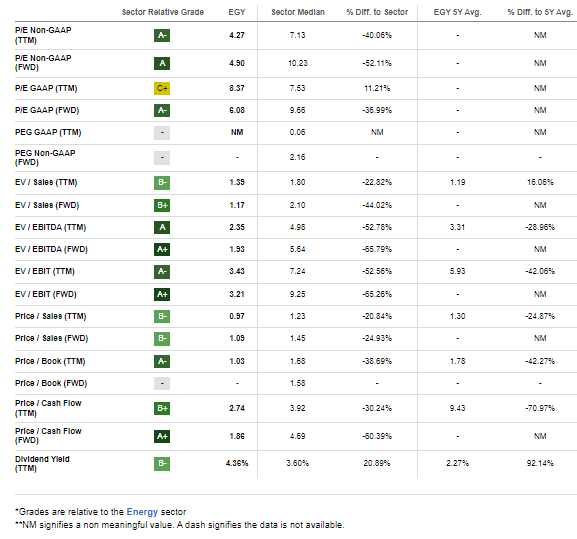

EGY’s forward non-GAAP P/E is exceptionally low on the surface at under 5, which is below the sector median. I notice, though, that it is toward the top end of its valuation recent range. As graphed below, the market has not paid this much for this small oil producer since Q1 of 2022 – back when interest rates were much lower and when oil was on a steep increase.

If we apply a 5 P/E to $1.20 of next 12-month EPS, then the stock should be near $6. So, it is roughly 25% to 30% undervalued on an earnings basis. And that aligns with the stock’s price-to-sales discount to the sector median. Still, a small and volatile cyclical energy company like this should require a margin of safety among investors considering owning it.

EGY: Attractive Valuation Metrics

Seeking Alpha

EGY: Historically High Operating P/E, Still Low Versus the Sector Median

Koyfin Charts

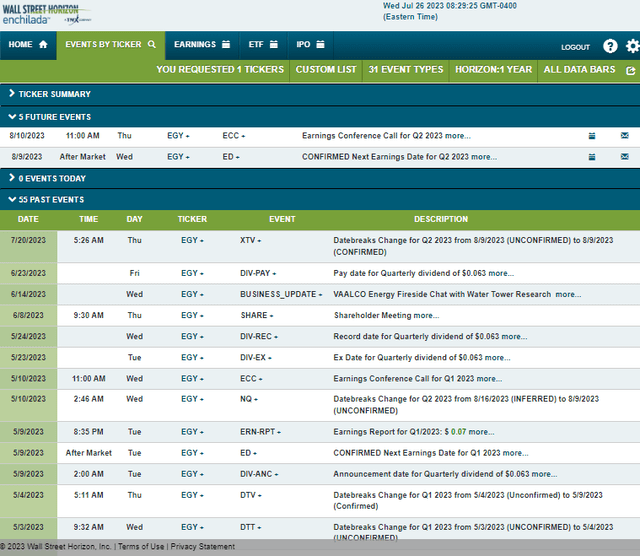

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2023 earnings date of Wednesday, August 9 after market close. The calendar is light on volatility catalysts aside from the reporting date.

Corporate Event Risk Calendar

Wall Street Horizon

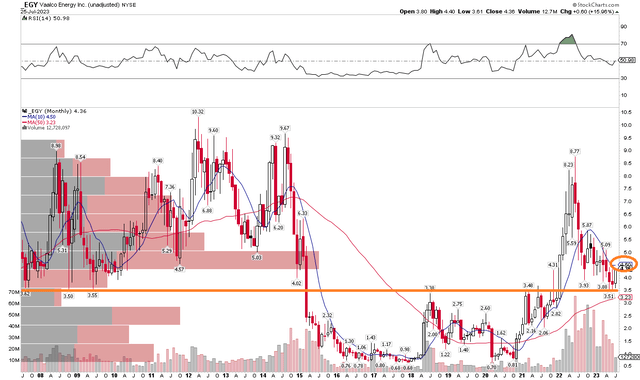

The Technical Take

Readers know I like to focus on near-term price action and momentum trends, but with EGY, I spotted a significant long-term price point. Notice in the chart below that the stock has support near $3.50. Shares bounced off that point of polarity a few times in the last couple of months. Moreover, EGY met selling pressure on rally attempts from 2018 through the first half of 2021. Once the bulls powered the stock above $3.50, it was off to the races, and it went on to touch highs not seen since 2014 during the commodity boom of 2022.

Following a major crude oil price freefall from June last year through early 2023, the stock was sliced by more than half. With a rising 50-month moving average and noted support at $3.50, I assert a long play with a stop under $3.50 is a solid risk/reward play. There could be resistance around $6 – when I zoom into the 2-year daily chart, I see that level as a key battleground between the bulls and the bears, and the current RSI momentum reading has reached the best buying pressure level since last October.

Overall, the risk/reward situation appears to be favorable from the long side.

EGY: Key Long-Term $3.50 Support, $6 Near-Term Resistance

Stockcharts.com

The Bottom Line

I have a buy rating on VAALCO with a target of $6 based on both the fundamentals and the technicals.