Ryan Fletcher

In a previous report, I marked Hexcel Corporation (NYSE:HXL) stock a hold arguing that the company’s share price had grown ahead of its fundamentals. Since then, the stock has been more or less flat while the S&P 500 (SP500) gained nearly 13%. After reporting its Q2 2023 earnings, Hexcel is currently trading nearly 6% lower. In this report, I will be analyzing the results to determine whether this offers a more compelling entry point for investors and determine any upside or downside for the stock based on the evoX Financial Analytics tool.

What Does Hexcel Company Do?

For those not familiar with Hexcel, it might be good to provide an introduction to the company’s operations. Hexcel Corporation provides composite materials and structures. These days, the reduction of greenhouse gas emissions plays an important role. Composites provide lower-weight solutions, thereby reducing fuel consumption in, for instance, cars and aircraft. Furthermore, the company provides material solutions for the wind energy market. So, with greenhouse gas emission reductions in mind, there are significant opportunities. On each of these sectors where Hexcel could provide solutions, there are remarks to be made, which I will do when discussing my investment view on Hexcel Corporation.

Aerospace and Defense Boost Revenues

Hexcel Corporation

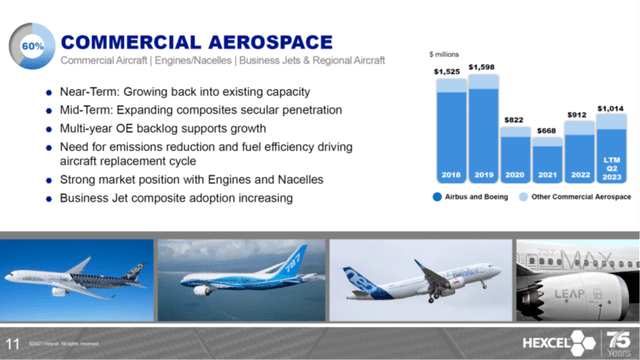

Like many aerospace companies, Hexcel is still in recovery mode. How fast that recovery will be is going to depend on the ramp-up trajectory for commercial airplane production which in turn depends on the overall aerospace supply chain health. The twelve-month trailing figure shows that sales grew by 11% and 16.1% for the quarter. For the first half of the year, sales grew by 23%, so there is a deceleration in Q2 on the sales growth, which is caused by a combination of a more challenging comp and continued challenges on key commercial airplane programs.

Overall, growth was primarily driven by the Boeing (BA) 787, Airbus (OTCPK:EADSY) A350, and Airbus A320neo, while adoption of lightweight materials on the business jet also has been a positive contributor. The overall revenues have only been 63% recovered, so significant recovery runway continues to exist, but it is likely a mid-decade story before we will see the commercial aerospace revenues fully recovered.

Hexcel Corporation

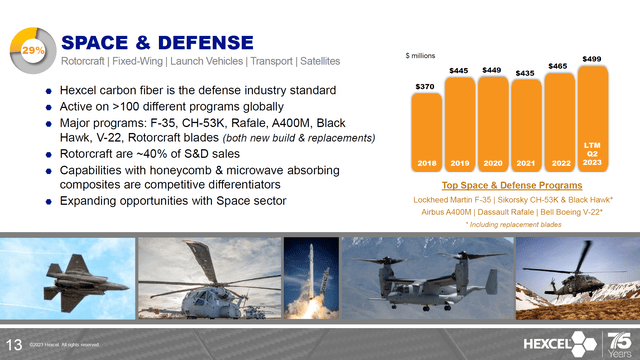

Defense tends to be the stable factor for Hexcel and with increasing defense budget and some new production programs that are ramping up such as the CH-53K and the Future Vertical Lift, we do see some growth and expect growth in the future as well. LTM revenues grew by 7.3%. In the second quarter, the growth was even stronger, with 22.9% driven by F-35, Rafale, and Black Hawk related sales. For the first half of the year, the growth was 14.6%.

Hexcel Corporation

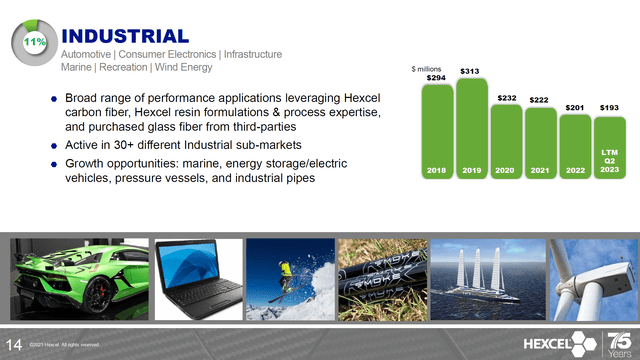

The Industrial segment remains the ugly duckling of Hexcel, with a 4% sales decline over the last twelve months, 1.9% for the quarter, and 7% for the first half of 2023. The big driver of the industrial used to be wind energy led by supply work for Vestas, but ever since that work has been lost Hexcel is busy reinventing its industrials segment. The company is pivoting away from wind energy to other markets such as consumer electronics, marine, and automotive, but we are not given any kind of insights on how well they are progressing. However, given that there continues to be a decline since 2019, we can only assume the Industrials segment will be on a long-term trajectory to return to growth.

Hexcel Stock Continues To Run Ahead Of The Recovery Curve

Hexcel Corporation

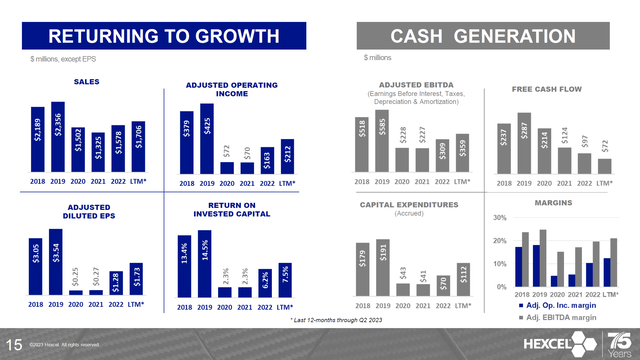

Revenues have recovered 72%, while adjusted operating income is 45% recovered and adjusted EBITDA is 61% recovered, and free cash flow has recovered 25%. So, realistically Hexcel is still years away from recovering to pre-pandemic levels. That is the case when we look at the recovery pace, and that is the case when we look at when certain commercial programs start ramping up revenue contributions and defense equipment demand can start translating into purchase orders for suppliers. The pre-pandemic share price for Hexcel was in the $80-$85 range and its current share price is $71.35. On nearly identical share counts, the share price has recovered by 80 to 90 percent far ahead of revenue or earnings recovery. To me, that indicates that a lot of the future growth is already priced in.

For the first half of the year, adjusted profit increased from $75.8 million to $124.8 million, marking a 65% increase, but free cash flow decreased from a $19.6 million outflow to a $44.7 million outflow on higher capital expenditures partially offset by higher operating cash flow.

Hexcel Corporation

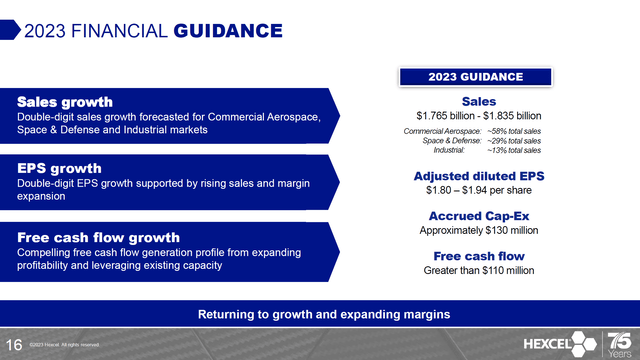

For the full year, Hexcel increased its guidance from a range of $1.725 billion to $1.825 billion to $1.765 billion to $1835 billion in sales, with no changes to the share in sales by segment. Adjusted EPS guidance has been increased by $0.10 on the low end and $0.04 on the high end. Hexcel beat Q2 estimates on revenues as well as earnings per share, yet is trading down in today’s session. The reason likely is because that while the company guided up for sales, it reduced its lower bound of the free cash flow generation for this year by $30 million.

While I do think that the stock price recovered far ahead of the recovery in fundamentals, I don’t quite think it is accurate to look at it like that. The reason is that CapEx guidance has increased by $40 million to include $38.0 million in CapEx for the acquisition of the land and building at our Amesbury, Massachusetts facility to support future growth. So, we have $40 million increase in CapEx and a $30 million reduction in free cash flow (“FCF”), which would suggest that an operating cash flow level for which Hexcel does not guide there is a $10 million improvement.

Is Hexcel A Good Stock To Buy?

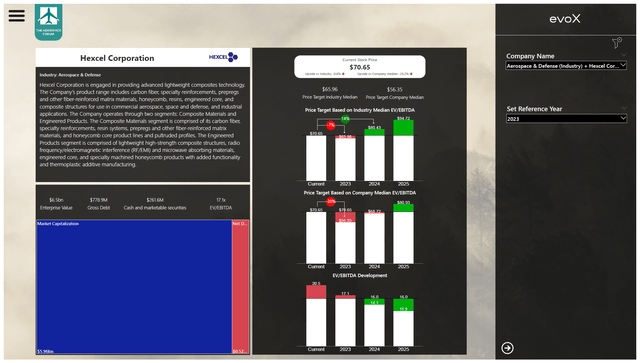

The Aerospace Forum

I like Hexcel as a company, their product is important in aerospace, and they are active on the growing commercial and defense platforms. What I don’t like is the Industrial segment, which is having a hard time turning things around absent of wind energy sales. The products that Hexcel produces are extremely important to achieve lightweight and high-specific strength materials, so for the long term, Hexcel will likely continue to excel (no pun intended) with their portfolio. However, I have entered the numbers into the model for Hexcel, and based on its median EV/EBITDA multiple, the stock is overvalued with no fundamental upside until 2025, and if we apply a higher multiple in line with industry peers there is no upside until 2024. With that in mind, I am not inclined to mark shares a Buy and maintain my Hold rating for the stock.

Conclusion: Hexcel Is A Great Company With A Not-So-Great Stock Price

I like Hexcel. When I look at the company’s presentations and having an aerospace background, I can understand why people are invested in the company. However, at the same time the stock price has run ahead of its revenue and earnings, and it is actually valued fairly and perhaps overvalued with 2023 earnings in mind. That was the case last quarter and is also the case this quarter. From a fundamental point of view, there is no reason to buy the company’s stock for its 2023 results. If you buy, then you buy it at a premium, and perhaps that is a premium that the company deserves based on its products and its growth prospect, but I don’t see a reason to go all-in on Hexcel. Perhaps you could add some shares here and there for the longer term, but it would still be at a share price that is running ahead of its recovery profile.

Either way, looking at what Hexcel Corporation offers to the market, I do believe that for the long term, this can be an extremely rewarding opportunity. However, you just have to be OK with buying the stock at a higher price than is justified by the fundamentals as the stock seems to be excessively forward-looking, meaning that fair value won’t be reached unless the stock corrects somewhat.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.