Sundry Photography

Thesis

As I mentioned in my last article on Enphase Energy, Inc. (NASDAQ:ENPH), I believe that international growth and especially growth in Europe will be the key to success. And now, a few months later, I still stand by that thesis, and I would add that I think the hypergrowth will continue for about 3 to 5 years. So expect to see strong international growth in the earnings report, specifically from Germany.

This makes Enphase an attractive investment opportunity over this period at its current valuation. Let me explain why I believe this in more detail in the following sections.

Enphase Energy Balance Sheet

I like it when companies are not overleveraged because it gives you one less thing to worry about, and Enphase’s balance sheet is rock solid. Total cash and ST investments of $1,778 million versus total debt of $1,317 million shows that they could easily pay off their debt if they wanted to.

ENPH Growth Outlook

The reason I said I think the hypergrowth in Europe will continue for 3 to 5 years is because that is what many people in the industry have told me. And especially 2023 is a fantastic year for the industry in Germany, as the German government has abolished the 19% VAT on photovoltaic systems as of 01.01.2023.

I’m a big fan of looking at incentives, so let me give you an example of how many people in Europe are really making a lot of money right now because of the transition to renewable energy.

In Europe a photovoltaic system most of the time costs between 20k and 30k € depending on whether you want a 5kwh or 10kwh storage. And customers typically finance it over a 10-year term, which will cost them about €250 to €350 per month. As a result, the photovoltaic and solar systems are still affordable for customers in Germany, Austria, Switzerland, or the Netherlands and offer a positive added value.

And from the money the companies get, they pay subcontractors €2.5k to €3k to install it on the roof. And right now there is a shortage of installation teams, so you even have companies from Eastern or Southern Europe coming to Central Europe to install this and earning in 1 day more than they would earn in 1 month in their home country. Usually, it takes a 2 to 3-man team 1 working day to install everything.

Then there are the people who acquire the orders and sell them to the companies, who also currently receive a commission of about 10% of the order volume. In addition, only electricians are allowed to connect the systems to the grid, and most of them are fully booked, so there are many people who bought their photovoltaic systems last year and had everything installed on their roof, but have been waiting several months to have them connected.

For example, there are orders from last year that are still being processed, even though new companies are being founded every day to meet the demand. In addition, some parts are in short supply. At one of Germany’s largest solar shops, nearly all Enphase components are unavailable. The shortage problem affects not only Enphase products, but multiple companies and multiple parts that are needed.

So far, FY23 is much better than FY22 for most companies in the industry despite the shortage, so you can expect H2 of FY23 to be even better when the shortage is over, and most likely FY24 will see a further increase. In the second half of 2023, the factory in Timisoara, Romania, is also expected to be ready for the European market with the Enphase IQ8.

In addition, the price of a PV system with storage is likely to fall in the future, which could lead to new growth in poorer countries in Europe and similar countries in the rest of the world.

Enphase Insider Buys

There is a saying that for an insider, there are many reasons to sell, but only one reason to buy. So, it is interesting to see that Mandy Yang is buying shares, which could lead to the conclusion that she thinks the shares are undervalued. But even more interesting are the big purchases made by board member and billionaire Thurman John Rodgers. He bought shares for nearly $5.5 million. And his 2017 investment in Enphase will likely have paid off handsomely for him.

Valuation

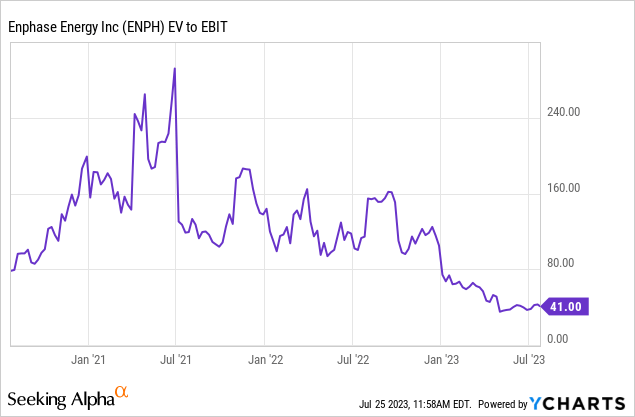

Enphase Energy’s EV/EBIT multiple is the lowest it has been in the last 3 years, despite strong growth prospects, a secure balance sheet, and a strong product. Depending on how the market absorbs the earnings, the stock could go even lower, but over the next 3 to 5 years, I see the risk/reward as really positive because I see how much growth is available in Europe. So I would say the entry price is attractive right now.

Enphase Competitive Advantage

Enphase has a competitive advantage because there are some safety regulations that are very favorable to Enphase. But not all countries have them. For example, there is a big difference between France and Germany, which makes it more difficult for Enphase in Germany.

Another advantage of Enphase is the flexibility to add modules, which is a selling point for some customers.

It is often argued that microinverters are better than string inverters, which would favor Enphase, but as is often the case, there are arguments for both sides and technological conditions can change quickly. To be clear, both have their pros and cons, and it will most likely be an individual decision as to which suits someone better.

Conclusion

As I said, I like the risk/reward of Enphase over the next 3 to 5 years, but since this is a fast-growing industry, a lot can happen in that time that would affect my opinion today. So right now I think it is an attractive entry price, but depending on political, technological, and other reasons, this could change quickly as this company is dependent on many variables. However, the European Union, with a population of nearly 450 million, is a large market that should provide sufficient growth for the next few years.