LL28/iStock via Getty Images

Investment Thesis

Nucor Corporation (NYSE:NUE) is a very well-managed and cheaply valued steel company, with strong prospects. On the surface level, paying around 9x this year’s EPS for Nucor doesn’t scream of a bargain valuation.

However, this valuation pays no credit to the fact that steel is critical for 4 mega-trends that are afoot at present: rebuilding, reshoring, repowering, and renewing.

Future Energy is how the world will transition over the next 3 to 5 years away from a dependency on fossil fuels (predominantly coal and oil), towards cleaner energy sources. And that transition isn’t going to take place without steel at the epicenter.

There’s a lot to be excited about Nucor, so let’s get to it.

Why Nucor Corporation?

Nucor opens its press release with a reminder to investors that Nucor just reported its “second-strongest start to any fiscal year in Nucor history”. A bold statement. Particularly given that its share price has been very volatile in the past year and a half, and hasn’t really gone very far during this period. What’s more, both astonishing and frustratingly, Nucor’s share price is still down, albeit marginally, from the highs it set earlier this year.

But this story doesn’t end here. In fact, I believe that we are on the cusp of a steel supercycle that will take a lot of investors by surprise. But in hindsight, this will have seemed the most obvious point in time to get bullish on Nucor (and some of its peers).

First, let’s get to its financials to get some context.

Revenue Growth Rates Set to Ramp Up in H2

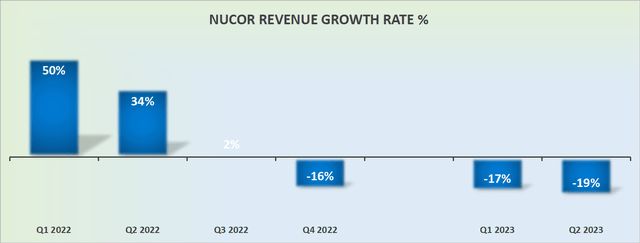

NUE revenue growth rates

Since Q1 2022, Nucor’s revenue growth rates have been posting consistently decelerating and worsening revenue growth rates. However, I strongly believe that this will mark the trough decline for Nucor’s revenue growth rates.

Put another way, investors should attempt to form some view of 2024’s outlook. Can the argument be made that Nucor’s 2024 will be better than 2023? That’s the only real consideration that investors need to ponder. And I believe that the answer is a clear yes. Why?

This is not due to some misguided and hopeful rose-tinted analysis. Instead, it’s common sense. After all, it would require quite a lot to go wrong for 2024 to be worse than 2023 in terms of revenue growth rates.

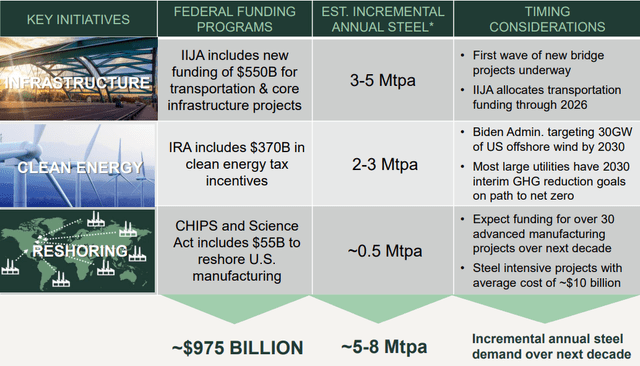

What’s more, Nucor has positioned itself for 4 key megatrends:

- Rebuilding (infrastructure, bridges, roads)

- Reshoring (factories, chip-industry, etc.)

- Repowering (electrical grid)

- Renewing (wind turbines and solar panels)

Every single one of those trends is undeniable. And they require steel. A lot of steel.

NUE Q2 2023

Furthermore, there are several Federal stimulus packages that will significantly increase steel demand in the next several years. And these packages are just getting started.

With that in mind, let’s discuss Nucor’s balance sheet.

Nucor’s Steeled-Balance Sheet

I often declare that when it comes to investing in any business, but particularly commodities, you have to start your analysis with the balance sheet. Anything else is a distraction and a waste of time.

A poor balance sheet can kill the best investment ideas. You can look towards Carvana (CVNA) as a vindication of this concept.

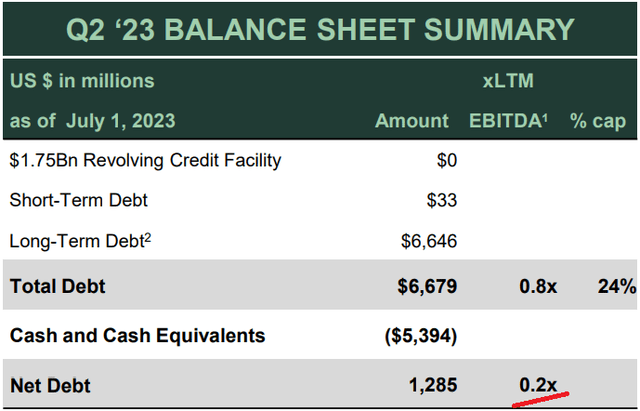

NUE Q2 2023

What you see above is a company that has a rock-solid balance sheet. That’s step one towards any serious investment decision passed with a clean bill of health.

So, yes, the very near-term outlook for Nucor into Q3 points to a step down in earnings power relative to Q2 2023. However, I strongly recommend that investors look beyond the next 90 days and consider what the next 1 to 2 years look like for Nucor.

We see a US-based company that is well-positioned for a significant increase in steel demand that is coming on the back of Federal stimulus, together with 4 undeniable mega-trends.

What’s more, I suspect that Nucor is priced at around 9x this year’s EPS. And probably slightly cheaper than this looking out to next year, if we assume that Nucor continues to buyback its outstanding shares.

The Bottom Line

I find Nucor Corporation to be a well-managed and attractively valued steel company with strong prospects. Despite paying around 9x this year’s EPS, the true value lies in recognizing steel’s critical role in four mega-trends: rebuilding, reshoring, repowering, and renewing, all of which are driving the future of energy transition towards cleaner sources.

Nucor’s financials suggest that revenue growth rates are set to improve in the coming few quarters, particularly with the company positioned to benefit from federal stimulus packages and undeniable trends requiring significant steel demand.

Notably, Nucor’s solid balance sheet makes it a strong candidate for long-term investment. While near-term earnings might see a dip, I am optimistic about Nucor’s potential over the next 1 to 2 years as it capitalizes on the growing steel demand from various sectors. In sum, I’m definitely bullish on Nucor.