Rick_Jo/iStock via Getty Images

I wrote a bearish Tesla (TSLA) article over a week ago here, and of course the bulls “ripped me a new one” for daring to disagree with their pick, where easy money has been earned since January. While I did not feel a need to detail why high multiples on sales and earnings do not mix well with slowing underlying growth trends, I will now offer the “opposite” suggestion to own a name with sharply rising growth and a still low P/E. The bullish purchase argument is a simple Wall Street concept, working wonders over the years for investors. A company’s price to earnings multiple is divided by business earnings growth rates to create the fabled and uniquely successful PEG Ratio.

Basically, if Tesla is a Sell using its future PEG overvaluation setup (according to Wall Street analyst consensus forecasts, not my own), First Solar (NASDAQ:FSLR) is a screaming Buy today. Let me explain why.

U.S. Solar Panel Production Growth

Patented and proprietary technologies producing thin-film solar panels, built almost entirely in-house, then sold to utility-scale solar farm developers, corporate & government customers, alongside a minor market of homeowners is First Solar’s business model.

The marketing angle to potential panel buyers is more-costly FSLR panels upfront vs. silicon-based panels imported from China offer better efficiency capturing energy and dramatically longer lifespan for owners. After decades of service and a track record for proof, First Solar’s products seem to end up being the lowest total-cost panels on the market, generating the best return-on-investment [ROI] for owners.

Here is an explanation of the benefits of its Cadmium Telluride thin-film technology taken from the company’s website:

Q: WHAT MAKES FIRST SOLAR’S THIN FILM PV MODULES COMPETITIVE?

A: First Solar thin film modules are manufactured using a fully integrated and resource efficient process which enables affordable, high volume production with the lowest environmental impacts in the industry. In addition, First Solar’s high efficiency thin film modules are proven to deliver more usable energy per watt than conventional silicon-based modules, resulting in a lower levelized cost of electricity ($/MWh).

Q: WHAT ARE THE ENVIRONMENTAL BENEFITS OF THIN FILM PV TECHNOLOGY?

A: First Solar’s advanced thin film PV solutions are the industry’s leading eco-efficient technology due to their superior energy yield, competitive cost and smallest life cycle environmental impacts. By using less grid electricity during manufacturing, First Solar modules have the smallest carbon footprint, fastest energy payback time and lowest life cycle water use and air pollutant emissions of any PV technology.

Q: HOW DOES CDTE DIFFER FROM CADMIUM?

A: First Solar modules contain cadmium telluride (CdTe) which is a stable compound that is insoluble in water and has an extremely high chemical and thermal stability. These properties limit its bioavailability and potential for exposure. First Solar modules contain very little CdTe. The semiconductor layer in First Solar modules is a few microns thick, equivalent to 3% the thickness of a human hair. Additionally, the thin film semiconductor is encapsulated between two sheets of glass and sealed with an industrial laminate, further limiting the potential for release into the environment in the event of fire or breakage.

Q: ARE THIN FILM MODULES DURABLE IN THE FIELD?

A: Yes. First Solar modules are tested for safety during breakage, fire, flooding and hail storms, and meet rigorous long-term durability and reliability testing standards. Module breakage is rare and occurs in ~1% of modules over 25 years (0.04% per year), with more than one-third of breakages occurring during shipping and installation. During operation, breakages typically consist of impact fractures whereby the module remains bound together by the industrial laminate.

Q: IS THIN FILM PV TECHNOLOGY SAFE FOR THE ENVIRONMENT?

A: Yes. More than 50 researchers from leading international institutions have confirmed the environmental benefits and safety of First Solar’s thin film PV technology over its entire life cycle; during normal operation, exceptional accidents such as fire or module breakage, and through end-of-life recycling and disposal. First Solar provides the PV technology of choice for leading utilities and power buyers such as Southern Power Co., NRG Energy, and Capital Dynamics. With more than 25,000MW sold worldwide, First Solar modules have a proven record of safe and reliable performance.

Q: CAN FIRST SOLAR MODULES BE RECYCLED AT END-OF-LIFE?

A: Yes. First Solar offers global, competitively-priced and flexible PV module recycling services. First Solar has a long-standing leadership position in PV recycling with over a decade of experience in operating high-value PV recycling facilities on a global and industrial scale. First Solar’s high-value recycling process recovers more than 90% of a PV module for reuse in new modules and glass products.

Specifically, regarding the outsized growth outlook, First Solar is a clear winner from the Inflation Reduction Act‘s approval in Washington DC last summer in my opinion, including the tax/credit rules that have been set and updated since July 2022. Other laws have also been passed under the Biden Administration that should push First Solar into a stronger operating profit outcome. These include the Bipartisan Infrastructure Law and the CHIPS and Science Act. All told, First Solar’s U.S. production will receive the biggest boost in government incentives for buyers and tax write-offs for the company vs. competitors.

For an in-depth discussion of the real-world accounting benefits coming to the company’s bottom line from government tax changes, you can read an excellent piece by Seeking Alpha analyst Beth Kindig in late June here.

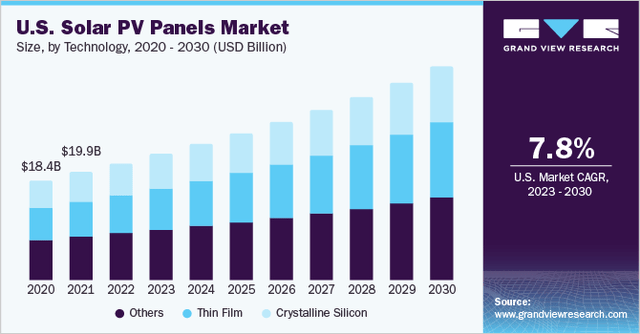

Below you can view the current industry panel demand growth forecast of nearly +8% annually into the year 2030 for the U.S. (with a similar rate of sales growth projected elsewhere on the planet.) And, First Solar inventions are expected to grab dramatically higher market share over time.

Grand View Research – U.S. Solar Panel Growth Projections 2023-2030

On top of these growth drivers, FSLR is the largest of the major competitors globally not manufacturing exclusively in China. For example, First Solar is one of the biggest panel sellers in India with production plants in this important nation going green (turning to renewables) to fight climate change, with nearly 1 billion for a population. I mentioned the advantages of India growth for the company in my previous bullish article on First Solar in December 2021 here.

The net result of all these positive variables should be an extremely rare jump in corporate profits annually over the next five years as orders, production, and sales are massaged higher. Tax incentives in many parts of the globe, climate change, and First Solar’s leading technology/economic proposition are laying the groundwork for rapid expansion.

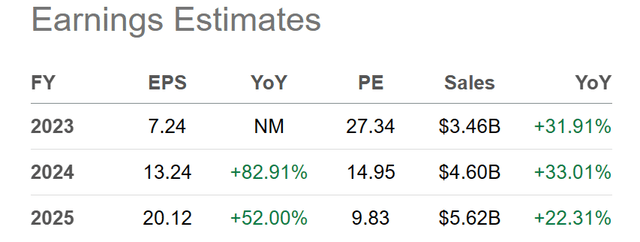

Wall Street analysts who keep track of all the developments and latest sales trends are projecting EPS above $20 and total company revenues annually to roughly between 2021 and 2025.

Seeking Alpha Table – First Solar, Analyst Estimates for 2023-25, Made July 23rd, 2023

PEG Valuation Stats

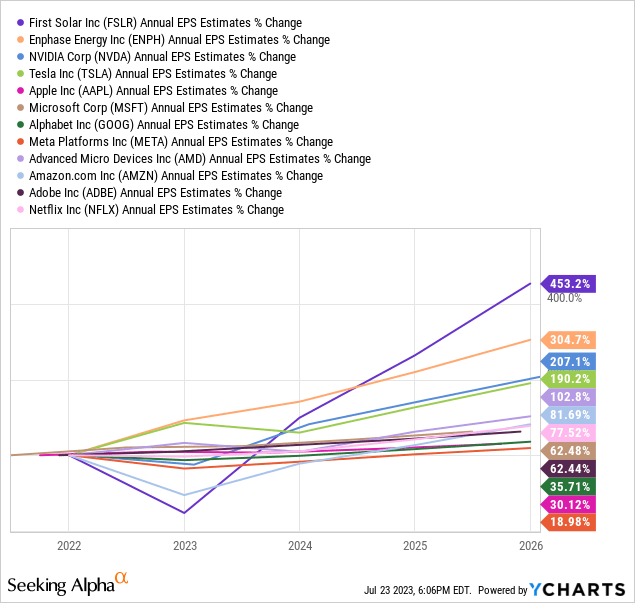

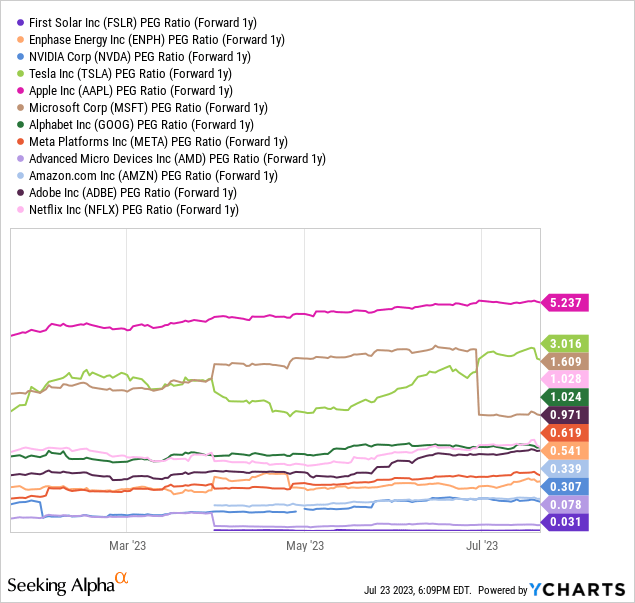

Let’s review the expected EPS growth rate for First Solar into the end of 2025, and compare it to the other top growth-stock picks in America. Trust me, the bullish investment thesis really stands out when we take an unemotional look at the facts and estimates. Believe it or not (whether created by government incentives or not), First Solar shareholders are projected to experience the biggest expansion in profits (+453% over four years) vs. Enphase Energy (ENPH), NVIDIA (NVDA), Tesla (TSLA), Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG) (GOOGL), Meta Platforms (META), Advanced Micro Devices (AMD), Amazon (AMZN), Adobe (ADBE), and Netflix (NFLX). In addition, this “leading” long-term growth outlook position doesn’t change if you measure from either the end of 2021 or 2022.

YCharts – Major U.S. Technology Growth Stocks, Analyst EPS Estimates for 2023-25, Made July 23rd, 2023

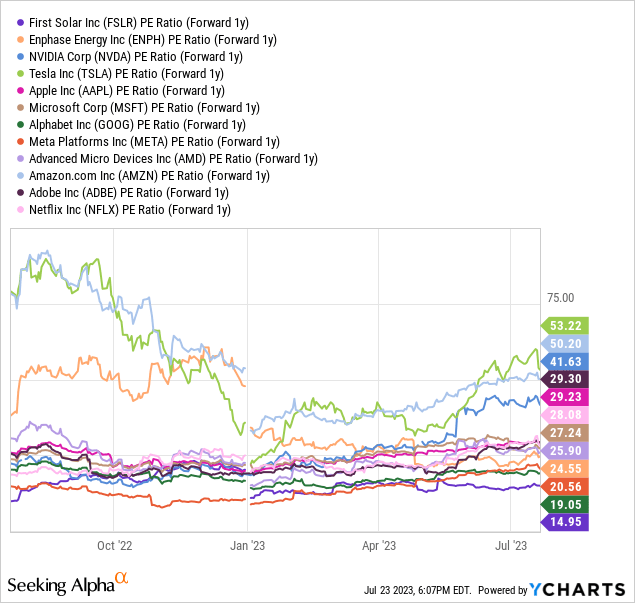

So, you would guess First Solar’s equity valuation on immediate future earnings would be sky-high, just like NVIDIA or Tesla. WRONG! Out of this peer sort group, First Solar is the LEAST EXPENSIVE to purchase today. Below is a graph of forward 1-year P/E ratios, with fluctuations in the multiple over the last 12 months drawn, based on stock price swings and changing analyst estimates. A forward P/E of 15x for First Solar is nothing like the valuation of 53x for Tesla, 50x for Amazon, or 42x for NVIDIA.

YCharts – Major U.S. Technology Growth Stocks, Price to Forward Estimated Earnings, 1 Year

When we combine the growth rate outlook and today’s low valuation on projections, PEG Ratio analysis highlights First Solar as the cheapest to own by a huge distance, with a number barely a fraction of the 1.0x traditionally considered buy territory. Using this valuation/growth concept, Apple and Tesla seem the “easy” sells, not buys like many analysts argue. You have to put growth and valuation into proper context. Yes, my April article on Apple was a bearish call, and my view has not changed.

YCharts – Major U.S. Technology Growth Stocks, Forward 1-Year Estimated PEG Ratios, 6-Month Changes

Technical Trading Momentum

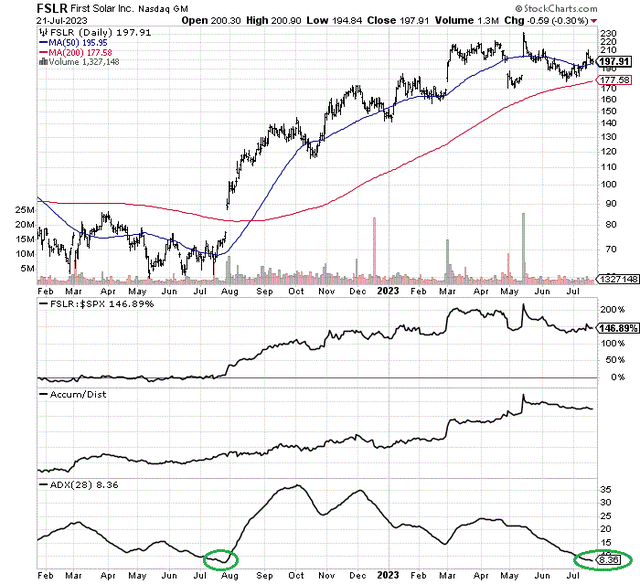

The FSLR trading chart pattern has been quite strong since the Inflation Reduction Act passed last summer. Shares have outperformed the S&P 500 index by almost +150% over the latest 12-month (and 18-month) period.

The robust Accumulation/Distribution Line trend of buying is drawn below. Maybe the loudest technical reason to buy shares now is found in the 28-day Average Directional Index reading. Low ADX scores under 10 signal something of a balance between buyers and sellers. Often, price bottoms form when the ADX score is slack and unmoving for weeks. If and when buying pressure resumes, low ADX numbers can highlight a lack of overhead supply. Then, price escalates to find sellers for transactions. The last time this 6-week ADX calculation reached a similar level was during July 2022 (circled in green), just before price took off to the upside.

StockCharts.com – First Solar, 18 Months of Daily Price & Volume Changes, Author Reference Points

Final Thoughts

First Solar has an estimated 5.5% market share of total solar panel sales worldwide for early 2023, in a very competitive landscape. So, there is plenty of room to grow at rates far beyond an already hot industry pace of expansion.

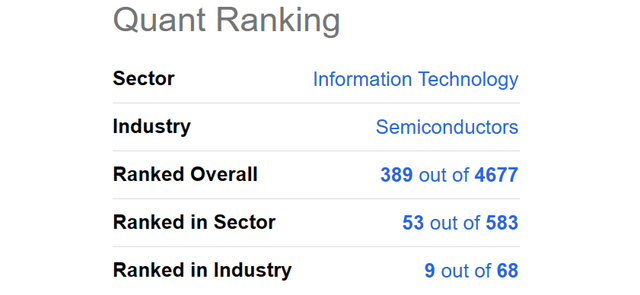

Seeking Alpha’s computer-derived Quant Ranking is high and rising. With a top 10% score vs. the Information Technology sector and Top 8% number vs. the whole universe of equities followed today, even better rankings should appear by the beginning of 2024 on much improved sales and income results.

Seeking Alpha – First Solar Quant Rank, July 23rd, 2023

What are the risks to First Solar’s high-growth future? I think a recession with a banking/lending crisis are important roadblocks that may crop up into 2024. Solar projects are usually financed, and demand for renewables would likely wane in a deep recession scenario. Decision makers might put off pulling the trigger and signing contracts if lending rates/availability are not friendly enough to make the electricity math worthwhile.

No doubt a credit crunch or new inflationary problems into 2024-25 would also be a significant headwind for the other high-growth names in this article. For my money, I am not deterred by potential recessionary macro risks in the solar panel marketplace. Oversized government credits and tax breaks are now reality, whether you agree with them or not.

Perhaps the biggest worry (long-term risk) is politicians attempt to rewrite tax and credit incentives for green-energy buildout. If this is our future, First Solar’s now-predicted growth rates could fail to materialize. However, if the world continues to catch on fire like the summer of 2023, with record average air and ocean temperatures worldwide over recent weeks, calls for new and expanded government incentive programs to move away from fossil fuels may appear in all nations.

I rate First Solar a Buy and own a sizable position in my portfolio. I have a 12-month price target of $300 (+50% price advance), which would only push the likely P/E to 20x on 2024 income forecasts. If you put a 30x multiple on better-than-expected EPS growth into early 2025, targeting a FSLR price of $500 (+150%) in 18-24 months is not a far-fetched goal. If past Wall Street trading rules/math still apply, buying a well-above average growth idea at an absurdly low valuation (low PEG Ratio) should deliver outsized investment gains.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.