deepblue4you/iStock via Getty Images

Introduction

Since 2020, we have discussed a lot of energy-related topics. The most important one is the bull case for upstream oil companies. Over the past three years, I have boosted my energy exposure to more than 17% of my total portfolio value, and I do not expect to be a seller of these assets anytime soon.

I am convinced that energy assets are key in achieving satisfying long-term results, as I believe that the times of subdued energy prices we witnessed prior to the pandemic are over.

- US shale output growth, the growth engine of oil supply, has peaked.

- Inflation is likely to remain sticky.

- We could see a rotation from (overvalued) growth/tech stocks back to (undervalued) value stocks, which include energy.

- A lot of upstream companies are in a terrific spot to distribute loads of cash to their shareholders.

One of these stocks is Diamondback Energy (NASDAQ:FANG). While I do not own it, I believe it is one of the best oil plays in the world. The company is highly efficient, has deep reserves, is dedicated to letting shareholders benefit from its success, and could be a takeover target, given its attractive valuation.

In this article, I’ll guide you through my thoughts as we assess this Midland-based driller.

My Thesis Is Developing As Planned

My oil bull case is based on two things.

- Subdued supply growth, as the US shale industry is not the world’s supply growth engine anymore.

- Demand may be slowing, but we’re far from peak oil demand.

I discussed both of these issues in depth in a recent article (among many others). So, don’t worry. I’m not going to start this article with another 1-2K words lecture on my thesis.

What I will do, however, is update my thesis.

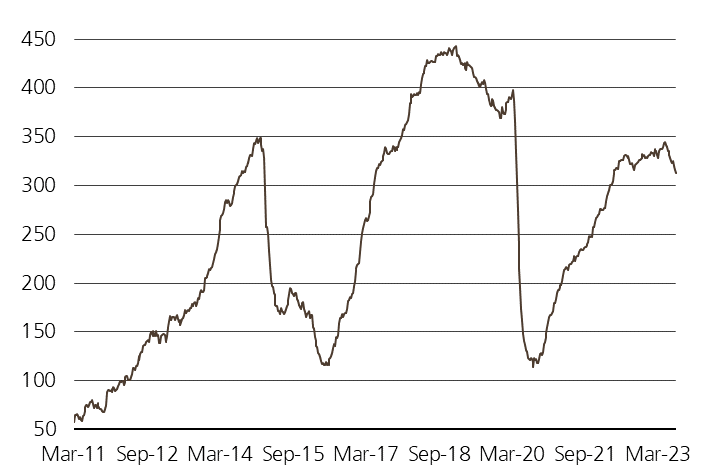

Using Wall Street Journal data, we’re seeing that drillers in the US are reacting to the changing environment by dropping rigs – faster than expected.

Wall Street Journal

According to the paper, the shale patch is experiencing a rapid decline in rig numbers, reminiscent of the COVID-19 pandemic peak, even as oil prices remain favorable, which is what makes this situation so interesting.

This drop in rigs can be attributed to a divergence between private and public drilling companies.

- Private companies, eager to capitalize on the post-pandemic recovery, rapidly added rigs but have now depleted many of their best wells, leading to a deceleration in drilling activity. This is part of my thesis focused on declining inventory quality.

- On the other hand, larger public companies, sitting on substantial inventories of premium untapped wells, have not significantly adjusted their drilling programs, as they prioritize investor demands for capital restraint.

This is absolutely horrible for the supply situation.

According to analysts, the number of rigs drilling for oil and gas has decreased from around 800 to about 670 since the beginning of the year, with private drillers accounting for about 70% of this reduction.

This is what the rig count in the Permian Basin looks like:

Twitter (@staunovo)

Needless to say, the slowdown is expected to result in sluggish crude production growth for the rest of the year.

As a result, despite a severe decline in global growth expectations, oil prices are elevated. WTI crude oil is currently trading at $77 and looking to break out after going sideways since the end of 2022.

TradingView (NYMEX WTI)

On a side note, this development is also why I expect inflation to remain sticky, forcing a rotation from growth stocks back to value stocks.

Diamondback Has It All

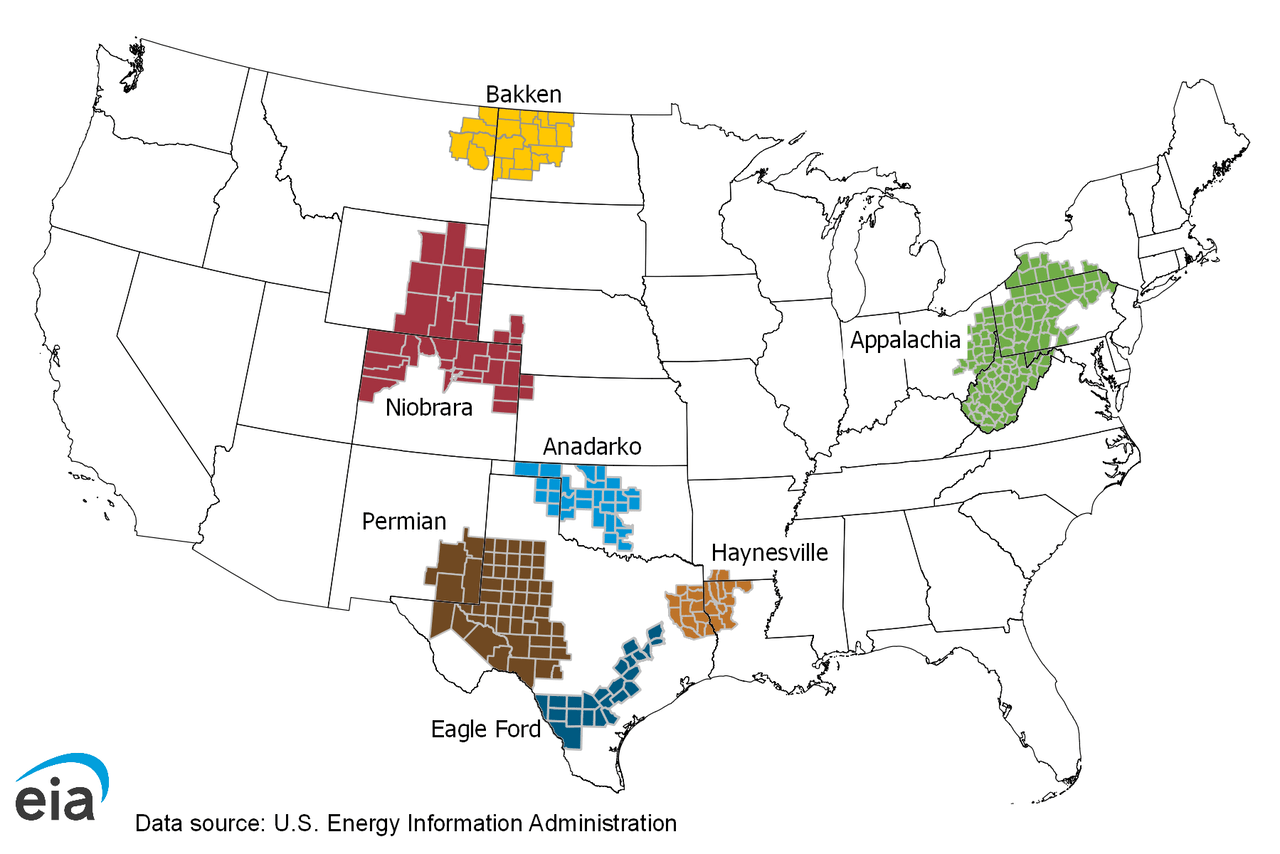

With a market cap of $26 billion, FANG is one of the biggest independent oil and natural gas companies primarily focused on the acquisition, development, exploration, and exploitation of unconventional, onshore oil and natural gas reserves in the Permian Basin.

Energy Information Administration

As I have discussed in a number of articles, the Permian Basin is one of the major producing basins in the United States, offering favorable operating conditions, mature infrastructure, long reserve life, multiple producing horizons, enhanced recovery potential, and related benefits.

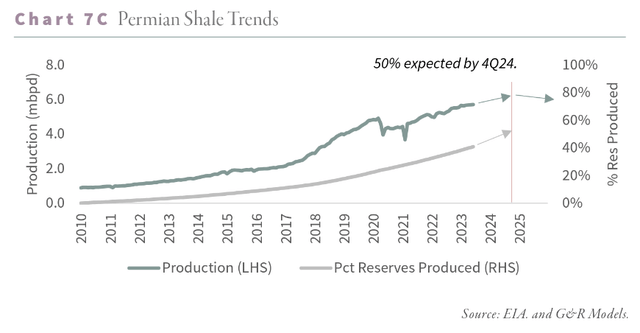

Right now, it’s also the only major basin able to grow – although production is expected to peak in 4Q24, which adds tremendous fuel to my bullish oil thesis.

Goehring & Rozencwajg

Hence, it is key that we only buy producers with plenty of reserves, as this keeps them from being pushed into a position where they have to engage in (sometimes) risky M&A deals to maintain steady production levels.

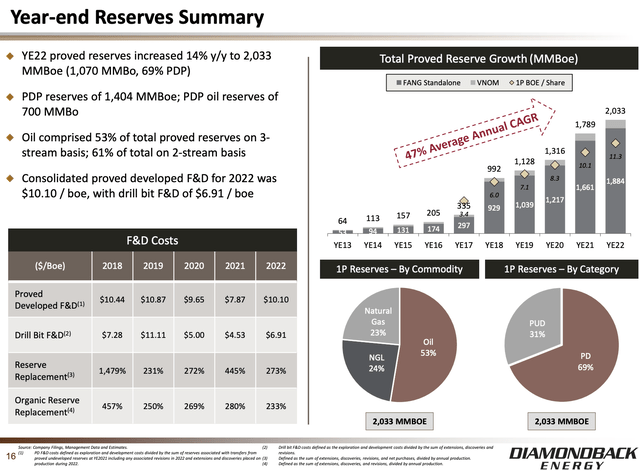

As of December 31, 2022, FANG’s estimated oil and natural gas reserves were 2,032,971 MBOE (thousand barrels of oil equivalent). This number includes estimated reserves of 148,900 MBOE attributable to the mineral interests owned by Viper Energy (VNOM), a stock-listed owner of land leased to upstream producers like Diamondback.

Diamondback Energy

Furthermore, these reserves consist of roughly 53% oil, 23% natural gas, and 24% natural gas liquids.

Based on average production of 425 MBOE per day in 1Q23, this gives the company at least 13 years’ worth of high-quality drilling reserves – assuming it finds zero new reserves, which isn’t going to happen.

These numbers are highly satisfying, and they even exclude recent M&A activity.

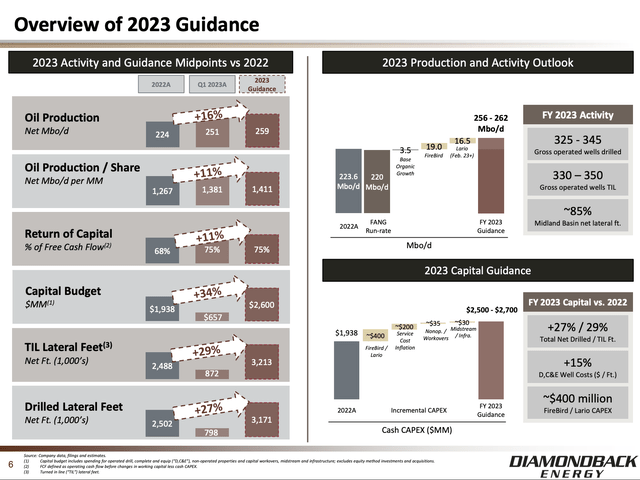

That said, the company is confident in its business, which means it is one of the few companies boosting output.

During the first quarter call, the company made clear that it anticipates continued production growth in the second quarter, driven by a full quarter of contribution from the Lario acquisition and expected organic growth.

The trend of increasing production is expected to persist throughout 2023 as the company develops large pads with high net revenue interest in core areas of the Northern Midland Basin.

Furthermore, Diamondback has provided guidance for second-quarter production of 258-261 thousand barrels of oil per day (430-436 thousand barrels of oil equivalent per day), and they remain confident in their full-year production projection of 256-262 thousand barrels of oil per day (430-440 thousand barrels of oil equivalent per day).

Diamondback Energy

Also, in light of inflation, the company believes that well costs have peaked over the last two quarters and foresees meaningful decreases in the coming quarters. The company expects to achieve cost reductions through decreased raw material and service costs and more efficient production methods.

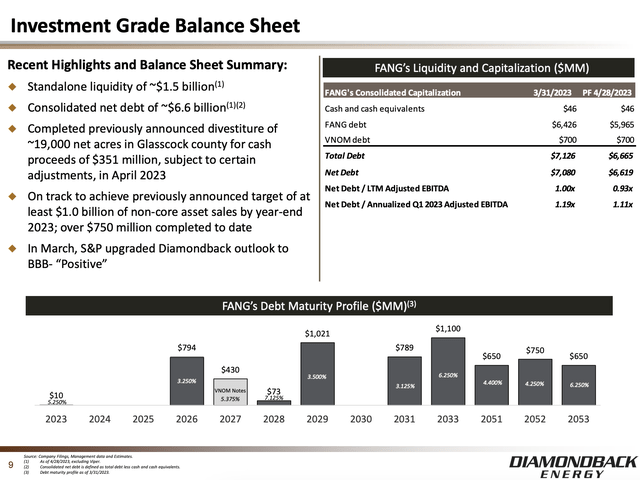

The company also has a very healthy balance sheet.

In the first quarter, Diamondback’s total debt increased to just over $7.1 billion, and net debt increased to just over $7 billion, resulting in a net debt ratio of 1.0x.

This increase in debt is primarily attributed to the cash portion of the Lario acquisition, which was completed during the first quarter.

Despite this M&A deal, the net leverage ratio remains extremely subdued.

It also needs to be said that the company has no major debt maturities until 2026. It recently got a credit upgrade to BBB- positive. I expect the company to be boosted to BBB within 12 months.

Diamondback Energy

When combining deep reserves with (increasingly) efficient production and healthy debt levels, we get fertile ground for shareholder distributions.

Diamondback Shareholder Rewards

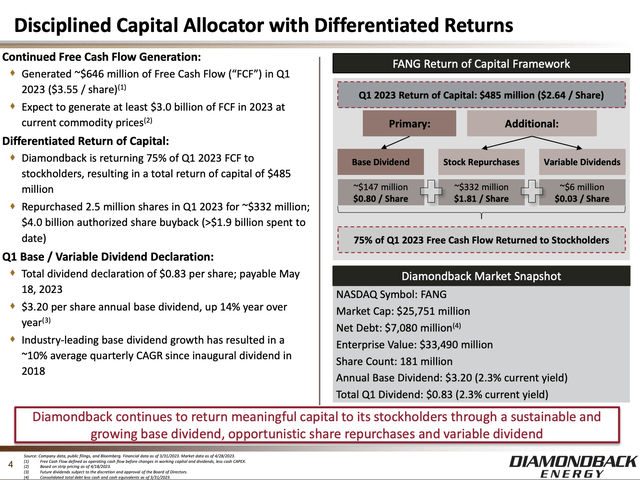

Diamondback has a very shareholder-friendly distribution plan. It aims to return 75% of free cash flow to shareholders, consisting of a base dividend, a variable dividend, and stock repurchases.

For example, in the first quarter, the company returned close to $500 million. Roughly $150 million of this was spent on its base dividend. The variable dividend accounted for just $6 million. $332 million went towards buybacks.

Diamondback Energy

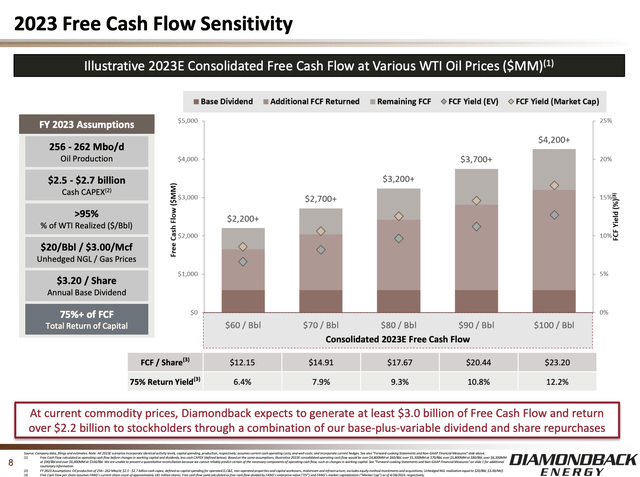

Based on current prices and the 75% payout policy, investors can enjoy a return yield of more than 10% at WTI crude prices above $90. Above $100, that number is 12%.

Even at $70 WTI, the expected return yield is close to 8%, which is truly impressive.

Diamondback Energy

Dependent on the breakdown of buybacks and special dividends, I believe that FANG offers a compelling mix of buybacks to boost its capital gains and dividends to satisfy income investors.

These qualities also increase the chances of M&A.

Why FANG May Be A Takeover Target

Discussing potential M&A deals is almost always pointless, as it is close to impossible to predict M&A deals without having insider knowledge.

Hence, M&A always plays a minor role in my research – if any at all.

However, in the case of oil and gas, M&A is increasingly important as companies are slowly running out of high-quality reserves.

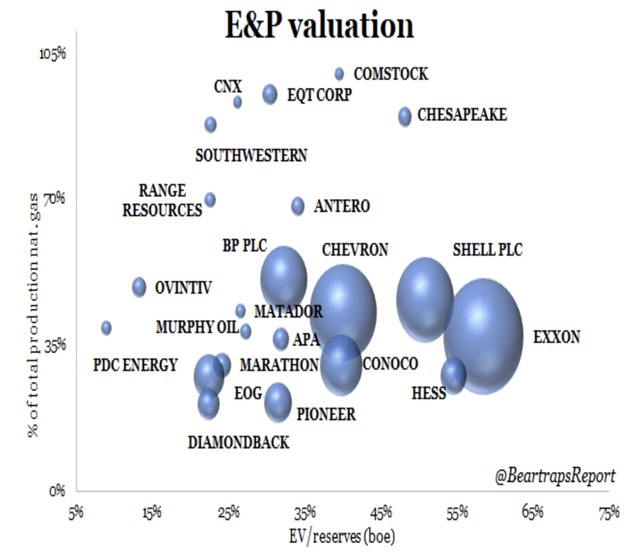

The Bear Traps Report looked into two key issues that play a role in M&A decisions.

- Oil production, as a percentage of total production. After all, oil reserves are more at risk than natural gas reserves.

- The valuation. Overpaying for M&A deals is an easy way to destroy shareholder value.

Looking at the chart below, we see that Diamondback is highly attractive. Not only does the company have a major oil footprint, but it is also very attractively priced when comparing its enterprise value (market cap and net debt) to its reserves. Only a small number of stocks are trading at more attractive prices.

Bear Traps Report

Again, I’m not making the case that FANG will be acquired, but I would not be surprised if a major operator were to make a bid. This could be Exxon Mobil (XOM) or a similar operator, as FANG’s size makes it unlikely that smaller producers would make a move to buy this driller.

Besides that, it also shows that FANG is attractively valued.

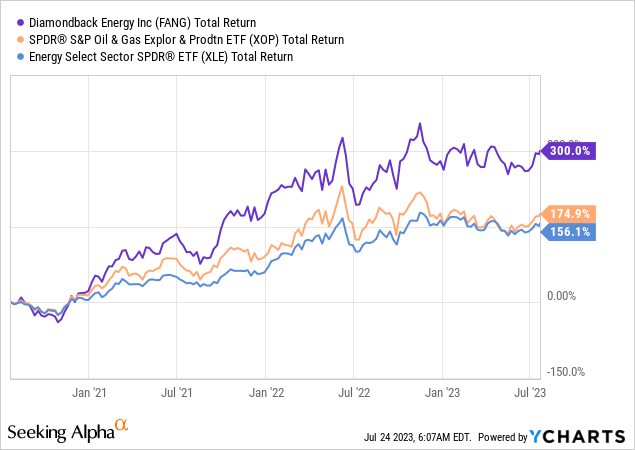

Having said all of this, when adding the company’s deep reserves, efficient operations, attractive shareholder distributions, and valuation, I have little doubt that FANG will continue to outperform its peers in the drilling and energy sectors and deliver satisfying long-term returns.

However, as bullish as I am on energy stocks, I need to add that these stocks are highly cyclical and volatile, especially compared to some of the more defensive dividend stocks you may own. Please keep that in mind when making investment decisions.

Takeaway

My energy-focused investment thesis is strongly centered around the bull case for upstream oil companies. Having boosted my energy exposure to over 17% of my portfolio, I am convinced that energy assets hold the key to achieving satisfying long-term results. With US shale output growth peaking and inflation remaining sticky, there’s potential for a rotation from overvalued growth stocks back to undervalued value stocks, including energy.

I believe Diamondback Energy stands out as one of the best oil plays on the market. With its highly efficient operations, vast reserves, dedication to rewarding shareholders, and attractive valuation, FANG has all the right ingredients for success.

The company’s commitment to returning 75% of free cash flow to shareholders through dividends and buybacks offers an impressive return yield, even in the current market conditions.

While I believe FANG will continue to outperform its peers and deliver satisfying long-term returns, it’s important to remember that energy stocks can be highly cyclical and volatile.

As always, exercise caution and consider the unique nature of these investments when making decisions.