ArtistGNDphotography

Clearway Energy Inc. (NYSE:CWEN, NYSE:CWEN.A) is a renewable energy YieldCo that owns an 8-gigawatt, operational portfolio of wind, solar, storage, and a few natural gas power production facilities across the United States. Its contracts feature a weighted average lifespan of 10 years, and its customers are mostly investment grade-rated utilities, corporations, universities, and governments.

Since I last wrote about CWEN in mid-November 2022, the stock has shed over 20% of its value as the company has faced headwinds from higher interest rates and unexpectedly weak wind power generation.

But the “3 Reasons Why Clearway Energy Is One of My Top Holdings” all remain true today:

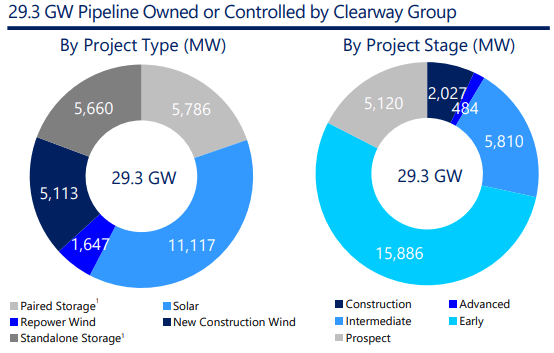

- CWEN still enjoys a long growth runway from the growth in renewable power production, both because of the “Inflation Reduction Act” and because of the increasing cost competitiveness of renewables (even aside from government help). What’s more, after selling its thermal energy assets last year, CWEN retains so much dry powder that it will not need to issue equity to fund any of its growth objectives through 2026. The total development pipeline of 29 GW is over 3.6x the size of CWEN’s currently operational portfolio.

- CWEN still boasts strong sponsorship in the form of the equal ownership of its parent company and sponsor, Clearway Energy Group, between Global Infrastructure Partners with 50% and TotalEnergies (TTE) with 50%. Plus, CWEN has no incentive distribution rights (“IDRs”).

- CWEN remains on track to increase its dividend at the upper end of its 5-8% annual target range through 2026, indicating 7-8% dividend growth for the next 3.5 years.

The primary headwind weighing on the company right now is high interest rates, which (all else being equal) decrease the profitability of each new investment by shrinking the spread between cost of debt and cash flow yields on investment. Higher rates especially bite when your credit rating is the sub-investment grade level of BB/Ba2, as CWEN’s is.

The good news is that the only debt CWEN needs to issue for its near-term investments is non-recourse, project-level loans secured by their corresponding assets. This is self-amortizing debt, which means that CWEN pays down the principal over time such that a much smaller balloon payment is due at the maturity date.

Between its ~5.9% dividend yield, defensive characteristics, and clear visibility into 7-8% dividend growth through 2026, CWEN.A looks like a particularly attractive dividend growth investment, primed to produce double-digit total returns and robust future income generation. I’m buying the stock hand over fist.

Recent Update (A Reminder That Renewable Energy Is Unpredictable)

While the idea of harnessing the power of the wind and the sun are cool, it’s useful to remember that these sources of energy are intermittent, volatile, and thus hard to predict with any degree of certainty.

CWEN recently reported that Q2 wind production was ~25% lower than estimated, representing its “lowest-ever quarterly production reading.” One of the primary contributors to this weak output is CWEN’s Alta Wind Complex assets in the Mojave Desert of California, reporting 20% lower production.

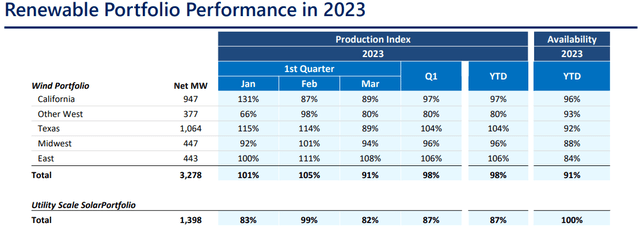

The variability of wind power output is striking. For example, CWEN’s California wind assets (including Alta) outperformed internal expectations with 131% output in January of this year, but performance dipped to 87% of expectations the following month.

CWEN May Presentation

Apparently, in Q2, California’s wind generation came in at around 80% of expectations.

The good news is that management still foresee growing the dividend at the upper end of their 5-8% annual target range through 2026 while maintaining a payout ratio in the 80-85% range.

More good news is that while rather variable and unpredictable wind assets make up 47% of CWEN’s current power production, it makes up only 23% of the parent/sponsor’s development pipeline. The remaining 77% of the development pipeline (much if not most of which will eventually end up in CWEN’s portfolio of operating assets) is solar and battery storage facilities.

CWEN May Presentation

Solar, of course, has its own variability and intermittency, but as the portfolio is balanced out by solar, the weakness and seasonality of one should be balanced out by the other. Notice in the above illustration that while CWEN’s wind portfolio generated 91% of expected power in Q1 2023, the solar assets generated 100% of available energy output.

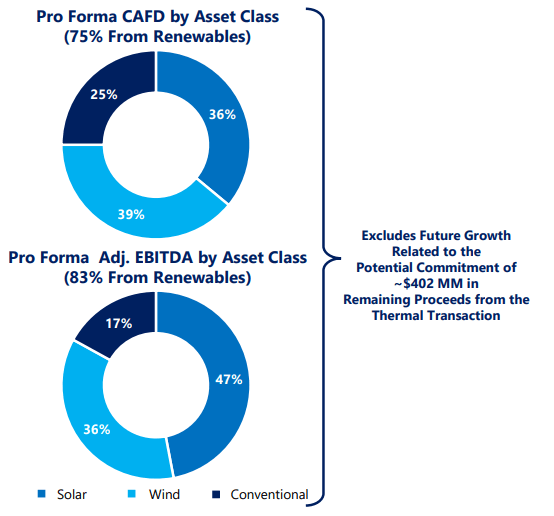

Here is how the power production fleet should look after all current committed capital is deployed into operating assets:

CWEN May Presentation

And when the remaining ~$400 million in proceeds from the thermal energy assets are deployed, solar will likely make up over half of EBITDA and 40% or more of cash available for distribution (“CAFD”).

Plus, as more paired storage facilities come online, these should allow CWEN’s power production assets to overproduce when conditions are good and store the excess power in batteries for later dispatchability.

Attractive Valuation

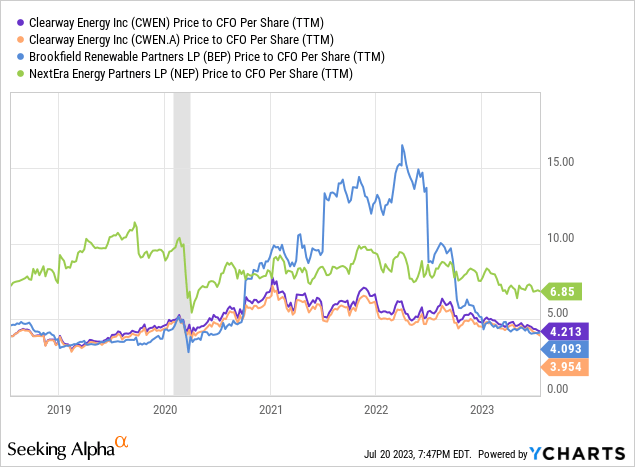

Renewable energy YieldCos are basically cash flow machines, so it makes sense to measure their valuations using cash flow metrics. The easiest one to choose using YCharts data is price to operating cash flow, or “cash flow from operations” (“CFO”).

As you can see, NextEra Energy Partners (NEP) is consistently the highest valued peer in the group, except for a roughly two-year period during the pandemic when Brookfield Renewable Partners (BEP) captured the top spot in a fit of euphoric valuation.

Historically, BEP has traded at roughly equivalent cash flow multiples as CWEN/CWEN.A, and since the beginning of 2023, it has resumed that historical pattern.

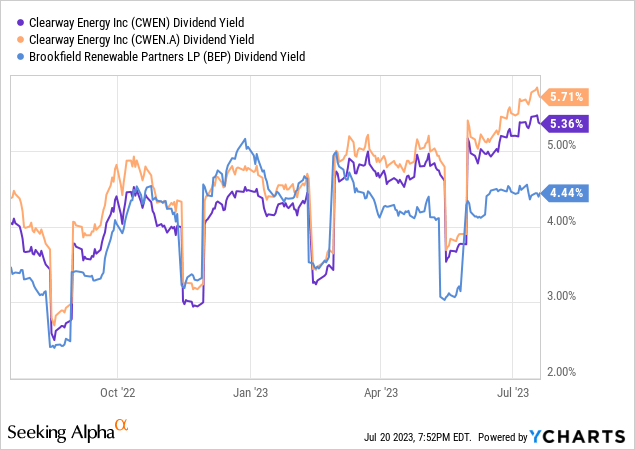

We can also look at dividend yields as a proxy for valuation, because each of these three peers has a payout ratio in the 80-85% range. YCharts misrepresents NEP’s TTM dividend yield, so we’ll just look at CWEN, CWEN.A, and BEP:

Here are the forward dividend yields of each:

- CWEN: 5.5%

- CWEN.A: 5.9%

- BEP: 4.6%

- NEP: 5.7%

As you can see, CWEN.A’s yield is the highest (and, as a proxy, its valuation the lowest), although if you averaged CWEN and CWEN.A’s yields, they’d equal about the same as NEP’s.

As such, if you’re looking to gain exposure to dividend-paying renewable energy stocks, BEP may be a reasonable buy for its size, diversification, and track record, but CWEN.A and NEP look like the most undervalued relative to their future growth prospects.

Defensive Balance Sheet Strategy

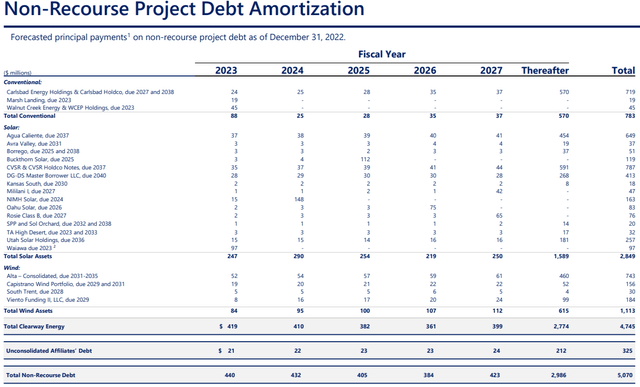

The vast majority of CWEN’s debt is in the form of non-recourse, self-amortizing, project-level loans. It needs to be emphasized how much more defensive this makes the company’s balance sheet.

CWEN May Presentation

As you can see, CWEN pays down an average of $417 million in principal each year for these non-recourse loans (including a few final balloon payments). If you don’t include balloon payments, CWEN still has over $350 million of principal paydown each year. As long as the projects themselves keep paying adequately, which they are highly likely to do, CWEN’s debt will continue to be automatically paid down over time.

Somewhat bad news is the fact that only some of this project-level debt features fixed interest rates. Most of it has variable rates at some spread above the LIBOR or SOFR. At the same time, however, the company enters into interest rate swaps for most of these variable-rate loans to hedge rate risk.

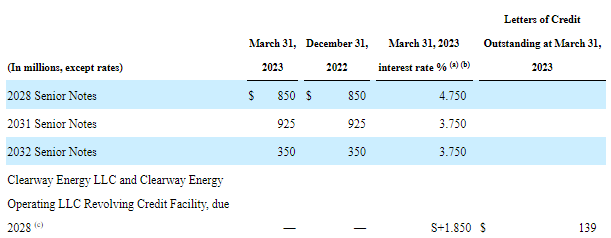

The remaining debt obligations are three senior notes maturing in 2028, 2031, and 2032, respectively, as well as a $700 million credit revolver (with nothing drawn on it as of the end of Q1 2023) maturing in 2028.

CWEN Q1 2023 10-Q

And, as you can see, the interest rates at which CWEN has these corporate-level senior notes fixed are very attractive, especially compared to the 6.5% to 7% yield at which BB/Ba2 corporate bonds trade today.

Bottom Line

Selling their thermal energy assets when CWEN did, at a very favorable price, has turned out to be a brilliant move, in my estimation. It has given the company ample dry powder with which to pursue 9-10%-yielding renewable energy investments, which should prove highly accretive to CAFD per share. It allows CWEN to pursue an ambitious growth plan without needing to issue either equity or corporate-level debt during a time when interest rates are high.

And though obtaining variable-rate, non-recourse loans for each new project doesn’t look great right now, I would expect interest rates to be lower a year or two from now. As such, the realized interest expense on these loans should be lower in the future. In the meantime, the principal on these loans will be repaid with relatively aggressive amortization schedules, diminishing interest expenses over time.

CWEN is a shareholder-friendly company with a very attractive dividend policy. CWEN.A pays a 5.9% yield and promises 7-8% growth over the next 3.5 years, and I would expect at least 6% dividend growth thereafter.

I am buying more shares every chance I get.