redtea

As of this writing, the second largest holding in my portfolio is pipeline/midstream company Energy Transfer (NYSE:ET). For those curious, it accounts for 15.4% of my hyper concentrated portfolio. You can imagine, then, both my excitement and anxiety as the company nears the release of earnings covering the second quarter of its 2023 fiscal year. This news will be released on August 2nd, after the market closes. So far, I have done reasonably well with my holding. I have owned shares since March of last year and, excluding distributions, generated a return of about 16%. I do believe that further upside is on the table. But as with any company that someone owns or is very interested in, it’s important to keep an eye out on changes. And almost certainly, any real change that would come about would be announced during an earnings release. Heading into that time, there are a few different things that I believe investors should keep a very close eye on. Absent anything significantly negative coming out of the woodwork, I would say that the stock is likely to appreciate from here.

A look at key metrics

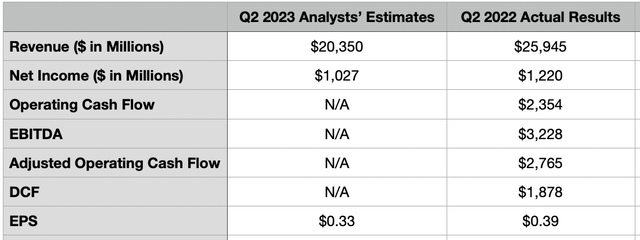

The first thing that the investment community will be focused on when management announces earnings on August 2nd will be certain key financial metrics. For instance, revenue is likely to be emphasized to some extent. Though I would argue that, because of the nature of the business, revenue is less significant than with many other firms across many other industries. The current expectation is for the company to report sales of $20.35 billion. That would actually be down from the $25.95 billion the business reported the same time last year.

Author – SEC EDGAR Data

On the bottom line, the expectation is for the company to report earnings per share of $0.33. That compares to the $0.39 per share the company reported in the second quarter of 2022. If analysts are correct about earnings, then the company will end up reporting net profits of $1.03 billion. That would be a decline compared to the $1.22 billion in profits generated the same time last year. A combination of volume associated with what the company pumps through its network (both assets it already owned and new assets coming on as a result of acquisitions and organic capital spending) and the spread that it can capture between the revenue it generates and the cost of those revenues. Even though the latter component sounds elementary, there are actually many working parts at play.

Just picking on one part of the company, for instance, we can get some insight here. The part that I chose to pick on is the Midstream segment. During the first quarter of this year, gathered volumes came in 13.9% above what they were the same time last year. And the volume of NGLs produced were about 7.1% higher year over year. Even so, segment margin declined from $1.04 billion to $973 million, while segment adjusted EBITDA shrank from $807 million to $641 million. The biggest contributor to the pain the company experienced on this front involved the non-fee-based margin of the segment. This hit the company to the tune of $138 million because of unfavorable natural gas prices of $70 million and unfavorable NGL prices of $68 million. Frankly, an article could be dedicated solely to these types of fluctuations. But you get the idea.

Other profitability metrics should also be focused on by investors. There aren’t any estimates provided by analysts regarding these right now. But I would argue that they are even more important than net income is. For starters, we have operating cash flow. During the second quarter of 2022, this metric was $2.35 billion. If we adjust for changes in working capital, it was $2.77 billion. DCF, or distributable cash flow, is another. It totaled $1.88 billion in the second quarter of 2022. Meanwhile, EBITDA for the company came in at $3.23 billion. If revenue and earnings are likely to decline, these will probably also shrink to some degree.

Digging deeper

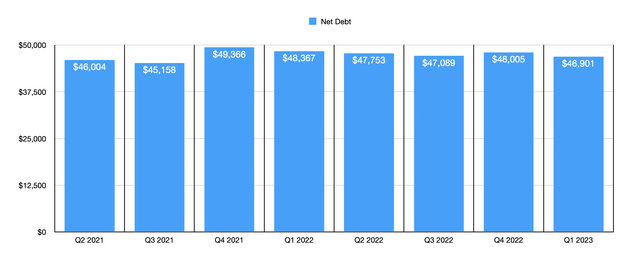

Outside of the headline items, there will be other metrics that investors should be paying attention to. The amount of cash flow that the company generates will go a long way toward determining whether or not the company can reduce its debt. As you can see in the chart below, management has not really prioritized debt reduction over the past several quarters. In fact, overall debt seems to be in a fairly narrow range. But with interest rates rising, it would be nice for management to focus on paying debt down. Perhaps an even better idea than this, though, would be to focus on redeeming some of its preferred stock.

Author – SEC EDGAR Data

Historically speaking, the Series A preferred units that the company has issued, totaling $950 million in all, carried a required distribution of 6.25% per annum. But effective February of this year, it switched from a fixed rate to a floating rate. That rate is based on the three-month LIBOR plus a spread of 4.028%. Given the data that’s available right now, that takes the effective yield up to 9.57%. That change on just that $950 million alone translates to an extra $31.5 million in distributions that the company needs to pay out every year. The good news is that, also as of February of this year, the company can redeem the preferred stock for its liquidation preference. All of the company’s preferred units have either a fixed to floating or fixed rate reset feature to them. And all of them leave open the opportunity to be redeemed. Although I don’t expect that the company will do anything significant on this front, I think it would be very bullish if they did.

We also need to be paying attention to other things like its distribution and its capital projects. Leading up to the first quarter earnings release, management increased the distribution on common units from $1.22 per annum to $1.23. This may not sound like much. But every penny adds up. And right now, I have an effective yield on my units of 10.9%. If we see an increase of $0.01 each quarter through the end of this year, it would bring up the effective yield to 11.1%. That adds up over time.

On the project side of things, management is expecting to allocate about $2 billion on growth initiatives this year. It will be interesting to see whether this changes or not. And speaking of projects, one pain point for the company has been its Lake Charles LNG project. This is a rather ambitious project that the company embarked on years ago. However, the firm recently pushed regulators to grant it a three-year extension, effectively pushing out the start date for it to start exporting from 2025 to 2028, because of delays and, in part, because of its desire to include a carbon capture and sequestration component to the facility. Management had warned that the failure to receive an extension on top of the two-year extension that it received back in 2020, could doom the project entirely. And with $350 million already invested in it, and 7.9 million tons of LNG offtake, translating to about 50% of its overall output, already under contract as of the time the extension was struck down, news coming out when management reports financial results in the coming days could be either really positive or really negative.

Another author here on Seeking Alpha provided a really great assessment of the extension and everything around the project that is relevant. I highly recommend that you check out his work here. My own stance on the matter is that the project likely will be completed. After all, in just the past few days, Energy Transfer announced that it had entered into three long term agreements to sell LNG from the project when it does launch. These projects total another 3.6 million tons of offtake each year, with the largest individual agreement accounting for 1.6 million tons and covering a 20-year term. The other two cover 1 million tons each and cover 15 years.

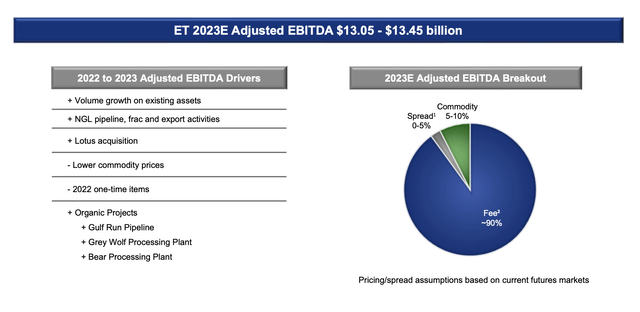

Energy Transfer

The last thing that investors should be paying attention to is perhaps the most important. And this would be expectations that the company has for the current fiscal year. Thanks in large part to the company’s ability to close its acquisition of Lotus Midstream earlier this year, management increased EBITDA guidance for the company to be between $13.05 billion and $13.45 billion. This was up from the prior expected range of between $12.9 billion and $13.3 billion. Given volatile market conditions, combined with some of the other points of uncertainty that I mentioned already, it remains to be seen what the overall outlook should be. I would argue that the company will probably keep its guidance unchanged. But that is something only time will tell.

Shares are dirt cheap

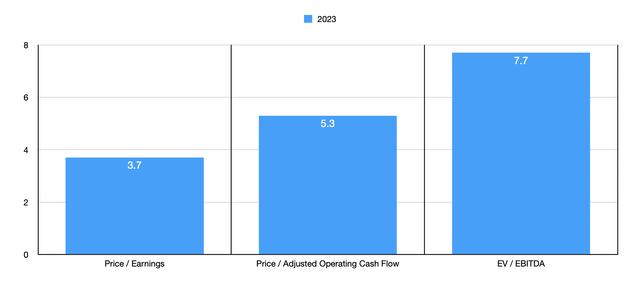

Author – SEC EDGAR Data

There is one final thing that I would like to touch on in this article. And this is my view that shares of the company are some of the cheapest out there. Using the guidance provided by management for EBITDA and extrapolations that I made off of that for both adjusted operating cash flow and DCF, I was able to value the company as shown in the chart above. I also compared the company to five similar firms in the table below. Remarkably, four of the five firms ended up being cheaper than our prospect when it comes to the price to adjusted operating cash flow multiple and the EV to EBITDA multiple. If the company were to trade at a price to operating cash flow multiple that matches the average of what its peers are trading for, it would imply upside for shareholders of 80.5%. Using the EV to EBITDA approach instead would yield a more modest but still impressive 37.7%.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Energy Transfer | 3.7 | 7.7 |

| Kinder Morgan (KMI) | 7.5 | 11.0 |

| The Williams Companies (WMB) | 7.7 | 10.4 |

| Cheniere Energy (LNG) | 3.5 | 4.3 |

| Enterprise Products Partners (EPD) | 7.9 | 9.7 |

| MPLX LP (MPLX) | 6.8 | 8.9 |

Takeaway

Based on the data provided, I believe that this would be an interesting time for shareholders. There are a lot of important points that investors should be paying attention to for when the company does report financial results. My overall opinion of the company is still incredibly favorable and I believe that further upside is highly probable in the not too distant future. Shares of the business are cheap, both on an absolute basis and relative to similar firms. And while I would like the company to start redeeming its preferred units and possibly paying down debt, I’m also happy to collect the rather lofty distributions it’s currently paying out. Even if the stock stays sideways for a time, I believe that it will be well worth it when you factor in the distributions to the equation. Given all of these factors, I continue to believe that the company makes for a great ‘strong buy’ candidate.