Luis Alvarez

Investment thesis

Daqo New Energy (NYSE:DQ) has a ridiculously low valuation. The current market cap is more than $1 billion lower than the outstanding net cash position. DQ demonstrates stellar profitability metrics and is actively expanding its production facilities to ensure the capacity keeps up with favorable secular trends in the solar energy industry. The company faces high concentration and political risks, but I think that the multiple-fold upside potential far outweighs these risks. All in all, I give the stock a “Buy” rating.

Company information

Daqo New Energy is a holding company domiciled in the Cayman Islands. The company’s wholly-owned operating subsidiary, Chongqing Daqo, is in China. The subsidiary is focused primarily on producing and selling polysilicon which is used in wafer manufacturing for the solar energy equipment industry. The company also owns a subsidiary named Daqo Solar Energy North America to promote its products in North America.

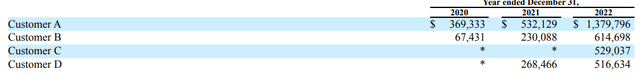

The company’s fiscal year ends on December 31 with a sole operating segment. According to the latest annual SEC filing, all of the company’s revenues are derived in China. Sales to the top four customers represented about two-thirds of the total sales in FY 2022.

DQ’s latest annual SEC filing

Financials

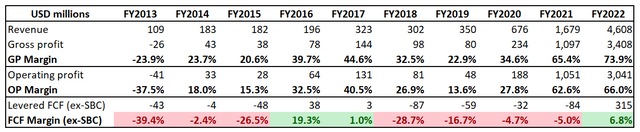

DQ’s financial performance over the past decade was stellar. Revenue grew at an impressive 45% CAGR over the decade, and profitability metrics improved substantially. The operating margin is at a stellar 66% level, meaning the company has a vast potential to accumulate capital to fuel further growth either organically or via acquisitions.

Author’s calculations

The business is capital-intensive. On average, over the last decade, the company reinvested more than 30% of its revenue in CAPEX. That said, a massive discrepancy exists between the operating margin and free cash flow [FCF] margin, which massive CAPEX explains. That was the main reason the company struggled to achieve a positive FCF margin. But now the company has scaled up enough to cover the required CAPEX and retain the remaining amounts.

The latest quarterly earnings release was on April 27; the company significantly missed consensus estimates. Revenue almost halved YoY with a 45% decrease. The bottom line followed the top line accordingly. The weakness was due to the soft demand in January, explained by the seasonal slowdown in the solar PV industry. Decreased prices stimulated demand in February, but the company faced a limited supply of high-purity quartz used in the silicon-ingot production process. Still, EBITDA was strong at $490 million during Q1, notably contributing to the company’s balance sheet.

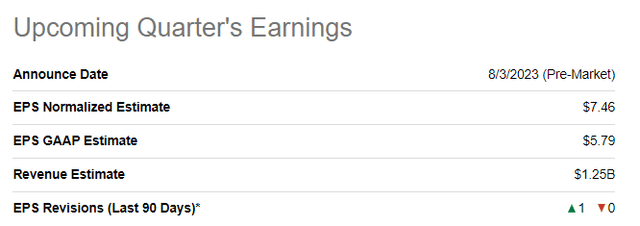

Seeking Alpha

Good news: in Q2, revenue is expected to bounce back and will be about flat YoY. On the other hand, the adjusted EPS is expected to shrink from $8.18 to $7.46. During the sector quarter, the company expects to produce 45,000 metric tons of polysilicon, which is about 13% higher sequentially. Overall, I am positive about the upcoming earnings release. About a month ago, the company announced that its Phase 5A facility in Inner Mongolia has ramped up to the full production capacity of 100,000 tonnes. That said, now the company’s overall production capacity is about 205,000 tonnes. This news is unlikely to affect Q2 earnings, but the management might upgrade the full-year guidance, which would be a bullish sign.

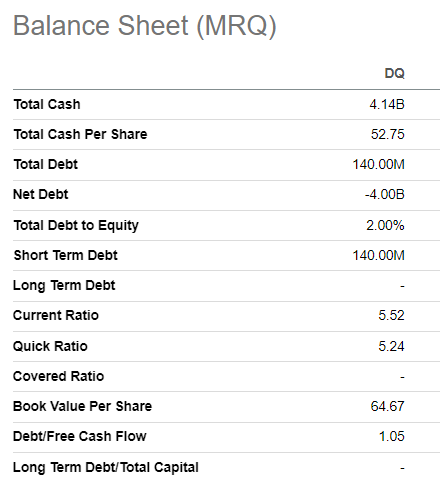

The balance sheet is a fortress with over $4 billion in cash and almost no debt. Liquidity metrics are also robust. Here I would like to emphasize that the company’s net cash position of about $4 billion is substantially higher than the current market capitalization of about $3 billion, which looks ridiculous.

Seeking Alpha

If we speak about the long-term prospects of DQ, I think the company is well-positioned to capture secular tailwinds. According to alliedmarketresearch.com, the global solar equipment market size is expected to compound at an impressive 11% rate up to 2030. The secular shift in the energy market toward green sources is apparent, and solar energy is emerging as a new superpower. It is impressive that this year investments in solar energy are expected to surpass spending on oil production for the first time in history. DQ has strong profitability and substantial cash reserves to fuel further growth. Therefore, I think the company will be able to absorb favorable secular trends.

Valuation

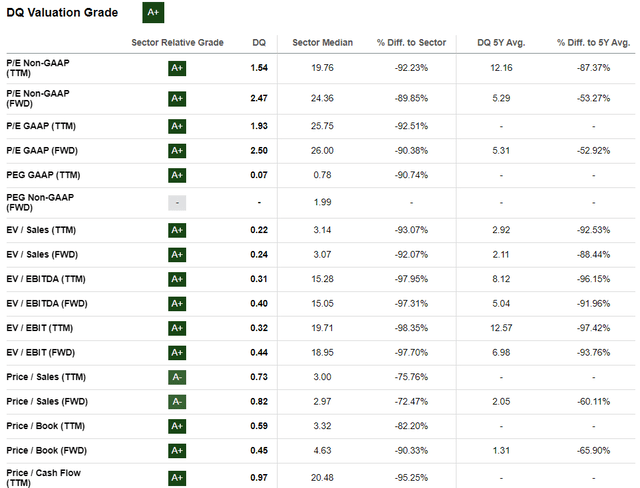

The share price declined about 4% year-to-date, significantly underperforming the broad U.S. stock market. On the other hand, DQ’s performance was slightly better than the iShares MSCI China ETF (MCHI), which declined 6% year-to-date. The stock has the highest possible “A+” valuation grade from Seeking Alpha Quant thanks to very low valuation multiples compared to the sector median and historical averages.

Seeking Alpha Quant

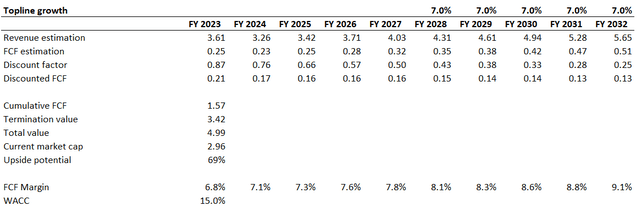

The company does not pay dividends, so I will expand my valuation analysis with the discounted cash flow [DCF] approach. I use an elevated 15% WACC for Chinese companies due to country-related risks. I have revenue consensus estimates available up to FY 2027. For the years beyond, I expect a 7% revenue CAGR. From the FCF margin perspective, I use the FY 2022 level, which was at 6.8%, and expect it to expand by 25 basis points yearly. This is a conservative assumption since the metric will peak at high single digits by FY 2032.

Author’s calculations

According to the DCF outcomes, the business’s fair value is $5 billion, which is substantially higher than the current market cap. The stock is very attractively valued with a 69% upside potential considering the $4 billion net cash position.

Risks to consider

The most significant risk that I see for DQ is a very high concentration risk. As we saw in the “Company Information” section, the top-four customers represent about 66% of the total sales. The largest customer represents about 29% of the total sales. This exposes the company to several vulnerabilities. If any of the major customers decide to reduce their orders, it will have a massive impact on DQ’s earnings. Relying on a limited number of large customers also means the company has little bargaining power and the power to negotiate favorable terms for DQ. Therefore, a high concentration risk means the company is vulnerable to disruptions in the industry trends.

DQ is a Chinese company and generates sales only domestically. I cannot name China a democratic country. Democratic principles ensure that power is distributed among different branches of government, and it is a practical constraint on exercising authority. On the contrary, China is closer to an authoritarian system, where the power is concentrated in the hands of a small group with almost no separation of powers. That said, political risks are high for the company.

Bottom line

To sum up, Daqo New Energy stock is a “Buy”. The company demonstrates stellar performance and is poised to capture favorable secular trends in the solar energy industry efficiently. The valuation looks ridiculously low, and the upside potential significantly outweighs the risks and uncertainties.