Vladimirovic

Investment thesis

NGL Energy (NYSE:NGL) stock is on fire this year with a 240% rally year-to-date. The company demonstrates positive trends in its profitability metrics, which are improving notably. On the other hand, there is a substantial net debt position, which accounts for about a third of the company’s FY2022 sales. With the operating margin at low single digits, I consider NGL’s vast net debt position as very risky. The valuation also does not look attractive to me. All in all, I assign the stock a “Hold” rating.

Company information

NGL is a diversified midstream energy partnership that transports, treats, recycles, and disposes of produced water generated as part of the energy production process and transports, stores, markets, and other logistics services for crude oil and liquid hydrocarbons.

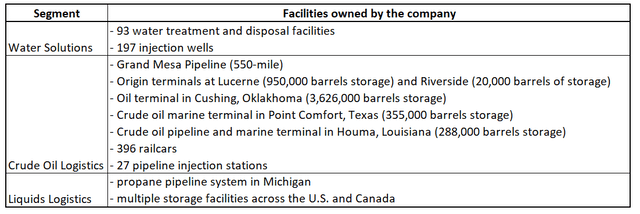

The company’s fiscal year ends on March 31. The business is organized into three segments: Water Solutions, Crude Oil Logistics, and Liquids Logistics. According to the latest 10-K report, in FY 2022, about 64% of the total sales were generated by the Liquids Logistics segment. Each of the NGL’s segments owns multiple operating facilities.

Compiled by the author based on the NGL’s latest 10-K report

Financials

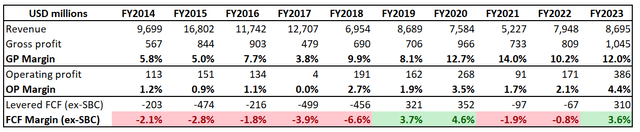

Despite the fact that NGL is not an upstream company heavily depending on commodity prices, the company’s financial performance over the last decade was very volatile. This was due to multiple reorganizations, which the management conducted to improve the profitability and predictability of the financial performance of NGL. Given the positive trends of profitability metrics expansion, the management did well in its optimization initiatives. The gross margin more than doubled over the decade. The operating margin also improved significantly, though I still consider that this metric is razor-thin. The stability in the free cash flow [FCF] margin is yet to be achieved. Only three out of the ten past years were positive in terms of the FCF margin with stock-based compensation deducted.

Author’s calculations

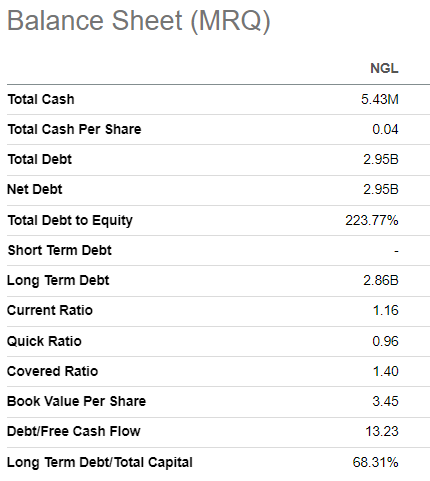

The company is not paying dividends, and share repurchases are very insignificant. Given the low and unstable FCF margin, it is not a big surprise for me. The balance sheet also looks weak with a substantial net debt position and a mere 1.4 covered ratio.

Seeking Alpha

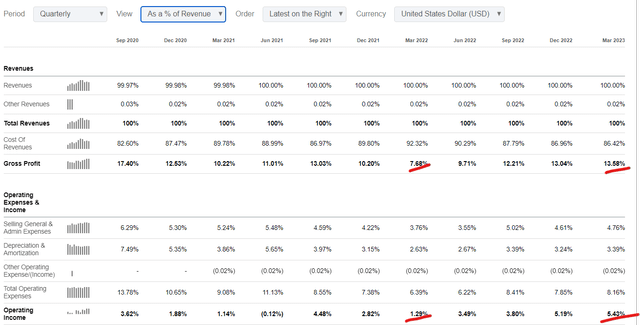

The latest quarterly earnings release was on May 31, with NGL missing consensus estimates. The miss in revenue was by $270 million, which is significant compared to the company’s scale. Revenue dropped by 19% YoY and the bottom line followed as well. Among the positive signals was the notable YoY gross margin expansion. It enabled the operating margin to expand significantly as well, though the operating expenses’ portion of revenue increased YoY.

Seeking Alpha

The upcoming earnings release is planned on August 9. Consensus estimates quarterly revenue to decline by 14%. The EPS is expected to be positive at $0.11, compared to -$0.04 a year earlier.

Seeking Alpha

Overall, I see positive trends in the company’s profitability metrics. Though, the operating and FCF margins are still thin. Moreover, the balance sheet looks weak with substantial leverage.

Valuation

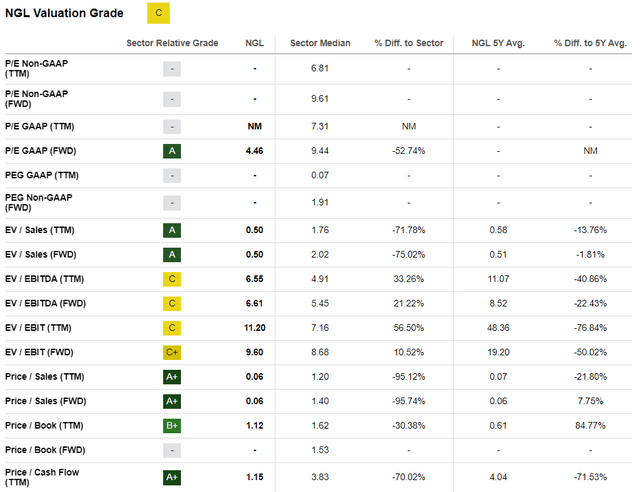

The stock price skyrocketed this year with a 240% year-to-date rally. This is far better than the broader market and the Energy sector (XLE). Seeking Alpha Quant assigned the stock a “C” valuation grade, suggesting the stock is fairly priced. The current multiples look attractive, apart from those with EBIT/EBITDA in the denominator.

Seeking Alpha

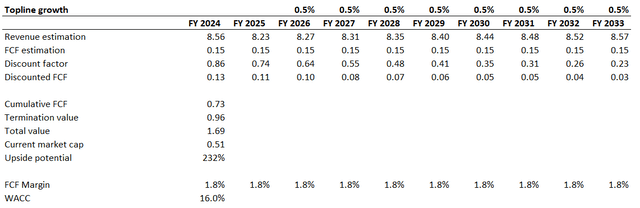

NGL does not pay dividends, so I think the discounted cash flow [DCF] approach is best suited to proceed with my valuation analysis. As we saw above, the company’s financial performance was volatile, and the FCF margin was precarious and mostly negative. That said, I prefer to select an elevated 16% WACC suggested by finbox.com. I have earnings consensus estimates available for the two upcoming fiscal years. For the years beyond, I have implemented a 0.5% revenue CAGR, which also looks fair given the historical financial performance. For the FCF margin, I use half of what was earned in FY 2022, i.e., 1.8%, and expect no expansion over the next decade.

Author’s calculations

As you can see, the current market cap is substantially lower than my fair value estimation. According to the DCF, the stock has a massive 232% upside potential. But do not forget the level of uncertainty regarding the FCF margin, over the past decade, there were only three years with a positive levered FCF ex-stock-based compensation [SBC]. Also, the company is in a substantial net debt position of about $3 billion. Therefore, I cannot conclude that the stock is attractively valued. The discount is fair given a very high uncertainty level over the underlying assumptions and the substantial net debt position.

Risks to consider

The company’s substantial net debt position is the most significant risk I see over the near term. The risk is considerable due to the company’s thin profitability and FCF metrics. They are at low single digits, meaning that even moderately insignificant unfavorable fluctuations or disruptions to the company’s operations can bring the profitability close to zero. The company does not have much cash reserves to weather the storm. A substantial amount of debt and low margins also mean that investors cannot anticipate either dividends or notable share buyback plans in the foreseeable future. Moreover, further increases in interest rates could impact the financing cost and add pressure to the bottom line.

NGL operates in a cyclical energy sector. The company is a midstream meaning that there is no direct correlation between the commodities prices and NGL’s earnings. But, economic cycles affect the demand for hydrocarbons. That said, production and transportation levels also fluctuate. The company’s earnings depend on the broader economic cycles, and we are currently not in the expansion phase, but closer to contraction. There is little certainty about the timing of pivoting back to expansion.

As we saw in the “Company Information” section, NGL operates a substantial infrastructure that includes multiple facilities across North America. Maintenance and repairs of these facilities are costly and there is little room to optimize expenses here. In case the company fails to sustain its infrastructure, unplanned repairs and downtime might occur. At the end of the day, it will adversely affect the company’s earnings.

Bottom line

To conclude, NGL is a “Hold”. There are positive trends in the profitability metrics expansion, but I need a couple more quarters to ensure the movement is sustainable. I also consider the company’s capital allocation strategy very risky. Discounted cash flows look substantially higher than the current market cap. But the valuation does not look attractive when you subtract the current vast net debt position.