jonathanfilskov-photography/iStock via Getty Images

Introduction

The energy transition is probably going to be the main investing theme of the next decade. Western nations are moving in the direction of regaining control of the commanding heights of their respective economies. As governments intervene more and more on the economic scene, they are going to create winners and losers. Companies aligned with government plans will be major beneficiaries.

The energy transition is a clear example. Companies that are perceived as helping to achieve net zero, such as renewable energy developers, energy storage providers, and carbon capture companies, are benefiting from a discounted cost of capital. On the other hand, the traditional oil and gas sector is suffering from a dearth of capital (this is the basis of my long-term bullish view on oil). Many governments around the world already offer various incentives and support programs, such as tax credits, grants, subsidies, and favorable regulatory frameworks. Another example is the rise of sustainable finance, including green bonds, and the huge focus on ESG investing. Companies actively involved in the energy transition can access a broader pool of capital at lower borrowing costs. I expect this trend to continue and intensify in the coming years.

This means that such companies will likely trade at higher multiples compared with other sectors. Which, of course, they already do. In fact, most names are not cheap, and many are not even profitable (and may never will). A value investor interested in deploying capital in this sector has to turn many stones. However, a company satisfying the following criteria:

- Exposure to the energy transition theme

- Undervalued based on current cash flow generation potential

- Significant growth pipeline

would represent in my opinion a solid investment opportunity. It would benefit from a secular trend and combine the characteristics of a value and a growth company. Orrön Energy (OTCPK:LNDNF, ORRON.ST), an independent renewable energy company that is part of the Lundin Group, is my chosen candidate for such a company.

Notes: Orrön Energy (OTCPK:LNDNF) trades both in Stockholm under the ticker ORRON.ST, and on the pink sheets under the ticker LNDNF. Liquidity is significantly better in Stockholm. The company has switched from USD to EUR in reporting its financial results, so all numbers in the article will also be given in EUR.

Orrön Energy: a brief history

Orrön Energy is the renewable energy business that emerged following the dissolution of Lundin Energy. Lundin Energy was a Swedish oil and gas company, with a portfolio of assets in the Norwegian Continental Shelf, in addition to a portfolio of renewable energy projects. It ceased to exist when Aker BP acquired Lundin Energy’s oil and gas branch in December 2021. As a result, Lundin Energy’s shareholders obtained both cash consideration and shares in Aker BP, while the remaining part of the business continued to trade under the new name of Orrön Energy. It is likely that the company changed its name to distance itself from the association with Lundin Energy’s controversial history. For years, the company has faced legal lawsuits relating to alleged involvement in war crimes in Sudan when it was still known as Lundin Petroleum.

I believe the decision made by the Lundin family regarding the transaction was well-timed. Through the merger with Aker BP, they were able to divest their Norwegian oil and gas portfolio at an opportune moment. While they still maintained exposure to the oil and gas sector through their involvement in International Petroleum (IPCO:CA) (the O&G Groups’ jewel, and also one of my key long-term holdings,) they reduced their overall exposure in order to concentrate on the green energy transition theme. They chose to focus, for instance, on Lundin Mining (OTCPK:LUNMF, LUN:CA), a growing copper producer which is also part of the Lundin Group. Given this context, it becomes clear why they also chose to retain their interest in the remaining business of Lundin Energy.

I believe the Lundins are capable capital allocators, and have created significant value for their shareholders throughout the years. They have the experience, the know-how, and the access to capital to develop ambitious projects from scratch, which is why I see their continued involvement (the Lundins still own about a third of the company) as a significant positive factor.

The primary drawback is the remaining legacy of Lundin Energy, including the ongoing legal costs associated with the Sudan case, which amount to approximately $8 million per year. I am unable to estimate the probability of a conviction. It should be noted, however, that the potential of a conviction in the Sudan case represents a “black swan” event that is currently negatively impacting the company’s valuation. Conversely, if the company were to achieve a final acquittal, it would likely experience a substantial revaluation.

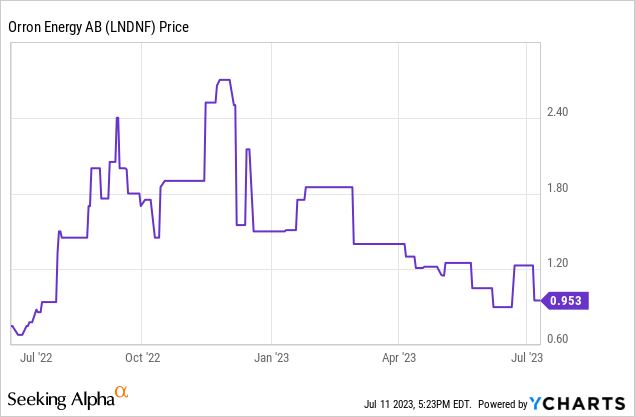

Recent share price action

Following the completion of the merger in June 2022, there was a significant decline in the share price. It is likely that many funds were forced to divest their position, as Lundin Energy was removed from indices. The company was also relatively obscure and unknown.

During the 2022 energy crisis, when electricity prices spiked in Europe, shares in the company appreciated almost 400%. As the energy crisis started to ease, the share price declined precipitously, and is now back almost to the same level as July 2022. This is despite the fact that:

- The drivers that led to an energy crisis in Europe last year (over-reliance on intermittent energy sources, loss of Russian gas supplies) are still in place, with the potential for renewed volatility in the coming months and years.

- The company has been growing significantly, adding more than 500GWh since July (starting from 300 GWh at inception), through 10 separate transactions, most notably via its acquisition of Slitevind.

Strategy and business

Orrön Energy possesses a portfolio of cash flow generating assets in the Nordic region, in addition to a number of growth initiatives in both the Nordics and Europe. The existing assets are mostly wind power assets, but there is also one hydropower plant in Norway.

The company’s goal is to consolidate the fragmented wind power industry in Sweden, where the top ten largest companies still control only 36% of total installed power. The acquisition of Slitevind in 2022 provided Orrön with a platform to acquire other smaller assets. At the moment, the company controls assets capable of generating an estimated annual power output of 500 GWh, concentrated in the historically high-priced regions of SE3 and SE4 in Sweden. Additionally, Orrön owns 50 percent of the Metsälamminkangas (MLK) wind farm in Finland, contributing an estimated gross annual power generation of around 400 GWh. Finally, the company holds a 50 percent stake in the Leikanger hydropower plant in Norway, located in the historically high-priced NO5 area, with an estimated annual power generation of around 200 GWh.

In total, Orrön’s portfolio currently has an estimated power generation of 800 GWh. This, however, is expected to grow to 1,100 GWh from 2024 onwards, thanks to the completion of the new Karskruv wind farm, in the SE4 price region of southern Sweden. The project is a key development for the company. It is currently ahead of schedule and on track for completion by the end of 2023. Because of Karskruv, capital expenditures for 2023 are going to be significant (guidance is for €80 million for the whole year); however, capital expenditures will decrease going forward.

In addition to its existing assets, Orrön Energy is actively pursuing a pipeline of growth projects. The company aims to optimize its operational assets by implementing solar energy and battery storage solutions at its current wind farms. Furthermore, Orrön is planning to invest in greenfield projects in Finland and Sweden. In the first quarter, the company announced its intention to expand its footprint to Europe and has entered into agreements to explore renewable energy opportunities in France, Germany, and the UK. Orrön has secured grid connections for a large-scale solar and battery storage project in the UK, while awaiting preliminary approvals in Germany and France. The company intends to finance its growth initiatives without dilution by utilizing internally generated cash flow and accessing low-cost capital. To this end, it has recently secured a €150 million revolving credit facility at favorable terms.

Risks

Regarding the main sources of risk for Orrön Energy, the company is exposed to the volatility of electricity prices in the regions where it operates. Currently, Orrön maintains minimal hedges, which will be phased out by the end of 2023. As a result, the company is impacted by fluctuations in spot electricity prices.

Additionally, Orrön faces the risk of unfavorable changes in taxation. However, it is important to note that high-price levies currently have minimal impact on the company’s financials, particularly as 65% of its generated power is located in Sweden, where the price cap is significantly higher than current prices. Furthermore, these measures are temporary and set to expire.

Since a substantial portion of Orrön’s electricity generation is derived from wind sources, the company is subject to weather conditions. Unfavorable wind conditions limit electricity generation, while abundant wind results in higher generation. However, it is worth noting that electricity prices are typically lower during periods of favorable conditions, which explains why the company’s realized electricity price is usually below the regional average.

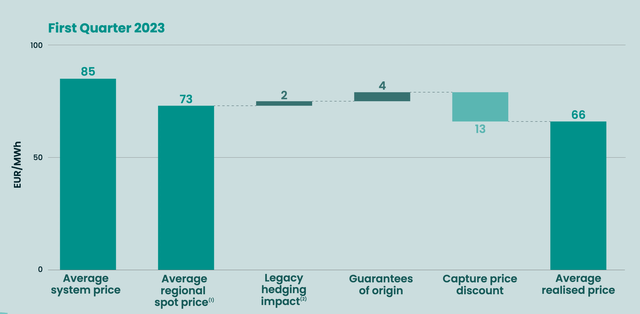

The difference between the realized price and the wholesale price is the capture price discount. It amounted to 13 €/MWh, or around 18%, during Q1 2023. This is an historically high value, and it is expected to normalize going forward. As can be seen from the visualization below, the average system price in Q1 was €85/MWh (a far cry from the peak of over €400/MWh touched in August last year). The average regional price was €73/MWh, lower than the system price. This only happened twice in the last 16 quarters, since the company’s assets are located in historically high-priced areas. It is also interesting to note that the company received a €4/MWh premium by selling guarantees of origin (by certifying that the electricity has been produced from renewable energy sources).

Realized electricity price for Q1 2023 (Company’s Q1 Presentation)

Recent financial results and valuation

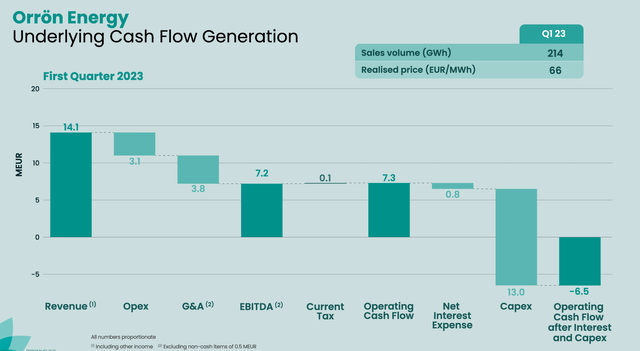

Despite facing somewhat challenging market conditions in Q1 2023, Orrön Energy was able to achieve robust results. On a proportional basis, the company generated revenues of €14.0 million, EBITDA of €6.7 million, and cash flow from operating activities of €16.6 million. Orrön maintains a strong balance sheet with minimal debt and has over €250 million of debt capacity available to fund future growth initiatives. Moreover, the company may consider initiating dividend payments in the future.

Cash flow generation during Q1 2023 (Company’s Q1 Presentation)

Orrön is currently trading at an attractive valuation, even considering only its existing operational assets. The company’s price-to-book (P/B) multiple is at 0.74. Based on its market capitalization of approximately €270 million, the company’s enterprise value-to-EBITDA (EV/EBITDA) multiple stands at around 10x. These valuation metrics do not account for the future growth potential of the company, in particular the fact that Orrön is expected to expand its capacity by nearly 40% starting from 2023 with the completion of the Karskruv project.

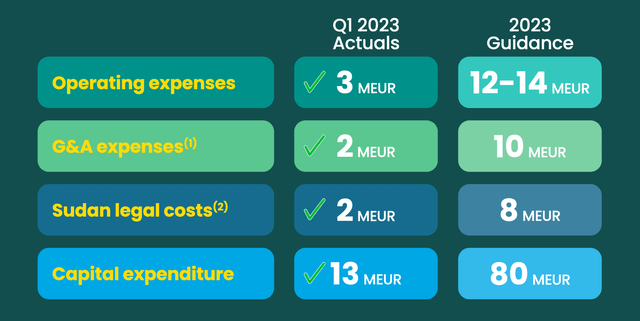

The company is tracking well against full-year guidance (Company’s Q1 Presentation)

Conclusions

Orrön is a young company, but it consistently delivers. It has been actively pursuing an aggressive M&A strategy, as evidenced by a series of smaller deals also during the last quarter. It is effectively managing its operating costs, which are tracking below guidance. It is delivering ahead of expectations in terms of its development projects.

Investing in Orrön represents a bet on potential future volatility in European energy prices, particularly due to its exposure to spot prices and absence of hedges. It is also an opportunity to capitalize on the ongoing trend towards a decarbonized economy. The company benefits from a lower cost of capital and can command premium prices by selling guarantees of renewable origin.

One significant drawback impacting the valuation is the ongoing litigation related to the Sudan case. However, considering the current valuation, the risk/reward ratio appears favorable for new investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.