Sky_Blue

Thesis

Enterprise Products Partners (NYSE:EPD) and Energy Transfer (NYSE:ET) are two of the most well-known midstream companies. Investors love them for their rich (and tax deferred) distributions as they consistently transport energy across the country and the globe. Historically, these companies trade with yield and in my opinion are undervalued by the market.

The market has not given either of these reliable companies any consideration for their long term growth potential. This potential stems from the natural gas export boom that will be coming to the US gulf coast in the next 12 to 18 months. These projects will increase demand for natural gas, as well as processing and pipeline capacity. In turn, this will eventually correspond to higher distributions and capital appreciation for both companies.

In this article I will perform a deep dive of how the US LNG export market will be transformed in the throughout the remainder of this decade and draw a correlation to how both EPD and ET will be long term beneficiaries, creating a unique opportunity for distribution growth and capital appreciation.

Drivers For Long-Term Growth

The United States has been blessed with massive resources of crude oil, natural gas, and natural gas liquids. These energy sources have allowed the US to become one of the largest energy exporters in the world. This could not be done without the infrastructure that is owned and operated by companies like EPD or ET.

Natural gas, NGLs, and petrochemicals are vital for both EPD and ET, comprising of 83% and 74% of EBITDA for both companies respectively. These companies are primed for success as the world becomes more and more dependent on US natural gas and NGLs.

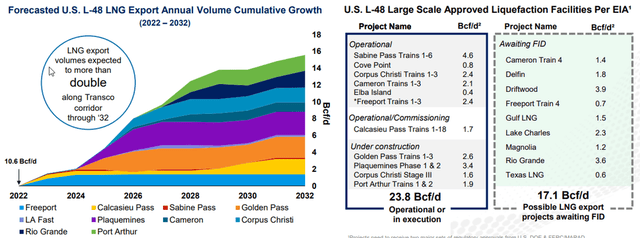

Currently, three liquefied natural gas export facilities are under construction in the US gulf coast to supply both Europe and Asia as demand for clean burning energy continues to grow. All three of these facilities are expected to begin commercial operations in the second half of 2024 with additional phases coming online in 2025. Combined, these facilities will export 7.6 BCF/d of liquified natural gas. This alone, is a 75% increase in the current US gulf coast export capacity.

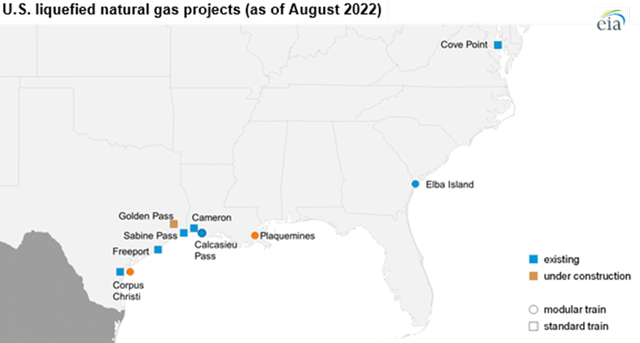

LNG Export Facilities (EIA)

Most importantly, these facilities coming online marks just the beginning of an explosion of foreign demand for LNGs. So far in 2023, roughly 5 BCF/d of export capacity projects have been given the green light. The largest project, Rio Grande has decided to move forward with its FID and also has awarded shipping contracts for the project. In addition, Port Arthur Trains 1 and 2 also reached FID in March of this year.

Williams Companies Earnings Presentation

Satisfying all of this potential demand not only requires a massive amount of natural gas, but also the pipelines and processing capabilities to move the molecules from the well head to the end users. This is where EPD and ET step in, they own the highways from the well head to the docks.

The Energy Highways

Starting at the well head, the natural gas stream has to be processed to separate the NGLs and the natural gas (methane). The NGLs then flow to fractionators for further separation into butane, propane, etc. The biggest source of these raw volumes is coming from the Permian basin. As a result, EPD is in the process of building four new natural gas processing plants as well as a twelfth fractionation plant. ET also has an additional two processing plants and one fractionation plant under construction to handle future demand.

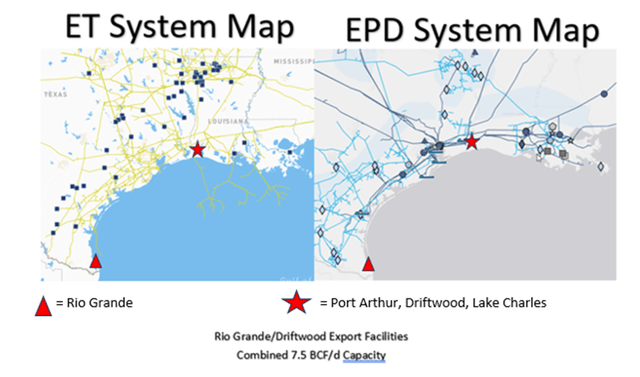

After the molecule stream is processed, it must flow to its final destination, the export terminals along the gulf coast. A majority of the new export terminals are slated to be located either on the southern part of Texas (namely Rio Grande and Corpus Christi), or the Lake Charles area of Louisiana (Port Arthur, Golden Pass, Driftwood). These areas are advantaged thanks to existing nearby pipeline networks and deep ports. However, more must be done to accommodate the massive volume that is expected at these terminals.

Both companies are making significant pipeline enhancements to be able to accommodate the tremendous amount of volume that will eventually be moving through the area. Upgrades are being made in both the Permian and Haynesville areas of their systems. EPD just placed into service in Q2, a 400 MCF/d expansion of the Acadian Pipeline which will service the Lake Charles area of Louisiana. ET also sees this area as a key future driver by completing the 42-inch diameter Gulf Run pipeline. This enormous pipeline can transport 2.0 BCF/d while also allowing room for future expansion efforts.

LNG Export Sites Vs ET/EPD System Maps (ET/EPD Company Website)

Growing the Cash Machines

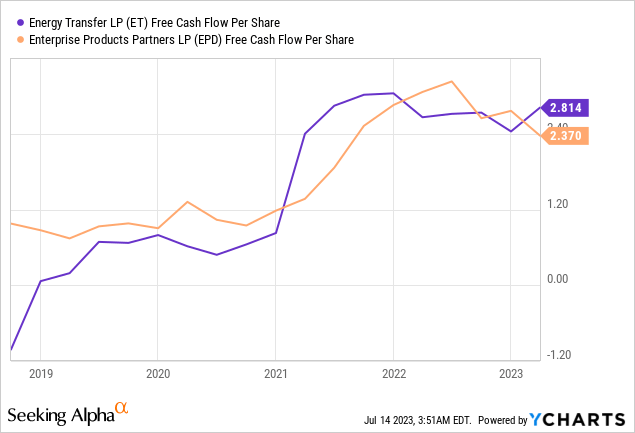

So far, we have gone through various factors that will spur huge demand growth for both EPD and ET’s processing and pipeline systems. However, as investors, we want to know how this is all going to translate into FCF and into distribution growth. Luckily, both EPD and ET have done this well over the last several years. Both companies have aggressively grown FCF per share since the onset of the pandemic but have stalled out some in 2022. This is primarily associated with higher capital spend on growth infrastructure to capitalize on the opportunity that growing LPG exports provides.

Overall, capital spend has been more aggressive over the last couple years with EPD on track to spend a combined $6.1 billion in capital projects between 2022-2024. Similarly, ET has a CAPEX budget of $2 billion for 2023 and has just completed its third acquisition in as many years with the Lotus Midstream transaction worth $1.45 billion.

This drag of FCF growth is temporary, however. Nearly all capital projects currently in the works for both companies are expected to be completed and in service by 2024, which sets investors up for higher FCF in two ways. First, lower capital spending leaves more dollars on the table for distribution. Secondly, all of these projects are cash flow accretive from day one due to the high demand that is already present. This has enabled the companies to have the contracts for these new assets completely full prior to bring the asset online.

These expansion projects are badly needed to support customer demand. Below are a few excerpts from both companies Q1 conference calls to show the general theme of high demand for their assets.

EPD

- We are running essentially full across all our assets, with the exception of the Rockies….

- Our ethylene export facility has been full since Day 1…….

- Jean Ann says that the pipelines at Corpus are full……..

- If you take our PDH 2 plant, our fractionator (Frac 12), our Acadian expansion, those will all be full on Day 1.

ET

- We do think that’s going to blow out and we were firm believers that in the next 2.5 to 3 years there’s been a significant need for more capacity and we do believe that will be our pipeline.

- We’ve got a tremendous capability that all we have to do is add pumps and can double our capacity up there as we can bring on more volumes upstream

- So we’re hitting records along our NGL systems and with the — like as we mentioned, the growing demand we just couldn’t be more excited about the assets that we have.

Additionally, in the Q4 earnings call Energy Transfer made the following comment regarding the robust demand created by the Golden Pass project.

That contract has a foundation customer Golden Pass……we will be fully utilizing that pipeline as much as we possibly can. I believe it flows almost up to 0.5 Bcf a day, actually physical volumes in addition to the demand charges that we’re getting from Golden Pass. And it’s our expectations that team will continue to fill that pipe up and every bit of the capacity is available until it’s begins being utilized by Golden Pass. As you know, probably that’s 1.65 Bcf of capacity that we can easily expand.

Capital Appreciation

The investing community largely sees the MLP industry to be a bond replacement style investment. In my eyes, they couldn’t be more wrong. Even though both companies’ stock price is in fact, well tied to its distribution, that doesn’t tell the whole story.

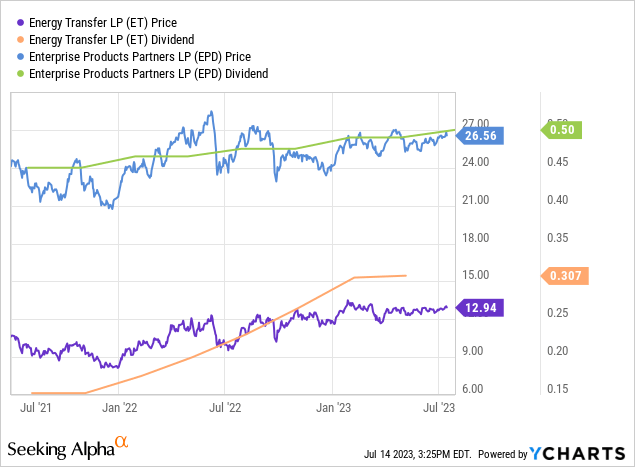

If an investor takes a step back and looks at the long term horizon for these companies, you see that since these companies have been able to grow the distribution, the share price appreciates as more investors are willing to own the stock. In the image below, you can see a steady price appreciation as the distribution grows. Its import to also note that share price never strays to far from the yield curve in either direction before correcting.

Dependability

To determine the dependability of EPD, one only needs to look at the distribution growth record for the last 25 years. This week marked the 25th annual increase in distributions and all signs point to this trend continuing.

EPD has a terrific financial record, being the only midstream company to achieve a Standard & Poor’s rating of A- and stable. This gives the company a lot to brag about and peace of mind for investors. The main reason for this rating is the debt profile of the company which has been artfully crafted. The total debt is now under 3x EBITDA with an average interest rate of 4.6% and is considered one of the strongest balance sheets in the industry.

ET’s record is not quite as stellar but significant strides have been made in the last several years. Going back several years, ET was in a significantly over levered position and was at risk of having its credit rating dropped. The firm did what was necessary by cutting the distribution and spent the proceeds to improve the balance sheet. The partnership has fully restored the distribution and is now on target to achieve the goal of a debt range of 4x to 4.5x. Further, the company has guided for a 3% to 5% distribution growth.

Risks

As previously mentioned, the share price for both of these companies largely follow their yield. This effectively creates both a price ceiling and floor for the share price. Should global demand or the U.S. supply dynamics shift, the assets of EPD and ET may not be needed as currently projected. In this case, the partnerships may struggle to grow the distribution and investors would see minimal capital appreciation in their investment.

Summary

I believe that the investment community focuses solely on EPD and ET’s yield, and thus is missing an opportunity to have your cake and eat it too. There are adequate projects nearing completion to meaningfully improve the cash flow dynamics of both companies. This coupled with numerous demand drivers for LNG exports, will support distribution growth, and in turn share price appreciation.

Many on this platform have taken an either/or approach to EPD and ET but I believe either are solid investments. Both companies service vital infrastructure that is nearly irreplaceable in the regulatory environment of this day and age, creating a very wide and defensive moat.