Thomas Barwick/DigitalVision via Getty Images

Investment Thesis

Las Vegas Sands (NYSE:LVS) owns and operates integrated resorts in Macao and Singapore with subsidiaries. The company’s integrated resorts offer a variety of amenities, including lodging, gaming, entertainment, retail shopping, convention and exhibition centers, and restaurants run by renowned chefs. With such an array of options, guests find something to suit their needs.

As the economy recovered from the global pandemic, the rebound was short-lived due to inflationary pressure globally. The two factors have rendered the company unprofitable. However, LVS is leveraging its competitive advantages, high-quality integrated resort offerings, diversified cash flow, and iconic brands with broad regional and international market awareness and appeal to thrive in the industry. The company registered improvement in its MRQ, energized by a robust travel and tourism spending recovery in both Macao and Singapore. I am upbeat about the company’s future trajectory considering its strengths highlighted above and the current threats (challenging macroeconomic environment) are temporary and will eventually subsidize.

Competitive advantages

Just like any other company, LVS’s sustainable competitive advantage helps it leverage growth and beat the competition in the long run. It drives consumer preference and thus results in higher profits.

Diversified, high-quality Integrated Resort offering

The company features non-gaming attractions and amenities, including world-class entertainment, expansive retail offerings, and market-leading MICE facilities. These attractions and amenities enhance the appeal of LVS, contributing to visitation, length of stay, and customer spending at the resorts. The broad appeal of offerings in various markets enables the company to serve the most comprehensive array of customer segments in the Macao and Singapore markets.

Unique MICE and entertainment facilities

LVS has the best-in-class properties, MICE, and entertainment facilities, contributing to markets’ diversification and appeal to business and leisure travelers while diversifying cash flows and increasing revenues and profit. A unique convention-based marketing strategy allows LVS to attract business-oriented travelers during the slower midweek periods while leisure travelers occupy properties during the weekends. Its convention, trade show, meeting facilities, and the on-site amenities offered at Macao and Singapore Integrated Resorts provide flexible and expansive space for meetings, incentives, conventions, and exhibitions [MICE].

Established and Iconic brands

Through a combination of the diversity of amenities, the scale of facilities, and its distinctive design, the company has built iconic brands to a great extent. The expansive amenities and exceptional customer experience shared on social media drive significant visits. The Marina Bay Sands brand is architecturally unique, and as a result, the property is often featured prominently on social media, in filmed entertainment, and in other media. All the brands offer both local and international appeal to customers.

A diversified cash flow

Integrated Resorts in Macao and Singapore contributed 53% and 47% of LVS’s total adjusted property EBITDA during the previous five years. Thus, cash flow from operations was derived from gaming and non-gaming sources, including retail malls, hotels, food and beverage, entertainment, and MICE. Diversification protects against downside risk and cash flow problems.

Q1 2023 performance

While travel restrictions and reduced visitation continued to impact the company’s financial performance during the quarter, a robust travel and tourism spending recovery is now underway in both Macao and Singapore markets. The company remains enthusiastic about the looming opportunity to welcome more guests back to its promises throughout 2023 and the years ahead.

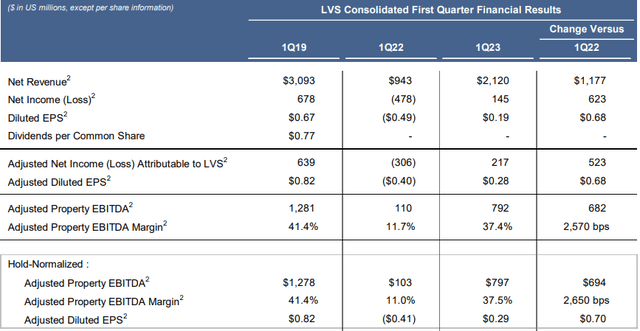

Looking at the Q1 2023 performance, net revenue was $2.12 billion, compared to $943 million in the prior year quarter. The trend was attributed to the increasing airlift capacity and relaxation of the travel restrictions. Operating income hit $378 million, compared to an operating loss of $302 million in Q1 2022. Additionally, net income from continuing operations was $145 million, compared to net losses of $478 million in the first quarter of the previous year. The gradual improvement in the quarter is a vote of confidence that the company’s upside is soaring.

Las Vegas Sands Website

During the quarter in the Singapore market (Marina Bay Sands), the property delivered an outstanding performance in both mass gaming and tenant sales. As the airlift capacity continues to improve and travel and tourism spending recovery from China and the wider region continues, LVS is opportunistic to introduce new suite products.

In Macao, all gaming and non-gaming segments accelerated revenue during the quarter. Following the relaxation of travel restrictions, increased visitation has driven gaming volumes, retail sales, and hotel occupancy during the quarter. In other words, business is back. The company is committed to deploying more capital to expand non-gaming offerings, with a concession of about $3.8 billion towards the expansion. Macao’s property portfolio’s mass gaming revenue reached $1 billion for the first time since 2019, suggesting the company’s performance soared to the pre-Covid-19 era.

Las Vegas Sands Website

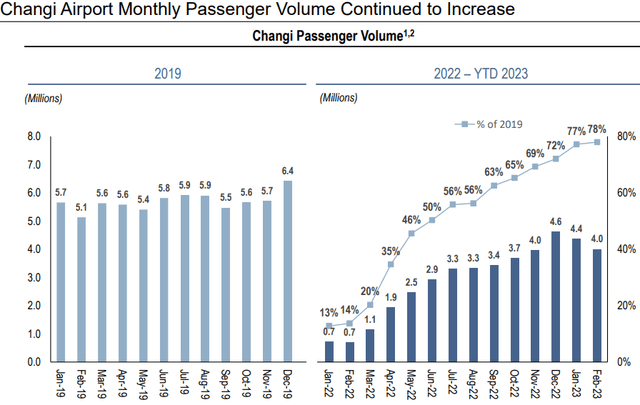

In conclusion, relaxations of travel restrictions and increased flight capacity have enabled an ongoing recovery in market visitation, with Changi Airport passenger volume in February 2023 reaching 78% of February 2019 volume. Notably, the company’s annual earnings and revenue are projected to grow by nearly 45% and 21%, respectively, outperforming the industry’s annual earnings and revenue growth by 30% and 12%.

Balance sheet analysis

Let’s now focus on the balance sheet. LVS’s short-term assets of $7.02 billion can cover its short-term liabilities of $3.92 billion, as demonstrated by the current ratio of 1.79X. Further, it has long-term assets of $15.70 billion against long-term liabilities of $14.97 billion.

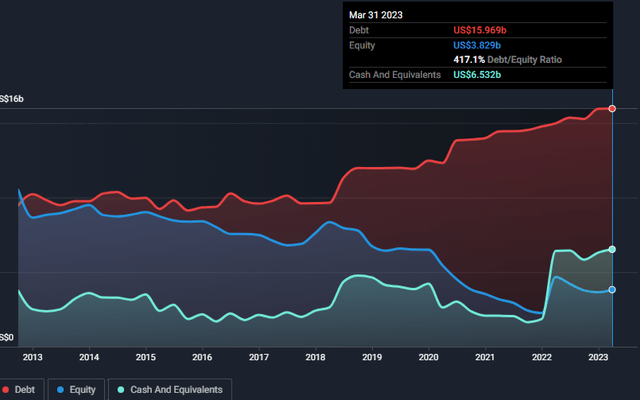

Of interest is that out of the total liability of $18.89 billion, nearly $16 billion is debt. The company’s debt-to-equity ratio has risen in the past five years, from 115% to 417%. Therefore, LVS has high financial leverage. One of the crucial elements worth evaluating is this company’s ability to service this high debt. With an EBIT loss of $95 million, it is very evident that the company’s earnings cannot cover its interest expenses of $764 million. Further, with negative cash flows from operations, it is alarming that the company’s cash flows can’t cover its current principal amount. In my view, this leaves this company in a very precarious situation.

The management has been pursuing growth in Macao and Singapore through investments in capacity expansion. Thus, LVS, to a great extent, has been channeling resources to reinvest in the business as a growth strategy. However, the company is unprofitable at the time and has registered EBIT losses since FY 2020. Therefore, I believe its use of debt financing has yet to pay off.

Simply Wall Street.

RISKS

The company bears the following risks besides the weak balance sheet.

- Downturns in the economy could potentially reduce discretionary consumer and corporate spending. Consumer demand for the company’s offerings is sensitive to fears of recession, exposure to a widespread health epidemic, such as the COVID-19 Pandemic, the increased cost of travel due to hiked fuel prices, etc. These factors could potentially reduce consumer and corporate demand for the leisure, luxury amenities, and business activities LVS offers, thus imposing additional limits on pricing and harming operations.

- Resurges or new variants of COVID-19: In the event of resurges in the places where the company operates, it will significantly impact the operations as policies restricting domestic or international travel will be limited, further disrupting the operating hours. The interruption poses a significant risk to the business, financial position, and cash flows.

Valuation

In the absence of a PE ratio due to negative earnings, I will use the PS ratio to judge the company’s valuation. My choice for this metric is guided by the fact that the company is in a relatively cyclical industry that may not necessarily show yearly net profits. Therefore, with a PS ratio of 8.81x, significantly higher than the industry median of 0.88x, it is evident that LVS is trading at a premium. However, considering its strong momentum, I still believe the company has some upside potential. I believe the market is pricing the company an optimistic future, which the MRQ improvements have affirmed.

In my view, the current momentum will fuel a minimal upside, and as a result, I expect the company’s shares to peak at about $65 per share. This valuation, therefore, means that it isn’t the right time for potential investors to board now, but the opportunity here is for current investors to hold until the stock peaks, cash out then wait for a cheaper entry point, perhaps when the financial health improves.

Conclusion

As travel restrictions loosen, the leisure industry is poised for a complete recovery. Integrated resorts like LVS anticipate increasing visitors as the industry continues to operate below 2019 levels. Nonetheless, it is utilizing its growth strategies to keep its head above water and remain profitable and sustainable. However, its high financial leverage, poor profitability, and cash flows leave the company at a very high financial risk. Further, the company is already trading at a premium, making it unattractive to potential clients. Considering these factors, I think the opportunity here is to hold until the shares peak at about $65, cash out the profits, and then reenter cheaply, perhaps when the financial health improves.