marketlan

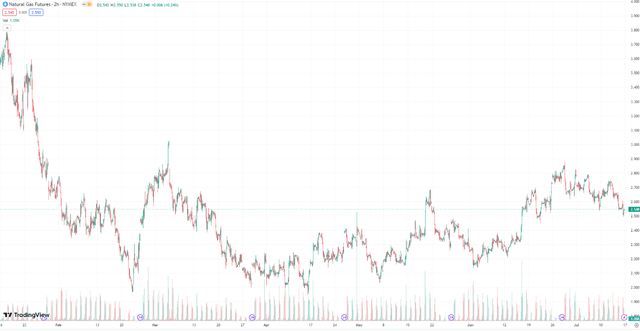

Natural gas (NG1:COM) may have bottomed in April at slightly below $2:

TradingView

Will gas go back to $10/MMBtu soon? Barring any weather-driven production outages as during winter storm Uri in 2021, probably not, even though natural gas can always surprise. Last year’s price spike was likely the product of unique circumstances, among which the European Union’s scramble to buy any LNG cargo available.

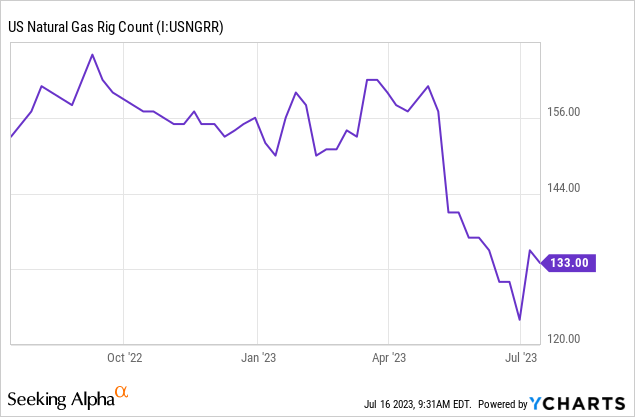

However, $2 isn’t sustainable either and the decline in U.S. gas-directed rigs sent a strong signal that supply is becoming uneconomic at these prices:

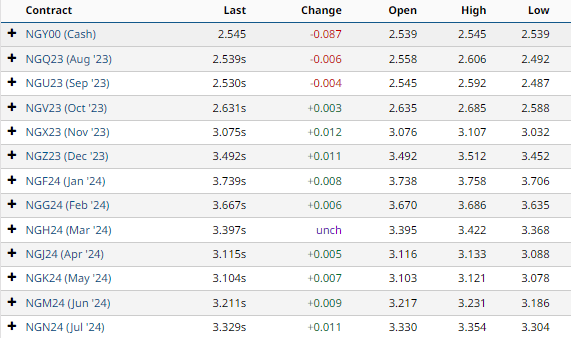

The futures curve continues to imply higher prices several months out:

barchart.com

Some of it is the winter seasonality, but $3-handle prices are expected next summer too.

So assuming natural gas continues its rebound to more moderate levels of $3-$4 per MMBtu, which natural gas stocks are a buy?

Virtually every E&P company, from the majors Exxon (XOM) and Chevron (CVX) down to privately held moms-and-pops, produces some natural gas. However, for many producers gas is more of a byproduct and big swings in the gas price don’t impact the cash flows as much as oil (CL1:COM).

When we talk about “natural gas producers” we think about companies that indeed generate most of their cash flows from natural gas. I focus here on a group of large, independent U.S. producers for which gas is the main driver. This includes Antero Resources (AR), Chesapeake Energy (CHK), CNX Resources (CNX), Comstock Resources (CRK), Coterra (CTRA), EQT Corporation (EQT), Gulfport Energy (NYSE:GPOR), Range Resources (RRC) and Southwestern Energy (SWN). Together, this group produced on average 23 bcf/d of natural gas (methane) in Q1; if we think of the U.S. market as 100 bcf/d, this is almost 25% of the domestic supply.

The bullish thesis for natural gas

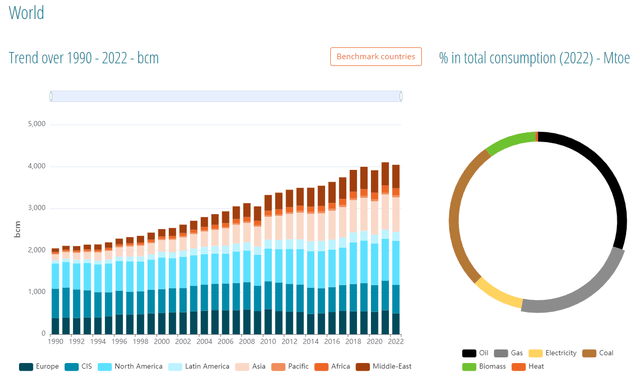

This isn’t intended as a macro article, but I will mention some of the big picture points. First, global gas consumption is in secular growth mode:

Enerdata

The latest data suggest 4,000 bcm global consumption which is about 385 bcf/d. So think of the global market as 4x the U.S.; also of U.S. production, 15% or so isn’t consumed domestically, but exported as LNG globally or via pipeline to Mexico.

In the unlikely scenario that electric vehicles displace ICE and oil demand falls, natural gas demand will still continue growing. We saw recently how the intermittency of wind and solar created quite a bit of energy stress in Europe and only the warm winter helped avert a crisis. Parts of the U.S. such as California and New England aren’t immune to these problems either as they have more limited pipeline connectivity to the rest of the United States. So gas as a “bridge fuel” will be needed for decades to come. Yes, there is nuclear, and the sentiment toward nuclear power is improving, but it still takes a whole lot of time to construct a nuclear power plant.

The challenge for natural gas is, simply put, getting it from point A to point B. Across long distances, the only method is LNG. This means expensive infrastructure for liquefaction (export plants), shipping (LNG carriers) and regasification (import terminals). It sill remains the case that the LNG infrastructure acts as constraint on the global gas trade. The U.S. produces 100 bcf/d but can export 12-13% of it.

The good news is that the LNG trend accelerated as the war in Europe seems to have taught policy makers some lessons on energy security. Yes, pipeline trade is much cheaper, but it also creates mutual dependency on both sides of the trade. Pipelines can also get blown up as it now seems. So why not pay up a bit more to have your own regasification terminal and the freedom to import from any of multiple suppliers in the world? That seems to be the logic of companies like Excelerate Energy (EE) or New Fortress Energy (NFE) that focus on regasification.

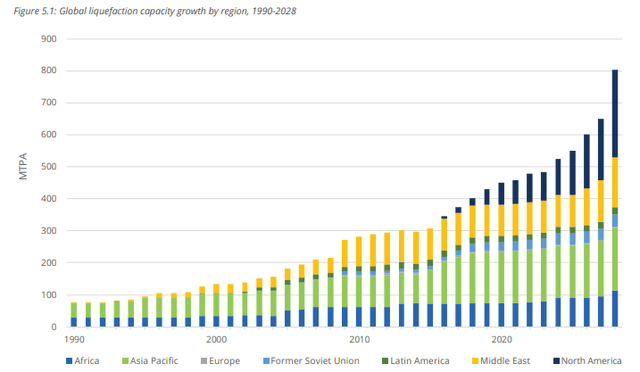

On the liquefaction side, FIDs have also accelerated. The International Gas Union, an advocacy organization for LNG, now expects global liquefaction capacity to reach 800 MTPA in 2028:

International Gas Union

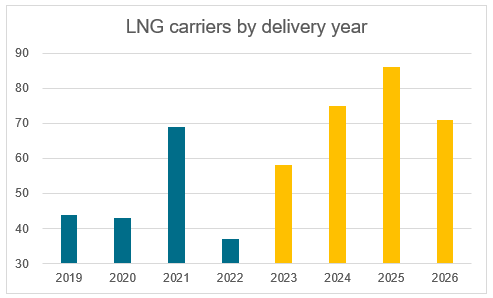

By my conversion math, that is about 104 bcf/d; so the LNG infrastructure may support 25% of the global demand soon. LNG carrier orders in shipyards are also at record highs:

The Energy Realist

This may not be great news for LNG tanker owners as it will drive charter rates down, but it is good news for the users of the LNG infrastructure (producers and consumers).

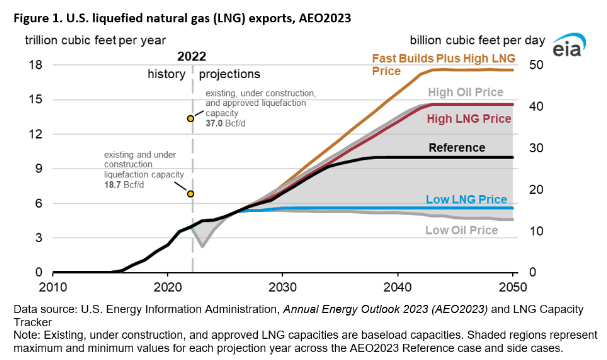

Much of the expansion in LNG export capacity will come from the U.S. The EIA, for example, sees 20 bcf/d export capacity a few years out:

EIA

Commodity prices are set at the margin, so if there is an export call on 20% of U.S. supply, this is quite meaningful.

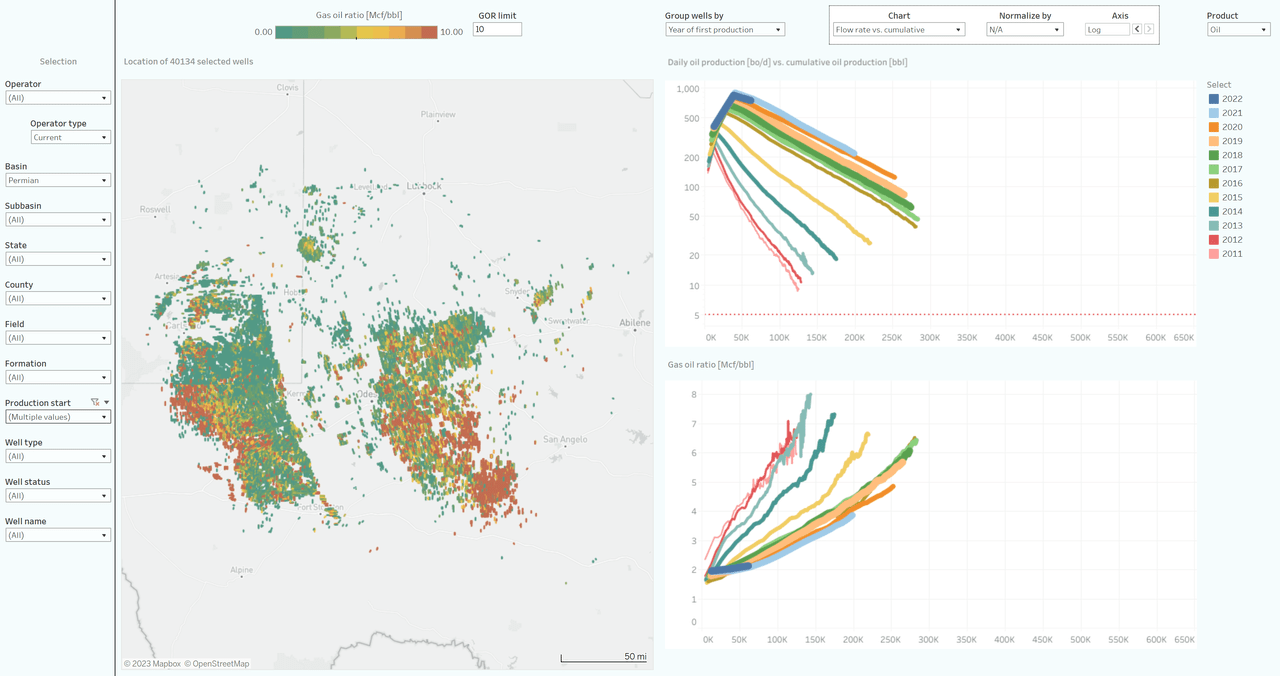

Are there any headwinds? Yes, rising gas-oil ratios as U.S. shale matures:

Novi Labs

As shale oil producers go through their best inventory, their wells are expected to get more gassy. As gas is a byproduct for oil producers, they are less sensitive to gas prices. This may put pressure on pure play gas E&P companies and should keep some lid on gas prices in the medium term.

So to recap:

- Natgas isn’t going away, even if all cars in the world get replaced by EVs overnight

- The U.S. will enjoy greater export capacity but potentially also greater byproduct supply

This probably favors moderate U.S. prices of perhaps $3-$4 in the medium term. Prices in Europe or Asia could be much higher of course, but U.S. producers sell at domestic prices and the middlemen capture the arbitrage. My thesis probably isn’t “ultra-bullish”, but going from $2 to $4 MMBtu would still be quite bullish.

Which natural gas stock should you buy?

Each gas producer has a unique production profile, hedging book, leverage and others so comparing a simple P/E ratio can be misleading. That is why I want to show you my focus group from several different angles; these are considerations investors should have in mind when looking at any gas prospect, not just the large producers I discuss here.

Liquids yield

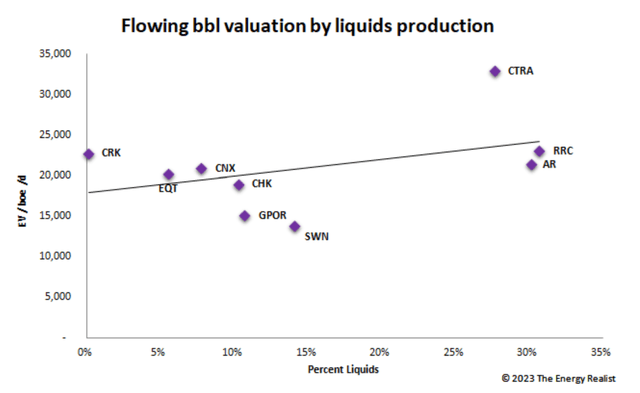

Production is always a mix of dry gas, natural gas liquids (or NGLs, such as propane, butane and higher) and oil or condensate. Even for my gas-focused group the percent of liquids varies, and, as liquids are more expensive, companies with higher NGL or condensate yields command some premium:

Company filings; The Energy Realist

Coterra, Antero and Range Resources stand out as more liquids rich than the others. However, valuations per flowing barrel also tend to increase with the liquids yield.

Price realizations

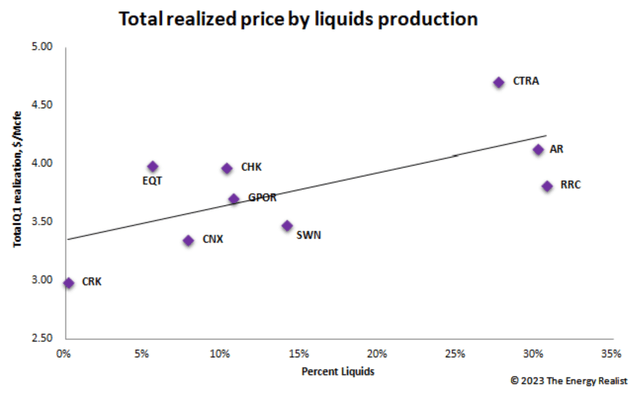

Companies with higher liquid yields will achieve better price realizations (on a Mcf equivalent basis):

Company Filings; The Energy Realist

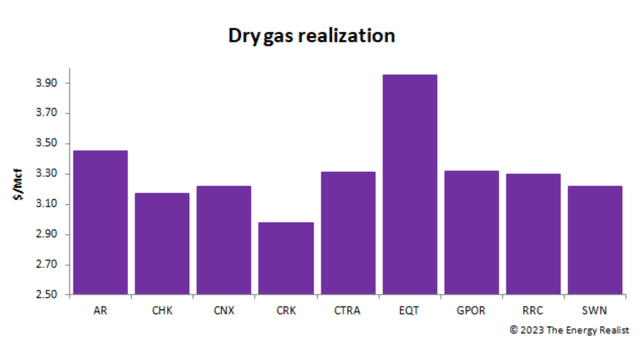

However, dry gas itself can also drive differences. Companies sell their production at different geographic locations so they may realize a premium or discount relative to a headline benchmark such as the NYMEX Henry Hub:

Company Filings; The Energy Realist

Chesapeake, CNX and Comstock Resources have the less advantaged pricing in the group for their dry gas production.

Hedges

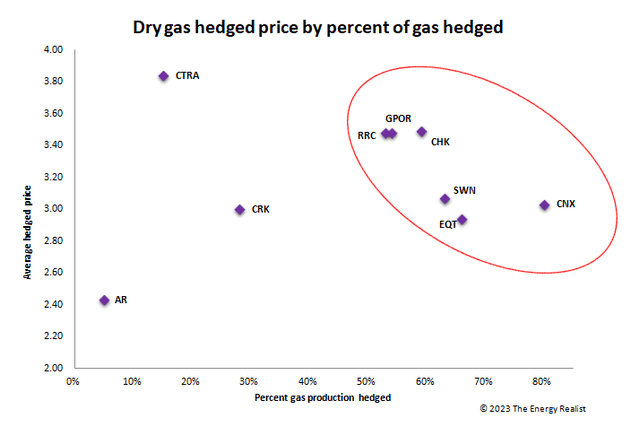

Oil and gas companies hedge a lot, especially if they are more debt-laden; the hedges may be required by the lenders. If you are hedged at $3/MMBtu, it matters little if the price is $10 or $15 MMBtu, and many windfall profits last year were lost to adverse hedges.

So the two relevant questions are: (1) what portion of your production is hedged; and (2) at what prices. For the remainder of 2023, the picture looks as follows:

Company Filings; The Energy Realist

Antero Resources is an outlier here; they have hedged a very small portion of their production and it is also hedged at a very low price. On the other end of the spectrum, RRC, GPOR, CHK, SWN, EQT and CNX are more than 50% hedged. GPOR, RRC and CHK are also hedged at average prices that exceed the market by $1 per MMBtu, so their hedges will be a cash flow tailwind.

Valuation

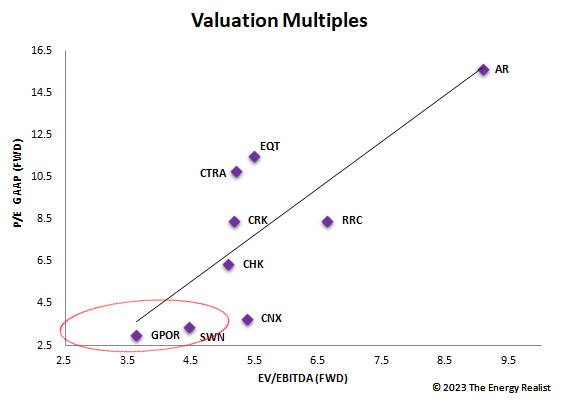

With the above context in mind, let’s jump into the valuation aspect. At the risk of stating the obvious, if the price of your commodity product was $10 last year but is $2 this year and the futures imply $3 to $4 next year, looking at any trailing metric is pretty much useless. We are only going to look at forward multiples here:

Seeking Alpha; The Energy Realist

Antero Resources is the most expensive company in the group; Gulfport and Southwestern appear to be the best value.

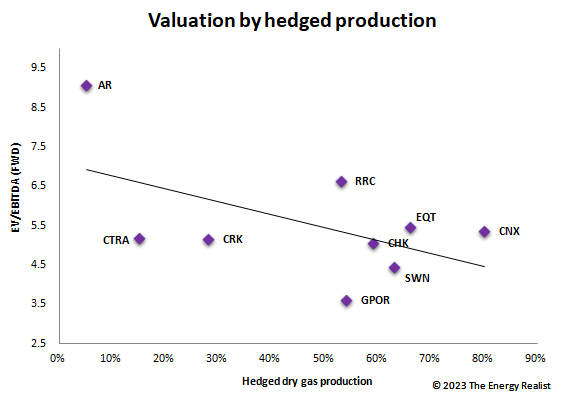

Interestingly, the less hedged you are, the more generous the valuation multiple:

Company Filings; The Energy Realist

Antero again stands out. AR has higher liquids yield too but it is comparable to Coterra. So this chart may make sense if equity investors expect a sharp rebound in gas prices; if we do go back to $10 per MMBtu, Antero would probably be the only who will capitalize on this in full. With stagnant prices this makes less sense.

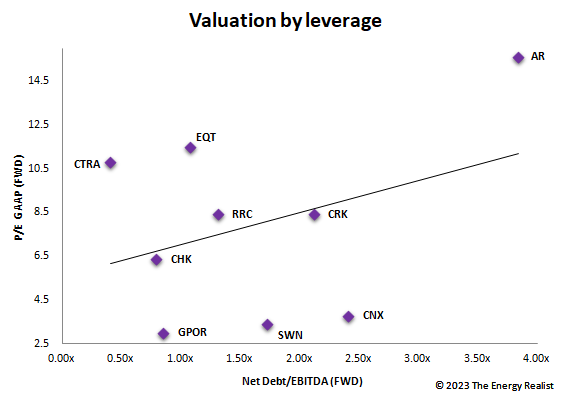

Interestingly, Antero is also the most leveraged in the group:

Company Filings; The Energy Realist

Again, this would make sense with a sharp gas rebound. Antero’s equity would benefit from the greatest “torque.” In a low to moderate price scenario, Antero appears overvalued though. GPOR seems the best value for less bullish scenarios with the third lowest leverage and the lowest P/E multiple.

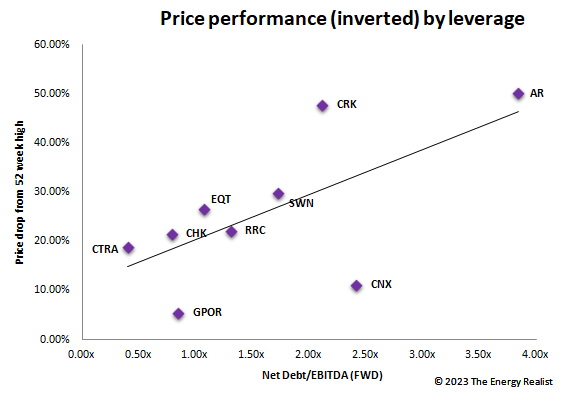

To build on my point that the high leverage is a big factor in Antero’s pricing, I also want to show you how leverage correlates to the drop from the 52-week highs:

Company Filings; The Energy Realist

Antero is down 50% from its highs, the biggest loss in the group. Low-leverage Gulfport is barely down at all. Leverage cuts both ways so it ultimately depends if you think we are headed to $3, $4 or $10 gas.

Bottom line

Two companies from the group stand out. Antero Resources is best positioned to capitalize on a sharp increase in gas prices and its high leverage will magnify the effect on the equity. However, if prices stay where they are or go up modestly, Antero appears overvalued.

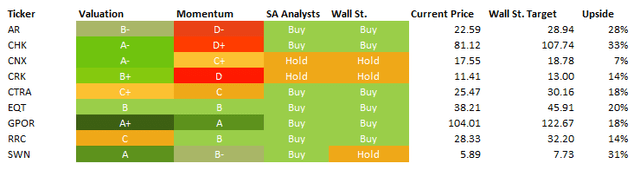

On the other hand, Gulfport appears as the most undervalued for a low to moderate price scenario. A meta-analysis of Seeking Alpha’s metrics (valuation, momentum, SA analysts and Wall Street) confirms that GPOR may be the best buy here:

Seeking Alpha; Author

GPOR scores the highest on valuation (like SWN) but is also the only stock with “A” momentum score (suggesting perhaps, that “trend following” investors may be interested too). GPOR has lower leverage than SWN and a higher hedged price that exceeds the market by a dollar.

If gas prices end up close to what the futures suggest, my bet would be on Gulfport. Antero appears to be the most expensive stock, even accounting for its liquids yield and pricing advantages.

Finally, I think this analysis (especially, the hedges which are in the money) shows that as a whole, the U.S. gas group can continue producing profitably even at today’s prices and we may have already seen the worst from the decline in rigs and frac fleets. I remain quite bullish on oilfield services companies that supply services to the above group:

- Nabors Industries (NBR), provider of land drilling rig services;

- ProPetro (PUMP), a completions/hydraulic fracturing company;

- Liberty Energy (LBRT), another pressure pumper and competitor of PUMP.

The starting valuation is one of the biggest drivers behind investment returns, and, after the selloff earlier this year, I believe that currently premium onshore services providers, with state-of-the-art equipment, offer better risk-reward than the gas producers themselves. Within the gas peer group, Gulfport would be my top pick.