muhammet sager

A little while ago, I wrote an update on the Kayne Anderson NextGen Energy & Infrastructure, Inc. (KMF), noting investors should vote to tender to the upcoming merger with the Kayne Anderson Energy Infrastructure Fund (NYSE:KYN). Given the pending merger proposal between the KYN and KMF, I wanted to add my thoughts on the KYN fund, for any readers who may be interested.

By itself, I view the KYN fund as an underperforming energy infrastructure fund that lags passive ETFs. For existing KYN unitholders, I fail to see the benefits of the KYN/KMF merger. I would avoid the KYN fund myself.

Fund Overview

The Kayne Anderson Energy Infrastructure Fund is a closed-end fund (“CEF”) that aims to provide total returns to investors with an emphasis on cash distributions by investing at least 80% of its total assets in securities of Energy Infrastructure companies. The KMF fund has $1.9 billion in total assets and $406 million in leverage for 21.7% effective leverage.

Strategy

The KYN fund exposes investors to investment opportunities in the energy infrastructure sector like midstream pipelines, natural gas processing plants, and utilities. Energy infrastructure companies tend to have contracted/regulated businesses that generate stable cash flows with high barriers to entry that may appeal to conservative income-oriented investors.

Portfolio Holdings

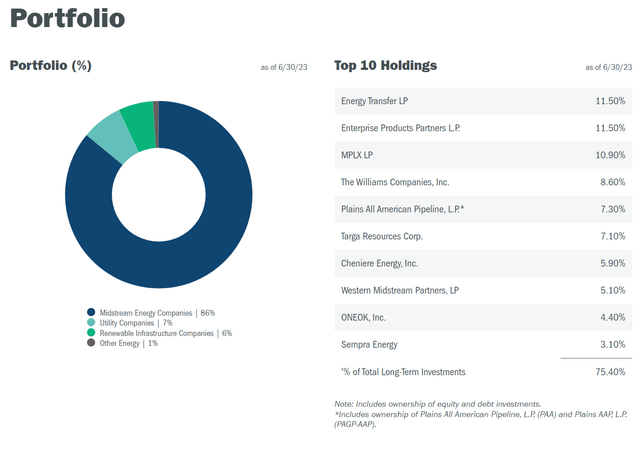

Figure 1 shows KYN’s sector allocation and top 10 holdings. The fund currently has 86% of assets invested in midstream companies, 7% in utilities, and 6% in renewable infrastructure.

Figure 1 – KYN sector allocation (kaynefunds.com)

The KYN fund is very concentrated, with its top 10 holdings comprising 75.4% of the fund.

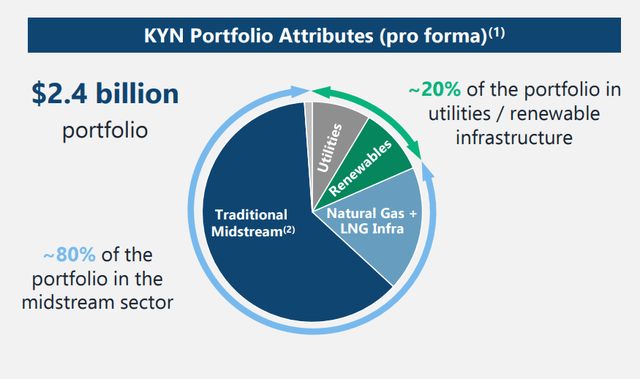

Investors should note that with the proposed KYN/KMF merger, the pro-forma sector allocation will shift modestly, with the percentage in non-midstream assets increasing to ~20% of the portfolio (Figure 2).

Figure 2 – Pro-forma KYN/KMF sector allocation (kaynefunds.com)

However, overall, the KYN fund should still be primarily an energy infrastructure fund, even after the KYN/KMF merger.

Returns

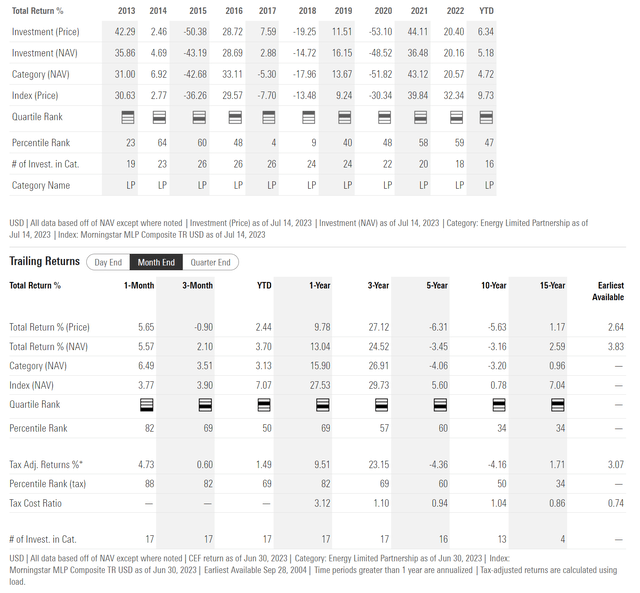

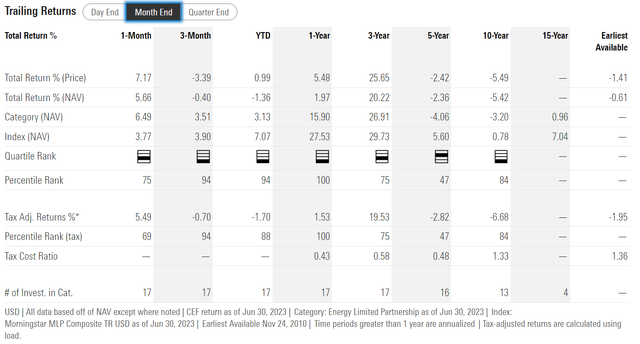

Figure 3 shows KYN’s historical returns. The KYN fund had a strong 2022, returning 20.2% when the S&P 500 suffered an 18% drawdown. This follows on a strong 2021 performance when the KYN fund returned 36.5%. However, longer term returns for the KYN fund have been subpar, with 5/10/15Yr average annual returns of -3.5%/-3.2%/2.6% respectively to June 30, 2023 (Figure 3).

Figure 3 – KYN historical returns (morningstar.com)

Distributions & Yield

The main attraction of the KYN fund is its high distribution yield. The KYN fund is currently paying $0.21 per quarter or an annualized 9.9% distribution yield. On NAV, the KYN fund is yielding 8.5%. The KYN fund’s distribution is backstopped by its portfolio of energy infrastructure assets that tend to pay high dividends/distributions.

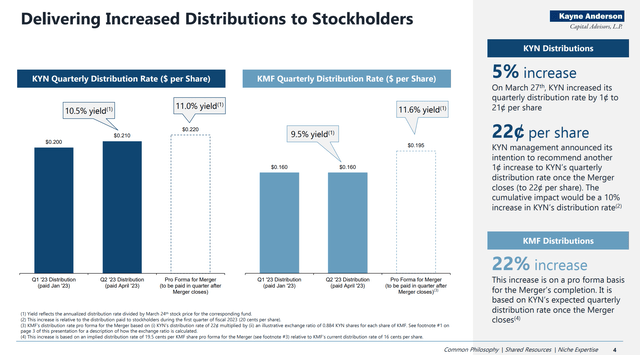

If the proposed KYN/KMF merger is approved, KYN investors stand to see a bump to the quarterly distribution to $0.22 / share (Figure 4).

Figure 4 – Pro-forma KYN distribution will be raised to $0.22/qtr (kaynefunds.com)

Fees

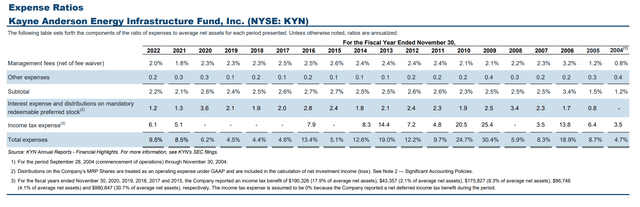

The KYN fund is an expensive fund, charging 2.0% in management fees in 2022. Combined with interest expense and other fees, KYN’s total expense was 3.4% in 2022 (Figure 5; note, income tax expense is not included in the above fee discussion).

Figure 5 – KYN charges a 2.0% management fee (kaynefunds.com)

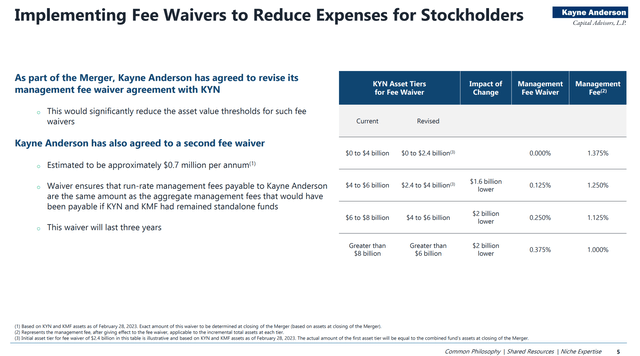

Note, KYN’s management have also agreed to reduce management fees for assets above certain thresholds, pending the KYN/KMF merger. However, these thresholds are set at the consummation of the transaction, so it will only apply to new assets (from inflows and market appreciation).

Figure 6 – KYN fund will implement fee waivers pending merger (kaynefunds.com)

If future performance is poor and/or the fund sees outflows (fund mergers usually trigger a bout of asset churn), there will be no impact to management fee rates.

KYN Vs. AMLP

With a 3.4% total expense ratio, the KYN fund appears to be an expensive way to gain access to infrastructure assets. For example, the ALPS Alerian MLP ETF (AMLP) is a passive ETF of energy infrastructure companies that only charges a 0.85% expense ratio.

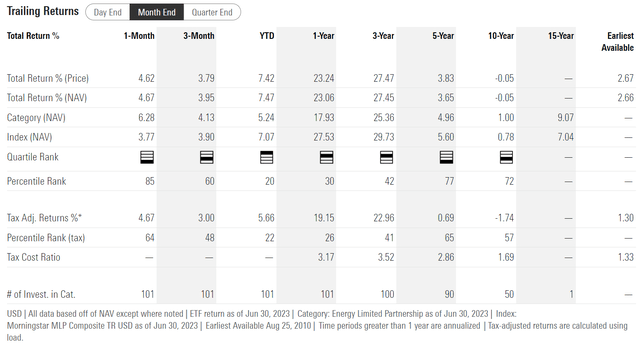

In terms of performance, the AMLP has outperformed the KYN fund, with 1/3/5/10yr average annual total returns of 23.1%/27.5%/3.7%/0.0% to June 30, 2023 (Figure 7).

Figure 7 – AMLP historical performance (morningstar.com)

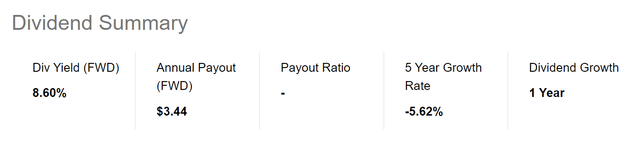

The AMLP also pays an attractive distribution yield of 8.6% that is comparable to the KYN fund without the use of leverage (Figure 8).

Figure 8 – AMLP pays an 8.6% distribution without leverage (Seeking Alpha)

KYN/KMF Merger Thoughts

The proposed merger between the KYN and KMF is marketed as a NAV-for-NAV merger that will ‘position the resulting fund for the future to capitalize on long-term tailwinds in the energy infrastructure sector’. The merger is expected to qualify as a tax-free reorganization and KMF unitholders will be issued KYN shares and or cash.

The KYN fund is a bit of an industry consolidator, as it had absorbed the assets of the Fiduciary/Claymore Energy Infrastructure Fund (“FMO”) in March 2022.

As mentioned above, I recommended current investors in the KMF fund to vote ‘yes’ to the merger, as it is in their best interests to do so. If the merger goes through, KMF unitholders who choose the cash option may see a closing of the KMF fund’s 14% discount to NAV. However, what about current investors in KYN?

For current KYN investors, I do not believe the KYN/KMF merger is in their best interests. From Figure 2 above, we can see that the proposed merger will dilute KYN’s energy infrastructure holdings. However, if we look at the historical performance of the KMF fund, with 1/3/5/10Yr average annual returns of 2.0%/20.2%/-2.4%/-5.4% respectively to June 30, 2023, we can see that KMF’s more diversified holdings have underperformed KYN’s more concentrated energy infrastructure allocation (Figure 9). So why should KYN unitholders diversify to get potentially lower returns?

Figure 9 – KMF historical performance (morningstar.com)

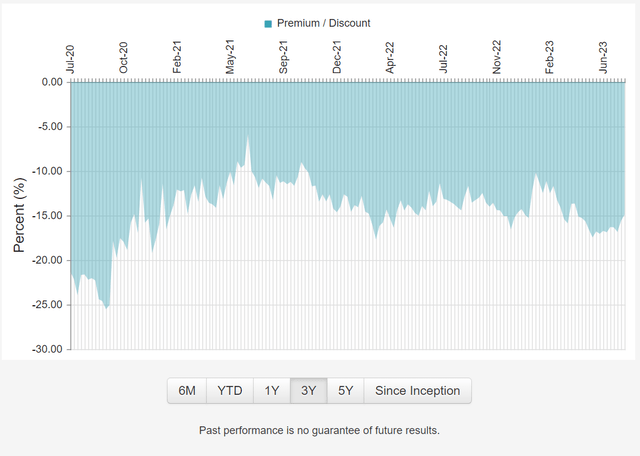

Furthermore, the 95% of NAV cash tender option is only available to KMF unitholders whereas the KYN fund itself is also trading at a steep 14% discount to NAV (Figure 10). What plans do management have to improve the discount for KYN unitholders?

Figure 10 – KYN trades at a 14% discount to NAV (cefconnect.com)

True, KYN management have proposed a $0.01 / quarter increase to the fund’s distribution. But as I continually stress to readers, distribution yields should not be the main driver of investment decisions. Instead, investors should focus on total returns, as retained capital can be left to earn higher compounded returns rather than paid out.

While the proposed KYN/KMF merger may benefit KMF unitholders (95% of NAV cash option, merging with a better performing fund), the same cannot be said for KYN. I fail to see how it benefits unitholders of the KYN fund.

The record date for the stockholder meeting was June 20, 2023 and I expect the results of the KYN/KMF merger vote to be available in the coming weeks.

Conclusion

Purely on its own investment merits, I believe the KYN fund is a below-average energy infrastructure fund charging a high management fee for sub-par returns. I would recommend investors avoid it.

For existing unitholders of the KYN fund, I do not see the merit of the KYN/KMF merger. Getting more assets for the sake of getting larger possibly only benefits the manager who earns management fees on AUM in my opinion. Investors should care about investment returns, and the KMF fund, although also managed by the same management team as KYN, has performed worse historically.

Instead of playing financial engineering and consolidating funds, I think management should try to improve its investment process so that investment returns, at a minimum, beat that of a passive ETF of energy infrastructure assets.