Serjio74/iStock Editorial via Getty Images

Above: Paris, opened in 2016, is strong attraction for premium mass play.

We are now days away from Las Vegas Sands (NYSE:LVS) Q2’23 earnings release. Right or wrong, we sniff a beat. Analyst consensus is looking for ~$0.42 to $0.53. We base our beat scenario from on the ground sources both in Macau and Singapore. We also must confess to some recency bias we’ve built into our analysis since China dropped zero covid policy last January 6th. We’ve noted that sequentially since that January data, the combination of pent up demand and saved bankrolls among premium mass and mass play has produced y/y dramatic gains in monthly GGR. June’s momentum halted with a slight decline. But that is clearly a seasonal trend built into the market even during its pre-covid hey-days.

So we are looking for something around the higher forecasts, perhaps even scraping near $~0.60 with revenue tipping above $2.42b. Even if we merely get consensus in the forty cent range, I am now projecting sequential gains for GGR both in Macau and Singapore which could move revenues back over $10b for the year. For context, LVS, with its Vegas properties in the group did $12.1b in baseline 2019.

The longer-term look at LVS shows it had reached over $146 when VIP was at its peak and before Beijing’s crackdown on junkets and money laundering in the 2013/4 years. 2015 showed the beginnings of a decline in the VIP segment. In those years, big play represented 70% of revenue totals. So the years between 2016 and 2019 saw the shrinking of that segment.

It was replaced by the growth of premium mass and mass segments. What is now left of VIP will migrate into premium mass, but the ball game is all in the mass sector post covid. And that is where LVS will shine given its market share in the low 20%+ range and its far and away biggest room capacity in Macau at 12,000. It is these factor that play heavily in our view in a bullish scenario for the stock in the quarters ahead for this year and next year as well.

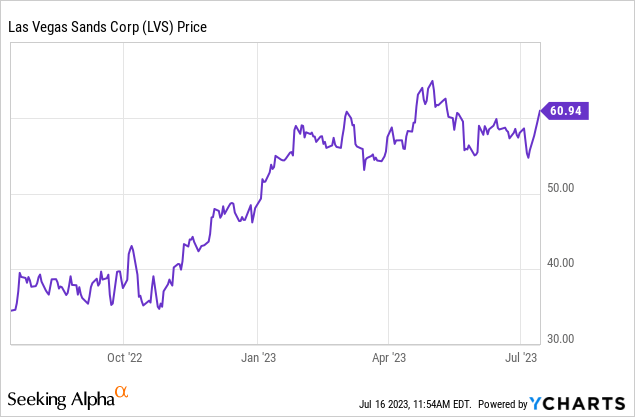

On Seeking Alpha, January 5th, I guided buy on LVS when shares were $51.99, then later that month they moved just above $58. These calls were made in the earliest post zero covid ban. Now at this writing the shares have moved just above $60, a bit of a dip off a 52 week high of $65. The sequential rise of GGR both in Singapore and Macau until the slight June dip have not changed my conviction that this is a $70-$73 stock in hiding.

Above: It’s time to move from BUY to STRONG BUY as both Macau and Singapore are sustaining post-covid gains.

For the year 2023 I am looking for an EPS of $2.65 to $285 and for 2024 we see accretive earnings contribution from Marina Bay Sands in Singapore with $1b in extensive renovations and modernization coming to the property before the end of the year. Behind it is LVS long term commitment to the government of Singapore for an additional $3.3b expansion which will include gaming space and rooms, but primarily focused on non-gaming attractions.

Also moving ahead to the end of the decade is a $3.8b LVS Macau expansion of mostly non-gaming attractions and rooms to meet the government mandated goals of changing the revenue mix to produce 30% or more of global tourist attractions. This will be a heavy lift for the entire sector which today, more or less produces about 10% of its revenue in non-gaming. But among its peers, LVS is very well positioned to build non-gaming revenue in the years ahead. This was a basic mantra of former LVS Chairman Sheldon G. Adelson and is already reflected in the existing properties offerings.

Key numbers

We have built our case that LVS is undervalued over a long period interrupted of course by covid from 2020 to as recent as last December. The movement of the stock since the travel bans were dropped have not been as dramatic as one would suppose given the emergence from covid hell.

What’s changed

- YoY EBITDA growth 84/84%

- Gross profit margin (ttm) has risen to 62.1%

- Our estimated EPS for 2023 is above current consensus at $2.40

- We are looking for a further EPS performance above consensus of $3.73 to $04.26

As we have noted in prior SA commentary the reasons we believe LVS shares have not made it out of the gate as fast and ahead of many peers are evident. Investors continue to see the majority holding in the hands of the Adelson Foundation as adding to the difficulty of valuing the stock on the same capital structure as peers. The company’s decision announced in March of 2021 to sell off its entire Las Vegas portfolio was seen by many investors as a mistake. That $6.2b sale happened just as the Vegas market was soaring out of its covid malaise and pent up demand was explosive. The deal closed in early 2022 when that market was breaking historic gaming revenue numbers.

WSJ

Above: Many analysts were critical of LVS’ move to sell its Vegas assets which had been doing well. But management has its expansion interest elsewhere.

The company clearly characterized itself going forward as essentially an Asian company. The goals were to identify a third Asian market in which to build an integrate casino resort. Speculation centered on Thailand where a special legislative committee approved consideration of legalizing casinos. Despite the usual anti-casino public outcries by some segments of the population, the initiative has crept forward. No matter what the outcome, LVS will be among the most well positioned global operators to establish a footprint there.

LVS

Above: The proposed Long Island New York development is far off, but news of a license win for LVS could come before the end of 3Q23.

At best such a turn of events is so far in the distance that investors remain unimpressed. Also exacerbating the shoulder shrug of investors who in past years have looked to LVS for yield, the prospects for reviving dividend flow are at this point unknown. However, that may not be as far away as some investors think. Clearly as it always has been, the Yay Dividends mantra of Sheldon Adelson, was a core principle of his rationale. After all Adelson took half the yield off the table for himself and his foundation. But in that long stretch of years that the Fed kept rates ridiculously low, the yield on sold LVS shares was a feature of its value. LVS will need to sustain its revenue recovery and margin increases to bring back dividends. I believe that could happen this year.

The China economy has turned sharply down and stimulus is coming

Add to this the growing bearish outlook on the macro China economy. Best consensus estimates of GDP growth there are looking at ~2% for the current quarter and 5% for the year. The general outlook is bearish laid on the lower trade surplus, new home sales looking flat there, inflation rising and the general view that many China stocks have come under pressure and will continue that way until there is some clarification about further stimulus and the strength or lack of it in the Yuan.

On top of all this is the persistent global tension between Washington and Beijing emerging from issues old and new. The South China Sea naval issue lingers, fresh tensions over fears for Taiwan, China’s support for Putin’s Ukraine war. All these negatives built into the sector in general, appear to impact sentiment on LVS more than others because, within its own descriptive, its s a de factor Asia company.

But in our view, the strength and positioning in two of the globe’s most dynamic gaming markets in Macau and Singapore with proven properties and a massive capex development ahead that can only be accretive to future value tips the scales in favor of a higher valuation for LVS.

We will see 2023 Macau GGR beating all expectations. Morgan Stanley has revised its outlook several times noting as we do the sequential gains each month in GGR recovery. Its latest estimate puts 2023 GGR at $20b with EBITDA rising 70% for 2023 and 6% for 2024. Our own forecast as of the end of 2Q and what we see coming regardless of the slack in the China economy now, is a range of $26b to $28b for this year. We are looking for 2024 to meet and surpass baseline 2019 in the $37 to $38.7 range. The core of our call here agrees with the MS view that market infrastructure and improvement plus gains in overall footfall to Macau will be the key drivers.

I blend in my own proprietary archival data updated to the last week in June which tracks activity on the casino floor. I take archived data sets from Macau pre and post 2015 crackdowns, plus factoring in the covid disaster between 2020 and 2022 into my calculation. My on the ground observers, all former colleagues in the industry visit casino floors in peak and slack time frames. They eyeball occupied gaming positions. They observe game flow of average bets and times played. I then compare their estimates to my archived data sets on slots and table games. They estimate covers in dining outlets, show attendance. My results show that while VIP’s decline is apparent without question, premium mass is robust. This is as of the end of June.

There has been migration from the lower and middle end of VIP into that segment. But mass is where the home runs are being hit. This is in terms of daily footfall, average bets that have met prior amounts before both the 2015 crackdown and baseline 2019.

Stipulation: Please note that these appraisals of casino floor activity are not scientifically based research and do not presume to be. But they are the very well educated opinions of industry pros who can read action on a casino floor as accurately as it is possible. Over time I’ve found them to hold up very well when the shekels are counted at the end of each month by Macau regulators.

Conclusion

From the beginning of this year to now, shares of LVS have moved from ~$51 to ~$60. That’s not anything near an exponential burst. Nor has it neared my own PT’s from back then in the $70s. I do believe that price resistance based on the lingering investor concerns about the equity make-up of the stock are at the heart of why it has not shown more positive sentiment bringing it closer to my PT. I’ve reviewed my analysis from January and am moving my call from BUY to STRONG BUY.

To me, the prospects for the stock ahead far outpace current sentiment. LVS’ market cap sits at $46.57b, its long term debt at $15.99b and cash on hand $6.53b. It is well positioned to rapidly recover its baseline 2019 revenue and grow further from there.