zhengzaishuru

I last updated Devon Energy Corporation (NYSE:DVN) investors in May, as I anticipated DVN to bottom out, as its selling pressure seemed to have abated.

DVN has held its levels since then, even though it still underperformed the S&P 500 (SP500). However, the constructive consolidation over the past two months since DVN formed its March lows at the low $40s suggests that dip buyers are likely accumulating. It augurs well for my thesis that we could have been the worst selloff in DVN, as it has underperformed against its Energy Select Sector SPDR® Fund ETF (XLE) since October 2022.

With underlying crude oil prices also holding their consolidation zone since bottoming out in March, I assessed that buying sentiments in DVN could improve moving ahead.

DVN has struggled for momentum since October 2022, and rightly so. Revised analysts’ estimates suggest a steep decline in its adjusted EPS for Q2, down more than 50% YoY, after Q1’s 22.3% decline. As such, dip buyers who bought its lows in 2020 likely rotated out of DVN late last year, as they anticipated its blockbuster year would not likely be repeated.

Accordingly, Wall Street estimates suggest Devon Energy could report an adjusted EPS of $5.82 for FY23, down 30% YoY. Notably, the projections are in line with its E&P peers, which are also expected to see an earnings decline of nearly 30% YoY.

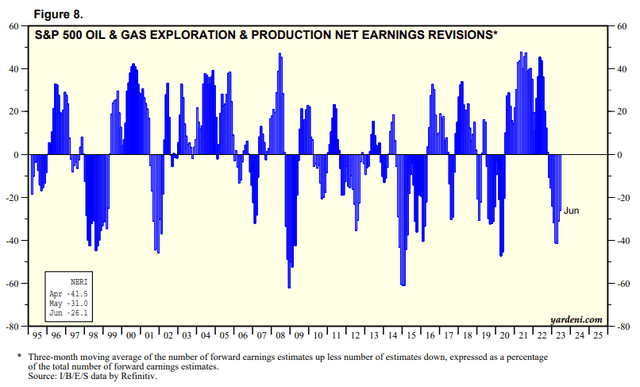

S&P 500 E&P net earnings revisions % (Yardeni Research)

However, I gleaned that analyst pessimism likely reached a nadir in April 2023, as they marked down their estimates. However, the extent of the downward revisions has also decreased, in line with the price action in underlying energy prices and Devon Energy’s sector peers.

I believe the market operators are trying to assess the macroeconomic dynamics on whether they still anticipate a recession moving ahead. China’s weak recovery from its COVID reopening has also intensified concerns that it might not be able to bolster a stronger second half for E&P players like Devon.

Moreover, the bifurcation in the forecasts between the IEA and OPEC could also have increased confusion about the medium-term estimates.

Devon Energy’s cost advantages have proffered it a narrow economic moat that should underpin its ability to grow its production levels sustainably. However, DVN’s steep decline from its October 2022 highs likely indicates that the market thinks that Devon Energy could be more significantly impacted if energy prices continue to remain in their doldrums.

I believe the critical question that investors need to address now is whether dip buyers have the conviction to defend the current levels, helping to stabilize buying sentiments in DVN.

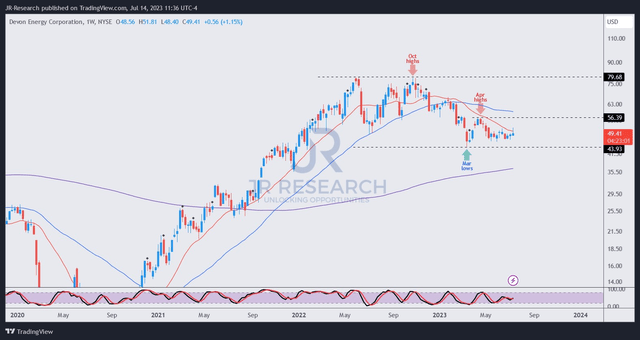

DVN price chart (weekly) (TradingView)

Taking a closer look into how dip buyers have supported DVN’s recent consolidation could unveil crucial clues for investors.

As seen above, DVN buyers didn’t allow its March 2023 lows to be breached, helping DVN to hold the low $40s defense line robustly. That has helped set the stage for an accumulation zone at the current levels, even though I have not observed aggressive buying momentum.

At a forward EBITDA multiple of 4.96x, it’s still below its peers’ median of 5.2x (according to S&P Cap IQ data), suggesting relative undervaluation. Hence, it corroborates the dip-buying interest in DVN, as investors support it after it crashed from its October 2022 highs.

Therefore, I’m increasingly optimistic that DVN could bottom out here, given analysts’ pessimism and the potential inflection point in its operating performance from Q2. I believe buyers have demonstrated their conviction that DVN seems attractive at the current levels, offering investors a solid opportunity to buy more before the rest return.

With that in mind, I believe getting more constructive with Devon Energy Corporation is appropriate.

Rating: Strong Buy (Revised from Buy).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!