JaCZhou

The use of renewable energy is a growing trend worldwide. One interesting industry to explore is the one that provides solutions for storing these irregular renewable energy sources. Fluence Energy, Inc. (NASDAQ:FLNC) stands out as a provider of large-scale energy storage systems in an industry that is projected to grow at a CAGR of 23% until 2030. Additionally, US-based companies enjoy long-term benefits from The Inflation Reduction Act. It’s worth noting that Fluence Energy is still in its early stages of its operations and hasn’t generated earnings yet, but there are promising signs of demand for its solutions and services in the next couple of years, which could lead to potential growth and profits. As a result, investors may want to consider a bullish stance on this stock.

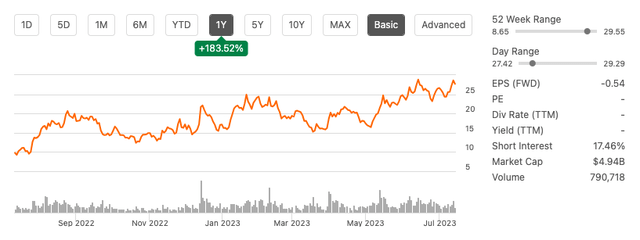

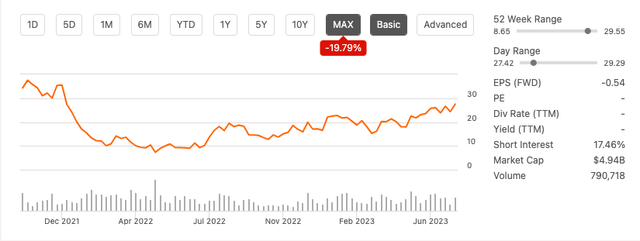

Stock trend since IPO (SeekingAlpha.com)

Company overview

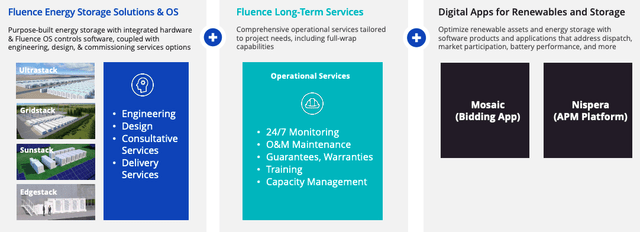

In 2018, Fluence was established as a result of a joint venture between Siemens (OTCPK:SIEGY) and AES Energy (AES). The company has a highly experienced management team with a long history in energy solutions. In 2021, Fluence acquired an AI driven software and digital intelligence platform renamed Fluence IQ from Advanced Microgrid Solutions for $125 million. Then, in 2022, the company acquired Nispera, a SAAS company that uses AI, for $30 million. Nispera has a digital portfolio of 15 GW. Fluence Energy specialises in energy storage products and services, specifically batteries that store and increase the efficient use of electricity. They also offer services to manage and monitor these systems. The company mainly produces grid stacks, which are ideal for high-energy-demanding applications such as large electric distribution points. Additionally, they have sun stacks that are specifically designed for solar plants, and edge stack products that are the least complex and used for industrial and commercial customers.

Solution and services overview (SeekingAlpha.com)

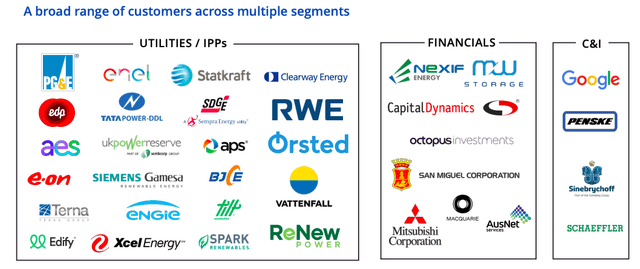

Many customers are drawn to these solutions because they offer improved battery reliability and performance, automated operations, cost savings, and increased energy storage revenue. These solutions are popular with B2B businesses, including large utilities, developers, and industrial and commercial enterprises.

Customer overview (Investor presentation 2023)

Revenue streams and growth potential

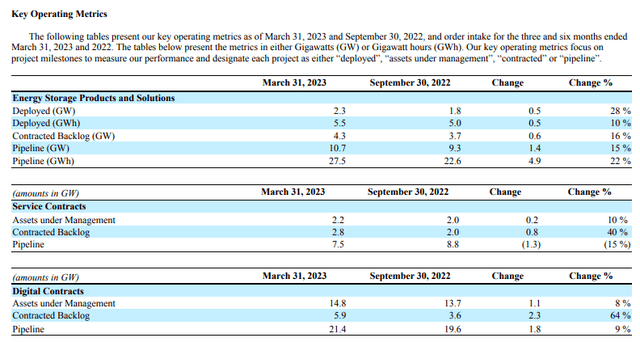

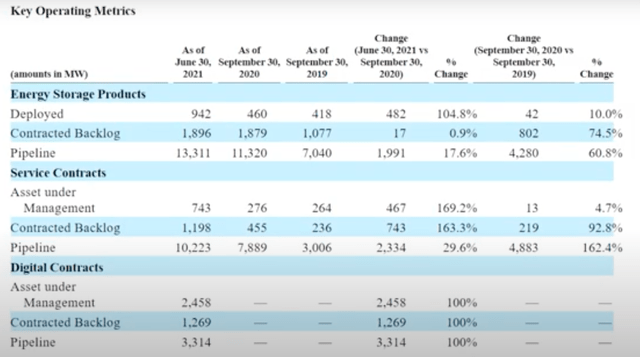

Fluence earns revenue by selling its products and providing ongoing maintenance, management, and software licenses. Customers can either manage their energy solutions or entrust the responsibility to Fluence Energy. The number of energy storage products and solutions, service contracts, and digital contracts has significantly increased year over year with double-digit growth. Additionally, a strong and expanding pipeline of revenue, excluding service contracts which saw negative growth, is likely to be realised within the next two years. This indicates a high demand for the company’s products.

Key operating metrics in GW (Sec.gov)

When we examine the Key Operating Metrics from 2019 to now, it’s clear that this business is experiencing significant growth momentum, and it’s not just a one-time strong showing.

Key metrics since 2019 in MW (sec.gov)

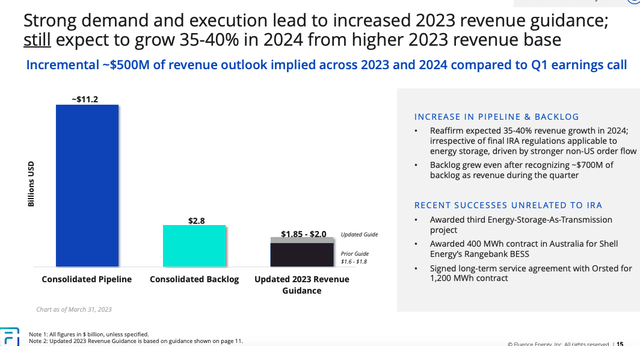

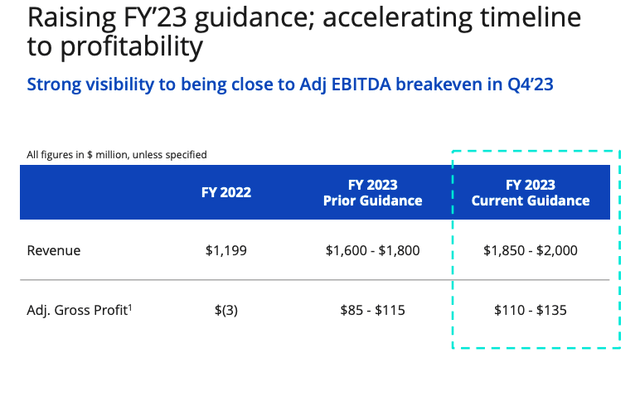

The management team has increased their outlook for FY 2023 due to the pipeline’s strong growth across various key operating metrics. Additionally, there are positive indications for a successful growth year in 2024.

Growth opportunities (Investor presentation 2023)

Financials

We are assessing a promising young company experiencing exciting YoY growth. However, they are now operating at a loss and are projected to continue to do so in the near future. Upon analysing the company’s key growth indicators, we have observed year-over-year growth, a growing pipeline, and a backlog. However, the company’s gross profit margin is notably low at 3.37%, and its gross profit for the trailing twelve months was $54 million.

Annual revenue and gross profit (SeekingAlpha.com)

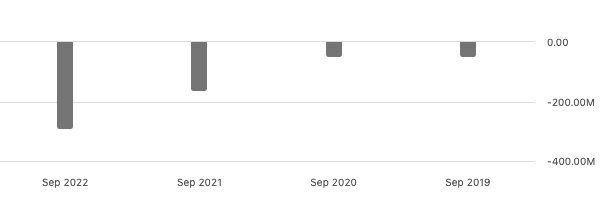

Net income was TTM negative $106 million, and we can see that losses from continuing operations have been downward trending. We expect this within the industry, which has high initial costs, which will reduce as the business expands and maintains its customers for longer periods.

Annual earnings from continuing operations (SeekingAlpha.com)

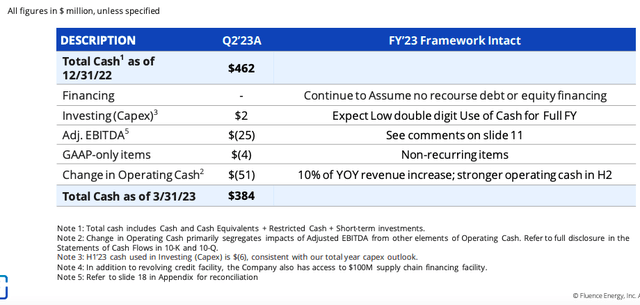

As the company is still reporting substantial losses, it is good to see that the Balance sheet has total cash at $384 million, which gives the company some margin to continue to grow and eventually achieve profitability. If we look at liquidity, the company has a current ratio 1.34, indicating that it can cover its short term liabilities.

Balance sheet (Investor presentation 2023)

The current trading price of the stock is lower than its average target price of $29.38, and it has been getting more attention from analysts lately. The consensus among Wall Street analysts is bullish, with a 4.23 rating. Although the stock has lost 19.79% of its value since going public in 2021, it has generated returns of 183.52% over the past year. However, there is a relatively high short interest in the stock at 17.46%, which suggests that investors have a negative outlook for its future performance.

Stock trend since IPO (SeekingAlpha.com)

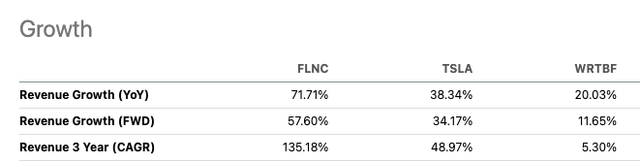

While I am comparing Fluence to Tesla (TSLA) and Wartsila (OTCPK:WRTBF) because they are all involved in energy storage, investors must recognise that they are at different stages and offer other products and services. We can see that as a young company, Fluence is experiencing a significant growth rate of 71.71% YoY in its top line, which is nearly twice as much as Tesla and over three times as much as Wartsila, although it is positive to see double-digit top-line growth in the battery industry for more mature companies.

Revenue growth versus peers (SeekingAlpha.com)

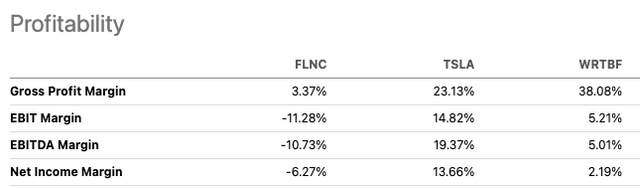

Although the company has not yet turned a profit, its profitability margin of 3.37% is quite low compared to its larger competitors. However, we anticipate that this will improve as the company matures and progresses into a more stable business stage.

Profitability relative to peers (SeekingAlpha.com)

Risks

As an investor, it’s important to be aware of the risks involved when investing in young growth companies that haven’t yet generated profits. These companies are often overhyped, and critical factors such as growing debt and incurred costs are often overlooked. It’s worth noting that the gross profit margin of this particular company is quite low, which could become problematic if inflation continues to rise and costs increase even more. Currently, the company outsources most of its manufacturing to factories in Asia, but it plans to expand with a facility in Utah in 2022 and has plans for Europe. Political factors could also play a role in the company’s potential growth. It’s worth noting that the business is seasonal, with the highest number of orders typically occurring between April and September. The company’s top 5% of customers also contribute most to its overall revenue. If a key customer were to leave, this could hurt growth.

Final thoughts

This company has shown significant growth in its key performance indicators, which is expected from an early-stage company. However, there is a risk in investing as it has yet to generate earnings and has small gross profit margins. Despite this, the company has enough capital to continue investing in growth. The guidance for FY2023 is strong, and the outlook for 2024 is positive, which may be a reason for investors to consider a bullish stance on this stock.

FY 2023 Guidance raise (Investor presentation 2023)