baona

Investment thesis

Devon Energy (NYSE:DVN) suffered year-to-date due to the weakness in oil and gas prices, which were sliding to the decelerating global economic growth, meaning lower demand for energy commodities. My analysis suggests the valuation is still unattractive despite the stock’s weak performance this year. The momentum for the energy sector looks weak amid the harsh macro environment of high-interest rates. I do not think that DVN is a good investment at the current stock price level, so I assign it a neutral rating.

Company information

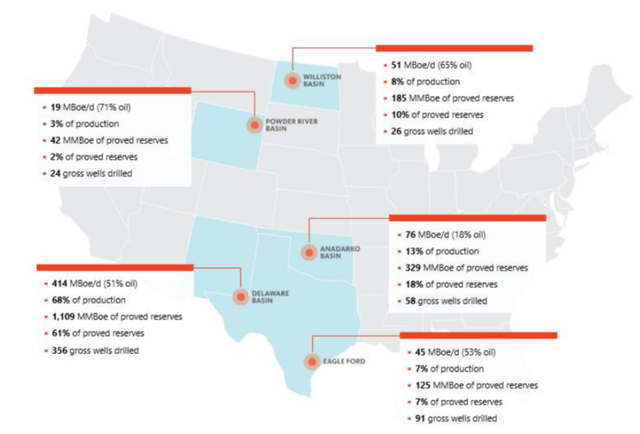

Devon Energy is an independent energy company engaged in exploring, developing, and producing oil, natural gas, and natural gas liquids [NGLs]. The company’s operations are concentrated in various onshore areas in the U.S.

Devon’s latest 10-K report

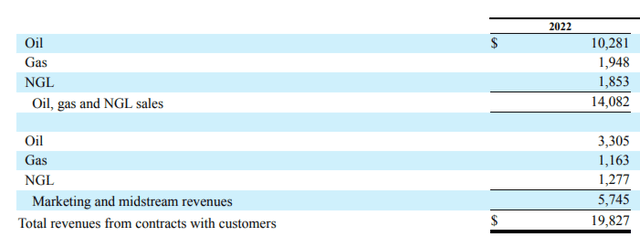

The company’s fiscal year ends on December 31. In FY 2022, DVN’s revenue from oil sales comprised about 53% of the total.

Devon’s latest 10-K report

Financials

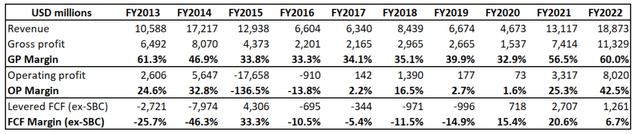

Devon’s financial performance has been volatile over the past decade as an oil and gas company. When the crude oil prices were above a hundred dollars per barrel, the company demonstrated a stellar 60% gross margin and above 20% operating margin. That was true at the beginning and the end of the past decade. But in the middle of the decade, crude oil prices suffered due to the oversupply caused by the shale oil and fracking technologies expansion. And that were the years when the company generated substantial negative free cash flows [FCF].

Author’s calculations

The business is very capital-intensive because the company has to drill new wells to support the pressure to avoid a decrease in each well’s efficiency. Over the past decade, the company spent over $42 billion on CAPEX, about 40% of the total 10-year revenue. The company’s operating margin becomes razor-thin and even negative when commodity prices plunge.

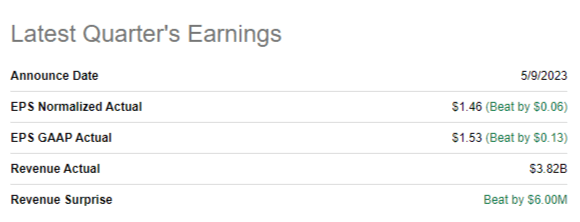

DVN announced its latest quarterly earnings on May 9, delivering slightly above-the-consensus results. Revenue was flat YoY, and the adjusted EPS shrank from $1.88 to $1.46. The decrease in Q1 EPS was primarily due to lower selling prices for crude oil, natural gas liquids, and natural gas, which outweighed the positive impact of achieving record production levels. Net production averaged 641,000 barrels of oil equivalent per day, a 12% YoY increase.

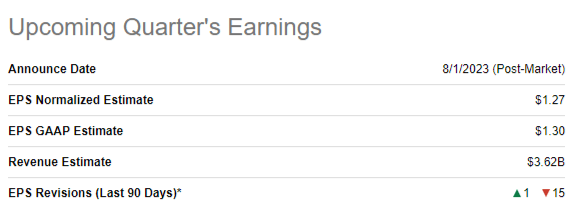

Seeking Alpha

The upcoming quarter’s earnings are expected to be announced on August 1, with a significant decrease in revenue due to much lower average prices. The adjusted EPS is expected to decrease twice amid the decrease in commodity prices.

Seeking Alpha

The company’s balance sheet is in good shape, with moderate leverage and liquidity metrics. DVN is in a substantial net debt position of about $6 billion. It is lower than recent years’ highs, but I believe the management could have allocated last year’s record profits to improve the balance sheet more than they did. Moody’s and Standard & Poor’s assess the company’s debt rating at the investment grade level.

Valuation

The stock significantly underperformed the broader market year-to-date with about 10% stock price decline. DVN also underperformed the Energy sector (XLE), which was almost flat YTD.

Valuation of oil and gas stocks is challenging. As we saw in the “Financials” section, long-term financial performance is very volatile and heavily dependent on commodity prices and economic cycles. Therefore, I believe that a discounted cash flow approach is not a good fit here.

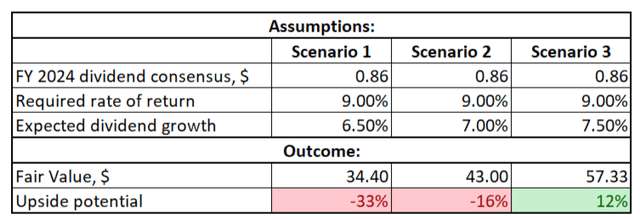

First, let me simulate three different scenarios of the dividend discount model [DDM] depending on the assumptions regarding the dividend growth profile. I have dividend consensus estimates expecting a $0.86 payout in FY 2024. Valueinvesting.io suggest that DVN’s WACC is at 9%, and I consider this fair. Due to the inherent high volatility of oil and gas companies free cash flows, projecting a dividend growth rate is tricky. Therefore, I prefer to simulate three scenarios to understand which dividend growth rate the company should demonstrate for the stock to be worth the current price.

Author’s calculations

As you can see, to prove the current stock price, the company should deliver a sustainable dividend growth rate of above 7%. With that said, from the DDM perspective, the stock is overvalued. I think so because a 7% dividend growth rate is complicated to sustain, especially considering the nature of DVN’s business. Another factor why I believe that sustaining a 7% dividend growth rate is unlikely to be delivered by Devon is its relatively high payout ratio of about 64%. The oil and gas business is capital-intensive, and the company will not be able to sustain production levels if a substantial portion of the cash flows are not allocated to CAPEX.

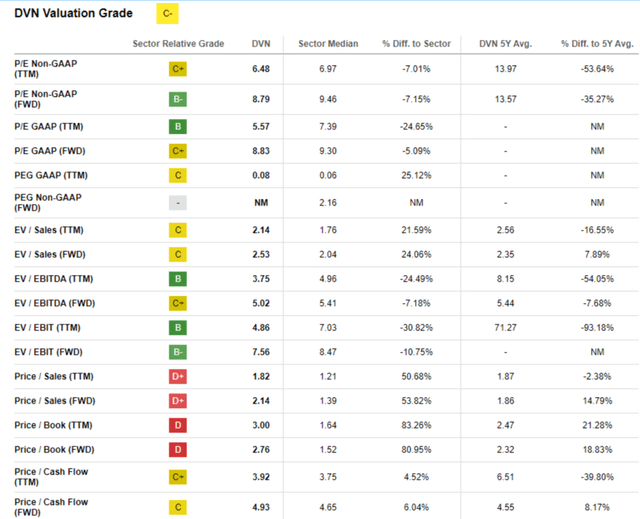

Now let me proceed with multiples analysis. Seeking Alpha Quant assigned the stock a “C-” valuation grade because of a mixed picture when we compare current multiples with historical and the sector median.

Seeking Alpha

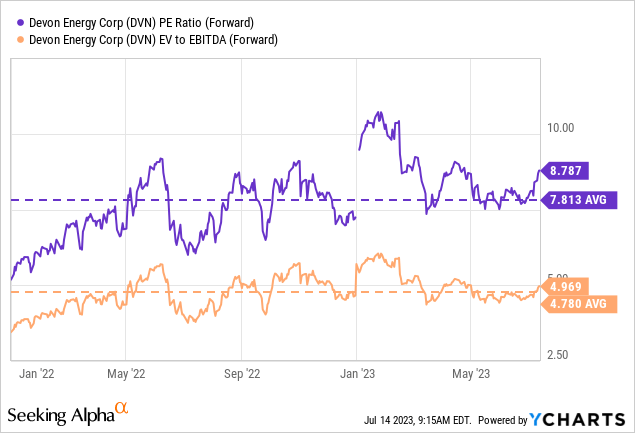

Comparing the last 5-year averages might be inappropriate because, over this period, many shocks occurred to the oil and gas markets, including the COVID-pandemic and the war in Ukraine. I would instead compare current multiples to the long-term average over the past ten years. As shown below, the current forward P/E ratio is substantially higher than the long-term average. The EV-to-EBITDA relationship is also currently higher than the ten-year average but to a lesser extent.

Overall, both valuation approaches point to the stock price overvaluation.

Risks to consider

Investors in Devon Energy stock should be aware of several risks. First, DVN’s earnings depend highly on crude oil, natural gas, and natural gas liquids prices. Commodity prices are out of the company’s control since they depend heavily on geopolitics. Over the last few years, we all saw how the crude oil price skyrocketed after Russia invaded Ukraine and started softening after the U.S. decision to use strategic oil reserves. These events are almost impossible to predict, often leading to the market’s overreaction to positive and negative news. This leads to high volatility for the energy sector stock prices. Devon Energy’s financial performance may be unpredictable, exposing investors to potential financial risks.

Second, apart from the global oil and gas supply side, the demand side also significantly affects Devon Energy’s profitability. We currently see a very harsh macro environment in the developed part of the world, meaning that the demand for energy supply is poised to be soft soon. The eurozone is already in a recession, and we see the highest interest rates in North America since the Great Recession, meaning that economic activity is also likely to decelerate in the U.S. and Canada.

Third, Devon Energy’s operations include exploring, developing, and producing oil and gas properties subject to geological uncertainties, operational challenges, and regulatory changes. Exploration activities do not always lead to successful outcomes, resulting in potential capital losses. Operational risks, such as equipment failures or production interruptions, may also affect the company’s financial performance.

Bottom line

To conclude, the stock is a “Hold”. Strong momentum in oil and gas is apparently gone and can only be regained if disruptions to the global energy market occur again. This can be both from the demand side or the supply side. Potential further cuts in oil production by OPEC could be a potential disruption. Still, we saw it multiple times over the past several months, and it did not help the stock price deliver sustainable growth back to $100. Moreover, the valuation of DVN looks unattractive.