Jeremy Poland

Tullow Oil (OTCPK:TUWLF)(OTCPK:TUWOY) spent a few years (at least) with a swashbuckling image. This rather small player was willing to take some big risks to get that “home run” offshore discovery. Unfortunately, like many players that do not right size the risks for the size of the company (and do not pay enough attention to costs either), this left the company with a lot of higher than wanted costs and much higher than wanted debt.

Management addressed the shareholders the second time (after the previous management was given an unceremonious boot) in 2022. At this point, it was a discussion of a pathway forward for a teetering company. But fiscal year 2022 helped the company out tremendously with some sky-high commodity prices.

As management noted in their third address in fiscal year 2023, they did repay some debt but they still owe $1.9 billion. They also took steps to further develop the Jubilee field in Ghana and should be reporting to shareholders a material increase in volume this fiscal year. The combination of some debt payments and production growth should provide some breathing room for the first time.

At this time, it is probably best for investors to wait to see the results of the additional production. That $1.9 billion in debt is still quite a lot of debt for current production levels. This management has done a darn good job so far of pulling the company “back from the brink”. But there is clearly a lot more work to be done. Many investors may want to watch from the sidelines until ratios improve to the point where this would be a financially safer investment.

Operations

Tullow is an offshore operator with interests in Africa as well as other areas such as Guyana. As such, it is a relatively small player in a part of the industry known for large projects with significant upfront costs. Returns can be fantastic, and more than one entity has reported a material discovery that assured a great future.

However, for every success story, there are a lot of failures. As such, a company like this, needs to right-size the risk so that any one failure does not “bet the company” or change the company finances for the worse. The pile of debt indicates that previous management did not understand risks and how that correlated with debt management.

Current management appears to have increased production by drilling lower cost and lower risk development wells. If this proves successful once production is underway, it could materially increase the company cash flow to substantially improve the balance sheet debt ratios.

But going forward, debt levels will have to be managed far more carefully than they were in the past Investors may want a demonstration that management “got the memo” and will be more conservative going forward.

Cost Progress

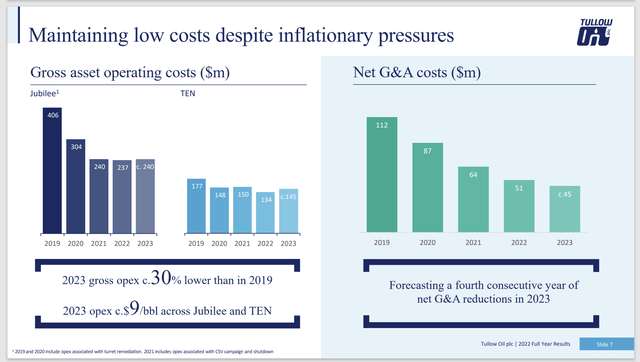

Not only was there a swashbuckling attitude towards exploration. But it appears that costs were likewise not well managed by previous management. This management also needs to get costs in line. They appear to be making material progress on that front as well.

Tullow Cost Control Efforts Of Major Production Leases And G&A (Tullow Corporate Presentation Fiscal Year 2022, Results)

In any commodity industry, the players generally receive the same price for the same product. Therefore, cost control often provides whatever profitability advantage available for a producer.

When a company like Tullow has a pile of debt, then low costs are essential to repay the debt to a comfortable level. This is an illustration as to why it is so important not to incur debt (as previous management did) unless there is “room” to service the debt due to very low costs and extreme project profitability.

So many investors believe that financial leverage is necessary for a large return. But most of the insiders I follow that build and sell companies look for a low-cost advantage to result in a superior margin. Oftentimes, those insiders will sell stock rather than incur debt. The result of that strategy is there remains a company when there is a failure.

But debt has to be repaid regardless of success or failure. The result of using debt is often what is seen here. There is a lot of debt that now has to be paid from current operations. The situation forces management to live within cashflow when that is what should have happened from the beginning.

Near-term

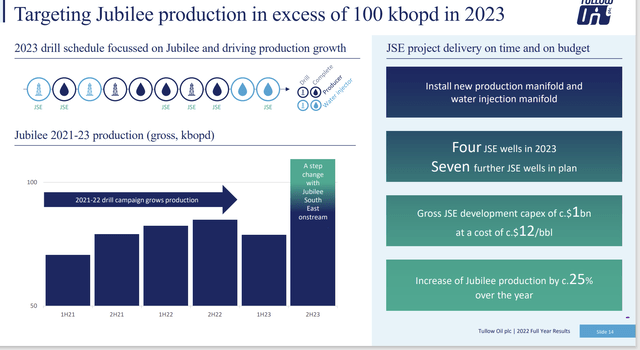

This management is banking upon a large increase in Jubilee production to help improve balance sheet ratios materially.

Tullow Presentation Of Jubilee Production Increases (Tullow Presentation Fiscal Year 2022 Summary Results and Future Plans)

Drilling your way out of a debt straitjacket is never easy. An offshore plan to improve your finances can add way more “excitement” than the average investor is prepared to handle. However, management appears to be lowering the risk by developing a known field using modern techniques. This could turn out to be a “sure thing” in the upstream business (if that is possible).

Management has guided investors to “only” a roughly 20% increase in annual Jubilee production. So that means that much of the benefit of this strategy will be in the following fiscal year.

Key Takeaways

Tullow is an offshore operator that piled up way too much debt. Fiscal year 2022 commodity prices created some breathing room for this company to work its way out of the debt load. However, most investors will likely want to see further progress. Right now, there is a potential of high returns, but the financial leverage risk is sky-high. That kind of trade-off tends to be a loss, or breakeven decision long-term when the decision to invest is repeated over time in many similar situations.

Low debt levels are essential in this very low visibility and volatile industry. There is just not enough stability for most companies to have the debt ratio that is now present in the current situation.

However, if management’s plans to decrease the debt ratios succeed through a considerable increase in Jubilee production, then this could be an interesting possible investment consideration going forward. Personally, I would consider waiting to see some results before putting this one on my watch list.

Offshore, even if it is on the relatively shallow shelf, tends to have risks much greater than the highly predictable onshore unconventional business. When the high costs of each project are considered along with the lumpy growth that comes with a small company with big projects, then most investors will likely move on.

For those that can handle the risk, this is probably technically a hold until there is more progress with the debt ratios (or a wait and see).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.