pcess609

We already know the factors that will make this much tougher going forward.

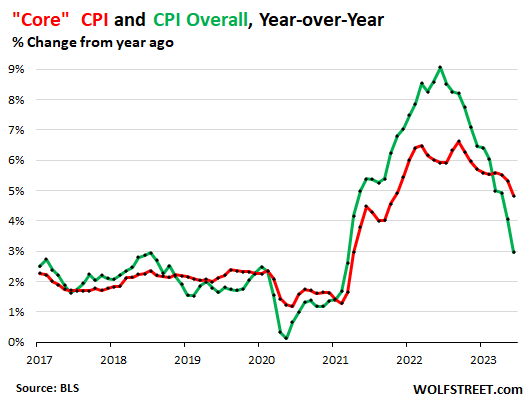

The “Core” Consumer Price Index rose by a still hot 4.8% in June compared to a year ago, but that was down from an increase of 5.3% in May, according to data by the Bureau of Labor Statistics today. June was the smallest increase since October 2021. As a measure of underlying inflation, core CPI excludes the prices of food and energy products that tend to move wildly in either direction.

Overall CPI rose by 3.0% in June year-over-year, the lowest since March 2021.

The chart shows core CPI (red) and overall CPI (green). The year-over-year plunge in energy prices (-16.7%!) pushed the overall CPI increases below those of core CPI. When energy prices stop plunging on a year-over-year basis, overall CPI will once again be above core CPI.

But it’s getting tougher in the second half because, based on what we know already, no forecasting required:

- Energy prices can’t keep plunging forever; in fact, they ticked up again on a monthly basis.

- The infamous “base effect” will fade next month for the rest of the year. The “base” for today’s year-over-year calculation is the surge of the index through June 2022. But in the second half last year, the index slowed sharply, which will be the lower base going forward, providing for bigger year-over-year increases.

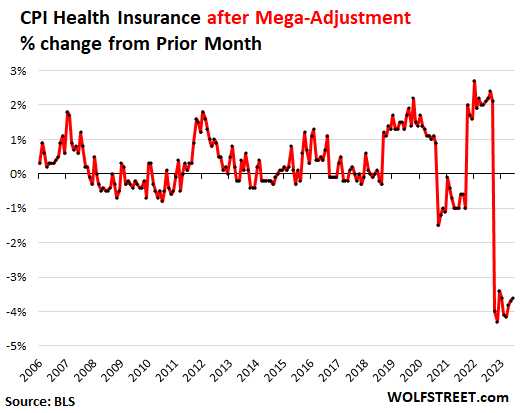

- The notorious “health insurance adjustment” pushed down CPI for health insurance to -24.9% year-over-year, which pushed down the entire medical care CPI to 0%. And this is a biggie. This adjustment ends in September and might swing the other way (more in a moment).

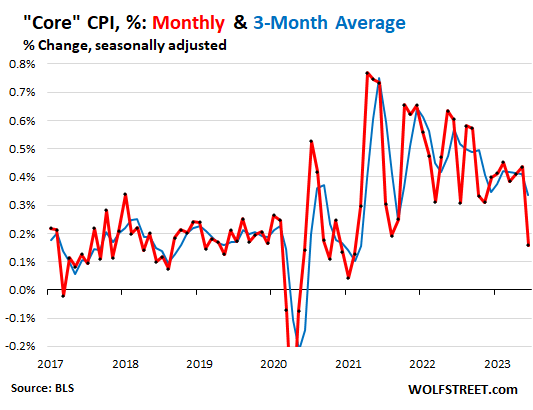

On a month-to-month basis, core CPI increased by 0.16% in June, compared to 0.44% in May, after two monthly increases (red line in the chart below).

The three-month moving average of core CPI rose by 0.33% (blue line), after four monthly increases above 0.4%. This was just below the December value, which had given everyone a lot of hope back then but was then followed by a series of increases.

Precisely what we’ve seen before: a large change in one month, only to be reversed a month or two later. Now waiting for the bounce.

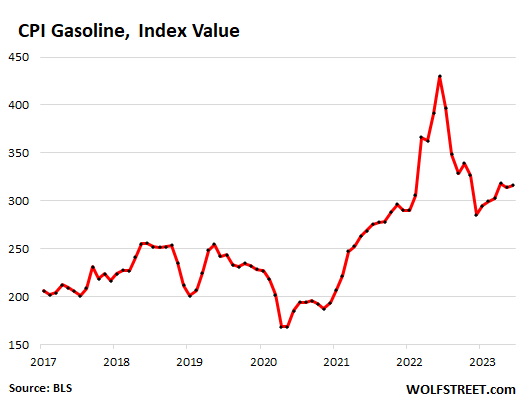

Energy prices plunged year-over-year, but rose on a monthly basis, on price jumps in gasoline and electricity services.

| CPI for Energy, by Category | MoM | YoY |

| Overall Energy CPI | 0.6% | -16.7% |

| Gasoline | 1.0% | -26.5% |

| Utility natural gas to home | -1.7% | -18.6% |

| Electricity service | 0.9% | 5.4% |

| Heating oil, propane, kerosene, firewood | -1.4% | -28.8% |

Here is the CPI for gasoline as index value, not percent change. It accounts for about half of the total energy CPI. It has been rising for six months:

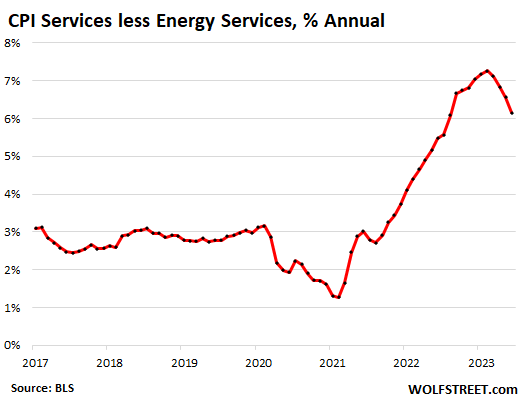

Core Services inflation (without energy services).

The index for core services (without energy services) increased by 0.25% in June from May, compared to an increase of 0.40% in the prior month (red line).

This is where the massive “health insurance adjustment” weighs heavily. It has understated medical care services since October 2022, but it will end in September 2023. In June, the CPI for health insurance plunged 24.9% year-over-year.

Other items that pushed down core services CPI were airline fares (-18.9% YoY, -8.1% MoM); car and truck rental (-12.4% YoY, -1.4% MoM); video and audio services and cable (-4.3% YoY, -0.5% MoM); and lodging including hotels and motels (-2.3% MoM, but +5.0% YoY).

Year-over-year, the core services CPI jumped by a still red-hot 6.2%, compared to 6.6% in May. February had marked a 40-year record of 7.3%.

Nearly two-thirds of consumer spending goes into services:

| Major Services without Energy | Weight in CPI | MoM | YoY |

| Services without Energy | 62.2% | 0.3% | 6.2% |

| Airline fares | 0.6% | -8.1% | -18.9% |

| Motor vehicle insurance | 2.6% | 1.7% | 16.9% |

| Motor vehicle maintenance & repair | 1.1% | 1.3% | 12.7% |

| Pet services, including veterinary | 0.6% | 0.5% | 10.4% |

| Food services (food away from home) | 4.8% | 0.4% | 7.7% |

| Rent of primary residence | 7.5% | 0.5% | 8.3% |

| Owner’s equivalent of rent | 25.4% | 0.4% | 7.8% |

| Postage & delivery services | 0.1% | 0.3% | 6.4% |

| Hotels, motels, etc. | 1.0% | -2.3% | 5.0% |

| Recreation services, admission, movies, concerts, sports events | 3.1% | 0.5% | 5.9% |

| Other personal services (dry-cleaning, haircuts, legal services…) | 1.4% | 0.2% | 6.5% |

| Video and audio services, cable | 1.0% | -0.5% | -4.3% |

| Water, sewer, trash collection services | 1.1% | 0.4% | 5.7% |

| Medical care services & insurance | 6.5% | -0.8% | 0.0% |

| Education and communication services | 4.9% | -0.3% | 2.4% |

| Tenants’ & Household insurance | 0.4% | 0.3% | 1.0% |

| Car and truck rental | 0.1% | -1.4% | -12.4% |

The “health insurance mega-adjustment” understates CPI, core CPI, services CPI, and Medical Services CPI through September.

Every month since October, the CPI for health insurance, thanks to this adjustment, plunged month-to-month by 3.4% to 4.3%. Year-over-year in June, it plunged 24.9%.

BLS undertakes annual adjustments in how it estimates the costs of health insurance and then spreads those adjustments over the following 12 months. Normally, the adjustment isn’t big, but for the prior 12 months through September 2022, CPI overstated health insurance inflation (+28% yoy in September 2022). That overstatement is being adjusted away every month since October 2022 (more here) and will continue through September 2023.

Then there will be a new adjustment coming in October for the next 12 months. In the past, those adjustments tended to swing in the opposite direction, as you can see in the chart below.

The Fed’s favored inflation measure, the core PCE price index collects health insurance inflation via a different method and doesn’t suffer these adjustments.

The CPI for housing as a service (“shelter”).

The CPI for housing is based primarily on two rent factors: “Rent of primary residence” (weight: 7.6% of total CPI) and “Owner’s equivalent rent of residences” or OER (weight: 25.5% of total CPI).

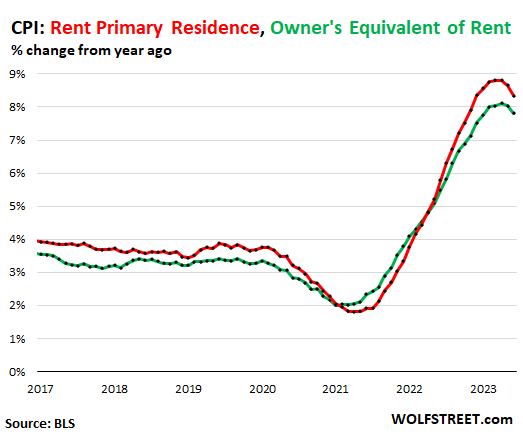

“Rent of primary residence”: +0.47% for June, +8.3% year-over-year (red in the chart below). Over the past three months, the monthly increases amount to annual rate of 5.8%.

The survey follows the same large group of rental houses and apartments over time and tracks what tenants, who come and go, are actually paying in these units.

Owners’ equivalent rent: +0.45% for June, +7.8% year-over-year (green). This is based on what a large group of homeowners estimates their home would rent for.

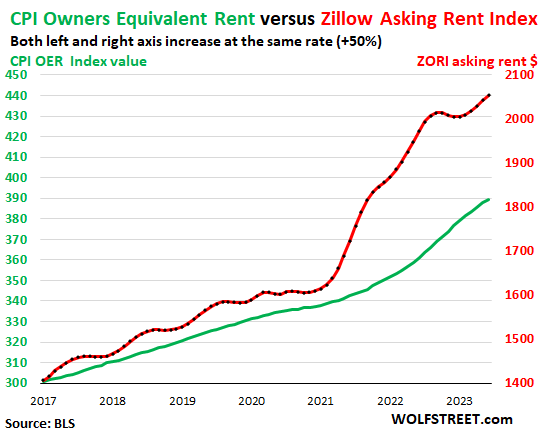

“Asking rents.” The Zillow Observed Rent Index (ZORI) and other private-sector rent indices track “asking rents,” which are advertised rents of vacant units on the market. The ZORI’s huge spike in 2021 through mid-2022 never fully made it into the CPI indices because rentals don’t turn over that much, and not many people actually ended up paying those spiking asking rents.

In late 2022, asking rents began to dip in dollar terms. But this year, the ZORI rose again and has been hitting new records in dollar terms since April.

The chart below shows the OER (green, left scale) as index values, not percent change; and the ZORI (red, right scale) as index in dollars.

The left and right axes are set so that they increase each by 50% to keep the proportional increase of both lines in sync, with the ZORI up by 45% since 2017 and the OER up by 30%:

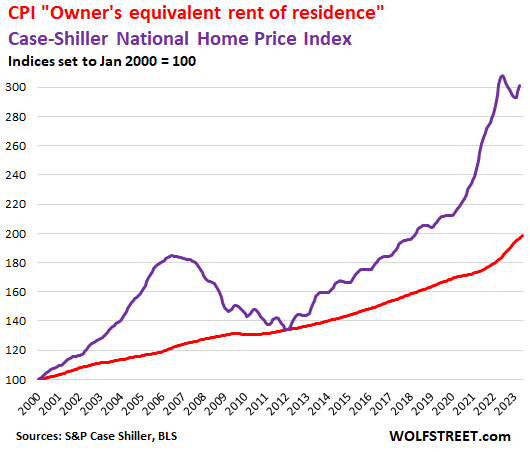

Rent inflation vs. home-price inflation: The Case-Shiller Home Price Index (purple) is experiencing what are largely seasonal upticks, similar to the seasonal upticks this time of the year in other years, even during Housing Bust 1.

The red line represents the OER. Both lines are index values set to 100 in the year 2000:

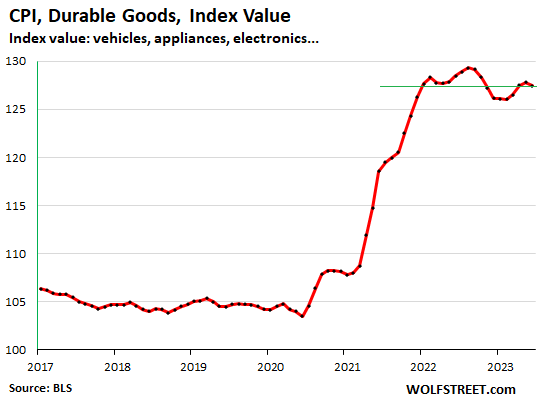

Durable goods prices stabilize at very high levels.

The CPI for durable goods, after a huge spike in late 2020 through 2021, has essentially moved up and down along a flat line since January 2022. In June: -0.3% for the month, -0.8% for the year.

The chart of the index value shows the sideways movement, with the June value being roughly the same as the January 2021 value. In other words, it seems to be normalizing at these very high levels, including the slight downward trend that the durables goods CPI has had going back many years:

| Durable goods by category | MoM | YoY |

| Durable goods overall | -0.3% | -0.8% |

| Used vehicles | -0.5% | -5.2% |

| New vehicles | 0.0% | 4.1% |

| Information technology (computers, smartphones, etc.) | 0.1% | -7.7% |

| Sporting goods (bicycles, equipment, etc.) | -0.3% | -0.9% |

| Household furnishings (furniture, appliances, floor coverings, tools) | -0.4% | 3.2% |

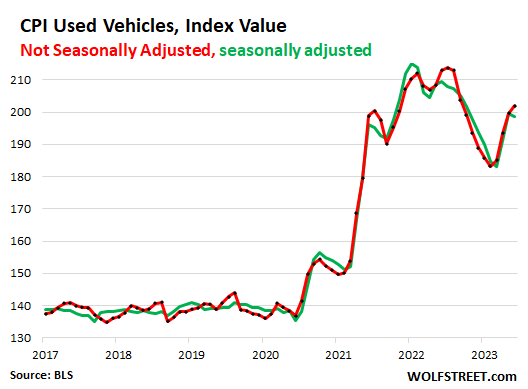

Used vehicles CPI, seasonally adjusted, dipped by 0.5% for the month, after two massive monthly spikes. Year-over-year, it fell by 5.2%.

Not seasonally adjusted, the used vehicle CPI rose by 1.2% in June from May, the fourth increase in a row.

The chart shows the index value, seasonally adjusted (green) and not seasonally adjusted (red). This is one of the most confounding charts in terms of the sheer pricing turmoil that persists to this day, with these huge ups and downs:

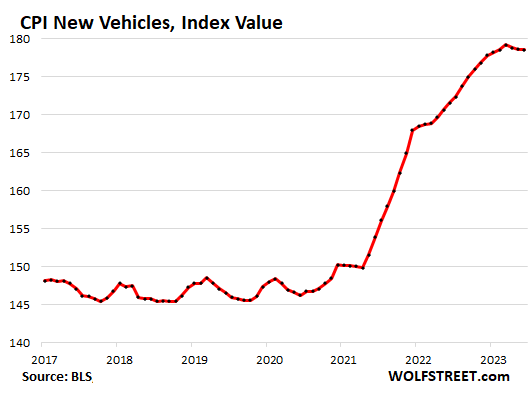

New vehicle CPI dipped just a hair for the month, the third month in a row of timid dips, amid growing supply, still sky-high prices, higher incentives, and strong demand, and amid big price cuts by Tesla and other EV makers, after the stunning surge in prices over the past two years that had been a mix of higher MSRPs, odious addendum stickers, and the near-elimination of incentives.

Year-over-year, the index increased 4.1%, the smallest since May 2021.

This chart of the index value shows just how little of the stunning price increase has been reversed – essentially nothing – and that the index appears to be normalizing at very high levels with a small downward trend:

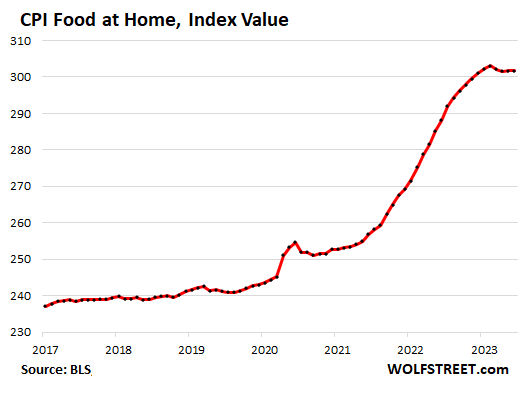

Food inflation.

The CPI for “food at home” – food bought at stores and markets – was unchanged in June from May. And over the past four months, it has inched down just a tiny bit, after what for many households had been a devastating spike in food prices.

Year-over-year, the CPI for food at home rose by 4.7%, the smallest increase since September 2021. Since February 2021, the index has spiked by 23.5%, and that little flat spot at the top isn’t much help, but at least food prices have stopped surging. The table below shows the major food categories, some, where prices actually dropped, and others, where prices still or again rose:

| Food at home by category | MoM | YoY |

| Overall Food at home | 0.0% | 4.7% |

| Cereals and cereal products | 0.1% | 8.8% |

| Beef and veal | 0.4% | 2.7% |

| Pork | -1.9% | -3.8% |

| Poultry | 0.8% | 1.4% |

| Fish and seafood | 0.8% | -0.9% |

| Eggs | -7.3% | -7.9% |

| Dairy and related products | -0.3% | 2.7% |

| Fresh fruits | 1.0% | 0.3% |

| Fresh vegetables | 0.7% | 2.1% |

| Juices and nonalcoholic drinks | -0.2% | 8.6% |

| Coffee | -0.6% | 3.3% |

| Fats and oils | -0.5% | 8.7% |

| Baby food & formula | -1.3% | 7.5% |

| Alcoholic beverages at home | -0.2% | 3.2% |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.