mysticenergy

After a stellar 2022, energy was the worst-performing sector in 1H23. However, not all energy subsectors have been pressured this year.

Energy infrastructure has been a clear bright spot with noticeable outperformance relative to the broader energy sector. Today’s note discusses the energy landscape so far this year and what may lie ahead for the rest of 2023 and into 2024.

What’s Weighed on Energy This Year?

Oil prices and energy stocks saw a decent start to 2023, but the banking crisis in March quickly spurred a sell-off in the commodity and energy equities (read more). A risk-off sentiment in markets and concerns around the economy had outsized impacts on the energy space.

U.S. benchmark oil prices fell below $70 per barrel to lows not seen since December 2021. With help from OPEC+ cuts, oil prices rebounded, and so did energy stocks, but the space has generally sputtered.

Various factors can help explain the malaise in energy. First, commodity prices have remained somewhat weak. Financial metrics for energy companies are generally declining on a year-over-year basis due to lower oil and gas prices after a banner 2022.

Energy has fallen to less than 4.1% of the S&P 500 from 5.2% at the end of 2022. The strength in technology and communication services and the buzz surrounding artificial intelligence has probably not helped energy either. Through July 5, the Technology Select Sector Index (IXT) was up 38.4% on a price-return basis this year.

Combining the hype around other sectors, energy’s lower weighting in the S&P 500, and potential profit-taking after a strong 2022, outflows for energy ETFs have been significant.

In the first six months of 2023, 43 North American energy equity ETFs saw outflows of over $11 billion, according to VettaFi’s LOGICLY data and analytics platform. That includes nearly $5 billion in outflows from the Energy Select Sector SPDR Fund (XLE).

Gains for MLPs and Midstream Contrast With the Rest of Energy

Some of the challenges for broader energy, such as lower commodity prices, are less impactful for midstream/MLPs. Because these companies largely earn fees for providing services, a move in oil prices from $80 to $70 per barrel does not materially change their bottom lines.

Energy infrastructure’s fee-based business model results in stable cash flows. As such, midstream companies have mostly guided to modest EBITDA growth in 2023 in contrast to the declining financial metrics for other energy companies (read more).

Cash flow stability also supports generous dividends, which enhances total return and adds to midstream/MLPs’ defensive qualities. MLPs and midstream have seen a bias towards dividend growth, supported by free cash flow generation.

In that vein, bellwether MLP Enterprise Products Partners (EPD) announced a 2.0% sequential distribution increase yesterday. Excess cash flow has also supported buyback activity, with EPD having spent $75 million on repurchases during 2Q23.

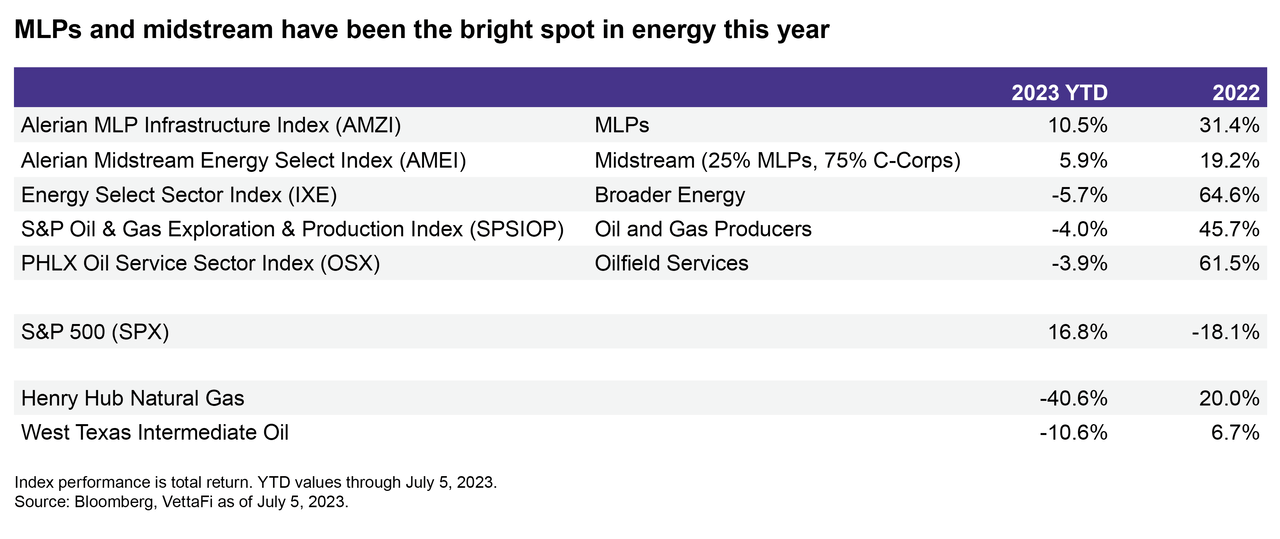

The table below shows year-to-date and 2022 performance for energy indexes, the S&P 500, and commodities. With the weakness in oil and natural gas prices, only MLPs and midstream have gains this year.

In addition to having less commodity price exposure, performance for the MLP-focused Alerian MLP Infrastructure Index (AMZI) was boosted by Magellan Midstream Partners’ (MMP) proposed acquisition by ONEOK (OKE), with the deal premium supporting performance for a large MLP constituent.

Total return performance also tends to favor MLPs and midstream due to their more generous yields. As of July 5, the AMZI and the Alerian Midstream Energy Select Index (AMEI) were yielding 7.8% and 6.5%, respectively.

What’s on the Horizon for Energy?

Will energy continue to lag, or will it rebound? Uncertainty surrounding the health of the global economy and implications for energy demand clouds the outlook.

If commodity prices remain subdued, energy infrastructure will likely continue outperforming broader energy and other energy subsectors. Midstream MLPs and corporations are expected to generate free cash flow and return excess cash to shareholders through dividends and buybacks – regardless of where commodity prices trade.

If recession risks subside or unexpected supply interruptions occur, oil and natural gas prices could improve. That could result in a positive sentiment change for the space and improved performance. Otherwise, it may be difficult for broader energy to gain traction, particularly if tech remains in the limelight.

Looking further out, energy commodity prices could improve into the end of 2023 and into 2024 as supply-demand fundamentals tighten. With OPEC+ cuts extended to 2024 and additional cuts for August from Russia and Saudi Arabia, resilient demand should lead to inventory draws for oil.

The outlook for the economy and demand trends in China remain key variables for both oil and liquefied natural gas (LNG). Weather is a key wildcard for natural gas prices in the U.S. and around the world. However, U.S. natural gas prices likely have upside risk into 2024 as LNG export capacity is added (read more).

Bottom Line

At the midway mark for 2023, macro uncertainty continues to be an overhang on the energy outlook. However, the crystal ball for energy infrastructure is arguably clearer given less commodity price exposure and the expectation for companies to continue executing on free cash flow and shareholder returns.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMEI is the underlying index for the Alerian Energy Infrastructure ETF (ENFR) and the ALPS Alerian Energy Infrastructure Portfolio (ALEFX).

Disclosure: © VettaFi LLC 2023. All rights reserved. This material has been prepared and/or issued by VettaFi LLC (“VettaFi”) and/or one of its consultants or affiliates. It is provided as general information only and should not be taken as investment advice. Employees of VettaFi are prohibited from owning individual MLPs. For more information on VettaFi, visit VettaFi.