Alex Wong

Investment Thesis

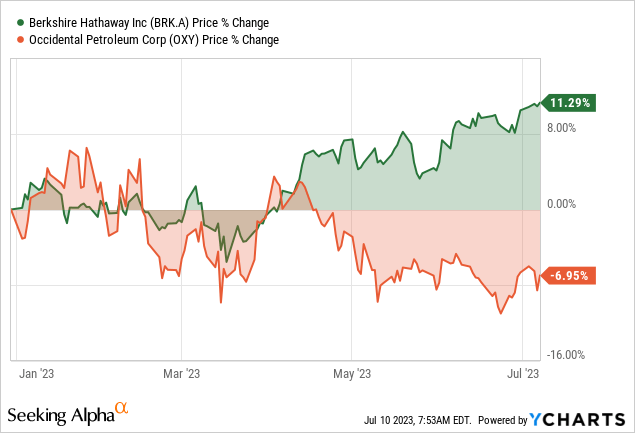

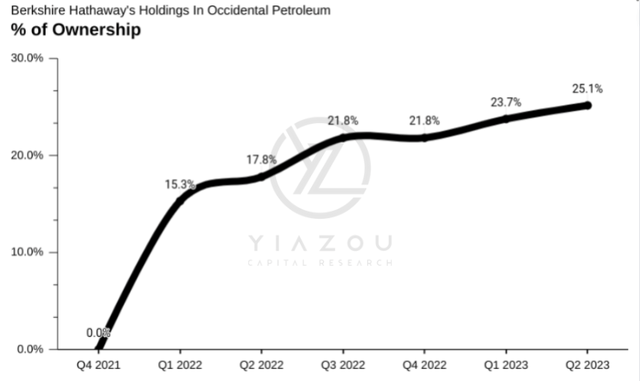

Warren Buffett’s investment in Occidental Petroleum Corporation (NYSE:OXY) has signaled his confidence in the sector’s dynamics and carbon capture technologies. Berkshire Hathaway Inc. (BRK.A, BRK.B) has raised its stake in Occidental to over 25%, establishing itself as the largest shareholder.

The article explores the recent developments in Berkshire’s ownership of Occidental and the factors that drive Buffett’s long-term confidence in the oil producer. Being one of the world’s most influential investors, Buffett’s actions generally help shape investor sentiment, making his increased stake in Occidental an important signal for other investors to consider the company’s potential.

Buffett’s Increased Stake In Occidental

Buffett has increased its stake in Occidental to over 25% through the recent purchase of 12.4 million additional shares. This move further solidifies Berkshire’s position as the largest shareholder of OXY, with Dodge & Cox holding the second-largest stake at over 10%. Berkshire initially became involved with Occidental nearly in 2019 when it provided $10 billion in equity to support Occidental’s acquisition of Anadarko.

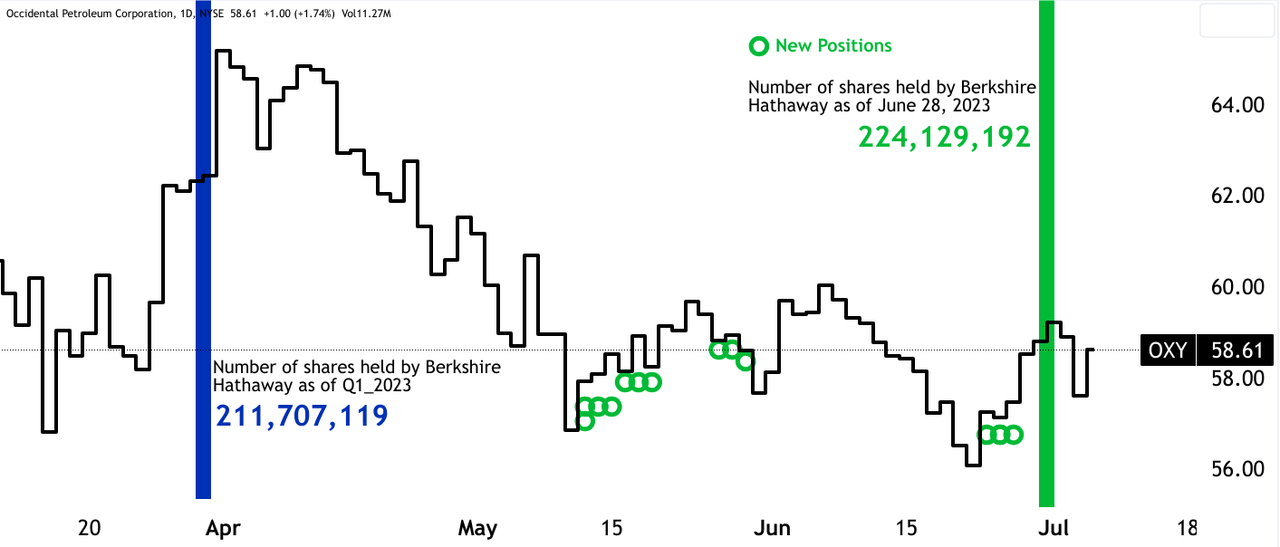

Further, Berkshire strategically purchased Occidental shares when the stock price dipped below $60. By doing so, Buffett is capitalizing on opportunities to acquire more shares at favorable prices. In terms of institutional ownership, over the past 12 months, there has been a net institutional outflow of $1.16 billion from Occidental. However, despite the outflows, total institutional inflows amounted to $3.98 billion during the same period. The current institutional ownership of OXY stands at 78.3%. This suggests that while there has been some selling pressure from institutions, there is still significant institutional interest in the company.

Moreover, Buffett’s interest in Occidental coincided with geopolitical events such as Russia’s invasion of Ukraine and rising oil prices. Despite these circumstances, Buffett has explicitly stated that his company has no intentions of taking control of Occidental. Buffett expressed confidence in Occidental’s management, emphasizing that the right team is already in place.

Author’s Estimates

Buffett’s Latest Moves On Occidental

After Q1 2023, Buffett strategically increased Occidental’s position during May and June 2023. The concentration of purchases within a specific price range of $59-$56.50, slightly above the current support level, indicates that Buffett sees potential for the stock to rebound and move higher.

From a technical perspective, this move suggests Buffett is intensifying the support level to prevent the stock price from falling further. By doing so, he may be looking to boost bullish momentum in the stock, potentially attracting other institutional investors and market participants. Additionally, the concentration of purchases at a specific price range implies that Berkshire sees the stock as undervalued below a specific level, leading them to accumulate more shares at a lower price.

tradingview.com

How Much Occidental Berkshire Can Buy

Berkshire has received approval from the U.S. Federal Energy Regulatory Commission (FERC) to acquire up to a 50% stake in Occidental. Berkshire is already the biggest shareholder in Occidental, with a stake worth $13 billion, and this approval allows them to increase their ownership further. The FERC determined that Berkshire’s proposal to purchase Occidental’s stocks is consistent with the public interest and stated that the acquisition would not have an adverse effect on utility rates or competition.

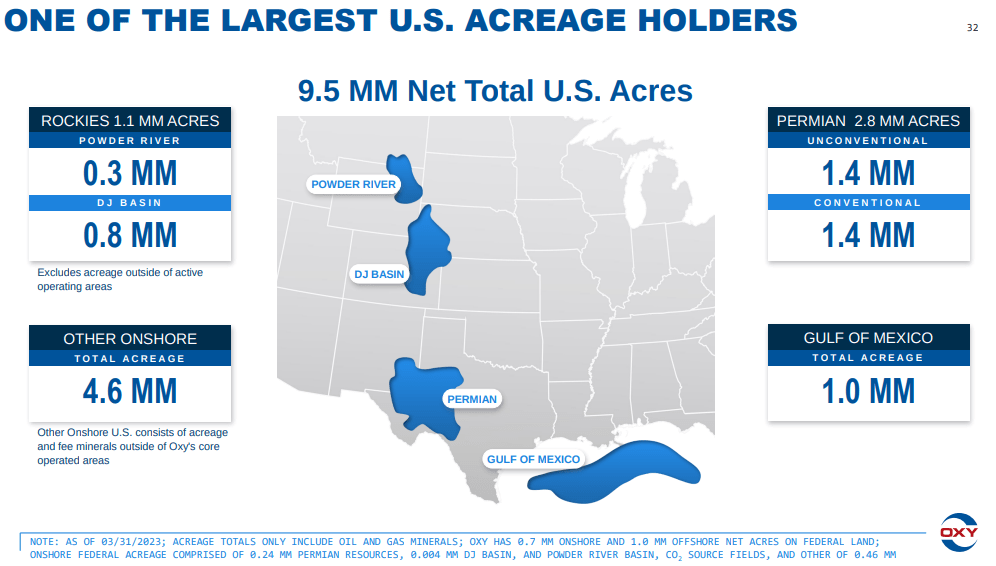

Unlike many other oil and gas companies, Occidental has reported its intention to be part of an energy transition and has invested in technology aimed at carbon capture and reducing emissions. The company plans to use carbon capture technology to increase fossil fuel production in West Texas while burying the captured carbon in the ground. Occidental is one of the largest producers in the productive Permian basin and has set ambitious emissions reduction targets, aiming for net-zero carbon emissions by 2050.

Additionally, Berkshire already has a significant presence in the energy industry through its subsidiary, Berkshire Hathaway Energy, which includes utilities serving customers in the Midwest and West. Berkshire further expands its oil and gas sector presence by acquiring a stake in Occidental. The move by Buffett demonstrates their confidence in the outlook of the oil and gas industry, despite concerns about climate change and a shift towards renewable energy. Buffett has consistently defied conventional wisdom and has been resistant to disclosing more detail about Berkshire’s greenhouse gas emissions and investing more in environmental sustainability.

OXY

The Key Rationale Behind Buffett’s Occidental Investment

Several key factors made Occidental an attractive investment opportunity for Buffett. Firstly, Buffett may consider the Russia-Ukraine war to last longer, with potential escalations rather than resolutions. As the 15.3% ownership of Occidental was reacquired during Q1 2022 (after exiting the position during Q2 2020), a significant and massive move was executed simultaneously with the Russian invasion.

Additionally, another rationale is the energy market dynamics and the strategic role of the U.S. oil and gas industry, as Occidental is one of the largest oil producers in the U.S. Occidental’s operations, financial performance, cash flows, and expenditures are highly affected by the volatility of oil prices, majorly, and by natural gas prices, minorly. Other critical factors include the Midland-to-Gulf Coast oil spreads and inflationary pressures.

Notably, oil prices decreased in Q1 2023 due to inflation, and economic data signified a potential softening in energy demand, despite the ongoing Russia-Ukraine war, OPEC moves, and the Biden Administration’s actions on the U.S. Strategic Petroleum Reserve. If the Russia-Ukraine war further escalates, it may lead to a rapid boost in demand for oil and gas due to the global impact on energy supply and flow, which may also work in Occidental’s favor.

Finally, Occidental’s investments in carbon capture and sequestration technologies may also be a bullish catalyst. Its focus on direct air capture facilities to extract carbon from the atmosphere may lead to a competitive edge on its net-zero pathway.

Takeaway

In conclusion, Warren Buffett’s increased stake in Occidental Petroleum Corporation reflects his long-term confidence in the company’s fundamentals and solidifies its position as the largest shareholder. Lastly, considering geopolitical events and fluctuations in oil prices, Buffett’s actions demonstrate his confidence in Occidental’s management and potential value growth.