da-kuk

Excitement around advances in artificial intelligence have captured media and investor attention since the success of the latest version of ChatGPT and “blowout” guidance by AI chip supplier Nvidia (NVDA). However, there are few tangible examples of “real world” successful applications of AI technology, particularly with actual financial and operational metrics.

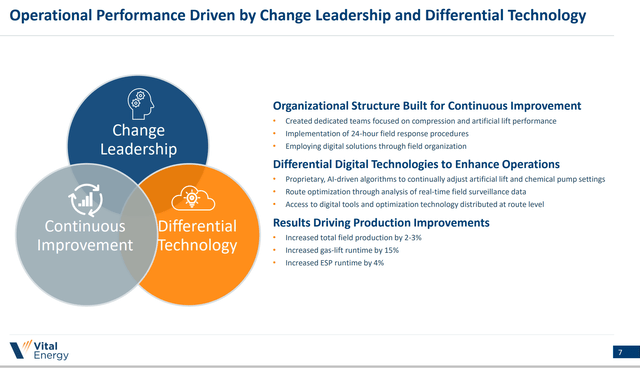

As such, I was surprised to find such an example in the recent corporate presentation of a heavily discounted oil & gas producer, Vital Energy (NYSE:VTLE). Many companies have recently touted their use of AI in their investor calls and presentations. However, most of those pointed to potential future gains from this technological advancement. Vital couldn’t be more different. Vital is showing tangible operational improvements from deployment of this technology:

Vital Energy June Presentation

Key tangible improvements from implementing AI that Vital cites include:

- Increased total field production by 2-3%

- Increased gas-lift runtime by 15%

- Increased ESP runtime by 4%

These improvements may not sound like a lot, but they matter to Vital for a few key reasons:

First, Vital is one of the only actual AI beneficiaries in the market that I’ve seen that is able to quantify historical, tangible operational improvements through deployment of AI technologies. Considering the nascent stage of AI technology, there could be considerable additional gains, as well as potential “first mover” advantages to Vital.

Second, Vital is acquiring additional oil & gas assets at a rapid pace. Successful application of AI technology may allow for more rapid and effective integration and operation of these assets. Even small operational improvements can yield substantial improvements in financial results, particularly in high revenue, lower full cycle margin businesses like resource extraction.

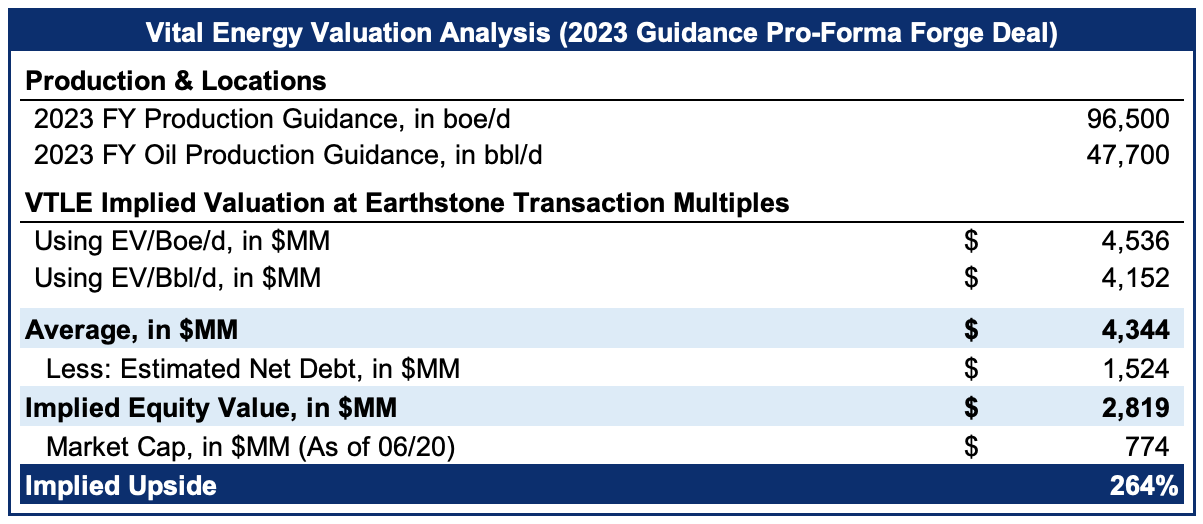

Third, Vital is trading at a large discount to competitors and to its intrinsic value. This is not some AI beneficiary at 30x revenue. It is an oil & gas producer trading near 2x EV/EBITDA, at a large discount to its proved reserve value, and at meaningful discount to recent nearby asset and company transactions.

Discounted Valuation Offers Substantial Upside

The most recent area transaction comp, of an asset of a similar total production and acreage size and footprint, implied 264% upside to Vital’s share price at the time of the transaction:

Bison Interests Analysis

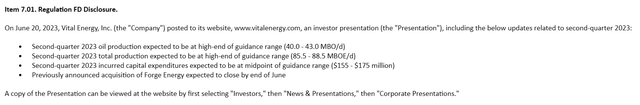

There are of course transaction nuances and reasons why Vital has traded at a discount to peers and comparable transactions. However, Vital is delivering quarter after quarter of operational outperformance. Vital’s latest update was barely noticed by the market and didn’t seem to make news headlines:

8-K filing, Edgar Website

As Vital continues to deliver strong quarters, at least partially due to the implementation of AI driven operational improvements, VTLE stock may re-rate higher to be closer in line with competitor and transaction valuations. And as a company that is successfully implementing the latest technology, perhaps Vital’s shares could trade to a premium valuation to reflect this.