bjdlzx

Ring Energy, Inc. (NYSE:REI) CEO (and Chairman Of The Board) Paul McKinney recently gave an interview. One of the things mentioned that is often missed by Mr. Market is that this company is a conventional operator. That alone keeps the competition at a lower level than would normally be the case and allows for above average profitability of wells drilled.

Just about any management strategy book (for example “Competitive Strategies” by Michael Porter) would mention that the best way for small companies to grow profitably is to avoid competition by finding a niche that others bypass for whatever reason. Ring Energy has done just that.

The recent Stronghold acquisition furthers the strategy with still more conventional opportunities. Now this does not mean that management has ignored technology advances.

For newer readers, Ring Energy acquired Stronghold for $200 million in cash, a delayed payment, and very roughly a little bit more value (than the cash payment) amount of stock. Total estimated cost was roughly $450 million. The major idea was that the company doubled its production without doubling its debt. Thereby management had the idea that cash flow and free cash flow would “gain” as in improve key ratio through this acquisition. This acquisition became the Southern Central Basin Platform slide.

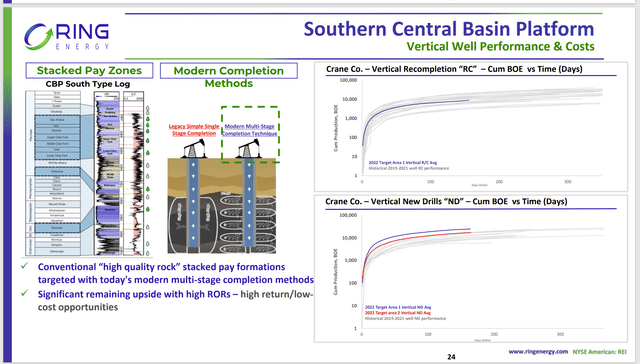

Ring Energy Proposed Development And Reworks Of Acquisition Basin Wells (Ring Energy EnerCom Dallas 2023: The Energy And ESG Investment Conference April 2023)

The whole idea of the acquisition was to use the latest well completion techniques (as briefly outlined above) to raise the profitability of the recently acquired acreage. If the idea works, then profitability climbs even if production does not. But there is a very good chance that production will climb because the paybacks on many of these proposals are very fast.

When the second quarter report comes out (expected August 7 post-market), we should get an update on this with probably (finally) enough information to see how this idea is working out. The first quarter was simply not enough time or history yet.

Vertical wells, like the ones shown above, are darn cheap to drill. In this case, they are fairly shallow as well.

The Original Return Case Made To Shareholders

When the acquisition proposal was made, management had the same slide with a little more information back in November.

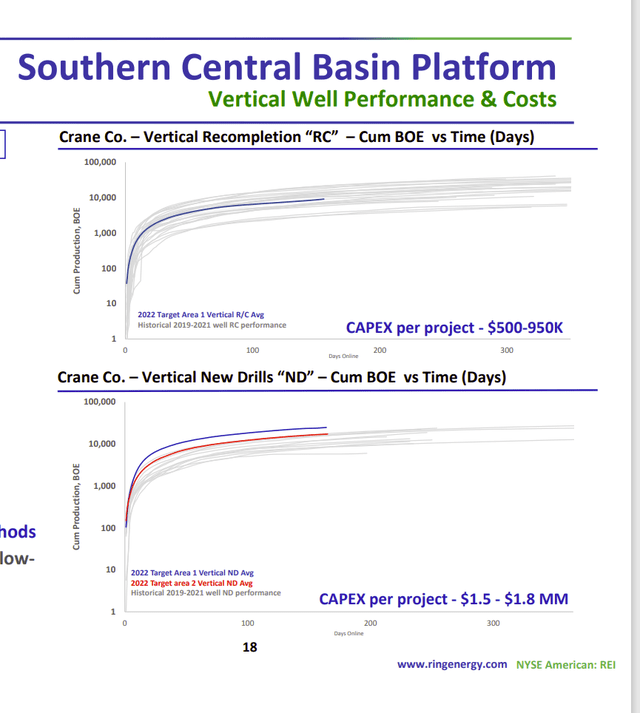

Ring Energy Stronghold acquisition well expected results compared to expected costs. (Ring Energy Third Quarter 2023, Earnings Conference Call Slides)

As can be seen, the projected oil production alone will pay for the projected costs within a few months. Once the oil production passes 10K barrels in total around the 100-day mark, the revenue alone is $650,000 (assumes received price of $65 for oil). That is more than at the rework cost before you include all the other production. It is also a substantial paydown of a new well cost even with production and other costs considered.

But the neat part about this is that conventional wells have a far less decline rate than is the case with unconventional. Therefore, there will be some decent flow rates the following year to provide some nice cash flow. That influences the time value of money in that you get more money sooner.

The payback on Ring Energy wells is typically in months rather than years, with many wells on all the leases having a breakeven of a received price of around $30 for oil. This has been mentioned by management many times in the past. Sometimes due to costs, it climbs into the $30’s, but that is still a competitive advantage over many in the industry.

When you combine this with the fact that most of the industry is focused upon the unconventional part of the industry, then an investor realizes that this company has a very profitable opportunity. Leasing costs for these intervals turn out to be very cheap. Basically, everyone wants unconventional prospects, so this company has these intervals “all to itself” and just a few other competitors.

Priorities

After any acquisition, the first thing is to optimize operations and thereby reduce future costs. Many will remember that required a lot of well equipment changes after the Northwest acquisition. Of course, then covid hit to prevent the company from getting the full benefit of the acquisition. Hopefully this time around there is nothing like that in the future.

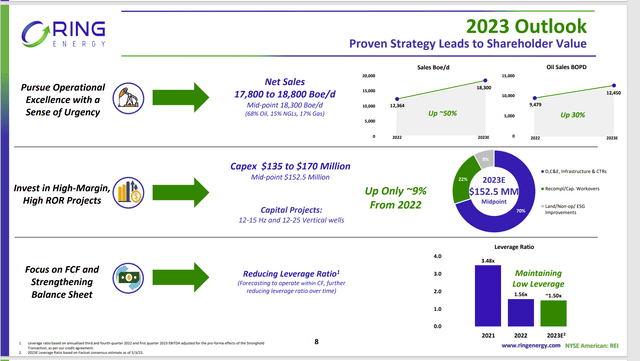

Ring Energy 2023 Guidance (Ring Energy First Quarter 2023, Earnings Conference Call Slides)

Therefore, production growth over the combined operations is unlikely to be more than single digit growth – if it happens at all. This is a relatively large acquisition for Ring Energy given the company’s production before the acquisition. But it does move the company forward towards that minimum amount of production needed for savings and optimal operations in general.

Management intends to live within cash flow as demanded by the market and the lenders. That will limit growth. What was going to happen was management was going to borrow as it transitioned from a development stage company to an operating model. But covid quickly changed those plans. What was a typical transition strategy quickly turned into a financial nightmare. Hence, the stock dilution with the acquisition.

As a side note, companies that “sit there and take it” are the companies that do not make it. This management is clearly doing anything but that. The whole market and lending atmosphere changed dramatically before this company had an operating model in place for the market (and lenders) to see. Therefore, management is dealing with the hand it was dealt. Those kinds of managements generally succeed.

The Difference Is

Ring Energy has an advantage over a lot of companies that found themselves in a similar situation. In addition to low acreage costs, the company has very low well breakeven points.

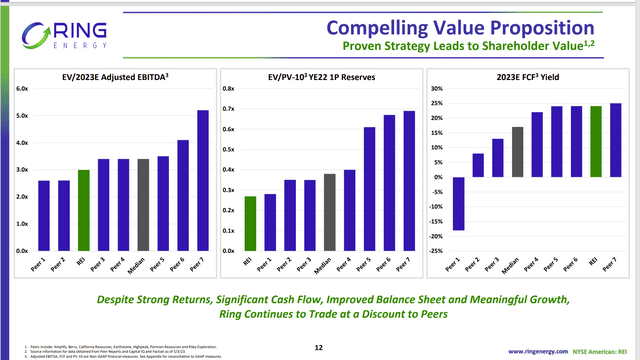

Ring Energy Value Comparison To Peers (Ring Energy First Quarter 2023, Earnings Conference Call Slides)

The advantage means that Ring Energy has a better than average chance of overcoming the market doubts about the ability of the company to handle the debt load.

Already, the lenders have relaxed a lot of debt covenants because of the acquisition. Mr. Market has yet to improve its view of things. Management “aided the cause” by announcing a non-core sale and debt payments of $25 million for the second quarter.

The reason that the market lags is that the market focuses upon free cash flow compared to total debt. Right now, there is no track record of that in the eyes of the market. In fact, due to the conversion from lease gathering and acquisition (development stage) to operating, the free cash flow record really does not exist because the operating history of the company is on the scanty side. Complicating it more was the fact that the covid challenges interrupted this transition.

This whole market judgment reflects itself in the valuations shown above. Therefore, what management has to do now is take those well profitability characteristics to mold a company with rather generous free cash flow. Should this process not go fast enough for the market, then there may be yet another acquisition to speed the process along.

These wells were profitable enough even before the acquisition for management to “dig itself out.” But the debt market would not allow that. Now there is some debt flexibility that the company did not have before. There is also a decent backlog of very profitable reworks. So, the future looks a lot better than the past (and the past did not look that bad).

Investment Considerations

The finances make Ring Energy, Inc. a higher-risk proposal. But it is a strong buy consideration for patient investors that can handle the risk and the volatility of the stock price of a small company. Clearly the market does not expect much at current valuations.

But management does not have to do anything spectacular to keep a better future on track for arrival. That alone makes this different from a lot of more risky investment proposals. All the company has to do is avoid a sustained oil price crash.

As such, Ring Energy, Inc. could be worth far more than the current stock price. But it will take some patience as small companies generally do not get revalued overnight. Still, this could be very much worth the wait.