MAYBAYBUTTER

Introduction

BioXcel Therapeutics (NASDAQ:BTAI), a biopharma company based in Connecticut, leverages AI and machine learning to develop innovative treatments for central nervous system and immuno-oncology disorders. Its product lineup includes two main offerings: IGALMI, an FDA-approved formulation of dexmedetomidine for treating agitation in schizophrenia or bipolar I or II disorder, and BXCL701, an oral inhibitor designed for the treatment of small cell neuroendocrine metastatic castration-resistant prostate cancer.

In my previous assessment of BioXcel, I acknowledged the promising prospects of upcoming trial readouts, which could potentially boost its stock value. However, I emphasized the inherent uncertainties and challenges, such as securing substantial market penetration and proving real-world efficacy. Given these concerns and the company’s existing IGALMI marketization difficulties, I maintained my long-term “Sell” recommendation despite the possibility of short-term gains from positive clinical trial results.

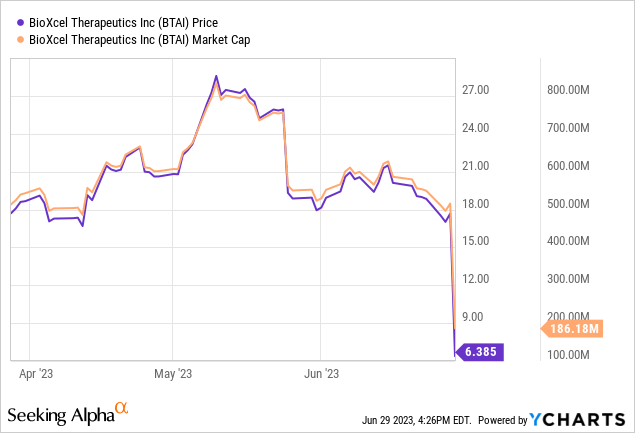

Recent developments: On Thursday, BioXcel revealed that its high-dose dexmedetomidine treatment successfully met the main objective in the TRANQUILITY II Phase 3 Trial, targeting acute agitation associated with Alzheimer’s Disease. However, the company also revealed details that could potentially compromise the reliability of the trial’s data. As a result, BioXcel’s stock value plummeted, closing 63% lower.

The following article updates investors in light of this revelation.

Q1 2023 Earnings

Before we begin, let’s review the company’s most recent financial report. For Q1 2023, BioXcel announced a stable net revenue of $206,000, identical to Q4 2022 figures, with a projected increase in H2 due to additional formulary approvals. R&D costs increased to $27.8 million, mainly attributed to clinical trials and CMC costs, compared to $18.6 million in Q1 2022. SG&A expenses also surged to $23.6 million due to IGALMI’s commercialization costs, a jump from Q1 2022’s $12.9 million. The net loss increased to $52.8 million from $31.5 million in Q1 2022. As of end-March 2023, BioXcel had a cash position of $165.5 million, expecting to sustain through 2025 considering strategic financing and expected IGALMI revenues.

BioXcel’s Data Integrity Under Scrutiny: Understanding the Impact

According to a Form 8-K by BioXcel, in December 2022, the FDA conducted an inspection that uncovered troubling inconsistencies at one of BioXcel’s trial sites, managed by a principal investigator who enrolled a sizable 40% of the participants in the TRANQUILITY II Phase 3 clinical trial. Not only were there procedural shortcomings cited, such as the delayed report of a serious adverse event (SAE), but there were allegedly fabricated email correspondences regarding another SAE brought to light in May 2023. These alarming discrepancies, including alleged failures to maintain adequate case histories, have cast a substantial shadow over the trial’s integrity.

BioXcel’s response has been to initiate an internal investigation and commission an independent audit of the data collected at the principal investigator’s site. However, these measures offer no guarantees of uncovering the full extent of the data inaccuracies or inconsistencies, leaving a cloud of uncertainty over the approval prospects of BXCL501 (dexmedetomidine). This situation could even necessitate a completely new clinical trial, introducing the possibility of divergent outcomes from the original TRANQUILITY II trial.

The severity of these concerns cannot be overstated. The principal investigator’s extensive involvement in the trial and the potential data integrity issues pose significant threats to the credibility of BioXcel’s clinical trials and regulatory approval process. While the reported serious adverse event involved a placebo patient, the wider implications regarding data integrity are a severe blow.

The outcome of these investigations will significantly impact the future of BXCL501 and BioXcel’s reputation. Even if BioXcel manages to secure supplemental approval, these issues could still have far-reaching implications for its longer-term credibility and success. The critical aspect to watch will be how BioXcel addresses these significant failures in oversight and manages to rebuild trust with regulators and the wider investment community.

My Analysis & Recommendation

In conclusion, the shadow of regulatory uncertainty cast over BioXcel Therapeutics only heightens the concerns I previously expressed regarding its marketability. The severe discrepancies unearthed during the FDA inspection raise questions not only about the credibility of the company’s data but also about its commitment to stringent regulatory compliance and ethical conduct. This could potentially lead to a deepened trust deficit among investors and other stakeholders, resulting in a more challenging path forward for BioXcel.

Moreover, these issues have the potential to jeopardize not only the future of BXCL501 but also BioXcel’s overall reputation in the industry. Even if the company manages to effectively respond to these regulatory challenges, lingering doubts may continue to hamper its credibility and ability to deliver long-term value to its shareholders. The ripple effects of these developments could also affect the company’s overall financial stability, especially considering the increased R&D costs and SG&A expenses that the company has been reporting.

Furthermore, while BioXcel’s attempts to manage the crisis through internal investigations and independent audits are a step in the right direction, they may not suffice to fully restore investor confidence. The ability of the company to weather this storm and maintain its long-term viability will be determined by its actions in the coming months.

Taking into account several factors, I have revised my investment recommendation to a “Strong Sell” for BioXcel. Despite the company’s stock now being nearly equivalent to its cash value, it’s important for investors to expect ongoing net losses for the foreseeable future. This is largely due to the sluggish market initiation of IGALMI. Furthermore, I foresee the FDA demanding another Phase 3 trial from BioXcel for supplementary approval. If this transpires, it will be both time-consuming and costly. The combination of these regulatory uncertainties and existing marketing issues significantly heightens this stock’s risk factor. Therefore, until BioXcel proves to have effectively addressed these concerns, re-establishing trust among both investors and regulators, I strongly recommend investors exercise extreme caution when considering this stock.

Risks to Thesis

When the facts change, I change my mind.

While I have laid out a strong case for a ‘Strong Sell’ recommendation, it’s important for me to consider the potential risks that could counter this thesis:

-

Resolution of regulatory issues: BioXcel is currently conducting an internal investigation and has commissioned an independent audit of the trial data. If these efforts prove successful and the FDA’s concerns are adequately addressed, it could restore faith in the company. There’s always the chance that the issues might be isolated or limited and may not significantly affect the approval and marketability of BioXcel’s offerings.

-

Successful commercialization of IGALMI: Despite the concerns I’ve highlighted about market penetration and real-world efficacy, if BioXcel manages to successfully commercialize IGALMI and capture a sizable market share, this could drive revenues and restore investor confidence.

-

Positive future trial results: As a research-driven company, BioXcel has a pipeline of potential drugs. Future successful trial results, particularly for BXCL701, could boost the company’s stock value and potentially offset the current issues.

-

Potential Acquisition or Partnership: BioXcel’s FDA-approved drug for a widespread condition could potentially make it an attractive target for larger pharmaceutical companies. A strategic partnership or a buyout could significantly uplift the stock price.

-

Improvement in financials: The company’s financial situation, particularly its increased R&D and SG&A expenses, is indeed a cause for concern currently. However, a financial turnaround resulting in increased revenues or decreased expenses could positively impact the stock price. The company’s projected increase in H2 revenues due to additional formulary approvals could be an early sign of this.