In less than one year’s time, eight states in the U.S. Midwest will no longer have a waiver for fuel volatility during the summer driving season, forcing suppliers of the region to sell a different baseline gasoline blendstock to meet Clean Air Act (CAA) requirements. This development was announced on March 1, 2023, by the U.S. Environmental Protection Agency (EPA) following petitions from the states’ governors, which sought the change to allow for a higher concentration of ethanol in gasoline during the summer months when fuel volatility standards are most stringent.

Outside of the federal reformulated gasoline zone and certain regions of the country working with the EPA to reach compliance with CAA through a State Implementation Plan, finished gasoline during the summer months needs to meet a nine-pound per square inch Reid vapor pressure (RVP) standard. Ethanol increases gasoline’s RVP, but for more than 40 years, gasoline with a 10% concentration of ethanol was granted a one-pound psi RVP waiver by Congress. The congressional authority was deliberate in allowing the one-pound psi RVP waiver to only apply to gasoline with a 10% concentration of ethanol, explained the U.S. Court of Appeals for the District of Columbia Circuit in a ruling on July 2, 2021, upending an EPA decision in 2020 granting the waiver to E15 — gasoline with a 15% ethanol concentration.

The court said only Congress has the authority to allow the waiver for E10 to apply to E15, striking down the EPA rule in a major defeat for the ethanol industry and their proponents that for years had beseeched the agency to allow for summertime E15. Citing trend analysis and discussions with fuel retailers, marketers, and terminal operators, the ethanol trade group Renewable Fuels Association forecast that the number of retail outlets selling E15 would surge to 11,000 in 2024 if not for the court decision. They calculate E15 sales would be 12.6 billion gallons or 91% lower between 2021 and 2024 than expected if E15 is not allowed year-round, leading to a net loss of 630 million gallons valued at $1.3 billion.

To circumvent the legal blockade, the governors of eight states in the Midwest petitioned EPA to reject the RVP waiver for E10 in what the agency said in their March 1 announcement approving their petitions as “a permanent solution to provide year-round E15 in those states.”

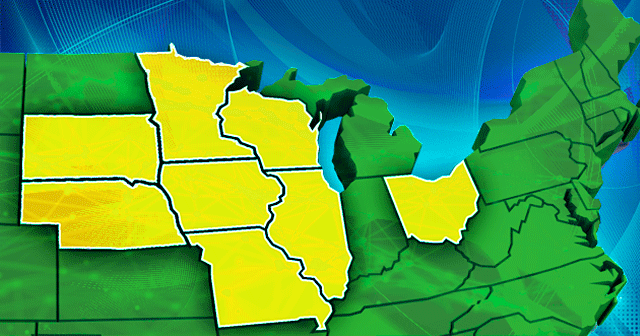

“Pursuant to provisions specified by the Clean Air Act (CAA), governors of eight states submitted petitions requesting that EPA remove the 1-pound per square inch (psi) Reid vapor pressure (RVP) waiver for summer gasoline-ethanol blended fuels containing 10% ethanol (E10). This action acts on those requests from the Governors of Illinois, Iowa, Minnesota, Missouri, Nebraska, Ohio, South Dakota, and Wisconsin by proposing to remove the 1-psi waiver,” states an EPA summary explanation of the proposed rule.

The governors of eight states in the Midwest petitioned EPA to reject the RVP waiver for E10.

Governors have the authority to seek a change in gasoline volatility requirements if they can prove that implementing the waiver would increase emissions and contribute to air pollution in any part of the state. EPA said the information submitted by these states met the requirement. The end of the waiver takes effect on April 28, 2024, two years after the eight states submitted their petitions.

Governors of Kansas and North Dakota rescinded their requests to remove the one-psi waiver for E10.

American Fuel and Petrochemical Manufacturers (AFPM) said opting out of the one-psi RVP waiver for E10 would make it illegal to sell E10 in these states during the summer, creating a boutique fuel.

“They are not giving an RVP waiver for E15; they are taking one away from E10,” states the trade organization.

“Instead, a new regional boutique fuel with lower RVP would need to be produced and sold for this portion of the Midwest market,” said AFPM. “A boutique fuel for only these midwestern states is going to be significantly more complicated and expensive to produce and will require major adjustments to the refineries and fuel supply chain infrastructure serving the Midwest.”

AFPM hired consultants at Baker and O’Brien to study the issue. They found that a new gasoline blend for these eight states would come with annual costs between $550 and $800 million. A supply disruption could push annual costs to $1.1 billion, found the consultants.

They found that a new gasoline blend for these eight states would come with annual costs between $550 and $800 million.

“The cost to produce, store, and distribute a unique Midwestern fuel that must be segregated from other fuel is expected to range from 8 to 12 cents per gallon (cpg) in the near term,” according to Baker O’Brien.

AFPM and Baker O’Brien indicate that studies indicating far lower costs are making an assumption that removing butane alone would be sufficient in making the new fuel.

“However, removing butane alone will not be enough for every refinery to produce RVP-compliant fuel,” they state.

“Estimates from these states incorrectly assume that each of the nearly 30 refineries currently providing E10 summertime gasoline [blendstock for oxygenate blending] to the Midwest will seamlessly adapt to produce a new blend of gasoline. This is incorrect,” said AFPM and Baker O’Brien. “Not every refinery currently located in or providing gasoline to these states has the infrastructure and capability to manufacture a new gasoline grade.”

This reality means there will be fewer refineries capable of supplying the summertime E15 BOB for these states.

These constraints would result in approximately 125,000 bpd less in-region gasoline production and 33,000 bpd less in-region diesel fuel production during the summer, which is “equivalent to the loss of fuel from an outage at a large Midwest refinery.”

These constraints would result in approximately 125,000 bpd less in-region gasoline production and 33,000 bpd less in-region diesel fuel production during the summer.

Capital improvement projects are estimated at $50 to $75 million per refinery, while “upgrades typically take two years to implement.”

On June 8 at the RBN Energy’s xPortCon 2023 conference in Houston, Aaron Milford, CEO and president of Magellan Midstream Partners, said he is hoping for a delay in the rule, noting the potential loss of 150,000 bpd of gasoline production for the Midwest. Milford said it is still unknown which refiners will produce the new blendstock and highlighted the enormous challenge in segregating multiple gasoline blends with existing storage tanks.

Milford said he believes an initiative expanding the oxygenate level in gasoline should be done at the federal level, not the state level where it creates a patchwork market. He said Magellan Pipeline is communicating with state governments, communities, farmers, and consumers of the problem in eliminating the RVP waiver for the eight states.

Get more details about our refined fuels solutions and demand insights.

About the author

A 27-year veteran of the energy industry, Brian L. Milne serves in multiple roles, including editor and analyst. He has delivered dozens of presentations on various topics related to the energy markets and has been quoted widely in the media, including The Wall Street Journal, Barron’s, USA Today, CNN, and major regional news outlets. Milne has authored numerous articles for international magazines exploring market dynamics and providing forward-thinking commentary and analysis. A graduate of Monmouth University in New Jersey, he has a B.A. in history and an interdisciplinary in political science (magna cum laude).