The high cost of living, primarily driven by inflation, has become a major concern in political discussions across North America. Political parties have recognized this issue as a top priority for voters, made various promises, and implemented policies to ease these financial burdens. As a result, addressing the cost of living has become a central objective of recent elections.

Carbon dioxide removal incentives are the antithesis of this objective.

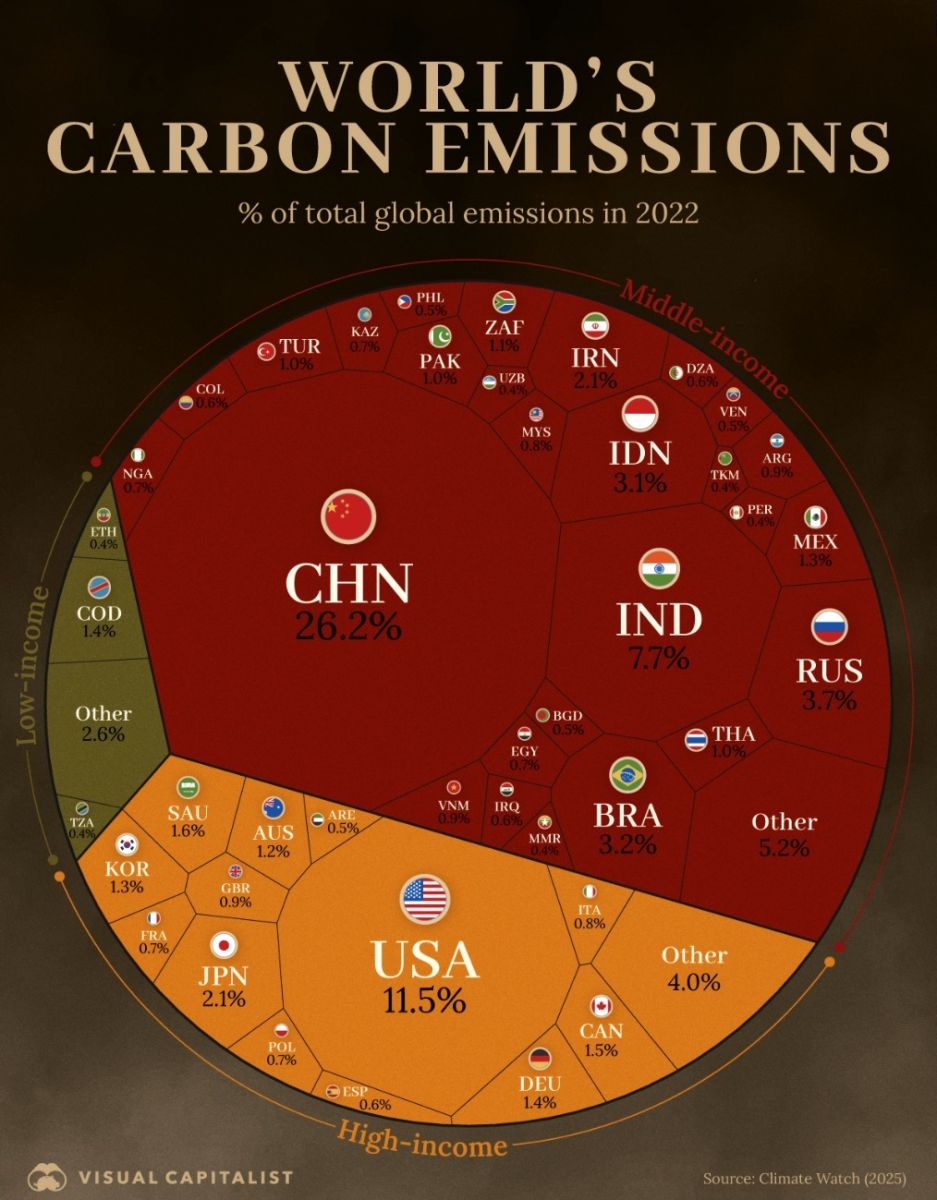

In 2022, Climate Watch ranked the World’s Global Emitters according to their incomes, and the United States and Canada ranked first and fourth amongst the high-income nations.

Both have promised to reduce their emissions, but in reality, they both subsidize this accumulation through fossil fuel subsidies.

In 2022, the U.S. government spent around $757 billion on fossil fuel subsidies, including $3 billion in explicit subsidies and $754 billion in implicit subsidies, which included the $500 billion the IMF estimated was borne by society due to the negative externalities of fossil fuel use, such as environmental degradation, health impacts, and climate change. And the $196 billion foregone tax revenue due to underpricing or exemptions for fossil fuel production and consumption.

In Canada, Environmental Defence revealed that in 2024, Canada provided nearly $30 billion in direct subsidies and public financing to oil and gas companies and projects, and over $74.6 billion over the last five years.

In 2024 alone, the pollution costs from oil and gas operations were estimated at $53 billion.

In addition to the subsidies it receives, the fossil fuel industry in both countries is now seeking “incentives” to remove the emissions it has contributed to the atmosphere over the decades, an offshoot of the generation for which it pocketed massive profits.

In the U.S., the 45Q Tax Credit incentivizes up to $85 per metric ton of CO₂ permanently stored underground and $60/ton for CO₂ used for enhanced oil recovery and applies to Direct Air Capture (DAC) projects and point-source capture from power plants or industrial facilities.

As shown in the Climate Watch graphic, the U.S. produced 11.5% of the 2024, global CO2 emissions of 41.6 billion tonnes for a total of 4.8 billion tonnes. At $85 per ton this would be a $408 billion a year liability.

It should be noted that this would be over twice the cost of President Trump’s Golden Dome missile defense project.

45Q is controversial because fossil fuel companies can claim public funds for capturing CO₂ from their operations. When used for enhanced oil recovery, this would increase oil production, particularly if no emissions cap is in place.

However, the 2022 Inflation Reduction Act shifted the 45Q incentive away from fossil capture towards atmospheric removal.

It funds over $3.5 billion for DAC hubs and tens of billions more for clean energy manufacturing, green hydrogen, and electric vehicles, and it boosts Department of Energy research into carbon removal and storage technologies. The aim is to target “hard-to-abate” emissions, not fossil business as usual. It prioritizes permanent CO₂ storage, not temporary offsets, and requires monitoring, reporting, and verification of carbon storage. The risks are that some DAC hubs are located in fossil fuel-producing states like Texas and Wyoming, raising concerns that the hubs can be used to extend fossil infrastructure.

Without guardrails, these hubs can co-opt public funds under the guise of carbon removal.

In Canada, the government is actively engaging with the Pathways Alliance, a consortium of six major oil sands producers, on a proposed $16.5 billion carbon capture and storage (CCS) project in northern Alberta. A federal government tax credit of up to 50% of eligible capital costs is offered for the project. Plus, the $15 billion Canada Growth Fund seeks to support through Carbon Contracts for Difference to de-risk investments in low-carbon technologies by guaranteeing a minimum price for carbon credits or emissions reductions. And the federal government has indicated a further willingness to allocate up to $7 billion in funding through special contracts aimed at de-risking large-scale CCS investments.

The consequences of these kinds of subsidies are the distortion of market signals, leading to the overconsumption of fossil fuels, contributing to pollution, climate change, and environmental damage.

The health impacts are linked to various health problems, including respiratory illnesses, cardiovascular diseases, and cancers. Taxpayers bear the economic costs associated with addressing these impacts and mitigating climate change.

Prorated based on Canadian/US emissions, the health impacts alone would be an annual burden of $65 billion on the $2.5 trillion Canadian economy.

Fossil fuel subsidies break the covenant that the current U.S. and Canadian governments have made to their citizens to reduce their economic burden. They are the ultimate hypocrisy.

The U.S. and Canadian governments have made numerous promises and enacted policies aimed at lowering costs for their citizens, particularly in the face of recent inflation and rising living costs. They have also promised to bring down fossil fuel subsidies, aligning with broader goals to combat climate change and transition to renewable energy sources.

The recent U.S. federal budget proposal included eliminating tax breaks for fossil fuel companies, such as the Intangible Drilling Costs deduction and the Percentage Depletion Allowance. And some lawmakers introduced bills aimed at phasing out fossil fuel subsidies and redirecting those funds toward renewable energy development.

In 2023, Canada became the first G20 country to publish a comprehensive framework to eliminate fossil fuel subsidies ahead of the 2025 deadline set by the group. This framework applies to existing tax measures and 129 non-tax measures, aiming to ensure that federal support for the fossil fuel sector aligns with Canada’s climate objectives.

Under this policy, federal support identified as a fossil fuel subsidy can no longer be provided unless it fulfills one of six criteria, such as enabling significant net greenhouse gas emissions reductions or supporting clean energy initiatives. However, the framework includes exemptions that may allow certain subsidies to continue, particularly those related to carbon capture technologies and projects with credible plans to achieve net-zero emissions by 2030.

Canada currently emits approximately 700 million tonnes of CO2 annually. The cost of CO2 removal with Saskatchewan’s Boundary Dam 3 carbon capture project is estimated to be CAD 100-120 per tonne, and it sequesters only about 800,000 tonnes. So, achieving net-zero emissions by 2030 would cost about $77 billion a year.

The public won’t stand for it, particularly when they can access energy orders of magnitude cheaper than fossil fuels, which cools the surface and sequesters atmospheric CO2 at no additional cost.

Instead of being bit players in the global energy market, they should provide life-sustaining energy to the other 87% of emitters shown in the Climate Watch graphic.

The World faces a new danger of ‘economic denial’ in the climate fight, André Aranha Corrêa do Lago, Brazil’s Secretary for Climate, Energy and Environment, and leader of this year’s COP30 UN climate summit, says in an exclusive Guardian article. “The new populism is trying to show [that tackling the climate crisis does not work],” he said. “

That life can’t come soon enough. Scientists now predict the world could experience a year above 2°C of warming by 2029 while others say the Earth is heading for 2.7°C warming this century.

Subsidizing carbon dioxide removal is just another DANGEROUS exercise in economic denial.