There’s ambition, and then there’s trying to decarbonise an entire national grid by 2030. The UK has opted for the latter. But while the headlines might focus on offshore wind targets and solar megaprojects, the real story lies in what happens behind the scenes: grid architecture, infrastructure lag, market mechanisms, and the political plumbing that determines whether wires get laid, permits get signed, and electrons flow cleanly.

I recently spoke with John Sturman, Managing Director of NatPower UK, for episode 215 of the Climate Confident podcast. We covered everything from the UK’s bold 2030 goals to the unseen friction slowing things down. This post takes a step back from the podcast itself and zeroes in on the strategic decisions nations must make when shifting their energy system at scale. Spoiler: it’s a lot more complicated than just building more wind farms.

The Grid is the Ground Game

Let’s start with the grid. The transition from fossil fuels to renewables isn’t just about replacing dirty power with clean power. It’s about replacing centralised, predictable generation (big thermal plants) with decentralised, intermittent assets (solar panels, offshore wind farms, home batteries, and EVs).

The UK grid was never designed for this kind of diversity. Historically, a handful of coal and gas plants pumped power in one direction. Now? The system needs to handle thousands of sources, many of them weather-dependent, with demand-side behaviour that shifts by the hour.

And here’s the kicker: the grid isn’t ready. As John put it, the bottleneck isn’t the build-out of renewables. It’s the lagging investment in the transmission infrastructure that ties it all together. That’s a story repeated in country after country. Decarbonisation plans look solid on paper until they hit a 15-year wait for a substation upgrade.

To make matters worse, the UK’s transmission network is still a regulated monopoly. National Grid owns and operates the entire high-voltage infrastructure. Even developers like NatPower, willing to self-fund new substations, are blocked by licensing restrictions. It’s a textbook case of regulatory inertia stalling technological progress.

What Clean Power 2030 Actually Means

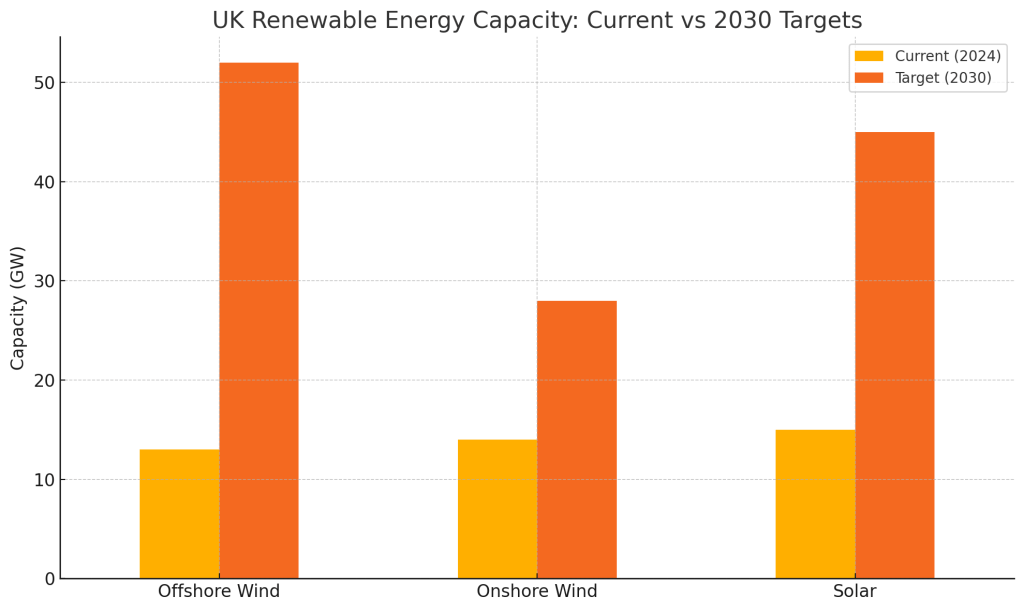

The UK’s Clean Power 2030 ambition isn’t subtle. It calls for:

- Quadrupling offshore wind capacity

- Doubling onshore wind

- Tripling solar generation

Let’s visualise that for a second:

These targets aren’t aspirational posters. They imply an astronomical construction effort within a very tight window. Offshore wind alone will require faster permitting, industrial-scale maritime construction, and ports capable of handling it all.

But scale isn’t the only problem. Timing is. Because wind and solar are variable, the system needs something to fill the gaps. That’s where battery storage steps in.

Batteries: The Backbone of Flexibility

Sturman was clear: storage isn’t optional. It’s the only way to reconcile renewable intermittency with demand reliability. In fact, NatPower is currently developing 15 massive battery storage sites across the UK, each designed for 1 GW of connection capacity and four-hour duration.

That’s 4 GWh per site. Multiply that by 15, and you get a massive 60 GWh of storage being developed by a single company.

But there’s a strategic nuance here. These batteries aren’t just backup. They’re also traders. In a peaky market like the UK, where energy prices fluctuate dramatically across a 24-hour cycle, batteries enable what’s called arbitrage. Buy low, store, sell high. It’s grid balancing and market-making all in one.

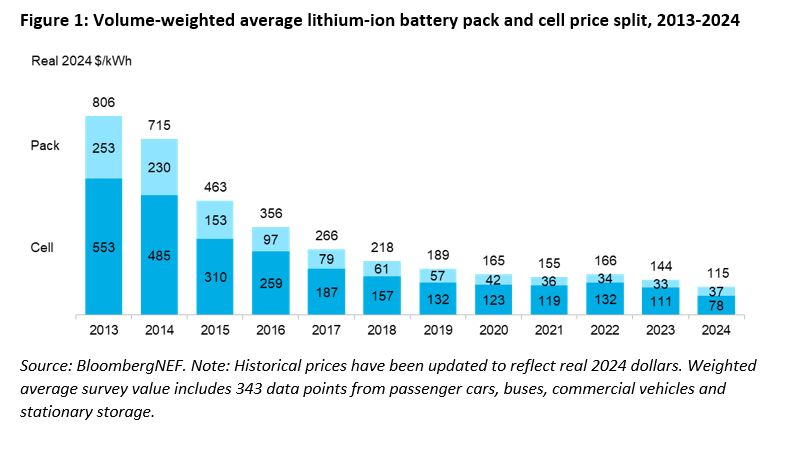

Battery costs have also dropped 86% in the past decade, according to BloombergNEF. The industry is now entering a phase where 12-hour and even 24-hour battery systems could rival pumped hydro, without the geographic constraints. That’s a complete rewrite of what’s possible for long-duration storage.

Digitisation and AI: The New Dispatchers

As the grid becomes more decentralised, managing it gets exponentially harder. Enter AI.

Optimising dispatch across thousands of small generators, batteries, and flexible loads isn’t something human grid operators can handle manually. AI can analyse weather forecasts, price signals, grid frequency, and battery charge levels in real time, and issue commands every five minutes (or faster).

NatPower expects trading to shift from 30-minute blocks to five-minute intervals in the UK market. That evolution alone could unlock major efficiency gains and cost reductions for consumers.

The hidden advantage? Predictive weather modelling. AI will increasingly be tasked with forecasting solar irradiance and wind speed at highly localised levels. In an all-renewables world, that’s not nice to have, it’s mission-critical.

Maritime: The Overlooked Energy Sink

You hear a lot about EVs. You hear less about ships. But port electrification is becoming a major piece of the puzzle.

EU regulations already require ships to plug into shore power rather than burning heavy fuel oil while docked. That’s pushing demand spikes at ports, which, in most cases, aren’t equipped for them. Add to that the rise of electric ferries and hybrid cargo ships, and you’re looking at megawatt-scale demands popping up unpredictably.

NatPower is now investing in maritime charging infrastructure, including 5-10 MW plugs that could cost £2-3 million each. That infrastructure will be key as the shipping industry begins a gradual shift to electric or hybrid propulsion, especially on routes under 200 nautical miles.

Policy Lag and the Planning Trap

The planning system in the UK remains one of the largest roadblocks to rapid deployment. Local opposition, bureaucratic inertia, and NIMBYism routinely scupper wind and solar projects.

Most onshore wind applications are still refused locally and only get built after costly appeals. This isn’t sustainable. NatPower argues, and I agree, that decisions about strategically critical infrastructure should not be left solely to local councils. When you’re trying to decarbonise a nation, some decisions need to be made at a national level.

What’s more, the capacity market (the mechanism that pays generators to be available in times of peak demand) needs a rethink. Gas peaker plants, often only used a few days a year, can still distort prices due to the UK’s marginal pricing model. That’s something policymakers urgently need to resolve if we want market signals that actually support clean energy.

Community Engagement: Not Optional

Decarbonisation isn’t just technical. It’s cultural. You can’t force a wind farm onto a village without blowback. At the same time, surveys consistently show that the majority of UK citizens support renewables.

The disconnect? Local benefits. NatPower’s approach, offering up to £1 million per year in community funding per project, goes well beyond the standard industry playbook. It’s a signal that these projects can deliver tangible, direct value to residents, not just shareholders.

More of that, please.

Decarbonising at National Scale: The Realities

So, can the UK decarbonise its electricity grid by 2030? Technically, yes. Politically, economically, and infrastructurally? That’s the harder question.

Let’s be honest: 2030 is unlikely. But even if it takes until 2032 or 2033, the effort is worth it. Clean power unlocks stable energy prices, new green jobs, and energy sovereignty. And it lays the foundation for electrifying everything else, from transport, to industry, to heating.

But it won’t happen on ambition alone. It’ll take market reform, planning reform, grid investment, storage deployment, and a digital nervous system to hold it all together. Most of all, it’ll require trust and collaboration between government, industry, and communities.

Listen to the Full Conversation

If you’d like to hear John Sturman lay this out in his own words, the full episode is available now:

🎧 Decarbonising the UK Grid with John Sturman

Whether you’re a policymaker, investor, or just someone trying to understand what real climate action looks like, it’s well worth your time.

Subscribe to the Climate Confident Podcast for more interviews like this. And if this post sparked ideas or questions, I’d love to hear from you. Drop me a line or share it on LinkedIn with your take.

This article was originally posted on TomRaftery.com. Photo credit Torsten Reimer on Flickr