Stock futures rose on Monday evening after the S&P 500 extended its losses for a third day following President Donald Trump’s tariffs announcement.

Futures tied to the S&P 500 were about 0.8% higher, while Nasdaq-100 futures gained about 0.9%. Futures linked to the Dow Jones Industrial Average jumped 398 points, or 1%.

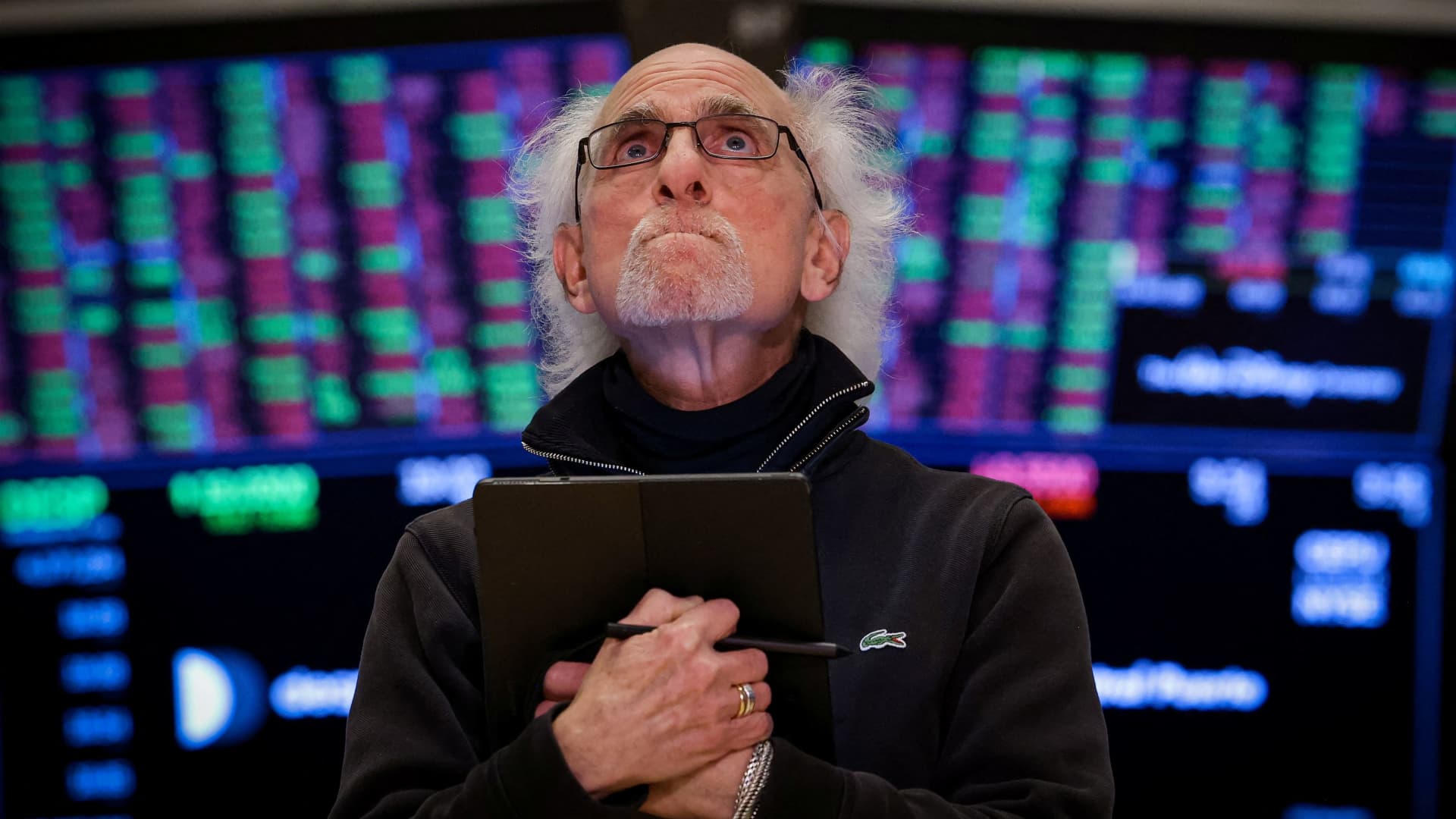

The moves come after yet another volatile trading day on Wall Street, which saw the highest trading volume in at least 18 years at roughly 29 billion shares:

- The 30-stock Dow fell 349 points, or 0.9%, paring back losses earlier in the session, when the blue-chip index plunged more than 1,700 points. Between session highs and lows, the index swung 2,595 points.

- The S&P 500 lost 0.2% after being down 4.7% at session lows. While the broad market index finished the day more than 17% off its 52-week high, it briefly entered bear market territory in the session.

- The Nasdaq Composite ticked 0.1% higher, with investors buying shares of key megacap technology names like Nvidia and Palantir. The tech-heavy index was off more than 5% at its session low.

At one point in Monday’s session, stocks saw a sharp rise into the green after speculation on social media of a tariff pause. The White House later told CNBC, however, that any chatter of a 90-day tariff reprieve was “fake news,” leading the indexes to pull back.

Treasury Secretary Scott Bessent suggested in an interview with Fox News Monday that tariff negotiations with other countries could last until June. He said that “maybe almost 70” countries, including Japan, have contacted the White House regarding negotiating tariffs.

Meanwhile, the benchmark 10-year Treasury yield climbed above the 4% level. That’s despite Trump’s tariffs exacerbating fears of a possible recession hitting the U.S. economy.

“It appears that the storm is easing, perhaps helped by the fake story of the easing of the tariffs,” said Louis Navellier, founder and chief investment officer of Navellier & Associates. “The rising Treasury yields are a strong indication that recession fears had become overblown, and perhaps the expectation that the Fed will not be making any emergency cuts. It also may be that Trump’s strategy will not turn out to be as destructive as the bears insist they are.”

Nevertheless, the S&P 500 has lost more than 10% over the past three trading sessions. The CBOE Volatility Index – known as Wall Street’s so-called fear gauge – spiked to about 60 on Monday.

On the economic data front Tuesday, the National Federation of Independent Business will issue its small business index reading for March. Later this week, the consumer price index report is due.

Trading volume boomed as Trump’s tariffs shook stocks for a third day

Market participants traded about 29 billion shares on Monday, resulting in the highest volume day in at least 18 years, according to FactSet and Nasdaq Trader.

It was a rocky day for stocks, with the S&P 500 briefly touching bear market territory and the Dow Jones Industrial Average seeing a swing of 2,595 points from its low to the high of the session.

Monday’s volume surpassed Friday’s volume of 26.77 billion shares, as well as the 10-day average volume of 16.94 billion shares.

— Gina Francolla, Darla Mercado

CVS Health, Broadcom among the stocks making moves after hours

Some stocks are making big moves in extended trading:

- Health-care stocks — Shares of Humana, CVS Health and UnitedHealth jumped after The Wall Street Journal reported that the Trump administration will raise payment rates for Medicare insurers next year to 5.06%, higher than the 2.23% increase the Biden administration had proposed. Humana gained more than 13%, while CVS Health and UnitedHealth advanced more than 7% and about 6%, respectively.

- Levi Strauss — The clothing stock rose more than 1% after the company reported its first-quarter results. Levi Strauss reported adjusted earnings of 38 cents per share, a 52% jump compared to the prior-year period. Revenue of $1.53 billion for the period also marked a 3% jump compared to last year.

- Broadcom — The semiconductor stock moved more than 2% higher following the company’s authorization of a new $10 billion share repurchase program, effective through Dec. 31.

Read the full list here.

— Sean Conlon

Stock futures open in the green

Stock futures opened higher on Monday evening after another volatile session on Wall Street.

Futures tied to the S&P 500, along with Nasdaq-100 futures, gained 0.6%. Futures linked to the Dow Jones Industrial Average jumped 321 points, or 0.8%.

— Sean Conlon