Europe’s energy transition isn’t creeping forward—it’s sprinting, hurdling over old paradigms, vaulting past fossil fuel relics. Ember’ recently released European Electricity Review 2025 lays it out in stark numbers: solar just leapfrogged coal. Gas? In a tailspin, shrinking for a fifth straight year. Renewables? Almost half of Europe’s electricity. A decade ago, that number seemed like a moonshot. Now? Baseline reality.

This isn’t just about climate targets. This is about shielding economies from the tantrums of fossil fuel markets (or petro-dictators), carving out energy independence, and proving that clean energy isn’t a compromise—it’s an upgrade. But for all the milestones hit, pitfalls lurk. Grids groaning under pressure, storage bottlenecks throttling potential, policy inertia threatening to drag it all down. The trajectory is clear. The obstacles? Equally so. The question is—who’s got the will to clear the path?

Renewables Have the Momentum—But It’s a Race, Not a Victory Lap

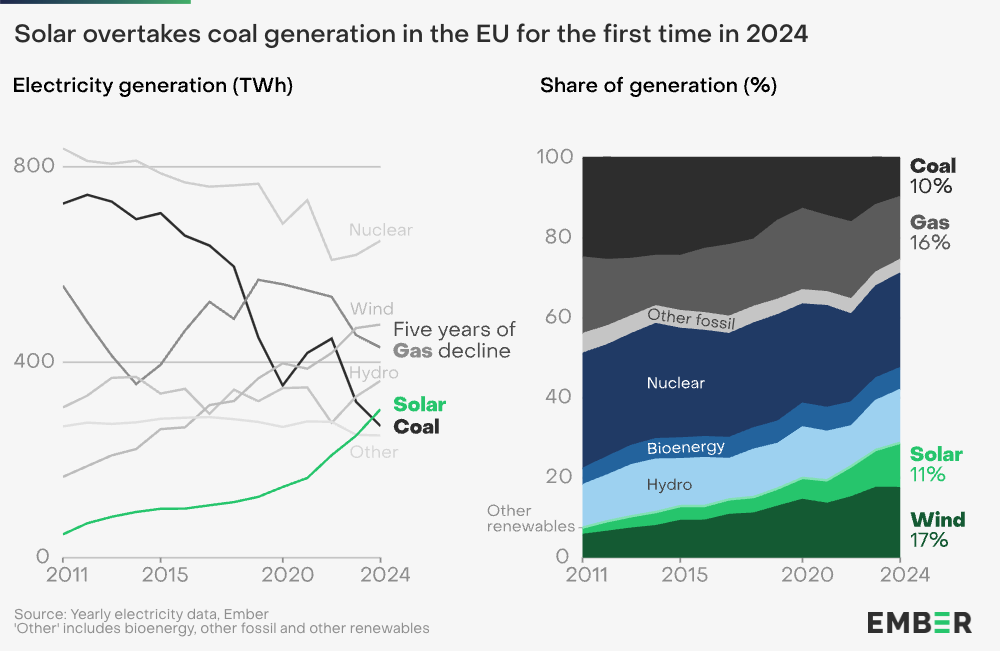

One number jumps off the page: 304 TWh. That’s how much electricity solar pumped into the EU grid in 2024. Coal? 269 TWh. A power shift that once felt hypothetical just became cold, hard data.

Wind? Still a juggernaut. Holding firm as the EU’s second-largest electricity source, trailing only nuclear. And gas? Bleeding market share, year after year, unable to reverse its downward spiral—even as electricity demand ticks upward again. Fossil fuels used to dominate Europe’s power sector. Now? The numbers tell a different story: emissions from power generation have plummeted to less than half of their 2007 peak.

And the financials? Brutal for the old guard. Since 2019, wind and solar have axed €59 billion worth of fossil fuel imports. If those renewables weren’t there? Europe would’ve burned through an extra 92 billion cubic meters of gas and 55 million tonnes of coal. At post-Ukraine war prices, that would’ve been an economic gut punch.

The transition is winning on price, security, and emissions. But it’s now running into a different beast: infrastructure. Storage. Grid upgrades. Demand-side flexibility. Without those, this momentum? Stalled.

Storage, Infrastructure, and Smarter Demand—The Bottlenecks Are Real

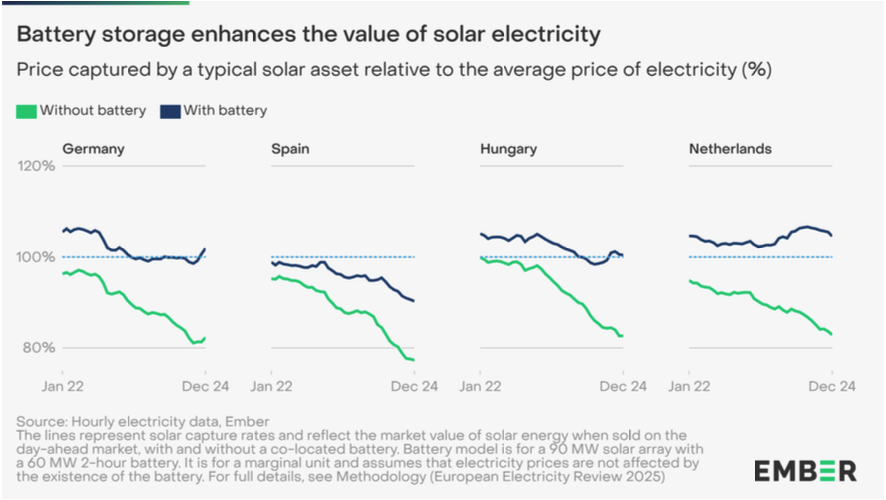

More solar and wind isn’t enough. The energy needs to be where you want it, when you want it. And right now? That’s the choke point.

- Storage Needs an Upgrade—Yesterday

Peak solar production floods the grid at midday. Demand peaks in the evening. The gap? Screaming for storage solutions. Yet, the EU’s total battery storage sits at 16 GW—woefully inadequate. Worse? Most of it is hoarded in just two countries: Germany and Italy. That won’t cut it. Scaling up storage—fast—is non-negotiable. - Grids Are Creaking Under the Load

The European grid was built for predictable, centralised power. Now? It’s dealing with variable, decentralised renewables. Transmission bottlenecks are already throttling wind and solar expansion. If interconnection and grid upgrades don’t accelerate, clean energy won’t reach the places that need it most. The solution? More cross-border infrastructure, fewer bureaucratic delays. - Electrification Has to Be Smarter

Europe’s energy demand is shifting—heat pumps, EVs, industry electrification. But if that demand spikes at the wrong time? It strains the grid. Enter dynamic pricing, AI-driven energy management, and flexible loads—tools that can synchronize demand with renewable supply. Without them? Wasted energy, higher costs, and inefficiencies.

Policy Can Make or Break the Transition

Markets are pushing renewables forward, but policy still holds the steering wheel. And right now? Some roadblocks need smashing.

Take wind power—a star player that’s now stumbling. Why? Permitting nightmares. Bureaucracy. Local opposition. Inconsistencies in policy. The result? Deployment is slowing, and targets are at risk. Without intervention, Europe won’t hit its 2030 wind goals.

Solar? It’s outpacing government forecasts. Growth is happening faster than expected, which should be great news—except that policy hasn’t kept up. Grid constraints, lagging storage investment, and outdated market structures could sabotage the momentum.

What’s needed? Permitting reform, storage incentives, and aggressive grid expansion. The pieces are on the board. It’s time to make the moves.

Why the World is Watching Europe’s Transition

This isn’t just about Europe. This is about setting the pace for the global energy shift.

China? The king of coal. But also? The largest renewable energy investor on Earth. In 2023, China installed as much solar capacity in a single year as the EU had in total. Meanwhile, the U.S., powered by the Inflation Reduction Act, is pouring cash into clean energy, trying to outpace European decarbonisation. For now.

The race isn’t just about carbon reduction. It’s about who dominates the energy economy of the future—who controls supply chains, who innovates, who reaps the financial and geopolitical rewards. Europe’s transition is a case study, a signal to the rest of the world. The speed and success of this shift will shape global energy policies, trade relationships, and even political power structures.

What’s Next?

The European Electricity Review 2025 makes one thing crystal clear: the trajectory is set, but the work is far from done. Renewables are surging, but storage and grids are lagging. Policy progress is being made, but too slowly in some areas.

The next phase is about acceleration—ramping up storage, rewiring infrastructure, and ensuring demand adapts to the supply revolution. The pieces are falling into place. Whether Europe cements its position as the global leader in clean energy or gets stuck in bureaucratic quicksand? That part isn’t written yet.

Originally posted on TomRaftery.com. Photo credit Bureau of Land Management on Flickr