A New American Empire…

Donald Trump has taken back the White House, threatening to upend the world order and build a new American empire, from Panama to Greenland. So far, Europe’s politicians and bureaucrats have resolutely refused to explode in outrage.

https://www.politico.eu/article/belgium-brussels-donald-trump-white-house-paris-climate-agreement-nato/

Workart by Germán & Co is fully owned.

Office of the President of Russia.

Glory, glory, hallelujah! Going deeper and deeper and deepest…

Have you paid the electricity bill? What is that? Electricity bill?

Yes, electricity bill. What is that? With each passing day, the world increasingly resembles the summer of 1972 in Reykjavík, the capital of distant Iceland. This city is nestled in the icy waters of the Atlantic Ocean, specifically in its northern reaches, closer to the famous Greenland, and far removed from the economic and geopolitical turmoil of its cousin in the Baltic Sea and Europe of course.

What is the flash back?

Firstly, we must talk on Iceland due to the complexity and inexplicable intelligence of its remarkable ecosystems that envelop the island. In Iceland, many of these paradigms converge. The solar constellation’s light shines with such intensity during the, causing a peculiar phenomenon – especially for those who are not from there – during which night vanishes, and brightness persists throughout the entire twenty-four hours of the day. As autumn approaches, this same stream of brightness gradually fades and disappears entirely in winter, transforming into an eternal darkness that troubles the human soul.

However, we also focused on the enigmas of environmental biodiversity. Iceland’s proximity to the Arctic should make it uninhabitable, but it is not. This lost rock near the North Pole has an incredible, almost infinite source of geothermal energy from the copious activity of its volcanoes. Such is the amount of force evolving in its underground caverns that the pressure from it seeks an outlet by fracturing the island’s ground, resulting in the formation of geysers. They furiously emanate jets of hot water and near-boiling steam dozens of meters into the air. Due to its abundant geothermal energy, these conditions make Iceland self-sufficient in electricity consumption.

It is thanks to the unique symbiosis of the biological diversity of this otherwise uninhabitable delta that it has become a microcosm suitable for the development of human life. This small population of Icelanders, around 400,000 people, is one of the happiest societies on Earth, yet the reality seems different: its suicide rate is one of the highest in the world.

Unlike the countries on the old continent, they do not have the natural benefits of this incredible ecosystem in terms of energy. History and its contradictions… It was the summer of 1972, Tuesday 11 July to be precise. One of the purest and most solitary ecosystems in the world, Iceland, had chosen – who knows for what reason, to help cleanse the polluted atmosphere of that sinister bipolar world – to host one of the most notorious events of the Cold War, the so-called Match of the Century for the world chess championship.

Media coverage of the sporting event unfolded under a strategy of intense propaganda by both political systems. The world’s attention focused on all the probe balloons fired from the circus set up in the tiny Reykjavík.

The comings and goings of the unpredictable prodigal chess child and aspiring world champion, Robert (Bobby) James Fisher (Chicago, Illinois, USA, 9 March 1943), represent the United States. His opponent, known as the knight of the sport of kings, international grandmaster, and world chess champion Boris Vasilyevich Spassky (St. Petersburg, Union of Soviet Socialist Republics, USSR, 30 January 1937), was the other star of this staging.

The aspiring world chess champion, Bobby Fisher, who only the day before, 10 July, had decided to take part in the championship – not at all unusual for him, given his well-known habit of making as much money as possible out of the situation – had to resort to a phone call from the US foreign secretary, Henry Kissinger, to finally make his participation in the Match of the Century viable.

The championship staged at the National Theatre in Iceland. The match was played over twenty-five games, and the first of the two chess players to reach the coveted and necessary score of 12.5 points would crown the new world champion. In short, one of the two political blocs would win this worldwide media war. However, in this stratagem of scholars with supernatural intelligence, the loss limited only to the dishonour of having defeated, according to the world.

— Chicken run applies to an offensive escalation in which neither side has anything to lose (The Chicken “Josefina Mesa … – Blogger”).

Speculatively, after forty-nine days of cognitive attrition and fifty-four moves, we can think that this was the tenor of the penultimate game (20) for the world chess championship between Spassky and Fisher on 29 August 1972 at the National Theatre in Iceland, to force a draw premeditated. Of course, both Fisher and Spassky really don’t have anything significant to lose in this situation…

In the current geopolitical landscape, which resembles the summer of 1972 but involves a greater number of significant players, including major nations like China and North Korea, alongside a hidden and increasingly influential Iran, there is a pronounced element of propaganda filled with misinformation. After 1,000 days of war between Russia and Ukraine, the expression “chicken run”—which suggests an offensive escalation where neither side has anything to lose—does not apply in this case. On the contrary, all parties involved have much to lose because President Trump has been speaking out loudly about the matter, and the European Union has “reprimanded” Norway.

https://www.politico.eu/article/norway-oil-europe-profits-ukraine-russia-war-oslo-western-sanctions-democrats/

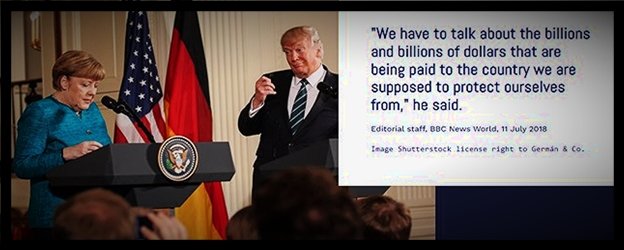

A stern reprimand from Trump to Putin…

Today, President Donald Trump delivered a sharp warning to Russian President Vladimir Putin, urging him to halt the aggression in Ukraine without delay. Trump emphasized that if a swift resolution isn’t achieved, Russia could face hefty taxes, tariffs, and sanctions on its imports. However, we all know that such measures have often fallen short in the past. Sanctions and economic strategies have a bit of a hit-or-miss history. They can certainly crank up the pressure on a nation, but they don’t always hit the mark in terms of achieving the intended political shifts. The effectiveness often hinges on how sturdy the targeted country’s economy is and how steadfast its leaders are in weathering the storm. Take Russia, for instance—past sanctions have made some waves, but they haven’t quite been the game-changer needed to alter its trajectory in a meaningful way. He also articulated his intention to offer assistance to Russia during these challenging times and acknowledged his previously amicable and cooperative relationship with Putin; however he emphasized the necessity of ending the conflict to avert further casualties. This statement represents a notable change in Trump’s rhetoric, as he has previously expressed admiration for Putin. He is now exerting direct pressure on the Russian leader to pursue diplomatic negotiations.

https://www.politico.eu/article/donald-trump-threaten-vladimir-putin-ukraine-war-tariff-sanction/

This position is deemed unacceptable.

Concurrently, it is imperative for the United States and Europe to garner as much support as possible, particularly in light of Norway’s reluctance to increase its contributions, given the significant economic benefits it derives from the ongoing conflict. Norwegian Prime Minister Jonas Gahr Støre has indicated in the past that “no one is willing to give away their natural gas currently,” and that Norway is not providing additional international economic assistance to alleviate the rising costs of natural gas, as stated during his official visit to Sweden on August 28, 2022. This position is deemed unacceptable.

Norwegian war profits from natural gas during this period are estimated at USD 33 billion.

Norway was invaded by Nazi Germany on April 9, 1940, during World War II. The occupation lasted until May 8, 1945. Norway’s experiences during World War II have left a lasting impact on its national consciousness. The invasion and occupation by Nazi Germany were significant events that shaped the country’s history and collective memory. This historical experience has likely influenced Norway’s foreign policy and approach to international conflicts and humanitarian efforts. Understanding the devastation and consequences of war firsthand, Norway has often advocated for peace and stability on the global stage. Their past experiences may contribute to their cautious and considered responses to modern geopolitical events.

Norway’s oil and gas sector plays a pivotal role in the nation’s economy. The government’s revenue derived from petroleum activities is significant, with projections indicating a net cash flow of USD 62.3 billion for 2024 and USD 56.7 billion for 2025. These revenues are essential for sustaining Norway’s welfare state and are anticipated to benefit both current and future generations. The oil and gas industry accounts for approximately 20% of Norway’s Gross Domestic Product (GDP). Furthermore, Norway’s supply of oil and natural gas to Europe is expected to remain relatively stable until 2030. Notably, Norway’s gas exports to the European Union experienced an increase of over 10% from 2021 to 2023, a trend that coincided with Western sanctions imposed on Russia and the subsequent rise in global prices. The profits generated from natural gas during this period were estimated to be USD 33 billion.

Mexico-USA Scuffle.

In an article published today by the Mexican newspaper “El Universal,” titled “To Navigate the Tariffs Imposed by President Donald Trump,” author Mario Maldonado outlines ten strategic measures designed to address the challenges posed by these tariffs. The proposed steps include:

1. **New Migration Policy**: Establishing a program aimed at stabilizing citizens in their countries of origin to manage migration flows from Central America.

2. **Achieving ‘Safe Third Country’ Status**: Mexico is expected to attain this designation through the mass deportation of migrants and the implementation of the “Stay in Mexico” initiative.

3. **Enhanced Crackdown on Cartels and Fentanyl Trafficking**: Intensifying efforts to combat the trafficking of fentanyl into the United States.

4. **Combating Smuggling from Asia**: Strengthening measures against smuggling operations originating from Asia.

5. **Reducing Imports of Chinese Products**: Accelerating initiatives to substitute imports from China with products sourced from Mexico.

6. **Increasing Integration of U.S. Products into Mexico’s Value Chain**: Revitalizing nearshoring practices and enhancing economic integration.

7. **Reviving Infrastructure on Mexico’s Southern Border**: Implementing infrastructure projects along the border with Guatemala.

8. **Renegotiating the USMCA**: Conducting a review of the United States-Mexico-Canada Agreement prior to 2026.

9. **Reversing Policies on Genetically Modified Corn and Energy**: Reintroducing genetically modified crops and amending regulations that favor state-owned enterprises over private entities.

10. **Collaboration with U.S. Security Agencies**: Enhancing information sharing and cooperation on security matters.

These measures are intended to alleviate the adverse effects of tariffs and to fortify the bilateral relationship between Mexico and the United States.

Well, everything is still open… good night…

The Owner of Non-Man and Other Tales… Second edition, revised and expanded…

Workart by Germán & Co is fully owned.

Help us make a dream come true…

From a young age we listen to the instructions of the elderly in the sense that we must be able to choose our path in life. It’s a nice metaphor.

There are those who, complying with this, prepare themselves to travel the highways of life, provide themselves with fast engines and soft seats. Others, simpler, choose secondary roads where the speed does not produce so much vertigo and the tolls are cheaper. Many have to join forces and travel the kilometers in collective buses that force the touches and strident music. And there are too many who have no other option than to walk along the humble paths crossing puddles or boulders and threatened by wild beasts or insects. This is the vineyard of the Lord, and everyone can make use of their free will. Say.

Reading the stories of Germán Toro Ghio one discovers that there are also those who chose all paths. And they also added the alternatives of lifts, elevators (and descenders), cliffs, flying devices and perhaps how many more.

With its eight stories, The Owners of No Man’s Land takes us to a world so real that, unfortunately, we tend to forget it. From the first story, he (Germán) rides the maelstrom of a roller coaster in which he mixes the discomforts of a Moscow hotel with the adventures in the Nicaraguan jungle. He is a de facto witness to the invasion of the USA army in Panama and his cousin of millenary stubbornness at the same time, without us being able to deduce which of the two experiences was more dangerous. He celebrates supposed birthdays in the company of an aphonic Fidel Castro (what a contradiction!) in a city of Havana corroded by sea salt or political blunders. He walks through one of the most unusual borders in the world, the one that divides the island of Hispaniola. He witnesses the sun sheltering us with unusual loves, in this case, his friend “Pepe” who, on a streak of good fortune, attracts them to a stale gypsy princess and a one-eyed gypsy king in the nights of Madrid and prologues his luck in the world of love to an island called Grinda in the Stockholm archipelago where Alexander’s honey captivates.

Germán also takes us to a café in Paris where Ernest Hemingway is in existential conversations about life, accompanied by the sweet notes of a Santa Teresa rum, which invades the soul with harmony and helps the journalist and writer try to persuade some young gang members to change the course of their lives, in this world of violence, organ trafficking, and arms. He evokes the spirit of the Nicaraguan poet and priest Ernesto Cardenal, particularly in his mesmerising “Ode to Marilyn Monroe”. This remarkable work invites him to explore the labyrinth of the mind’s afflictions, guided by the brushstrokes of legendary artists such as Sorolla, Munch, Botero, and Modigliani. Alongside this artistic journey, we encounter the candid whispers of Truman Capote in his poignant “Unanswered Prayers”, which lays bare the frailties of our contemporary society, political systems, and monarchies. Ultimately, Germán leads us to a heartwarming conclusion with the charming figure of “il Nono”, a grandfatherly character we all wish we could have known.

The book is magnified by experiences that have taken place outside the battlefields, far from palaces and ambitions. In other words, the principle of freedom of expression is paramount, even when individuals may endure defamation’s repercussions. With these stories, Germán Toro Ghio allows us to taste something of everything he keeps in his cupboard, and I hope he will continue to cook and deliver in successive books.

*Juan Forch, Puerto Octay, Chile

*Film director, writer, and political scientist is renowned for the 1990 "NO" campaign. / https://www.nytimes.com/2013/02/10/movies/oscar-nominated-no-stirring-debate-in-chile.html

PayPal at gjmtoroghio@germantoroghio.com

————————————————————————————————————————————————————

O gods, women, and men with the souls of gods and goodwill, we request your solidarity and support for launching the second revised and extended edition of “The Owner of Non-Man Lan and Other Tales” in November 2025. We have already contacted a senior editor at Penguin Random House in London to help us create a remarkable and distinctive book handcrafted to serve as an exceptional corporate gift.

Thanks in advance…

You can’t possibly deny me…

Have a wonderful day filled with good health, happiness, and love…

In December 2023, Energy Central recognized outstanding contributors within the Energy & Sustainability Network during the ‘Top Voices’ event. The recipients of this honor were highlighted in six articles, showcasing the acknowledgment from the community. The platform facilitates professionals in disseminating their work, engaging with peers, and collaborating with industry influencers. Congratulations are extended to the 2023 Top Voices: David Hunt, Germán Toro Ghio, Schalk Cloete, and Dan Yurman for their exemplary demonstration of expertise. – Matt Chester, Energy Central

Gratitude is a vital aspect of our existence…

In a world that’s constantly growing and grappling with inflation, the art of blogging faces its fair share of hurdles. To keep our content top-notch during these challenging times, we’ve poured resources into top-tier software, licenses, and stunning copyrighted images, among other essentials. But fear not, we’re not navigating this journey alone! Just last week on “X,” actions like “liking” or “retweeting” have become your secret weapons—free and private, thanks to “Musk” your support through these simple yet impactful gestures is not just a token of appreciation but a significant contribution that shapes our journey!

If you’re feeling motivated to make a difference, consider extending your generosity through PayPal at gjmtoroghio@germantoroghio.com, or by using our IBAN account: SE18 3000 0000 0058 0511 2611. Alternatively, you can support our blog with a secure contribution via Stripe using the donation link. Every little bit helps!

Thank you for being a part of our journey! Your generous support is truly invaluable to us! It plays a crucial role in helping us achieve our goals and make a positive impact. Thank you for being such an important part of our journey!

https://x.com/Germantoroghio/status/1882026599467421966

You can’t possibly deny me…

Have a wonderful day filled with good health, happiness, and love…

Natural Gas Terminal AES ANDRES, located in the Dominican Republic. Image provided by AES Dominicana.

Andrés Gluski, President and CEO of AES, articulated this perspective during the World Economic Forum held in Davos, Switzerland, in January 2023, stating, “I am confident we will need natural gas for the next 20 years.” He further emphasized, “We can start blending it with green hydrogen today.”

Not Angela, not…

Workart by Germán & Co is fully owned.

Workart by Germán & Co is fully owned.

What Happened with the Energy Sector: Market Talk Roundup.

By WSJ:

0823 ET – The market will move in the direction of new energy sources, boosted by technological changes, former U.S Secretary of State John Kerry tells Bloomberg at the World Economic Forum in Davos, Switzerland. President Trump is correct when he flags the need for firm energy, the former U.S. Presidential climate envoy says. “Trump’s drill baby drill should be build baby build,” he adds. Data centers demand a massive amount of energy, and the type of energy to be used remains uncertain. Currently, China is leading the renewable energy market, and the U.S. needs to compete. However, any progress is stopped by bi-partisan politics, he adds. “The energy crisis seems to have been weaponized.” That’s why the market will drive energy change supported by technology prices, rather than commodity prices or governments, he says. (najat.kantouar@wsj.com)

0526 ET – Europe should aim for a fair playing field rather than a level one, European Central Bank President Christine Lagarde says after President Trump took the reins of the U.S. government, promising to rip up much red tape. In the face of hotter competition from a more deregulated America, European regulators could put energy into removing overlap and extraneous rules, Lagarde tells CNBC at the World Economic Forum at Davos, Switzerland. But their focus should be on protecting consumers and savers from the next financial crisis and product hazard, and from climate change that in recent months caused disastrous fires in California and disastrous flooding in Spain, the central banker says. “That might actually provide not necessarily a level playing field, but a playing field where actors will actually compete in a fair way,” she says. “I think Europe is prepared for that.” (joshua.kirby@wsj.com; @joshualeokirby)

0317 ET – Trade need not be the enemy of the climate transition, World Trade Organization director-general Ngozi Okonjo-Iweala tells a World Economic Forum panel in Davos, Switzerland. “The general perception is that trade contributes to more global emissions,” Okonjo-Iweala says. “”But people neglect some of the [environmental] benefits that trade brings,” she says, pointing to the adoption of clean technology and renewable energies that would not be possible without global trade. She calls for greater adoption of policies that would allow countries to focus on lower-emission production, such as a global carbon tax. (joshua.kirby@wsj.com; @joshualeokirby)

1504 ET – Oil’s uptrend at the start of the year reflects unsustainable momentum fueled by winter demand, a short-term Chinese export boost ahead of U.S. tariff risks, and upside risks from U.S. sanctions on Russian oil, Forex.com market analyst Razan Hilal says in a note. “The bullish drive was rejected at the $80 resistance level as concerns over non-OPEC production risks resurfaced following Trump’s inauguration speech, which emphasized oil overproduction,” she says. A firm close below $75 for WTI could pave the way to supports at $72 and $68, Hilal adds. WTI settles down 0.5% at $75.44 a barrel and Brent falls 0.4% to $79.00 a barrel, extending their losing streaks to four and five sessions, respectively. (anthony.harrup@wsj.com)

1307 ET – President Trump should bring “action, decisions and probably more certainty,” to America’s Ukraine policy, says Maxim Timchenko, the CEO of Ukraine’s largest private energy company, DTEK. “More certainly about further development, more certainty about [the] position of [the] United States, more certainty about [the] resolution of this war. And I think that, 2025, we all hope that this year will bring fair peace to Ukraine,” he says. Timchenko, who is attending the World Economic Forum in Davos, says his meetings with American financial institutions during the conference have yielded “tangible, more concrete discussions,” about investment in the country. (joshua.jamerson@wsj.com)

0936 ET – SSE has underperformed the European utility index by 10% over the last 3 months, presenting an attractive entry opportunity for investors, analysts at Jefferies write. The U.K. government plans to overhaul its transmission grid to facilitate more offshore wind connections. This will be a game-changer for SSE’s transmission grids and presents significant opportunities for growth, the analysts write. SSE also appears to be on track to hit expected completion dates at its Dogger Bank offshore wind project—worries about which dragged on its stock in 2024, they write. The analysts upgrade the stock rating to buy from hold and set a share price target of 1,930 pence. Shares trade down 0.8% at 1,588.50 pence. (adam.whittaker@wsj.com)

0916 ET – Crude futures are little changed with the market digesting the implications of energy and trade policy under the Trump administration. Uncertainty around Iran sanctions, tariffs against Canada and Mexico and an increased possibility of an end to the Russia-Ukraine war could provide background support for oil, Ritterbusch says in a note. But initiatives like increased drilling permits in the U.S. “we almost view as redundant” with output growth this year limited by production already at record levels, and majors restricted by efforts to maintain shareholder returns, the firm adds. WTI is off 0.1% at $75.76 as the front month switches to March, and Brent slips 0.1% to $79.19 a barrel.(anthony.harrup@wsj.com)

0912 ET – Iberdrola is expected to continue its decade-long period of earnings and dividend growth in 2025 and beyond, analysts at Jefferies write. The analysts expect 6% earnings per share growth in 2025. The Spanish energy utility company’s exposure to electricity grids will continue to be one of its core strengths given the uncertain outlook for the renewables sector, they write. Iberdrola also looks set to stay ahead of its peers and capitalize on data centers as a source of revenue growth. The analysts upgrade the stock rating to buy from hold and set a target share price of 17 euros. Shares fall 0.75% to 13.23 euros. (adam.whittaker@wsj.com)

0650 ET – U.S. and Canada can collaborate more on energy—particularly on liquefied natural gas—and rare earth minerals, Royal Bank of Canada President and Chief Executive Dave McKay tells Bloomberg on the sidelines of the World Economic Forum in Davos, Switzerland. Canada could become a key supplier to the U.S. of germanium, a critical mineral used in the production of fighter jets, after top producer China banned the exports of germanium to U.S., McKay says. Canada is also positioning itself as a supplier of green energy to power U.S. data centers, and is seeing great interest from them, he adds. (cristina.gallardo@wsj.com)

0424 ET – India is open to buying more U.S. energy as President Trump seeks to “unleash” domestic energy production, A.S Sahney, chairman of IndianOil, says in an interview with Bloomberg at the World Economic Forum in Davos, Switzerland. He expects new U.S. sanctions on Russia to remove around 2 million barrels of oil a day. However, there is capacity across the oil market to fill this gap, he says. Sahney says he isn’t expecting volatility in the oil markets soon. Demand growth for gasoline in India isn’t slowing but diesel growth is temporarily lower, he adds. (adam.whittaker@wsj.com)

0336 ET – U.S. President Trump’s decision to ramp up production of liquefied natural gas is “certainly good news” for Europe, Valdis Dombrovskis, the European Commission vice president for the economy, tells the World Economic Forum in Davos, Switzerland. Europe can still put more pressure on Russia by reducing LNG imports further, the Latvian politician says. More than half of the EU’s LNG now comes from the U.S., he notes. Ukraine’s Western allies should focus on Russia’s sanction circumvention, he adds. (cristina.gallardo@wsj.com)

0247 ET – Policy direction by the Trump administration could play a dominant role in the oil market’s trajectory in the short term, says Dilin Wu, Pepperstone’s research strategist. On the supply side, Trump’s national energy emergency declaration and his push for energy independence are significant drivers of bearish momentum, Wu writes in a note. Trump’s policies could likely turn the U.S. into a net energy exporter, which may have lasting implications for global oil prices, Wu says. Traders will assess the balance between economic growth, energy security and policy risks, as more details emerge over energy production and trade agreements, Wu adds. Front-month WTI crude oil futures are down 0.65% at $75.34/bbl; front-month Brent is 0.5% lower at $78.89/bbl.(amanda.lee@wsj.com)

0153 ET – Technology solutions provider CSE Global should gain from President Trump’s declaration of a national energy emergency, Maybank analyst Jarick Seet writes in a note. The executive order will speed the permissions for oil and gas production. The move should boost U.S. oil- and gas-related activities significantly, benefiting the Singapore-listed company, which has significant exposure to oil and gas projects in the country, he says. Maybank maintains the stock’s buy rating and target price of S$0.64. Shares are up 1.1% at S$0.45.(amanda.lee@wsj.com)

1650 ET – Development of the Dorado oil project in Western Australia isn’t likely to begin before 2026, assumes Euroz Hartleys. Carnarvon Energy, which owns 10% of Dorado, yesterday said a final investment decision on the project wouldn’t happen in 2025 as planned and didn’t offer a new timetable. Euroz Hartleys cuts its price target on Carnarvon by 53% to A$0.18/share, but retains a buy call on the stock. “Carnarvon has A$180 million of cash, no debt and a US$90 million Dorado development free carry,” analyst Declan Bonnick says. “The cash alone is worth A$0.10/share, potentially a lower trading limit to the Carnarvon share price.” Carnarvon ended Tuesday at A$0.12. (david.winning@wsj.com; @dwinningWSJ)

1550 ET – Oil futures fall as the market weighs the implications of President Trump’s pledges to raise U.S. production through easier permitting and opening up acreage, and to turn back some of the Biden administration’s clean-energy policies. Oil “is also trading lower on the Trump delay in tariffs after threatening to impose big numbers on the U.S.’s top trade partners on day one,” Mizuho’s Robert Yawger says in a note. Trump said he’s thinking of imposing tariffs on Mexico and Canada on Feb. 1. A 25% tariff on Mexican and Canadian oil would put at risk about 4.5 million barrels a day of the 16.6 million b/d that goes through U.S. refineries, Yawger says. “Kicking that can down the street a couple weeks takes some supply chain concerns off the table for U.S. refiners…for now,” he adds. February WTI goes off the board at $75.89 a barrel, down 2.6% and March WTI falls 2% to $75.83. (anthony.harrup@wsj.com)

1407 ET – President Trump’s pledge to refill the U.S. Strategic Petroleum Reserve “right to the top” may act as a downside buffer for crude prices rather than a catalyst for a rally, says CIBC Private Wealth US senior energy trader Rebecca Babin. “You need the money for that,” she says. The sentiment is there, but “you’ve got to have the budget for it and then the pricing has to be there, too. I don’t think either of those things are lined up for it.” The SPR held around 394 million barrels on Jan. 10, compared with 638 million barrels at the start of the Biden administration. Filling it completely would take more than 300 million additional barrels. (anthony.harrup@wsj.com)