Moving from Kilowatts to Megawatts: Understanding Data Centers’ Energy Appetite

Exploring the increasing power demands, electric utility challenges, and renewable solutions in data center development in the USA.

By Saqib Saeed, Chief Product Officer & Maheen Mahmood, Analyst – at PTR Inc.

The growth of data-driven services, cloud computing, and generative AI has significantly increased demand for processing capacity and storage space. Traditional data centers are becoming outdated due to rising computational demands and network bandwidth requirements. Consequently, companies are expanding existing data centers or building new ones to accommodate the escalating volume of data. This article explores the demand landscape of the data center market in the USA, focusing on the potential impact of IoT and generative AI on the need for higher power capacities. It also examines critical data center markets in the USA and the challenges electric utilities face in meeting substantial power consumption requirements. It also discusses the emerging trend of adopting renewable energy as a greener alternative to meet power needs in the data center segment.

Introduction

Generative AI continues to revolutionize business dynamics, compelling strategic investments in data center operations to support increased storage, computation, and energy demands. Recent investments by key players like Google, Microsoft, and AWS highlight this trend. Investments in the U.S. data center industry have nearly quadrupled in 2024 compared to 2019 (IEA). The rising demands for storage, computation, and energy necessitate careful strategic decisions regarding data center design, location, and investment. Power requirements have surged to unprecedented levels, with AI-driven applications predicted to account for 20% of data center power consumption by 2028 (Schneider Electric). This increased demand has ignited significant investment activities in primary data center markets. Consequently, electric utilities are under pressure due to grid congestion as they endeavor to meet data centers’ power consumption needs. In response to this challenge, data center owners explore opportunities in secondary markets. Furthermore, there is a noticeable trend towards integrating distributed generation through renewable sources to ensure the sustainable provision of power for data centers.

Power Requirements of Data Centers

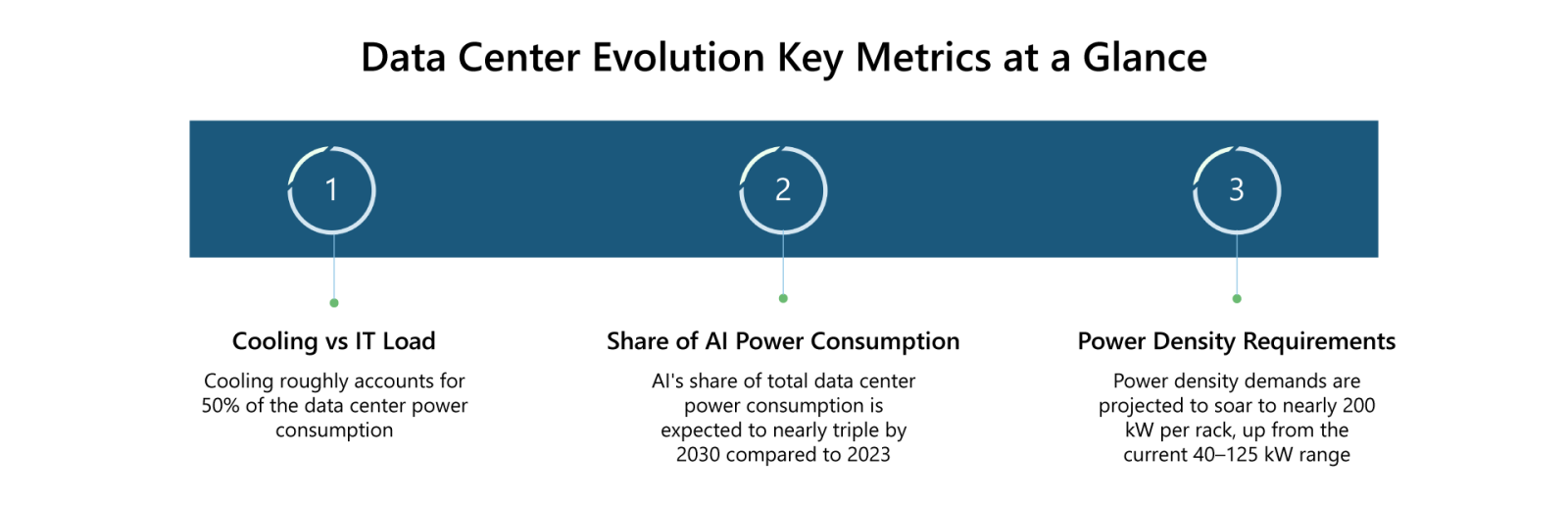

A data center building is a significant power consumer, typically consuming 10 to 50 times more energy per floor space than a standard commercial office building. The power usage in data center buildings primarily serves two types of loads: IT infrastructure and mechanical infrastructure (such as cooling systems and HVAC). Cooling and HVAC systems alone consume approximately 50% of the total power in data centers, while power consumed by storage and racks accounts for 26%.

With the projected demand from AI and machine learning, there’s a need for extreme power density, estimated to reach nearly 200 kW per rack, up from the current range of 40 kW-125 kW. This increase in power density necessitates a higher power supply for IT equipment.

Figure 1: Data Center Evolution Key Metrics at a Glance

Source: PTR Inc.

Overview of the USA Data Center Market

The United States remains the global leader in data center infrastructure, with Northern Virginia hosting over 350 facilities, solidifying its position as the data center capital of the world. This growth is driven by cost-effective electricity, connectivity, and proximity to major economic hubs. The operational capacity of data centers in the USA stands at approximately 13,500 MW, with pipeline projects indicating a potential expansion to 20,400 MW. At the regional level, the Americas lead the expansion of the data center market, followed by the Asia-Pacific region and Europe, respectively.

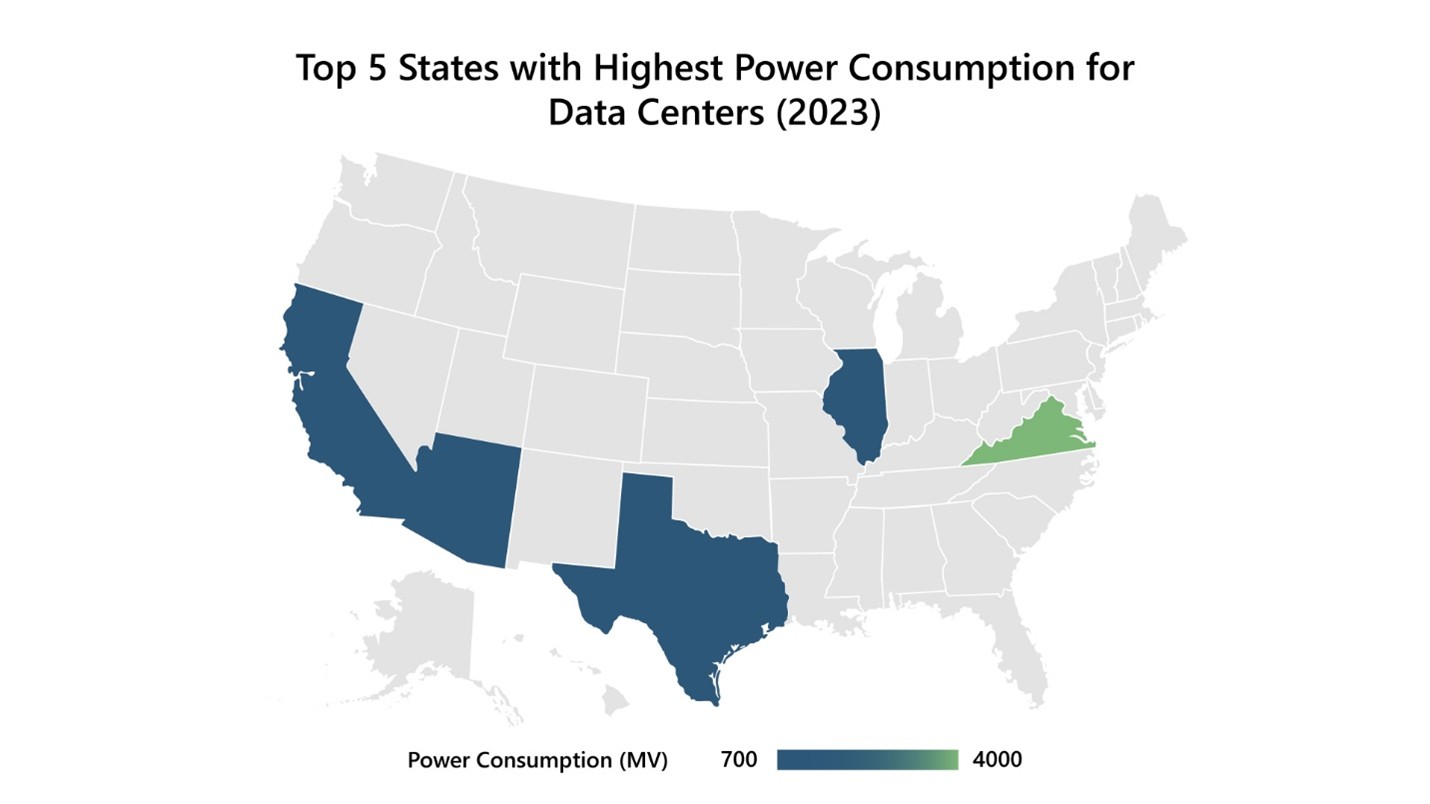

Landscape of Key State Markets

With the majority of data centers located in the USA, several developed states stand out as hosting many of these facilities, owing to various factors such as power availability, tax incentives, abundant water resources, and affordable real estate. Currently, the primary data center markets in the USA include Northern Virginia, Dallas-Forth Worth, Phoenix, Chicago, Northern California (Silicon Valley), Atlanta, and Los Angeles

- Northern Virginia: This region benefits from a robust fiber cable network and a central geographical location, facilitating low-latency data transfer to the eastern coast. It offers the lowest commercial electricity rates in the Mid-Atlantic region and is not susceptible to natural hazards like hurricanes. Northern Virginia has four transoceanic fiber cable connection points: MAREA, BRUSA, SAEx, and Dunant, which are the prime connection points to the markets outside the USA.

- Dallas: Positioned between the most significant data center markets in the U.S., Northern Virginia, and Silicon Valley, Dallas boasts affordable real estate and a strong economy, making it a primary data center hub.

- Atlanta: With a robust transportation network, affordable energy prices, and a skilled workforce, Atlanta has seen many data centers being established in the state.

- Northern California (Silicon Valley): Known as the hub of prominent data center owners like Google, Meta, and Amazon, Silicon Valley features internet exchange points (IXPs) and high-capacity fiber networking, making it one of the most interconnected locations globally and a key connectivity point for the West Coast.

- Chicago: Chicago’s strategic position as a connectivity gateway to the global market is complemented by its cost-effective living standards, fostering the attraction of a proficient workforce and significant corporations. Moreover, Illinois’ tax incentives, specifically exempting data center providers and tenants from state and local sales taxes on equipment acquisitions, underpin the region’s allure for business expansion and investment. The presence of Lake Michigan in the area allows for an unlimited water supply to cool the data centers. These reasons make Chicago the leading data center market.

Figure 2: Top 5 States with Highest Power Consumption for Data Centers (2023)

Source: JLL North American Data Center Report

Outlook of the Data Center Market

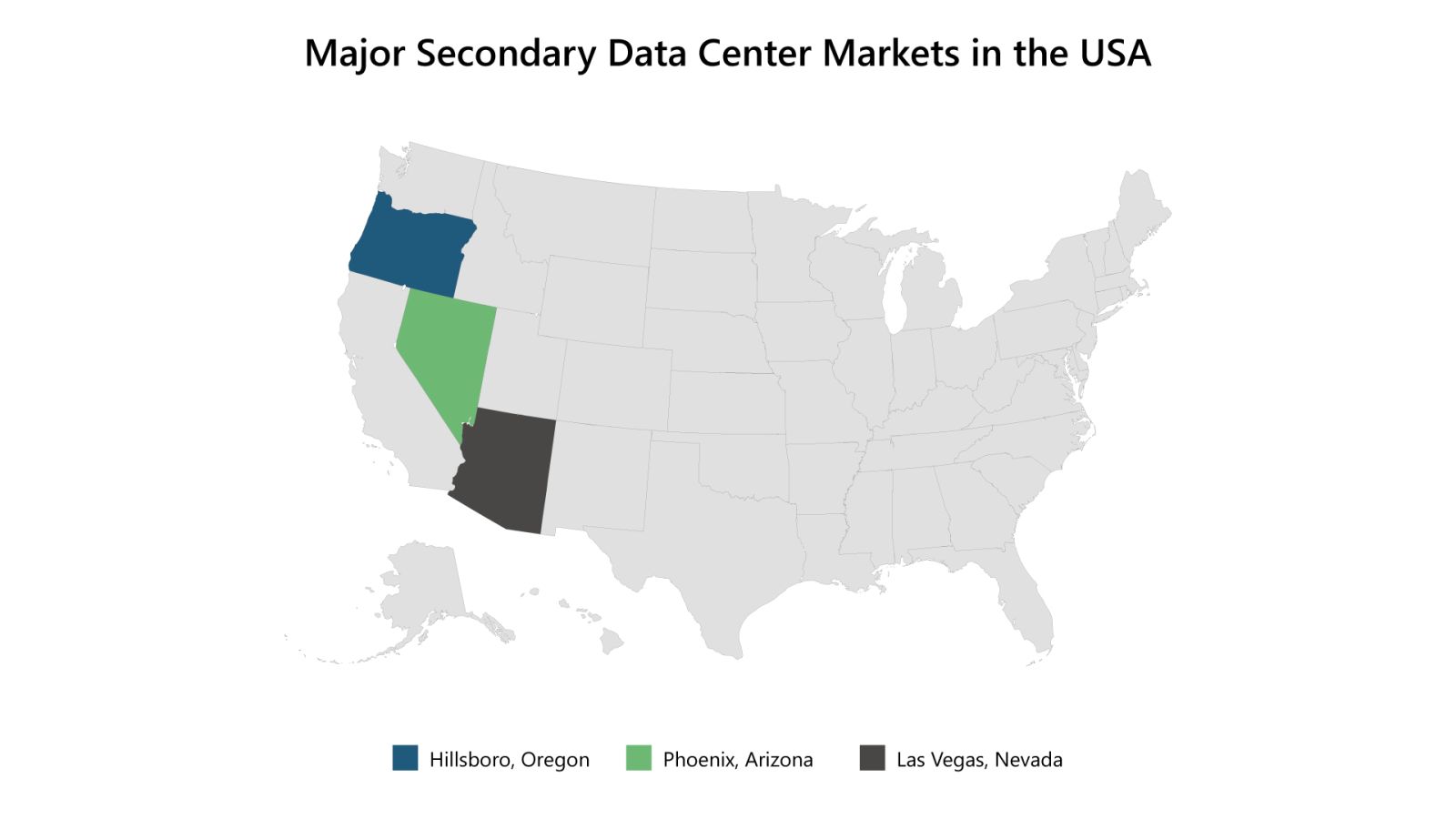

The data center market in the USA is projected to experience substantial growth. This growth is primarily propelled by rising internet usage, advancements in technologies such as augmented reality and virtual reality, generative AI, widespread smartphone usage, and the expansion of 5G technology enabling edge computing and connecting IoT devices to develop smart cities and buildings. In September 2024, BlackRock, Global Infrastructure Partners, Microsoft, and MGX announced a substantial investment in data center infrastructure, highlighting the escalating demand for advanced computing capabilities. Primary data center markets like Northern Virginia and Silicon Valley face significant space and power availability challenges. These regions are already experiencing shortages in available land, data center space, and power resources. As a result, enterprises are increasingly turning towards high-growth secondary markets such as Hillsboro, Oregon; Phoenix, Arizona; and Las Vegas, Nevada. A combination of tax incentives, advancements in renewable power sources, improvements in electricity transmission and distribution infrastructure, and affordable power primarily drives this shift.

Figure 3: Major Secondary Data Center Markets in the USA.

Source: PTR Inc.

Challenges for Electric Utilities to Meet Power Capacity Requirements

The growing demand for digital infrastructure is underscored by the global surge in data center construction, which currently consumes 4% of the electricity supply—a figure expected to rise to 6% by 2026, according to IEA statistics. However, there is a discernible shift in the strategies of data center owners. No longer solely focused on primary markets, they are now seeking regions with ample power resources and available land.

In Northern Virginia, a prominent data center hub, Dominion Energy anticipates challenges in meeting power demand until at least 2025 or 2026. Compounding this issue, data center owners face opposition from residents who are reluctant to see residential areas converted into data centers. Similar challenges are observed in Chicago, where power constraints and escalating land requisites prompt providers to explore innovative solutions, such as constructing multi-story buildings or relocating.

Despite the slower pace in established markets, burgeoning locales like Atlanta are gaining prominence. With 1 GW of pipeline projects already underway, Atlanta’s allure lies in its surplus power and expansive land, attracting hyperscale operators seeking expansion opportunities. Many prime parcels have already been secured for projects over the next two to three years.

Meanwhile, major players like Google, Meta, and Amazon are doubling their commitment to data infrastructure. With multi-billion-dollar investments earmarked until 2030, they are venturing beyond traditional strongholds into tertiary markets like Columbus, Indiana, and Minneapolis. They aim to construct state-of-the-art mega data center facilities, marking a significant shift in the industry’s landscape and its pursuit of scalability and resilience.

Renewable Utilization in Data Centers

The surge in computing power and rack densities have raised concerns about heat dissipation, especially in regions with warmer climates. This leads to the requirement for more efficient cooling systems, which contributes to drawing a significant share of power from the grid. This continued increase in power demand strains the grid, consequently slowing down data center construction in such areas. Moreover, there’s a growing commitment among data center operators to embrace sustainability and reduce carbon footprints.

Leading tech giants like Google, Meta, and Microsoft are at the forefront, pledging to transition to 100% renewable energy sources. They are exploring microgrids, battery storage systems, and direct current transmission to integrate renewable energy generation seamlessly. This shift mitigates carbon emissions and ensures a cost-effective and reliable power supply, which is crucial for preventing downtime for these critical facilities.

The focus now lies on establishing green data centers. For instance, IBM Cloud aims to achieve 75% renewable energy generation by 2025, while AWS targets net-zero emissions by 2050. Microsoft has set an ambitious goal to eliminate all carbon emissions since its inception by 2050. While the digital economy continues to grow, adopting initiatives that support green data centers is imperative. While the growth of the digital economy is essential, it is equally crucial to bring initiatives supporting green data centers, as these data center operators will be significant energy consumers from the grids. Financial incentives, stringent government regulations, and cost-effective renewable energy provisions can push operators to shift towards a greener and more sustainable future.

Conclusion

In conclusion, the data center market in the USA is undergoing a significant transformation driven by the rapid growth of data-driven services, cloud computing, and generative AI. This growth has resulted in a surge in demand for processing capacity and storage space, leading to the expansion of existing data centers and the construction of new facilities. As of 2023, leading operators have invested approximately $50 billion in the data center market in the USA, and it’s projected that the data center market will grow three times in size by 2030. The expansion will not only enhance the business of data center operators but also elevate the demand for suppliers of electrical, mechanical, and IT equipment required for these facilities.

However, this expansion is not without challenges, particularly in major primary markets like Northern Virginia and Silicon Valley, where infrastructure limitations and grid capacity constraints hinder the timely expansion of data center operations. To address these challenges, data center operators are looking into secondary market opportunities and implementing renewable energy solutions to meet their power needs sustainably. To construct these massive data center infrastructures, operators are considering power and land availability when opting for these nascent markets and developing these lands into robust fiber cable hubs to improve connectivity.

About the Authors

Saqib Saeed

Chief Product Officer – PTR Inc.

Saqib is a highly accomplished market research professional and a data storyteller in the international energy industry. With over a decade of experience in the field, he currently serves as the Chief Product Officer at PTR Inc. His expertise lies in the power grid and e-mobility equipment sectors. Throughout his career, Saqib has overseen numerous global market research studies and provided valuable insights to key decision-makers at various Fortune 500 companies. He is a member of the editorial board for Transformers Magazine and a member of the Advisory board of CWIEME Berlin. In addition to his market research career, Saqib has also worked in the manufacturing sector. Saqib holds a Master’s degree in Electrical Power Engineering from the Technical University of Munich.

Maheen Mahmood

Analyst – PTR

Syeda Maheen Mahmood, a market analyst at PTR, has extensive experience working on topics such as transformers, power converters, DC-DC contractors, data centers, and power quality equipment. In her current role, she manages various projects and delivers in-depth research for clients across North America and Europe, utilizing both primary and secondary research methodologies. With a degree in electrical engineering from NEDUET, she has been a key contributor at PTR for over a year, offering sharp analytical insights and actionable recommendations.

About PTR: With over a decade of experience in the Power Grid and New Energy sectors, PTR Inc. has evolved from a core market research firm into a comprehensive Strategic Growth Partner, empowering clients’ transitions and growth in the energy landscape and E-mobility, particularly within the electrical infrastructure manufacturing space.

Contact:

(sales@ptr.inc)