The U.S. Department of Energy released its long-awaited study on LNG exports Tuesday, and while the administration didn’t officially call for a ban on LNG exports – they might as well have. In a politically charged statement, U.S. Energy Secretary Jennifer Granholm said “that a business-as-usual approach is neither sustainable nor advisable,” echoing similar claims to those made by groups that the White House spotlighted for praising the pause.

As Independent Petroleum Association President & CEO Jeff Eshelman said in response to DOE’s study:

“U.S. LNG exports have reduced our trade deficit, helped our allies counter Russian aggression, and provided good paying jobs to hundreds of thousands of American workers. This thumb-on-the-scale “study” was an election year giveaway to Keep It In the Ground activists, and a thinly veiled attempt to give them a legal tool to sue American industry in the future. We hope the Trump administration will put this disastrous ‘pause’ behind us and allow Americans to get back to work.”

Notably, shortly before DOE released its analysis, S&P Global published a separate U.S. LNG Impact Study – the first of two in a series – that largely refutes many of the claims made by DOE on domestic prices and economic impacts. The second study is due in March 2025 and will focus on emissions.

LNG exports are a win for America and the world. They strengthen U.S. energy leadership, create jobs, and boost the economy. Blocking new projects risks economic growth, energy security, and global progress. A new @SPGlobal analysis demonstrates the importance of LNG exports.… pic.twitter.com/YEdjosdKC1

— U.S. Chamber (@USChamber) December 17, 2024

Let’s dive into the biggest claims in the DOE study – and the facts that refute them. And for a quick summation, check out this X thread from Bloomberg’s Javier Blas:

DoE Secretary commissions LNG report hoping for arguments against American gas exports.

DoE experts produce a rather nuanced 601-pages long report that doesn’t meet those hopes.

Solution? DoE secretary spins the 601 pages report into 3-page letter to achieve initial objective.

— Javier Blas (@JavierBlas) December 17, 2024

Claim: Permitting new LNG facilities will increase domestic natural gas prices.

This is an interesting one because even Secretary Granholm contradicts herself on prices, admitting that the United States has seen “stable” pricing:

“To date, U.S. consumers and businesses have benefited from relatively stable natural gas prices domestically as compared to those in other parts of the world who have faced far greater price volatility.”

Granholm’s statement echoes statements made within the study as well:

“…there is uncertainty in how rising export levels will affect the domestic market…there has not been a consistent relationship between domestic prices and export levels to date”

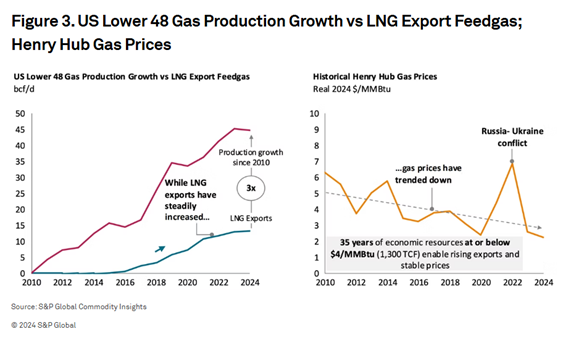

Despite nearly a decade of data saying otherwise, Granholm claims that “unfettered exports of LNG would increase wholesale domestic natural gas prices by over 30 percent” and “increase costs for the average American household by well over $100 more per year by 2050.” Notably, it wouldn’t be the first time DOE got it wrong on the relationship between LNG exports and domestic prices. A 2012 DOE study – published four years prior to the first shipment of LNG from the lower-48 – forecast that increased LNG could raise domestic prices by more than 50 percent. But that hasn’t happened. As the S&P Global study explains:

“…despite the 13 bcf/d growth in LNG feedgas requirements since 2016, US domestic wholesale gas prices have continued their downward trend, interrupted only temporarily by the combination of rapid post-COVID growth and Russia’s invasion of Ukraine in 2022.“ (emphasis added)

This is also backed by a Congressional Research Service report from April 2024 that found domestic natural gas prices have “have stayed stable and relatively low” since 2016.

Claim: Global demand can be met with currently permittaed U.S. LNG capacity because demand will decline in Europe and Southeast Asia, leaving China as the dominant U.S. market.

According to S&P’s study, natural gas will continue to maintain an essential role in the global energy mix, with projections looking through 2040. S&P’s Global Base Case projects a need for more than 100 MMtpa of new global LNG supply capacity to meet growing long-term demand. This projection does not include LNG capacity already under construction:

To have the proper LNG supply capacity to respond to incremental global demand, the United States must remain a key supplier of LNG exports, including to markets in Europe and Asia.

The S&P study outlines an important contrast to the DOE study in regard to LNG demand in Asia, in which South and Southeast Asia dominate LNG demand, not mainland China. Furthermore, in the near-term, LNG demand in Europe will continue to grow, as LNG exports will replace declining local energy production and closure of coal plants to support Europe’s emission reduction goals. U.S. LNG exports will also continue to provide energy security for U.S. allies amidst geopolitical conflicts.

Top LNG importing markets including Japan and South Korea already have considerable amounts of U.S. LNG under long-term contracts to ensure their future energy security.

Claim: LNG will displace renewables, not coal.

We already know that U.S. LNG is being used to displace surging coal use overseas and facilitate decarbonization in developing countries. S&P’s analysis similarly shows that a whopping 85 percent of lost U.S. LNG supply would be replaced by foreign, higher emitting sources:

“85 percent of the resulting global energy gap would be replaced by fossil fuels from non-US sources, led by alternative LNG and coal.”

If the United States stops exporting cleaner LNG, then countries will simply look elsewhere – for example, Europe and Asia would delay coal plant retirements and fuel switch to coal and oil – directly contradicting decarbonization goals.

As Karen Harbert, President and CEO of the American Gas Association emphasized:

“The contribution of U.S. natural gas to driving down emissions in this country and the potential for lowering global emissions is unquestioned.”

This theory of displacing renewables is – conveniently – also espoused by the same environmental activists who pushed the LNG pause to begin with, like Bill McKibben, who has said that LNG is “undercutting the move toward renewable energy.”

Claim: The LNG industry brings no benefits to local communities.

The economic benefits to the LNG have consistently been demonstrated. In fact, in 2018, the Department of Energy commissioned a study to evaluate the impact of U.S. LNG exports on domestic natural gas markets and on the country’s economy as a whole. Across each of the 54 scenarios evaluated, higher levels of LNG exports were projected to lead to higher levels of GDP and consumer welfare.

And the S&P analysis finds:

“The US LNG industry to date has contributed $408 billion to US GDP and supported an annual average of 273,000 jobs. These results were fueled by private expenditures totaling $289 billion across the extended LNG value chain over the past decade. In addition, the industry’s economic impact stretches beyond core gas producing regions, as LNG’ s full associated value chain extends across multiple states and industry sectors, including steel, equipment manufacturing, and construction among others.” (emphasis added)

A recent National Association of Manufacturers study similarly found that banning further permitting of U.S. LNG puts 900,000 jobs at risk and threatens $216 billion in GDP contributions.

Bottom Line: After nearly a decade of so-called study, the DOE’s report released this week places politics over energy security and threatens future investments. As American Petroleum Institute President & CEO Mike Sommers said:

“After nearly a year of a politically motivated pause that has only weakened global energy security, it’s never been clearer that U.S. LNG is critical for meeting growing demand for affordable, reliable energy while supporting our allies overseas.”

The post A Tale of Two Studies: DOE Study Rehashes Debunked Claims While New Analysis Highlights Critical Impacts of U.S. LNG appeared first on .