Fill ‘er up? OK, and will that be methanol or liquefied natural gas, Mr. Massive Lower Carbon Emissions Containership?

Today, that answer would likely be LNG.

Both lower-carbon options are breaking away from a containership fuel transition peloton that includes everything from hydrogen and biodiesel to ammonia and nuclear.

Reasons for the separation between the duo and the rest of the pack in the net-zero-emissions marathon are many, but refuelling infrastructure, operational versatility and commercial viability top the list.

Those factors are key in any transportation energy transition but especially in one that is as capital cost-intensive and cumbersome as deep-water shipping. (See The Substack Shipping News report on Seaspan Energy’s LNG bunkering plans in the Port of Vancouver: https://bit.ly/3CTdNEy).

Investing in new container ships is a multibillion-dollar, multi-decade proposition.

So, betting now on what will be the market’s low-carbon fuel technology of choice for ships 20 years on is difficult. It is a high-stakes riverboat gambler poker tournament. Indecisive players will lose their shirts. And more.

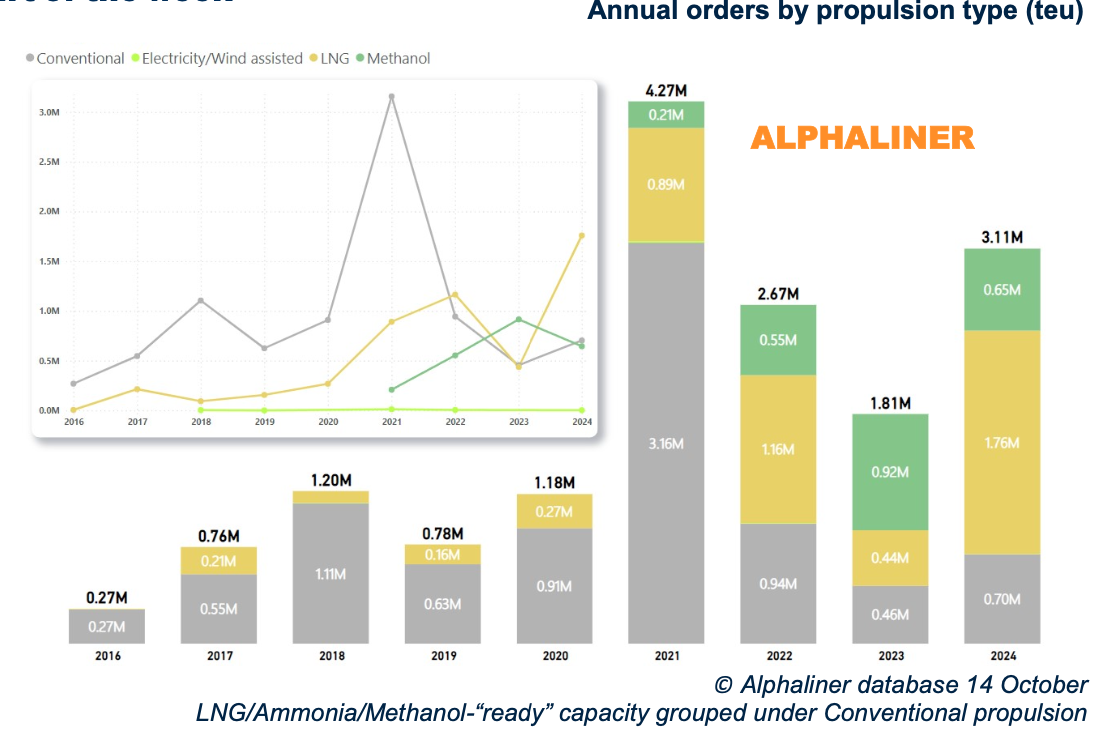

An Alphaliner update shows LNG holding the best hand at the tail-end of 2024.

According to the global shipping data company, LNG-powered vessels account for 55% of capacity in the current order book for new containerships. Methanol-powered ships, meanwhile, have slipped to 21% of new 2024 capacity from 51% in 2023.

The order book percentage by number of ships as opposed to overall container capacity breaks down to 41% LNG, 31% conventional and 28% methanol.

According to Alphaliner, concerns over the availability of green methanol “are clearly reflected in carriers’ newbuilding orders this year.”

The downturn in methanol’s marine fuel futures is reflected in the financials of B.C.-based Methanex Corp. (TSX:MX). The world’s largest methanol producer reported 2023 EBITDA of US$622 million and net income of US$153 million compared with 2022 EBITDA of US$932 million and net income of US$343 million.

The company’s 2023 revenue was US$3.7 billion compared with 2022’s US$4.3 billion.

Methanol demand is part of the story. It was softer in 2023 than expected. Prices were also lower. But demand increases have also been primarily in China, which now accounts for 60% of market demand. That gives it outsized market leverage over supply and availability.

Supply is a critical factor for ocean carriers. Availability is another.

LNG has an advantage here. It is now available for deep-water shipping at 185 ports worldwide; methanol is available at 125.

Alphaliner adds that shipper concerns over methanol supply increased in 2024 as methanol processing costs were higher than expected while planned production “has failed to take off.”

It quotes the Methanol Institute as reporting that 70% of global facilities planned for methanol production “have still not reached the final investment decision stage.”

Global production of green methanol and green ammonia will continue to struggle without the long-term market demand commitment required to justify that production.

There is also the relative energy inefficiency of alternatives such as green ammonia, which, as Danish Ship Finance points out, converts only 20% to 30% of renewable energy to usable power. That adds up to an overall 70% to 80% energy loss.

Those marketplace uncertainties and financial viability penalties do not play well at the multibillion-dollar containership energy transition table.

So, as Alphaliner points out, players placing orders for the largest containerships – 14,000 20-foot-equivalent-unit capacity and higher – are all in on LNG.

Time will tell whether that is the right bet.

www.linkedin.com/in/timothyrenshaw

@trenshaw24.bsky.social

@timothyrenshaw